Today I’m going to take another small break before the “season finale” of my financial and professional story and I’ll introduce my Net Worth spreadsheet.

September 2020 UPDATE: I wrote a series of posts about my Net Worth Spreadsheet which is more up to date than this old post. Check it out.

Since one of the main goals with this blog is to get and give advices in the personal finance world, I hope sharing my finances will be useful both ways: for those who don’t know how to track and measure their finances, here’s an opportunity to be inspired. For those who are smarter than me and manage their progresses in a simpler and more precise way… here’s an opportunity to help a nerd 🙂

First of all, what does Net Worth mean?

Your Net Worth is the algebraic sum of your wealth. It’s the sum of your assets, minus the sum of your liabilities. Essentially, it’s a single number that measures your wealth. Your cash, your savings, your investments, home equities… these contribute to increase your NW. Debts, loans, mortgages,… they contribute to decrease your NW. If your NW is below zero, it means you’re poorer than a homeless.

Why is it important to measure it?

If you want to achieve financial intelligence, integrity and independence (as suggested by the authors of Your Money or Your Life), one of the first steps to achieve financial awareness is knowing and tracking your current financial situation, i.e. your Net Worth.

Why do you want to achieve financial something?

I, personally, want to achieve financial independence. I’ve been financially aware and intelligent the entire life. Someone may feel overwhelmed by their financial life, debts, bills and other financial nightmares. To them, my first advice would be: stop, take a deep breath and then follow these steps:

- Understand your financial situation.

- what do you own/owe? Calculate your Net Worth and track it over time.

- where do my money go? Track your cash flow overtime, do a Budget.

- Act

- spend less than you earn & learn to be frugal, it’s funny!

- pay out your debts.

- learn how to invest.

- Dream

- define your long term life goals.

- let your healthy personal finance help you focusing on what really matters in life.

Ok, cool, I got it. Let’s start with the NW. How to measure it?

Before moving on, here are few resources that can be useful. Surprisingly, I’m not the first one talking about the NW. Here’s an amazing post by Trent Hamm, The Simple Dollar, and here a badass one by MrMoneyMustache.

The definition I gave is pretty straightforward: assets – liabilities. Now, sticking with the definition makes NW hard to measure: what are assets? Should I put everything I own in my net worth? How much are my books worth? What about my bicycles? And my socks??

I personally suggest to define your own threshold and only count things which are valued above it. Since my NW is in the order of hundreds of thousands, I decided not to put anything illiquid but my apartment. This is because I don’t own any material thing worth tracking. Had I been collecting valuable stamps or had I bought a car I’d probably be reporting these values into it.

I own a lot of books though, some of them are valuable, but I don’t report them in my NW because I consider the sale process to be more costly than the books value. I mean: I can’t simply press a button and convert my books to cash.

It’s important to account for hypothetical sale prices of anything you put into your NW. If you bought your apartment for 105k and it’s now worth 70k (yeah, made up numbers… shit!), your NW should be honest and use the current value.

Ok RIP, show us your NW!

Yes, I’m going to do it soon, relax 🙂 Before I’ll do that, few more things to discuss.

I don’t use personalcapital as a lot of Americans do (I don’t think it’s good enough for Europeans), I don’t use Mint and I don’t use any other dedicated serviceapp/website.

I monitor my Net Worth with a spreadsheet. I’m not suggesting you to do the same, I’m just stating that that’s what I do. In this way I gain a lot of freedom at the cost of my own time, since playing with sheets requires you getting dirty (with numbers and formulas, pun was not wanted). I’m open to suggestions here, but I’ve discarded any tool I tried so far.

I do that since 2004. If you’ve been following me in my financial story you may remember I had a gap in 2001-2004. I started my NW spreadsheet in Microsoft Excel, when having more than a single device was not common, and I moved everything over a cloudier solution in 2010: Google Sheets.

The document I’m going to share is not the original one: I just copied it, cleaned it from personally identifiable information and shared just the 2016 sheet. The original doc is richer, but in this one you can still see both my Net Worth and my aggregated Cash Flow.

I don’t do budget, I simply track total earning and total spending. Spending is high, but since I’m staying very low a couple of very high potential items I don’t think I need to know where is every Rappen going. In case my overall spending would grow in a significant way, I’ll surely wear the magnifying glass and go hunting for each expense.

Here we go! Enjoy!

Here’s the link to the shared Google Sheet.

Let’s analyze it. First, aggregates:

- Total Net Worth (row 36): As you may recall from latest chapter of my story, My NW skyrocketed at Hooli. I track it in 3 currencies, since I own assets in USD, CHF and EUR. Highlighted currency is CHF, even though my reference currency for FIRE goals is EUR. Current NW (July 25th) is above 500k CHF for the first time (yay!).

- Monthly Change and Percent (rows 37 & 38): increase respect previous month. In normal month I aim to increase my NW by 2% at least. This year there have been crazy months, since I started investing and since I took a 40 days sabbatical in April 20th – May 31st. This month, the after Brexit one, is going to be the best one with a temporary +28.8k (+6%), due to dollar rise (I depend too much on USD), good stock market performance, MissRIP 1k contribution and the usual close-to-2-digits monthly savings. Column P shows yearly aggregate data: so far in 2016 NW is up by 95k (+22.9%). In 2015 I achieved +116k (+38.7%) at the end of the year. The power of investing and compound interests!

- Incomes (row 51): Here’s my income. Actually it’s the “take-home pay”, as MrMoneyMustache suggests. In my take-home pay I include Swiss Pension Pillar 2 contributions, both mine and my employer’s. I don’t consider Pension Pillar 1, since it’s social security contributions and the actual social security figure I’m going to get back when I’ll be 65 are hard to predict and mostly unrelated to my current contributions. They will be extra unplanned money, that are going to be a positive surprise and make room for some safety margin 😉 The monthly income varies a little since it’s related to stocks vesting dates and bonuses (yes, that amazing spike in January!). What is stock vesting? Good companies, like Hooli, give stocks as part of the total compensation. A stock package is granted on day X but they are not all available soon for sale. Each grant has its own “vesting schedule”, which means that every once in a while, a portion of the grant is available to the employee. It’s an incentive to not leave the company, essentially.

- Spending (row 52): I don’t track individual spending, just the aggregate. I put there the differences in cash accounts and eventually sum or subtracts other major movements like investing or incoming salaries. As you can see we’re spending quite a bit. 32.7k in 7 months means ~4.7k per month. We can do better than that. We will do better than that when FIRE! Note: in both incomes and spending I account for my stuff plus shared. Miss RIP has her own economy and starting this month she’s contributing to the shared economy. More on that on its own post.

- Saving and Saving Rate (rows 53 and 54): Before you move on, take a couple of minutes to read why the saving rate is the only number that matter for FIRE goals. Ok, welcome back. 2016 so-far saving rate is 68.3%. A lot. And please consider that I went negative in May due to unpaid sabbatical! You may have noticed that actual savings and net worth increase don’t necessarily go together. Take a look at May and June: in May I didn’t work, ma saving rate was negative but my NW got a +12k. In June I worked the whole month, saved 12.5k but my NW didn’t move.

So yes, I should stop working. This is obviously due to investment performance and currency fluctuations.

Now some fine grain details:

- Estates (row 4): My apartment, my biggest mistake. Paid 105k plus proceedings, now I’m pricing it 70k. Probably worth even less.

- ETFs (rows 6-8): My investments. Details will follow. I started in February, rapidly ramping up to 250k USD total. In column A you can see which index the ETF is tracking.

- Stocks (rows 10-11): Hooli stocks. I count the unvested ones too, but only fraction of next vesting pack for each grant. If I’d quit Hooli today, the unvested will be lost. Starting from January 2017 I’ll stop counting unvested: better to consider only the money you actually have in hands or the legally due (like this month’s salary and 13th salary)

- Bonds (rows 13-16): I consider Pension Pillars 2 and 3 as bonds even though they’re not.

- Cash (rows 18-30): Yes, a lot of entries here. Individual vs shared, CH vs IT vs UK, CHF vsEUR vs USD,… as you can see starting from February I moved most of my savings to investments. The UK – ??? – IB accounts are cash accounts in my investment platform which is Interactive Brokers (affiliate link).

- Hooli (row 32): Portion of expected bonus and 13th salary. I do that to avoid big spikes in December and January. I should stop doing that for the bonus in 2017, since it’s not due and I may have negative surprises would I lose the job or quit.

- Other (rows 33-34): House “mortgage” with my father, other credits, taxes due,…

The total NW in CHF is calculated with a google app script that takes numbers and currencies and get evaluation using googlefinance API. At the end of each month, I take the snapshot of the values and freeze them.

That’s all for now!

Fun fact: according to the globalrichlist, I’m a very lucky earner, in the top 0.07% of the world, with 4 millions above me and 7 billions behind. The same is not true if considering wealth (NW). I’m just in the top 4%, meaning that there are tons of richer-than-me people around, on average 1 out of 25 (probably 1 out of 3 in Switzerland).

As always, comments are welcome 🙂

Thanks a lot for sharing this with us. I will have a closer look on it soon. Does it have graphs, like the ones that featured in your early “my financial story” chapters?

I would like to have a graph/diagram showing my savings rate (% of my income) and my total NW. The other night I tried to built something on OpenCalc but as I’m way more into foreign languages than numbers and Excel spreadsheets, I didn’t suceed. Need to do a tutorial, or google how to do it… or maybe get inspired by your spreadsheet. 🙂

Thanks.

Hi Julia.

No, the version I shared doesn’t have graphs.

Problem is that the original doc has too many personal information so it was not shareable.

I made this coy but I didn’t want to duplicate too many things and keep them in sync.

What I’m going to do is to freeze the historical and personal one and only work on the shared one, adding features and data. So… graphs will be coming soon 😉

I strongly recommend using Google Sheets. They are amazing and open to collaborations.

Hi RIP,

I was wondering how do you compute your 2nd pillar ? Especially month by month ? I only have an update at the end of the year by my “Caisse de pension”, but never monthly.

Thanks

Hi Poor Swiss (nice name!), I know from my payslip what’s going to Pillar 2, I know how much is my employer contributing so I know the total contribution.

I also know how mandatory/extra mandatory work, so I can compute the two portions.

I don’t account for dividends/profits during the year but as a lump sum on January the year after.

Every time I receive a statement from my Pillar 2 bank/insurance I react and change the numbers (if the drift is too big I sometime change it backward)

I hope it helps 🙂

Hi,

Thanks for your answer and about my name 😛

Yes, it’s helpful. I never thought of computing it like that. That is a good idea.

Can you tell me which number you take from the statement ? “Prestation en cas de sortie effective” ?

Thanks

The Poor Swiss

Hi PS,

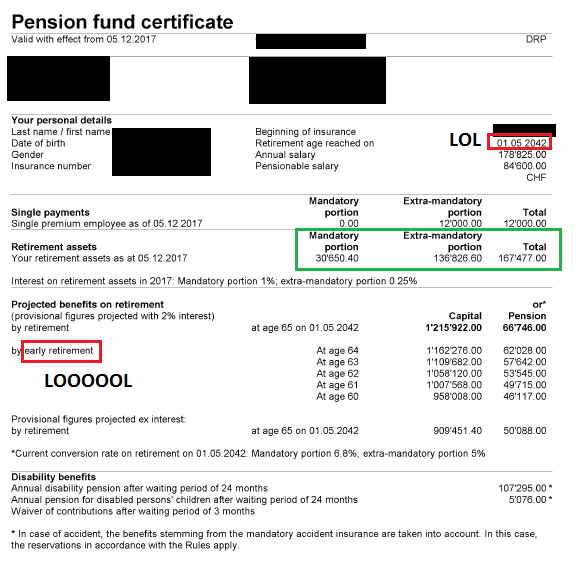

I take these numbers from my pension fund certificate:

Thank you very much for taking the time for this 🙂

Seems your pension fund certificate is much clearer than mine. I see what numbers to consider now 🙂

Enjoy your early retirement at 60 😉

This is you are making 180k chf a year

I don’t understand the question, if this was a question. Can you please clarify?

Someone needs to give an update on the movements in November 🙂 Building cash?

I am very interested to hear your view on the market and if there is market timing or other personal reasons.

Congrats on your blog and the quality on it, I am a big fan!

Will do, will so. It’s a mix of things, including (don’t say it, don’t say it!)… Market timing? Well, it’s more complicated. Will update on this but probably not before January

Ciao Mr Rip

Sono amico di Francisco P (ci facciamo un partitone a terra mystica prima o poi a tre). Domanda: hai 920k se non sbaglio in un etf obbligazionario a rischio bassissimo. Come mai? Secondo me dovresti avere più in azionario vista la fase del ciclo economico in cui siamo.

Food for thought durante la partita di terra mystica!

Spiegato qui: https://retireinprogress.com/2020-q3-financial-update/#Investments_8211_Analysis_Actions_and_Plans

Vada per TM, ma vi avverto: con i Nomads sono imbattibile 😀

Buongiorno,

Sono prossimo ai 32 anni e da sei stò perseguendo l’obiettivo dell’indipendenza finanziaria, ad oggi la mia barra di progresso è al 36%.

Trovo il suo blog estremamente interessante: trasparenza e completezza d’informazione sono merce rara!

Le vorrei porre due quesiti:

A) nel calcolo del net worth personale è opportuno contabilizzare il valore delle partecipazioni in aziende?

B) La società di cui sono amministratore accantona ogni anno per me 18K come TFM. Il giorno in cui terminerò il mio mandato questo TFM mi verrà liquidato al netto delle tasse da sostenere. Nel mio net worth consiglia di contabilizzare l’intero importo del fondo TFM o solo la parte che rimarrà effettivamente nelle mie disponibilità una volta pagate le tasse?

A) Assolutamente sì. Rimane più difficile dargli un valore, ma assolutamente sì.

B) io consiglio di contabilizzare sia il valore corrente come attività, che una stima delle tasse da pagare come passività. Altrimenti non si sta tracciando la situazione reale.