Hi RIP readers,

This week I didn’t write a new article because I’ve been focusing on a static pages redesign for my blog. The redesign is not completed yet but I’ve already made quite some changes, and I wanted to share them with you 🙂

Before we continue: this is a meta / blogging post. Maybe it’s not very interesting to you (or for you?). If you’re for the money/investing/struggle/journal posts, I warn you that this won’t be a helpful post for you (or to you?). See ya.

Someone noticed that the RIP Homepage changed. It used to show all the post excerpts in reverse chronological order, like many blogs do, but I’ve replaced it with a static page containing links to other sections of the blog.

[Note: A “static page” (which is not very static in WordPress btw) is a page which is supposed to not be a blog entry. It’s not showing up in the feeds and it’s usually presented in one of the menus like an About page, a Start Here page, a Contact page and so on.]

The rationale behind this change is that I wanted to have a way for new readers to find useful information quickly. My blog is an “ongoing inner dialogue”. The complexity of my thoughts is probably only followable by long time readers. I love that, but what about someone who discovers my blog today?

Let’s make an example. Since I quit Hooli I’ve met many new friends, and the dialogue goes like this:

NewFriend: “Wow cool! You quit Hooli! What are you doing now?”

RIP: “I’m relaxing a bit, and spending time with my family 🙂 ”

NF: (a bit worried) “Uh… don’t you plan to go back to work? You know… life in Switzerland is pretty expensive… And aren’t you getting bored without a job?”

RIP: “Well, after 7.5 years at Hooli I don’t have a rush to go back to work. At least not for the money. We try to live frugally, and I saved quite a lot of money 🙂 ” <– famous RIP-Joker grin

NF: “Congrats! Well, yeah, I understand. 7.5 years of Hooli salary, makes sense.”

RIP: “Btw, I don’t get bored at all. Maybe I’ll go back to work someday (someday = in September), but you know what? Today I feel busier than ever! I’m working on my side passions these days, when family duties give me a break. I’m passionate about Personal Finance and Investing 🙂 ” <– a warm smile

NF: “Really?? We need to talk! I know nothing about investing. OMG I would love to know more! I have some money I’d like to invest but I don’t know how… my bank is calling me to buy their funds! Should I buy Fund X of Bank Y? I have no idea!”

RIP: “Calm, relax. First: don’t buy your bank funds. Second, it’s more complicated than that. You should ask yourself what are your goals, your risk aversion, your time frame, your current situation (income, spending, savings, net worth)… I mean, you need to put some effort. Don’t delegate. I’m happy to help you, but I prefer to help with your learning journey instead of giving you cold advices 😉 ” <– RIP knows stuff

NF: “But I don’t have much time, and I don’t really understand finance and math. It’s too complicated!”

RIP: “It’s not that complicated, really. Of course there are many nuances, and if you want to dig deeper it gets as complicated as you want, in the end it’s just human psychology. But the low hanging fruits are really good and really low hanging. You can get 96% of the benefits with 4% of the effort, it’s a Pareto Squared field 🙂 ” <– geeky laugh, aware that the joke won’t be understood

NF: “Pareto what? O_o” <– Told you!

RIP: “Oh, it’s just a nerd joke, never mind. What I mean is that learning the basics of financial literacy is not that hard, and it makes you way less vulnerable. And don’t say you don’t have time. If you put 50 hours of work toward financial literacy I’d bet the lifetime impact would be in the order of several hundreds of thousands CHF at least, given your current profession and 30 years of career ahead of you. It’s like 5-10k per hour. You can’t not have time for that!”

NF: “Uh, I didn’t realized that… anyway, a friend of mine told me to buy Bitcoins. He made 100k in a month a couple of years ago. Did you find something similar? Or maybe I should buy Bitcoin?”

RIP: “No, my plan is not to find the winning lottery ticket. It’s about good financial habits, and a boring, slow journey toward wealth creation. Run away from get-rich-quick promises. And yeah, your friend had a great 2017. How is he doing today? 🙂 ” <– yes, this one was sarcastic 🙂 <– no, this one was not

NF: “I don’t know, I haven’t heard from him since a couple of years”

RIP: “I bet it’s more or less “A couple of years, five months and twenty seven days” (^_^) ” <– yeah, he wouldn’t understand, I know

NF: “How do you… O_o… btw, how can I learn more about investing? Do you have a book to recommend? Something to watch, read, or listen to?”

RIP: “I actually write on a blog about this topic. Well, not only investing, it’s much more. I also link to a lot of relevant external resources. (͡ ° ͜ʖ ͡ °) ” <– this asciimoji thing is getting out of hand

NF: “Awesome! I’d love to read your blog! Can you share it with me?”

RIP: “Yeah, sure. it’s called Retire In Progress. You’ll see that I blog under a pseudonym. I’m extremely transparent with my finances, my investment decisions, my life struggles. So I chose to keep my real identity a bit hidden. Well, not that much as you can see. Mind that it’s a very long form writing style. And… (ㆆ_ㆆ) ” <– yeah, this is when I realize that a new reader on my blog would find little value without further guidance.

I’m perfectly fine with sharing my blog with people I know personally, even if I don’t know them deeply. But I’d love to have a way to send new readers to specific paths according to their needs.

The old homepage contained excerpts of latest posts. I love my most recent posts, of course, they are at the cutting edge of my financial awakening.

But how could a new reader who knows nothing about investing benefit from them?

The reader who makes me the happiest is the reader who discovered my blog by pure chance, by randomly browsing the web, by following a rabbit hole, by being a Mustachian. Those readers devour my posts and write me a long, warm, detailed thank you email! Then we chat, maybe meet, maybe become friends, maybe start a mastermind group. And that’s what I love the most about my blog: the profound connections I’m creating with like minded people!

But I don’t want this blog to become a ghetto of financial nerds. The more I learn about finance and myself, talk about finance with friends, discover financial sharks who steal money from financially vulnerable people, and the more I want to make my blog a go-to place to get your personal finance seatbelt. To provide free personal finance education. Free as in free beer!

Making a static homepage is the first step in that direction. So far it points to other static sections of the blog, and to the Blog Page itself, the one with the articles feed. I’ve an ideal “site map” in mind, with top level pages and many layers below them. More changes are coming, stay tuned.

We can safely say that Retire In Progress is Work In Progress at the moment.

Which is fun because my career is also in a similar undefined “In Progress” state 🙂

Please allow me to show you what I’ve done so far:

The top level pages are five so far:

There are few more to come: one about Switzerland, another one about Monetization for sure, another one for the new project I’m going to announce at the end of this post, and maybe one or two more. I would like to not clutter the main menu too much, which is already hard to manage from mobile.

Side note: this is not a blog for mobile only readers. I don’t want you to scroll my 10k words post while taking a dump or commuting to work (in your living room). Take your time and be in front of a decent monitor at least 24″ wide. I’m optimizing this website for desktop experience. Sorry GenYs or GenZs readers, I’m getting old and grumpy.

Welcome Page is the new Homepage. I moved the “Start Here” page, previously called “FIRE F.A.Q.” and now called “FIRE Dialogue” below the welcome page. I might move pages around a bit in the near future. The idea is that the Welcome Menu should be the entry point for new readers who don’t have enough familiarity with Personal Finance, Investing, FIRE, and so on.

Under the Blog Page (which is the the old homepage, the articles feed) you’ll find a lot of sub pages for blogging categories. I’ll write a page for each interesting aspect of my blog (more or less a page for each block in the Binge Reading page). Each page will have a summary for that category and maybe a way to navigate you thru the most relevant posts for that category. So if you only care about investing, there will be a dedicated page with some context and pointers to relevant articles.

For now, the Blog Menu only contains the old Binge Reading page.

The old “external resources” page sucked a lot. It was unmaintained since years. I wanted to clean it and make it more useful. I actually wanted to add a lot more stuff here, and make this page the entry point for my Learning, Curiosity and Rabbit Holes. So I created a new main External Resources Page (still WIP) which contains pointers to the other pages in the External Resources Section of my blog. This is the section where I’ve put most effort during this week.

I compiled this enormous list of external blogs I follow, books I’ve read, podcasts I listen to, YouTube channels I follow, tools I use. I’ve created a page for each category, and wrote a mini review for (almost) each resource. A lot of work.

Take a look at the Blogs I follow. The list is so huge that I had to pub a table of content on top. I’m not bragging, this is actually the admission of my addiction. (´・_・`) <– same here

Here’s a list of Books that “shaped who I am today”. I wrote this page without the intention to tell a story, but in the end it became a trip through my chronological reading history, character building, and FIRE Epiphany. Read the “mini reviews” in the order they are presented to you, at least the Personal Finance and Personal Growth sections, and you’ll walk my growth path from broke teenager to rich old fart.

The Online Communities page tells you which forum, subreddit, social media or other communities I’m somehow active in. If you’re more into video/audio, then you want to visit my YouTube Channels and Podcasts pages.

Finally, a set of Tools I use, including banks, credit cards, brokerage accounts, personal knowledge management systems and more. Where an affiliate link is present, it’s clearly shown next to the link. And once again, the affiliation is not the reason why the link is there: it’s because I use the product, love it, and I’d recommend it for free anyway.

I’ve got many requests to add new resources to my external resources page in the past. Let me clarify once and for all, even though I know those who need to read this won’t: I don’t accept money to add your link here. This is a list written by my heart. If you want your blog/tool/service to appear here, develop an awesome service that would be of use to me and my readers, and I’ll probably discover it on my own, without you sending me a cold email doomed to be marked as spam 😉

Holy crap how much work, and it’s not done yet.

I plan to add my Learning Projects, and my Learning Journal. And maybe a page like Indeedably’s “I read”, which is the best way I’ve found to track and share what I’ve recently let my curiosity wander on.

The old About Page has been split in two: About Me and About RIP (this blog). Who am I? What is this blog about?

Please take a look at the new about pages, and also at the new Press Page, i.e. where RIP has been mentioned / interviewed / hosted as a guest.

I also plan to add here some legal stuff, to finally be GDPR compliant (legal disclaimer, privacy policy, terms of service, cookie informative, blah blah blah) and maybe more.

The final top level page, for now, is the Italia Page.

I’m putting here information in Italian language about who I am and what I write about on this blog, for Italian readers (which are growing in number).

I’ve also added in the Italia Page the few interviews I did in Italian language, and a couple of relevant posts to the Italian personal finance community. I’ll keep adding here all the relevant content that I’ll produce for my Italian audience.

I’ll also add sub pages soon-ish as well. I’m now digging deeper into Italian Financial Sharks, i.e. financial entities who want to abuse of average Mario’s financial illiteracy, and take all of your money. I think I’ll keep writing in English, but I’ll collect these resources in a Shark Prevention Page under Italia Menu. I might also decide to write reviews of Italian-specific or Italian-first financial tools like MoneyFarm, Fineco ETF Replay, and more.

What’s next? Well, I have to write the many “Category pages” under Blog Menu, the entire Monetization section (a manifesto, and the few ways you can offer me a beer), the Learning section under External Resources Menu, the Switzerland top level page (with Swiss guides), maybe a Now Page…

“RIP”

What? (•_•)

“First, stop with these asciimoji, please, you’re 43 years old”

Ok (╥_╥)

“Second, what was the ‘new project’ you were talking about at the beginning of this useless post?”

Oh right! Sure!

I have hard time sending people to the right entry point (not necessary on my blog) where to get the easiest to consume, and the more complete guide to “money, personal finance, FIRE, investing, philosophy, and meaning of life“. I don’t think there’s anything that I’d tell a personal finance beginner “Take this, it’s all you need”.

The closest resource I can think of is the book “Your Money or Your Life“, which is very good for financial awareness and financial integrity. Not good for investing. Or the entire MMM Blog, or my favorite LivingAFi blog, but they’re too FIRE oriented, and not good enough on personal finance for beginners. And too US-centric.

I want to guide the NewFriend we met at the beginning of this post thru a comfortable journey into my overall money (life?) philosophy, without requiring an act of faith or trust. I want to build a Personal Finance guide. Something like Personal Finance from First Principles.

An End to End guide from “I know nothing about money” to “I know how to issue a limit order on my brokerage account to buy shares of a high quality and low cost security that best fits my asset allocation and my risk tolerance for the financial goals I have set”

A guide that covers everything:

from the hows:

- how to build a net worth spreadsheet.

- how to track expenses.

- how improve your earnings.

- how to cut your expenses.

- how to invest.

- how to make personal finance forecasts / your own retirement calculator.

- how to pick an asset to investing in.

- how to judge an investment offer.

- how to actually buy and sell an asset.

To the whys and whats:

- what are your current struggles? what do you want to improve? why?

- what are your goals? why?

- what’s important to you? why?

- why work? why not work? why save?

- what are your passions? what would you do if money weren’t an issue?

I know, it won’t be a small guide. But I want it to be as complete as possible and as lean as possible. It will be a nice challenge.

This idea has been forming in my mind since several months. And I know I need to act now and not let it go away. This is important to me. I’m realizing that I’d love to be remembered for my personal finance education effort. I want to help those who are more vulnerable. Financial Sharks are everywhere, and a lot is at stake: your hard earned money!

The new Italian Financial Shark I’m investigating these days aggressively sells a similar – but I’d bet inferior – product for 1500 EUR, which is the entry level product on his website. He can also sell a Gold upgrade at 80 EUR/month, and a couple of packages for stock picking at 2-3k per year! I’m shocked by his aggressive marketing strategy, the closeness of his approach, his online rudeness and bullying attitude, and the fucking huge price tag he puts on “common knowledge“.

That’s why I’m going to develop a better product, and give it away here for free.

This guide, who hasn’t a name yet (suggestions? Few Ideas: Money End to End, Money Coast to Coast, Personal Finance 101, First Principle Personal Finance, RIP Money Guide…), is going to sit into a static section of this blog. Like the Humble Dollar Money Guide, which is very good, but too US-centric and not introductive and philosophical enough for me 🙂

I will also produce a ebook, I guess. I’d make it available for free for sure, but maybe if I want to put it on Kindle Store I need to charge minimum price. We’ll see.

The goal is to complete Version 1.0 before I’m back to work, on September 1st.

Let’s see if I’ll make it 🙂

Any feedback? Would such a guide be useful? Is there anything similar around that would make my effort wasted? I’m here to have my idea challenged – as always 🙂

“Awesome! I’m looking forward to reading the guide!”

Yeah, I know, it is awesome! I am awesome! (⌐■_■)

“RIP… stop, please”

è_é

( ͝° ͜ʖ͡°)=ε/̵͇̿̿/’̿’̿ ̿

Have a nice day!

I was first confused that the home page was no longer the blog posts but after this explaination it makes perfect sense. I’ve also seen that you linked my blog in the external resources section. Thanks for that 🙂

Guide name ideas:

Progress to Retirement

Know your Money

Financial planning for everyone

1 invested euro/franken a day keeps the poverty away

A Rappen a day keeps the Apple stocks away 😀

Hi,

I’m Italian, 54, still at job even if more focused on my personal life (not professional). Fortunately my professional career allowed me to have this chance. I’m looking for a better performance on my saving, and I’ve invested part of them in MoneyFarm (you mentioned above). I like 2 features of MF. First low commission (and ETF index fund with no expensive management), second income tax on the total performance of the fund (so you don’t pay tax on positive performance of a single ETF, and have credit on negative performance of another ETF). I’m curious to read your opinion about MF, and to know if you are investing with them.

Finally, I thank you for your job here. I read time to time, and always find something to think about.

I wouldn’t call these fees “low”:

They’re barely acceptable for amounts above >100k GBP.

What I’d be willing to pay for a roboadvisor is in the neighborhood of 0.15-0.20%. Wake me up when that happens 🙂

plus I have a friend with MoneyFarm that on March 24th (the bottom of the market) received a mail announcing they were going to change his investment strategy and be more cautious, i.e. instead of rebalancing stocks into bonds, they did the opposite, selling a fraction of his stocks at the bottom.

Not good, I do want a roboadvisor, not someone who’s trying to be smart. I want to avoid mistakes, not having another human who does mistakes on my behalf, and paying him a fee.

So far I’m not investing in MF and I don’t plan to, but I think it’s not a bad solution for beginners.

First comment on your blog. Yay! 🙂

I really love this idea! If you need any help with it (more ideas for chapters, guest posts, checking the book for typos – one of my passions ;-)), feel free to reach out.

I’m not very creative with names for your book, so I’m not sure I’ll be much of a help there.

I think it would help to keep the book title short (not more than 5 words)

PS: there is a similar book from Finanzwesir, but it’s available in German only: https://www.finanzwesir.com/angebote/finanzbuch

Just use Hooli Translate or Deepl to get an idea (if you want)

Do I look like a guy who’d buy a book in a language I don’t understand? 🙂

Joking, maybe I’ll check it out for inspiration! Thanks for the recommendation.

Hi Mr. R.I.P.,

I’m a loyal Italian reader of yours, and I really love your work.

With reference to your “sarcastic” statement about Bitcoin please remember that:

Bitcoin is to money, what Internet is to communication. It makes things cheaper, faster, and global. Like Internet no one owns it, anyone can use it, and it’s growing faster then anyone could ever imagine.

Bitcoin is the world’s first digital cash system that doesn’t require trusted third parties. It enables borderless, frictionless payments through a new invention – the decentralized asset ledger. This invention can be used for much more than just payments.

Bitcoin is the best performing asset of the last decade, is the best performing asset this year. Easy to transport and seizure resistant. And on a longer-term time horizon, it’s still very cheap! (https://digitalik.net/btc/sf_model/)

Bitcoin’s historical performance against Euro is:

first price: 97,0

last price: 8.372,1

EARNINGS: 8.531,03%

3.46% per day

24.19% per week

103.68% per month

1244.21% per year

PERIOD:

6,86 years

82,28 months

352,62 weeks

2.468,37 days

Source: digital_mine

Just keep on buying Bitcoin with a DCA strategy, and HODL… to the moon!

This shouldn’t turn into a dogmatic discussion, but a lot of your points can be questioned.

Yes, if you bought Bitcoin back in 2010, you would be a multi-millionaire by now. I doubt that you did that, otherwise you most probably would not comment on RIPs blog.

Bitcoin also has a bit of surviorship bias. There are countless other cryptocurrencies which didn’t survive. And yes, I know that BTC was one of the first ones (or maybe even the first).

The decentralized ledger is a great idea, but the implementation (needing a lot of calculation power) is not. I’m not even going into the details of small number of transactions etc.

BTC might have long-term potential, but in the end it’s mainly about speculation. You hope that your “investment” will raise in price, so that you can sell it to someone for more money in the near or far future.

Just look at the drop of BTC price in March. It was very much correlated with the stock markt. Which means that people who bought BTC tried to get rid of it during the stock market crash.

I doubt that you bought BTC in March this year, or that you bought between Dec 2018 and April 2019…

“Yes, if you bought Bitcoin back in 2010, you would be a multi-millionaire by now. I doubt that you did that, otherwise you most probably would not comment on RIPs blog.”

I didn’t, but believe me, it’s just the beginning: 21,000,000 BTC, 7,500,000,000 people = 0.0028 #BTC per person.

“Bitcoin also has a bit of surviorship bias. There are countless other cryptocurrencies which didn’t survive. And yes, I know that BTC was one of the first ones (or maybe even the first).”

There’s only one: Bitcoin. The others are just shitcoin 😉

“The decentralized ledger is a great idea, but the implementation (needing a lot of calculation power) is not. I’m not even going into the details of small number of transactions etc.”

Have you ever heard about Lighting Network? And about BTC payments via HF transceiver for long distance radio? The future is now.

The banking system, the SWIFT system, VISA and Mastecard are much much more polluting whereas the miners adopt pretty much just renewable energies especially for the survival of their businesses. Planet Earth is grateful 🙂

“BTC might have long-term potential, but in the end it’s mainly about speculation. You hope that your “investment” will raise in price, so that you can sell it to someone for more money in the near or far future.”

It’s just math. It’s just JP Morgan’s change of hearth. It’s just “send it to me by fax” when still nobody trusted the e-mail.

No need to sell my BTC in the future. 1 BTC = 1 BTC. And I can already spend them using my prepaid and/or credit cards.

Remember, BTC is decentralized, trustless, permissionless, borderless, timeless.

“Just look at the drop of BTC price in March. It was very much correlated with the stock markt. Which means that people who bought BTC tried to get rid of it during the stock market crash.”

Two explanations: 1. the halving event was approaching and the less skilled miners needed more cash to change their HD 2. the miners are also FIAT investors, and a lot of them needed to cover the margin calls in that bearish period.

Afterward? 3rd halving is over and BTC is still alive.

In the meantime, I’m more concerned about

• inflation

• corrupt banks

• the global debt crisis

• funds confiscation

• censorship

• authoritarianism

• sustainability of the FIAT system

“I doubt that you bought BTC in March this year, or that you bought between Dec 2018 and April 2019…”

I did it! I’m a steady DCA BTC buyer since August 2017 (I bought some shitcoin too and lost some money with a pair of f***ing ICOs: youthful indiscretion), and you know what? I suffered an extremely high volatility but I’m still in gain. Double-digit per annum. https://digitalik.net/btc/yearly_candles

And only recently I started to invest a little % of my BTC in DeFI and CeFI to leverage a compond interest on them, still HODLing.

To the Moon!

I’m repeating myself regarding dogmatic discussions…

Mate, you don’t really know me and I don’t know you. I know about Lightning, number of BTC etc. I would be much more impressed if you had understand how to program a blockchain and the real math behind it.

Congrats that you have been DCA from Aug 2017. Just do yourself a favor and check how much you would have gained if you invested in VWRL or a similar fund back then.

Your explanations for the drop in BTC price are funny. Been there, read this stuff so many times before. Just check the drop in stock prices and the drop in BTC price. Much more correlation and causality.

Maybe some more food your thought: if you think our current money system won’t survive, we are in some serious serious trouble. And trust me: you will have other problems than your BTC to the moon…

Reminds me of a lot of those gold bugs. What do you think will happen if the current economy crashes? There will be a civil war, and the man with a gun is going to take your gold or ask for your private keys.

Which, btw, could also happen with governments. They could prohibit owning BTC.

Just food for thought. You have your opinion, I have mine 🙂

Thank you for your kind reply FIREstarter.

“Congrats that you have been DCA from Aug 2017. Just do yourself a favor and check how much you would have gained if you invested in VWRL or a similar fund back then.”

Beside the fact that at this stage I’m more invested in ETF (ww diversified equity and bonds) than in BTC, look at this analysis: https://howmuch.net/articles/biggest-companies-vs-bitcoin-last-decade-performance

“Your explanations for the drop in BTC price are funny”

Miners often collateralize loans with Bitcoin, lenders offer cash loans for BTC deposits, and more advanced traders use leverage for futures contracts (https://howmuch.net/articles/biggest-companies-vs-bitcoin-last-decade-performance).

and

Older-Generation Bitcoin Miners Are Unprofitable After the Reward Halving (https://news.bitcoin.com/45-older-generation-bitcoin-miners-are-unprofitable-after-the-reward-halving/)

Traditional market and crypto are correlated? Maybe. Gold too, in the end.

“Maybe some more food your thought: if you think our current money system won’t survive, we are in some serious serious trouble. And trust me: you will have other problems than your BTC to the moon…”

In the past we were used to pay with gold . Why the current money system can’t change once again? Why you can’t accept the forecoming (r)evolution? Central Banks print money at they like, and the future inflation will burn our savings. And you trust this system?

“Reminds me of a lot of those gold bugs. What do you think will happen if the current economy crashes? ”

This is what is about to happpen in Venezuela and Lebanon, for istance, where there is a huge increase in crypto mass adoption.

“Which, btw, could also happen with governments. They could prohibit owning BTC.”

Think about chineese bitcoiners and shitcoiners: they’re still working notwithstanding their goverment’s censorship. Nobody can’t stop the process. Mass adoption is sure. It’s now.

In the end, I hope we will all reach our F.I.R.E. asap 🙂

ps non è che sei TU che stai usando uno pseudonimo? 😉 lo stile di queste risposte è molto simile a quello che usavi sul F.O.L.

I’ve seen that this comment turned into a minor debate Bitcoin good vs bad.

My opinion is that Bitcoin failed to deliver his promise of becoming a currency.

It’s a nice tulip bulbs container for speculators and ideologists, that apparently might hurt people again after late 2017.

I don’t plan to buy BTC or any other Crypto for now. I will use them when/if (strongly doubt) they become useful. So far, I can’t pay a shit with BTC. And the fact you’re not telling me that “pizza price has gone down from 1000 BTC to 0.0001”, but instead you’re telling me that “BTC price went up compared to EUR” means you also consider BTC as a speculative asset and not a currency.

BTC is not a currency, it’s a SoV. Even gold isn’t a currency, but you can use it for paying. Not easy.

Look at this recent Ray Dalio’s article: https://www.linkedin.com/pulse/big-cycles-over-last-500-years-ray-dalio/?trackingId=0hcvJXVpf0APN61Vf6WJZQ%3D%3D

Money printing, devaluation: it’s time again for a new hard money.

And BTC fits perfectly as “hard money 2.0”.

Even PayPal noticed it. And JP Morgan. And Grayscale too (!).

It’s just the beginning.

To the Moon.

P.S. when you interpolate the black swan event of BTC during 2010-2017 into the future, I see this:

Hi RIP, thank you for all the effort you put in keeping this blog always “up to date” with intresting bits of informations, both in the personal and in the financial sphere of your life! I am a fan of your career and sometimes i dream about working at hooli like you did, but seeing how it endend i’m not sure if it would be the best choice for me, so for now i plan to keep learning things and grow at slow but steady pace here in Italy. Since i’m italian and intrested in the investment fields i can guess with a 100% accuracy who is the shark you are talking about. I am not one of his customer but he is the one that seems the most trustworth of the ones that i have seen, and so i am really curious about what you will have to say about him. Maybe his marketing skills are top notch, i have been more than once just a click away to buy the “not-so” entry level product, but i am still investing using my common sense and limited knowledge, trying not to take shortcuts and fail big. Keep going at it, and thank you again for everything!

L.

Hi Luca, were you right with your 100% guess about my Italian shark? I’m very curious to know 🙂

Or was the Orange one? I mean, the more I look, the more I find. Financial illiteracy is a too big of an opportunity for sharks!

About Hooli, I would recommend it to everyone. Don’t get scared by my ending (which was not bad after all). My own story is unique, and it might have gone differently if I had took other choices. For example, changing team 4 times didn’t help. Had I stayed in Hooli Maps instead of changing team maybe I would have been promoted a couple of times more and now I’d be a manager with a different perspective (and 2x the money). I started my Hooli journey at age 35, maybe if I had started 10 years earlier I would have had more energies and less marriages/children/whatever.

There are a lot of “maybe”s in my unique path, and I’m definitely not regretting my decisions here. Just telling you that my path is not the only possible one – and even that one was pretty good I’d say: from zero to 1.2M in 7.5 years is not bad 🙂

I guessed it right 🙂 And you are right too in saying that here in Italy we are under a continuos “attack” from these so called sharks.

Frequently a new one pop out from nowhere because we are really in a sea full of small fish to feed on. Add to the financial illiteracy the fact that a lot of people dream of getting rich quickly and with small or no effort, and you have the perfect storm 🙂

I never thought you had a path that was not worth it, and if you say you’ve never regretted it maybe i will think about it once again.. even if we are almost peers and i can feel the youngster pressing from below! ^_^

BTC-Luca: I can’t reply to your last comment, and it will be my last reply to this BTC topic (don’t want to spam RIPs comments)

Investing more in traditional ETFs than in BTC is a wise choice. Personally, I would not put more than 10% into crypto. And yes, I also have some coins (which is money I don’t even count into my net worth)

I have some background in economics (and also macro economics), so let’s summarize your comments regarding gold and fiat money: your point of view is pretty narrowed. There’s much more to it than just watching some Youtube videos and reading websites focused on crypto/gold/conspirancy theories. No, people were usually not buying things with gold back in the days. The topic payment alone is much more complex than what you can read on 90% of the pages in the internet.

The current money system will most probably change, but nobody knows how the future money will look like. You think it will be cryptos, which is a bet.

Regarding future inflation: try to read more about money supply M1, M2 und M3. Just because central banks are “printing” money, this doesn’t mean we will experience an inflation in the real world.

Venezuela and Lebanon are suffering from hyper-inflation, so of course people are using cryptos to try preserve their wealth. Also, much more complex topic in general (oil, governments involved, political parties etc) to just use those as examples for the success of BTC.

Re your “mass adaption is sure”: nothing is sure, except death. I’d be really cautious with such statements.

PS: if you don’t trust the current system, why do you invest in ETFs? Rhetoric question…

PPS: I don’t even speak Italian nor do I know what F.O.L. is, so no: you are mistaking me for someone else 🙂

Good luck to you 🙂

I have some background in macro economics and finance too: graduated of the 7th wordwide economic school with 20ys of experience in the banking system… the enemy! 😉

My big problem is that I met some (former) colleagues that few years ago took the decision to quit their job to follow a crazy project of life (teaching blockchain & spreading the idea), and the more I study, the more I attend the courses they advise me, the more I use it and the more I get in love with BTC 🙂

I’m sorry, I’m getting fanatic 🙂

I’m very happy to learn that you are a Bitcoiner too.

Coming back to the main topic of this fascinating blog (thank you Mr. R.I.P.), my target is very similar to the author’s one with the main difference that I’d like to achieve my F.I.R.E. status increaingly secured by a deflationary SoV how only can it be BTC.

Good luck to you too, and thank you again for this exchange of views 🙂

ps love your “BTC-Luca” 😉

Blockchain as technology is very interesting.

Bitcoins as investment is just a bet (or better, a speculation).

Maybe bitcoins will be the gold of the new digital world but I wouldn’t plan my FIRE journey on it.

The best thing about working for crypto platforms and crypto investments is that most times…work is done remotely and you can make millions off it within a period of time.I worked with a legit crypto company and I was paid in digital assets. But I wanted more, so I reinvested my bitcoin with this legit crypto company. Met them through my former job and I made a 50k after about 7 days when I signed up with them. I’m so happy investing all my bitcoin with them and I have referred a lot of friends to [REDACTED BY RIP] and there’s been no complaints whatsoever. Everyone is happy! I bring y’all good news that if you want to recover your stolen bitcoins/wallet they are also capable of doing that.

[EDIT by RIP: Googling for this comment shows that it’s a copy&paste to advertise a service, the service that I just redacted.]

I don’t even think blockchain is interesting that much anymore.

What I considered interesting was “Proof of work”, but in the end it is causing more “climate change” than the oil industry 😀

Study: Over 74% of Bitcoin Mining is Powered by Renewable Energy

https://cointelegraph.com/news/study-over-74-of-bitcoin-mining-is-powered-by-renewable-energy

Thanks for the nice words Luca!

I’m really curious who are those BTC evangelists you’re talking about.

And no, you don’t look (too much) fanatic since you’re here, willing to have your knowledge challenged like all of us 🙂

You’re Italian, RIP??? Well, you learn something everyday… and I certainly wouldn’t have guessed it from your blogs (although perceptiveness was never one of my strong points – LOL). Looking forward to catching up on what I’ve clearly missed, & I might even try out my dismal Italian on decoding your new homepages 😉

How can you NOT know I’m Italian? It’s in my “about me” page, and I write about it in every post 🙂

Some of my BTC evangelists, friends in the real life and not:

Ferdinando Ametrano

Giacomo Zucco

Federico Tenga

Tiziano Tridico

Antony Pompliano

Sylvain Saurel

Thanks 🙂

Long term power law

https://digitalik.net/btc/long_term_power_law

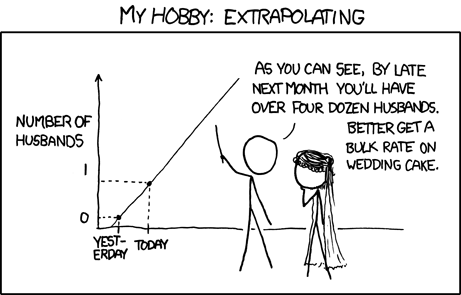

This reminds me of that meme “technical analysis: what a wonderful word for voodoo”. Beware of extrapolation bias.

I have also some fundamental analysis for you (part I e II):

https://medium.com/hackernoon/cryptoasset-fundamental-analysis-7-indicators-ratios-to-watch-e905da4b6c5

https://hackernoon.com/crypto-fundamental-analysis-part-ii-ix7fe31e3

I do not believe you can have a fundamental analysis without a cash flow.