Hi RIPpers,

I’m back after a long break. I’m back to stay.

First of all I want to thank all of you who sent me a nice email, message, comment. THANK YOU!

I’ve not been posting for a while, not because I lack motivation but because I lack perseverance. Yes, I’m working on it. Plus life has been a little bit complicated lately.

Anyway… welcome back to my quarterly financial update. As usual, the reference doc is my NW spreadsheet. As you may imagine I have a private version of the spreadsheet and I copy relevant data into this public one when it’s time to publish a financial update. I recently finished refactoring the 2018 personal spreadsheet and I changed a lot of things. These changes are not yet reflected into the public one, so expect a huge refactor later this month or before the next update 😉

Quarterly Overview

NW Delta +47.8k EUR (Oct +22.7k, Nov +10.3k, Dec +14.8k). Extremely good! Mr.Market is stil running as a crazy bull despite Dr. USD & CHF enjoying nosedives.

Measured in USD: +70.5k USD (average +23.5k per month).

Measured in CHF, our NW Delta for Q4 is +73.5k CHF (on average +23.8k per month, more than what we bring home!).

Saving Rate 68.5% for the quarter even though we indulged in a 10.5k CHF #antimustachian vacation to Maldives and… well… Christmas is always Christmas.

Yearly Overview

Net Worth delta month by month (in EUR). Note that these deltas may differ from previous monthly updates since I may adjust things backward:

- January: +8,165 (USD dropped a lot)

- February: +20,933 (USD came back)

- March: +49,016 (got married, joined NW with Mrs. RIP)

- April: +7,091 (USD and CHF dropping)

- May: +7,482 (USD in free fall)

- June: +12,803 (main wedding)

- July: -4,720 (both USD and CHF in free fall, otherwise a positive month)

- August: +13,232 (regular month)

- September: +21,564 (that’s what happens when market goes up and currencies don’t make me cry)

- October: +22,769 (same as above)

- November: +10,305 (USD and CHF down again)

- December: +14,813 (a lot of expenses but still an amazing month!)

Total 2017 NW Delta: +183k EUR (+33.24% during 2017), from 552k to 735k.

Measured in CHF: +268k CHF, +45.34%.

Measured in USD: +302k USD, +51.94%.

Total Income in 2017: 250k CHF. This is net income, i.e. take home pay. It includes, for both of us, salaries, pension contributions, bonuses, stocks. It includes wedding gifts. It includes dividends and profits for assets that does distribute profits. It doesn’t include reinvested profits or capital gains. How can we track net income? Well, it’s been easy since we were both taxed at source (eventual negative/positive tax returns has been considered extra expense/income). Now that we’re no more taxed at source things are getting more complicated, more on this later.

EDIT: I just realized income in CHF is lower than NW delta in CHF. It means if we hadn’t been working the whole year, our NW would have gone up anyway 😮

Total Expenses in 2017: 91k CHF. Ok, breathe. Don’t panic. Ok, panic now Aaaaaaaaaaaaaah holysheeet 90k expenses!! Well, 27k went for the two weddings. Another 10k for an extraordinary-one-of-a-kind trip. Ok, relax now. Yes, it’s been a dangerously expensive year, but seriously, we’re not going to get married again in 2018! What could happen that might impact that much our finances again??

“Buying a car, RIP”

Go away noob! I’m car-free since August 2008, I’m getting close to the 10 years milestone! Why should I ever need a car?

“Moving out of that cheap 50sqm flat, RIP”

Hahaha what are you talking about?? We LOVE our cozy, small, ultracheap apartment with no dishwasher, no washing machine, second floor (european floors) without elevator! Why would we ever need to move out??

“Cause you will have children, RIP”

What? I didn’t hear you… the phone doesn’t… the signal is not clear…

Yeah, we’re waiting for a baby 🙂

She’s expected to join the family in May 2018! And no, we’re not buying a car and (for now) not actively looking for a bigger apartment!

We’re sooo not prepared (but excited!) for this 🙂 We just started trying after the honeymoon and… hole in one!

I’m scared as hell, I don’t know how good I will be as a parent, how frugally I will be able to handle the pregnancy, the birth, the parenthood, how far in the future this event will move our FI date… but I’m incredibly happy and I can’t wait to play with her!

Total savings in 2017: 159k CHF. As you can see, even though market performed crazily good this year, most of our NW increase comes from savings! As a friend usually says: choosing to go out once less this month is more important than picking an ETF with a 0.01% TER lower than another.

Saving rate for 2017: 63.5%. Last year we achieved 68.8%. If we exclude wedding we’d have achieved 72.1% this year!

Quarterly Details

Metrics

Income: 76.7k CHF – Expenses: 24.1k CHF – Savings: 52.6k CHF

Saving rate: 68.5%

Saving rate for 2017: 63.5%. Excluding Wedding: 72.1%

Net worth: 735.3k EUR, Delta for the quarter is +47.8k EUR

FI% moved back to 61.27% – we changed monthly target and SWR, new FU Number is 1.2M (~100k bigger that previous one).

100% FI Forecast: 36 months left.

FI Date Forecast: December 2020.

Current Allowance: Year 25,735 EUR – Month 2,145 EUR – Day 71 EUR

Current Withdrawal Rate: Real: 10.61% – Ideal: 5.71%

Years of Ideal expenses accumulated: Real 9.4 – Ideal 17.5

Metrics don’t look very good. We spent a lot this year and moved the target away. Still 3 years left, assuming same income (but Mrs RIP will not work for a while), same expenses (they may go up or down depending baby impact) and market growth (pretty much unsustainable at this pace).

Major Wins

1) Mr Market skyrocketing!

Every single ETFs we hold (and Hooli stocks too!) skyrocketed. US, Pacific, Emerging Markets… only the Europe, after an amazing October, didn’t perform as good as the rest of the world. Very good! Or very bad, investing now is scary…

2) 2015 Tax Return (5435 CHF) cashed in 🙂

It was expected, but still pleasurable. I consider it income and I account for it in the month I get the money on my checking account. It’s actual income since hadn’t I overpaid taxed in first place I would have seen this as a take home pay. Remember I measure net income and, oh boy, it’s getting hard to measure with deferred cash flow and taxes.

3) First real dividend received!

I mentioned in one of my last posts (sooo looong ago) that I started investing in Dividend Stocks. Actually a dividend stocks ETF by Vanguard: VHYD.

This fund collects dividends from the owned companies and distributes dividends to shareholders quarterly, so I got my first dividends on December 🙂 It will actually be credited on my Interactive Brokers (affiliate link) account in January (already happened at the time of writing this post).

Dividend amount is 263 USD while market value of my VHYD holdings on Dec 31st is 47,276 USD (0.55% quarterly dividend, 0.32 USD per share). It’s been the smallest dividend of the year, according to ICTAX. This year yield has been ~3%.

I don’t know if I’ll be able to claim some US tax withhold on these dividends, but I guess I won’t bother for such a small dividend. And the fund is “world” so I have no idea – and don’t want to know – how to claim each county’s tax withhold amount. For US is relatively easy with the DA-1 form but as I said, such a small amount for now. I guess I’ll end up paying income tax in Switzerland on the (already taxed at source in each country) dividends.

I consider this dividend as credit in December 2017 (under “Other”) and income in January 2018.

Expected income tax on dividends is also accounted for (estimated 25%) in January.

I like dividends! I like them even though they’re not Swiss friendly (no capital gain tax here, but dividends are taxed). I like the idea of generating actual income from investments. I like the idea of not having to touch (much of) the principal in retirement. I may increase my exposure to dividends in the near future.

4) Exceeds Expectations

At Hooli, based on Q2 and Q3 performances. Working 80%! That’s an amazing October news that has boosted end of year bonus, salary growth and stocks refresh!

5) Ridiculous December Compensation

December salary, 13th salary, huge stocks vesting (30k USD gross) and (announced, not accounted yet) 24k CHF gross yearly bonus that will be paid in January. Bigger than 15% gross salary target even though I’ve been working 85% on average this year and the bonus is supposed to be prorated. Nice!

Money, money, money everywhere! I know it’s easy to accumulate wealth this way and I’m grateful for that. But it’s even easier to throw money away and inflate your lifestyle.

“But RIP, you spent an outrageous amount of money on a trip to Maldives..”

Yeah yeah, it’s one off, it’s a babymoon, it’s… ok, we exaggerated, but it didn’t make a dent in our December finances. It’s silly!

6) 2 small bonuses In November

Yes, I’ve been working a little bit harder recently. Anyway, 2 projects launched: 1000 and 1100 CHF as nice recognition along the way 🙂

7) Reasonable expenses in October and November

The time when a good month was a month below 4k is long gone 🙁

With BabyRip knocking at our door I have no idea how much it could change the satisfaction bar.

Anyway, 4.2k – 4.4k Oct and Nov (78.4% SR in October) is definitely a good news even though we indulged quite a bit in eating out. the 587 CHF restaurants expense in October expense is driven by Mrs RIP parents and brother’s family coming visiting us.

Major Losses

1) My Grandpa died at age 97.

On December 30th, a couple of months after her wife, my highlander Grandpa died 🙁

I’ve been so lucky to reach adult age with all my grand parents alive and in good health, but they’re all gone now.

R.I.P.

2) CHF and (even more) USD nosediving

They keep falling and they almost even out market gains. Currency fluctuations is my main nightmare these days. During 2017 CHF lost 8.3% vs EUR and USD lost 12.3%!

Should I stop measuring my wealth in EUR and switch to CHF?

Problem solved 😀

3) Expenses a bit out of control in December: 15.4k

Well, Maldives ate 10.5k of this pie, but still ~5k for regular expenses is borderline acceptable.

Ok, pregnancy is kicking in (558 CHF) but what about 500+ CHF for Christmas gifts?

Other financial facts

1) Reviewed Target SWR and FU Money

Truth is: we have no idea what we’re doing. We’re saving money but life is changing so many times we have no idea when we can call it FIRE. We have no idea what our expenses will look like when – and more important, where – we’re gonna be “retired”. We have this vague idea of “maybe we will move back to Italy where 3k EUR per month is luxury”, but Italy is rollercoasting to third world and maybe we don’t want to grow our little princess in such a horrible world. We don’t know.

Here in Switzerland we’ve spent 90k+ this year and we still don’t own a car, we live in a cheap apartment and don’t (so far) have kids. Someone says 100k per year is borderline for a family of 4 here. 100k per year means ~3M CHF FIRE Money… what the faaaaack!

I don’t think we’re going to make better plans or clarify our doubts in 2018, I guess we’ll be in survival mode and keeping up with life (and still hopefully stashing 50%+ of our income).

Maybe 2019/2020 will be the right time to make some final choice about retirement budget and location, unless something extreme happens (job loss, burnout, near death experience, atomic war, Berlusconi wins again in Italy, and so on).

For now, I’m increasing our monthly target expenses from 3000 to 3500 EUR/Month and increasing our target WR from 3.25% to 3.5%. The total effect is an increase of target FU Money from ~1.1M to 1.2M.

I’m increasing monthly target to 3500 EUR because it seems to me that we cannot live with less. I’m probably blinded by Swiss life costs, but I prefer to err on the side of safety here. And in Italy investments are taxed 26% both capital gain and profits. So 3500 withdraw means in the worst case (all profits) ~2600 net which is in line with my estimate of 1000 EUR per adult plus 500 per child. in case we’ll have a second child (we both want it) we need to raise the monthly target again.

Reducing WR to 3.5% after having been scared as hell by ERN (earlyretirementnow) SWR series where BigERN advocates for a 3.25% WR to be almost 100% safe in the very long run (60 years). I’ve convinced myself that some 0.5% of failure risks can and must be tolerated and btw, it’s a known problem how we – early retiree candidates – overestimate the fear of running out of money. There’s absolutely no chance of me not earning a dime in early retirement! And there are expected windfalls (inheritances) and annuities (pensions).

2) No more taxed at source: I got a C permit

It’s the equivalent of the American Green Card: a work permit that doesn’t expire. It’s a “permanent residence” permit. Hurrah, I’m a step closer to become a Swiss Citizen (do I want it??)

The only tangible change is that I’m no more taxed at source, i.e. I get the whole gross salary (minus pension plans contribution, unemployment insurance and other minor “taxes”) and I pay taxes all at once in March the year after.

It’s more complicated than this:

- You can pay monthly/quarterly/yearly advances. The City and the Canton send you some forecasts of your communal and cantonal due taxes and you can pay them to avoid interests of 0.5% if you pay later (who wants a 0.5% loan? I do!)

- You can only pay communal and cantonal taxes this way, not federal taxes. Federal taxes must be paid out in March all at once.

Not that hard, isn’t it?

Well, our situation is way more complicated since:

- I’ve been paying Tax at Source till October. Each salary was taxed on a marginal tax rate depending only on the monthly payslip itself and the tax bracket structure of my situation.

- My situation changed halfway thru the year since I got married. Married couples pay lower taxes but they need to cumulate the incomes and wealth. It usually means you pay more taxes if your salaries are within a 4x factor. Since I earn more than 4x Mrs RIP (yearly gross) we should save some money.

- My situation changed in October when I returned working 100%.

- Mrs RIP employer didn’t adjust her tax at source amount when we got married. And he didn’t interrupt the tax at source when I got the C permit (she should not be taxed at source anymore)

- My December payslip is huge and it would have been taxed a lot if I were taxed at source.

- So far I’ve always been postponing tax declaration to September, I have no idea how can they emit a federal tax bill if I hadn’t yet done my tax declaration by March 2018.

- I’ve done Pension Pillar 2 & Pillar 3 buy ins that will lower my taxes due (communal, cantonal and federal)

- Last year tax declaration said I should get back 9k CHF so… I don’t want to be long this year too, I’d rather be short and pay the difference.

So… I didn’t pay taxes in November-December and I received the suggested tax advance from city & canton tax office.

I had some headache on trying to estimate how much taxes I expect for 2017 and I’m accounting for them on several rows (expected income taxes due, expected capital taxes due, taxes already paid,…) of my private spreadsheet but in the end I just paid the advance they suggested me. It’s the first year in this situation and the most complicate one with a marriage and permit change mid year.

How long can one postpone this payment? Nice question. So far I’ve been declaring taxes for year X in September on year X+1 and the final bill came in one year later, September/October X+2 (I cashed in October 2017 the final negative bill for 2015). So in theory I can keep 2 years of due communal and cantonal taxes as a permanent 0.5% loan, something like 60k CHF. Forever.

I was tempted to pay ZERO advance and keep the money as a very cheap 0.5% forever loan but:

- I was scared to challenge Swiss tax authorities

- I’m not going to leverage on this loan and invest it, I’m actually hoarding some cash.

Did anyone try that? Is it worth?

3) Pension Pillar 2 buy in 12k CHF

As a routine in last 3-4 years, I’m doing voluntary payments to Pension plan that are tax deductible. More on this here. I claimed I’d stop in 2017 but apparently there’s a threshold on some cantons that won’t block your Pillar 2 withdraw and in my canton this threshold is 12k. It’s not yet fully clear, but official sources (citation needed) say that if you withdraw Pillar 2 Pension and in last three years you didn’t do voluntary payments above 12k you’re good to go, i.e. only pay kapitalauszahlungssteuer on the amount withdrawn.

4) I have a bunch of cash at hands

As I said above, I’m hoarding cash. December salary, 13th salary, huge stock vesting and (soon to come in January) yearly bonus.

I’ve been drained recently due to Maldives, Pillar 2 buy in, some ETFs rebalance in November but now (January) I’m sitting on ~90k CHF cash (but 10k expected taxes).

I’m slightly reluctant to invest/rebalance given the amazing latest Mr. Market performances but… gotta stick with it and rebalance in Feb! So far I’ve only made mistakes when derailing from my plan: my choice of selling my US Tech ETF has been a mistake (+12% since October), but I wanted to differentiate.

What about Cryptos? It deserves a post on its own. TL;DR not for now.

5) Financial independence Community

Great news!

Great news!

Several months ago I’ve been interviewed along with other 10 FIREing / FIREd for the book “Finanzielle Freiheit”, by Gisela Enders and the book came out – in German.

Finally it’s been translated in English!

Here‘s the website for the book:

All the proceeds will be donated to a children’s home in Romania. Robert White, one of the people interviewed, is from Romania and will ensure that the money gets to where it’s needed most!

“Hey RIP, but you’ve been interviewed in English and translated to German for the German edition… will your interview be translated back from German in the English edition?”

Ehm.. I assume they used my original interview, or else “I guess my chapter will be unreadable, we all know how creepy translations look back and forth!”

Wait… I just translated back and forth the previous sentence and it’s fine ![]()

That’s not all: I’ve been interviewed by Patrick from healthyhabits.de. Maybe I’ll be featured in another book, looking forward to reading it!

Last: Financial independence Week Europe (FIWE) 2018 has been announced: June 8th to 14th in Timişoara, Romania (same place as FIWE 2017). Apply now! This year I’m attending for sure!

“RIP, do you want to go to FIWE? You’ll be one month into fatherhood in June!”

That’s exactly why I want to run away from my family. It will be a great pain to detach for few days from my family but… what’s to be done has to be done 😀

Other Facts

1) Not many trips during this quarter

We’re not used to not travel so much, but the pregnancy is making Mrs RIP lazy so we stayed home most of the weekends, enjoying friends and good weather this fall.

2) … Except I went to Hooliland on October

I like to go to Silicon Valley once a quarter, it’s always funny, inspiring, relaxing and I get to spend some quality time alone too. And it’s hot in winter too!

3) … except we went to Maldives (but it doesn’t count, we went in January!)

The idea to go to Maldives dated back in September/October, i.e. as soon as we discovered we’re waiting for a baby. Someone calls it a babymoon: your last romantic vacation before your life is completely wrecked in parts by a 3kg creature that will destroy your dreams and permanently changes.

Last year we went to Mexico with a couple of VCF (Very Close Friends). Mr VCF has been one of my wedding witnesses and Mrs RIP and Mrs VCF work together. We spend a lot of time together and we consider them part of our expat family in Switzerland 🙂

If you remember, India & Maldives were among the candidates for last year trip. We gathered together several evenings and started organizing the trip, rating ~100 islands independently each of us, setting a budget (I was the one trying to bring the budget down!), a time frame, some constraints and then… we booked!

We booked very late (something like December 10th) for a trip that took place between Jan 3rd and Jan 14th. Yes, January 2018 is not “Q4 2017”, but I’m not going to write a post about our Maldivian trip alone. And we paid it in December, so I guess this is the best place to mention it.

Here’s a photo gallery, enjoy 🙂

4) Back to 100% at work: a report.

Since October I’m back 100%. I’ve been working 80% (Monday to Thursday) between January and September.

Well, I can’t say I like it. But it’s not been that bad so far. I’ve been busy with a couple of small projects that I liked slightly more (and that brought me bonuses).

I still dream about working less: in one of my ideal near future there’s me getting promoted and switching to 60%, while parenting and coasting to FI.

In the meantime I’m going to enjoy a 75% year (Hooli is veeeery generous with parental leave!) while being paid 100% 😉

5) Reading Recommendations

I’m deeply reading Sapiens and Homo Deus by Yuval Noah Harari.

Sapiens is a life changing book. It challenges your prejudices and makes you connect the dots of human history. It should be how history is taught in every school.

Take a look at his TED talks:

And the amazing TED session with Chris Anderson about the near future!

Life changing, read Sapiens (and Homo Deus)!

2018 Goals & Plans

It’s hard to set goals this year. We’re essentially waiting for this little hurricane to change our lives and see what happens. I prefer to stick with my principles (even though I didn’t read Ray Dalio’s book yet).

It’s hard to set goals this year. We’re essentially waiting for this little hurricane to change our lives and see what happens. I prefer to stick with my principles (even though I didn’t read Ray Dalio’s book yet).

Principles are: I’ll keep saving as much as I can, hopefully 50%+ of take home pay.

I’ll keep investing according to my IPS, eventually revisiting it and adjusting a bit.

I’ll aim to reach FI as soon as possible while trying to enjoy the path and recognize the line between frugality and deprivation.

“… enough?”

Wanna see me committing to anything this year? Naaah. ok, here’s a goal: become Millionaire in one of my three main currencies! USD is the natural candidate. Spoiler alert: at the time of writing NW is up another 40k USD (thanks USD for dropping every f***ing day) and it’s now in the neighborhood of 920k USD.

It seems an easy goal, isn’t it? We may be millionaire before summer, except if:

- The market crashed significantly this year (likely), but that would be good for newly invested money

- The USD and the CHF go up against the EUR, but that would mean that our NW in EUR would skyrocket! I’d rather end the year at 999k EUR with EUR:USD:CHF 1:1:1 than become millionaire with monopoly money.

“RIP, your kid will rip apart your finances”

Nice pun indeed 🙂

Yes, that’s a concern. What could happen?

- Mrs RIP not working after pregnancy leave? Net income goes down by 2.5 – 3k per month

- Move to a bigger house? Expenses go up by 1.5k at least.

- We need to use uber-expensive Child Care? Expenses go up 2 – 2.5k per month

I hope not all of them happen at the same time. Super frugal scenario 1 out of 3, more realistic scenario 2 out of 3. We’ll see.

Another goal? I will make my apartment in Milan productive again in 2018. Which probably means I’ll sell it. I’ve done some active steps to sell my house in January. I got the apartment evaluated by 2 different Real Estate agencies and value seems to be between 70k and 80k EUR, so the 70k EUR I’m accounting for in my NW is a pretty accurate guess, given that selling will have some costs.

That’s all folks!

“4000 words RIP, who do you think you are, Tim Urban??”

Hey Rip, don’t by scared – while kids cost I always felt that it was not really problematic. The real issue is similar to lifestyle-inflation, there is also a baby-equipment inflation. If you can keep that in check you are good. After all, Babies don’t care for all the crap you buy for them anyway. When there a little older and get swamped with xmas presents you see them playing with the wrapping instead.

As for investing – Vanguard High-Yield is cool. I personally don’t use it as it is technically not passive and a little pricey. Vanguards FTSE Developed Europe pays out 3,26% compared to 3,17% EUR of the HY. I guess your CHF might factor in with here as well.

Best,

El

Hi El, thanks for stopping by 🙂

I know baby-equipment inflation is a thing, but I guess I’ll have hard time keeping my wife under control with that. If it were only on me, I’d be playing with wrapping with my daughter!

What do you mean that VHYD is not passive? Did you mean “not accumulating”? Agree that the TER is not very cheap, but I guess being “world” and handling dividends and taxes in each country must not be super simple.

I’ll take a look at the ETF you suggest in my next rebalance day, thank you!

Hm, strange – did not receive an email notice of your reply although I followed the thread. Spam is also empty.

Regarding „not passive“:, there is an Vanguard All World that simply holds thousands of companies based on market cap. Your all world high div yield holds companies based on an more active selection – that being the guesstimate of future dividend payment based on historical payments. That is speculative and Jack Bogle is not a fan … although it’s his company ;-). You limit yourself to matured companies that tend to have higher payouts and less innovation/less growth. All of that is not bad, I just think that it might not be the best solution. All Vanguard ETF (in Europe) pay out dividends. I use a mix of

VG S&P 500 (<2% Div)

VG Europe (>3% Div)

VG EM (>2% Div)

VG Asia-Pac (>3% Div)

To build my own world portfolio with total cost of 0,13%. That works well at the moment but I’m not a guru so you might be better of with a World ETF in the long run!

Best

El

Very good point! Thank for your data, I’ll take with me when my next “strategy assessment” is due 🙂

Really glad you’re back. And not just with the financial summary, but also with all the important details (and funny snippets in between :).

Regarding kids (speaking as father of two), specially at the begging, you can greatly control expenses by purchasing some second hand items. Kinds don’t really care and they really use things only for a very short amount of time. And supply is huge, so price/performance is usually pretty high. Convincing SO is usually the hardest part…

And all the stuff you get from friends and family.. first few years should be easy. And for the new things, it definitely increases the price/performance ratio if equipment is used by at least two of them 😉

I’m afraid a little, things will get costly, when kids grow up.. (food, sports, trips, etc..) but on the other hand, we shouldn’t be so emotionally involved, as when first baby came around, so it’s easier to predict control expenses.

I hope I’ll be FI before my kid(s) grow(s) up 🙂

The only kids expense we predicted well was daycare. And today, I do not keep track in detail of kids expenses: good is good an d for clothing, I have a rough idea. Then there are hobbies, trips, toys, experiences we want to give them, summer camp,….

We stay faithful to a frugal lifestyle…

We are happy to have more than 50 square meters to live with the 4 of us… At some times, each of us needs some private space for me time

We still don’t know what will kick our asses harder. Daycare can be delayed until when (if) Mrs. RIP will get back to work. Housing can probably be delayed for another year… but then we gotta move 🙂

Welcome back Mr RIP!

Sounds like you’ve been having a pretty nice time. It’s brave of you wanting to come to FIWE – you’ll have to be extra specially nice to your wife between now and June so she’ll give you the time off. Maybe start by not calling her lazy – she’s growing a WHOLE NEW HUMAN BEING inside her. That’s hard work, let the poor woman sleep! Oh, and always be ready with food when she wakes up! 😛

I got the permit signed and voice registered YOU ARE ALL WITNESSES 😀

Book my spot for FIWE 2018!!

Ok, ok! Chill Mr RIP, I put you on the list. Please don’t hit me…

Congratulations to you both on the pending birth of BabyRIP! Now go visit Mrs. Frugalwoods and be comforted that babies can easily be done for very little cost… in $/Euro/CHF, that is. Time and sleep? Not so much.

It sounds as if Mrs W (above) is a very wise woman. You would do well to heed her words!

I wish we had the same frugal muscle of the Frugalwoods 🙂

… and when I say “we” I really mean “my wife” 😛

Haha, thanks for your kind words Mrs ETT. I don’t often get called wise 😛

Hey Mr. Rip,

As a new investor, I would be really grateful if you could answer couple “dry” technical question regarding your investment portfolio.

Which exchange do you use when buying STOXX600 – I can see that the ticket in your NW sheet is FRA:SC0C, but when checking the tickers at https://www.justetf.com/ch-en/etf-profile.html?tab=listing&isin=IE00B60SWW18, Frankfurt exchnage is nowhere to be seen.

Regarding SWX:CSSPX-USD – would you recommend Swiss exchange or London one?

Thanks a lot and please keep doing this blog, you are a great inspiration

Hi Stefan, nice questions!

Short answer: I have no idea 😀

Long answer: I’m collecting “questions to myself” in a doc and planning to answer hopefully most of them in April, after this intense month of work and theater acting and before my daughter is born (expected in early May).

I was recently surprised to see a lot of changes in my ETFs like “where they are traded”, “ticker symbols” etc. My guess right now is that they (institutions who issue the fund) are allowed to move stock exchange where ETFs are traded. I can say I’m pretty sure I purchased shares from Frankfurt Stock Exchange at one point. When I open my IBKR app I see “IBIS” close to SC0C, which I can’t quickly find what it means. My guess is that it’s handled by IB and transparent to me, since I don’t need to care about which stock exchange I use (assuming same bureaucracy and trade fees). Need to set time apart to better understand this though.

For the CSSPX I know I’m trading it from LSEETF, the new ETF-dedicated stock exchange in London. Would I recommend it… I don’t know. I try not to focus much on which stock exchange I perform my trades (maybe I should?).

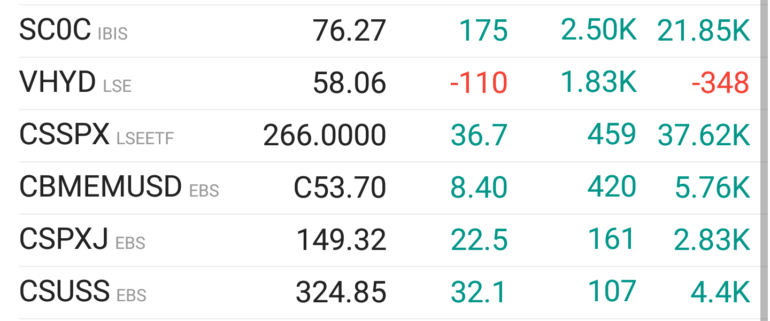

Here’s a today’s screenshot of my ETFs

Thank you for a quick response Mr. Rip!

I will do some extra digging before buying, but your insights make sense.

Thanks again for the inspiration and congratulations with a new member of the RIP family!