Table of Contents

Hi RIP friends,

Welcome to ETF List Part 2 on World / International stocks. Here you can find part 1 on US, where I also introduced the doc and explained the content.

TL;DR: I’m building a more detailed version of 2018’s ETF List, and it’s taking a lot of time because this time I want to be as professional as I can. I’m learning a lot of stuff in this process, and I’m enjoying it. Sadly, the time I can allocate to my blog is getting compressed by my daughter waking up earlier in the morning… and these posts are by far the most time consuming ever. Doing the research, gathering the numbers, discovering new funds, adding columns to the doc and so on. So please, be patient!

Here’s the doc embedded:

And here you can find it on Google Drive with commenting permission. Feel free to leave a comment if you have questions.

This second episode is on world / international stocks (from a US perspective), i.e. funds that own stocks from the entire world, or the entire world excluding US, or the developed world and so on.

Yes, I know it’s a vague category, but let’s put it this way:

- if you’re an american investor, part 1&2 (US + rest of the world) should be all you will ever need to know about stock ETFs.

- if you’re a uber-lazy investor and just want to own a single world fund, part 2 alone is all you’ll ever need to pick a stock ETF.

- if you want to own funds at macro-regional level (US, Europe, Pacific, Emerging…), you can skip part 2 completely.

So, with this part 2 we covered two out of three use cases so far. Not bad!

Doc-wide update: I added the “# of stocks” column. As the name suggests, it indicates the number of different stocks (companies) in the ETF. As you may imagine, a S&P500 fund owns more or less 500 stocks. I find the info to be useful: it gives me a rough idea of the differences between otherwise similar indices like MSCI World, MSCI ACWI, MSCI ACWI IMI.

“RIP, you should say indexes, not indices”

Both indexes and indices are valid plurals of index. I picked indices for no specific reason and I’m going to stick with it 🙂

Let’s dig into what I learned, found, discovered, personally picked, and recommend to you 🙂

Let’s start small, let’s start with the entire world.

What is “the world”?

What do you think a World ETF contain? Stocks from every country in the world, right? Probably each country’s weight in the index is proportional to the country market cap, and each stock is also market cap weighed in the index, right?

Yes!

Yes, each of the 23 countries are market cap weighed in the world index, and each company is market cap weighed in the country share.

“Wait… you missed a zero. Last time I checked, the world had an order of magnitude more countries, did I miss something?”

Nope! A World ETF owns stocks from only the developed countries, i.e. 23 countries according to MSCI.

“What the hell is MSCI?”

Glad you asked!

From their website:

We are an independent provider of research-driven insights and tools for institutional investors. For more than 40 years, MSCI‘s research-based indexes and analytics have helped the world‘s leading investors build and manage better portfolios. Clients rely on our offerings for deeper insights into the drivers of performance and risk in their portfolios, broad asset class coverage and innovative research.

MSCI is one of the independent organizations that, among other things, define market indices. Other independent organizations worth mentioning are Standard & Poor’s (S&P) and Financial Times Stock Exchange Group (FTSE Russell).

Vanguard ETFs are usually officially tracking FTSE indices, while iShares ETFs track MSCI indices. It’s not a law, but that’s what I found out while researching for this post.

Since I like the MSCI website more, I’ll be referring to MSCI indices in this quick intro to countries classification.

According to MSCI, countries are currently classified in Developed, Emerging, and Frontier:

So yeah, by default “The World” means the 23 developed countries.

In the Emerging Markets we find another bucket of 24 countries.

Indices are living things. In 2018 Saudi Arabia was added to the EM list, and in June 2019 Argentina will move from Frontier to EM too. There’s also a proposal to move Kuwait into EM being discussed these days.

Anyway, Developed and Emerging together forms the “All Country World Index“, also known as ACWI in MSCI terminology.

Since ACWI is market cap based, and since Developed has more than 10x the market cap of the Emerging, the performance difference between the two indices is minimal.

Take a look:

We know that thanks to the global economy the markets are becoming more and more interconnected – and performances more and more correlated – but Emerging Markets (green line above) can still be a diversification tool. High volatility, high risks, very speculative. But when diluted with the MSCI World (developed countries, yellow line above) into the ACWI index (blue line above), with their small impact, they have almost zero effect.

Investing in MSCI World or MSCI ACWI is almost exactly the same thing.

I’m not saying investing in EM doesn’t make sense. I’m saying that if you “market cap” the world, Developed countries cover more than 90% of the markets. If you want to bet on EM, you should allocate more than their current weight in the ACWI index.

Then there are the Frontier Markets. According to Investopedia:

Frontier markets are countries that are more established than the least developed countries (LDCs) but still less established than the emerging markets.

Frontier markets are also known as “pre-emerging markets“.

We’ll look into Emerging and Frontier Markets in another episode. Here we’re interested in indices and actual ETFs that include at least the developed countries (eventually excluding US).

The index that encompasses Developed, Emerging and Frontier is called MSCI ACWI and Frontier Market Index.

Given the minuscule market cap of Frontier markets, the impact of Frontier on the index is negligible:

It’s fun how they defined “the world” (23 countries), then “no wait, the REAL world” (+24 countries), then “wait wait (Ku)wait! Here is the really real world!” (+ another 20-35 countries).

How do they call the set of the ~250 actual countries in the world?

Even funnier: Vanguard total stock market Index is US only.

Btw, we’ll talk about Frontier investing in the EM episode.

We won’t consider “MSCI ACWI & Frontier index” here, mainly because I couldn’t find any ETF tracking the index. Which is reasonable though: market cap of Frontier is minimal and costs to access Frontier stocks is very high (reflected in high TER of Frontier ETFs).

About market cap by country classification:

According to Investopedia:

In January 2018, frontier-market stocks had a combined market capitalization of over $700 billion.

So, essentially, the entire Frontier Market is worth less than Microsoft. It would be 5th in the S&P500 if the entire Frontier Market were single company.

From Seeking Alpha, quoting a FTSE study:

According to FTSE, the market cap of securities in developed markets represents 90.9% of the total world market cap, while emerging markets represent 8.8%. Frontier markets comprise a mere 0.3% of the world’s total market cap.

91% of the market caps of publicly traded companies come from Developed countries. 9% from Emerging and a mere 0.3% from Frontier.

If you’re curious about market caps by country, here‘s a list I’ve found on Knoema.

Indices & Market Capitalization

How much of the market capitalization is represented by an index?

Let’s take for example MSCI World. Does it own stocks of every company in the developed world?

Well, it depends.

The MSCI world index itself is defined as:

a broad global equity index that represents large and mid-cap equity performance across 23 developed markets countries. It covers approximately 85% of the free float-adjusted market capitalization in each country and MSCI World Index does not offer exposure to emerging markets.

“But RIP, I’m not ok with just 85% of the market cap.. I want to invest in small cap companies too 🙁”

You can, my friend. Either tracking indices that cover 100% (actually 99%) of the Investable Market (IMI) for that region, or investing in ETFs that track small cap indices directly for the same region.

So there’s MSCI World IMI, MSCI ACWI IMI and so on.

The first strategy (accepting market cap weights) produces negligible results. At least I expect that, since I didn’t find a simple graph comparing MSCI World and MSCI World IMI. On MSCI website I could only find World IMI vs ACWI IMI. But I have performance numbers in my ETF List and yes, it seems there are not many differences between ETFs and their IMI version (ACWX vs IXUS, and EFA vs IEFA). Surprisingly, IMI ETFs have lower TER. I would have expected the opposite, given higher number of stocks to handle, more trades, more dividends to collect and so on.

IMI ETFs usually track many more stocks for almost no difference. But as I said for ACWI vs World, it makes sense to invest in World Small Cap stocks directly, if you want an exposure greater/smaller than market cap weight.

That’s why second strategy makes more sense if you want to be a smart beta investor (don’t try).

There are indices tracking World Small Cap stocks.

I didn’t dig much into it, but I reported a pretty popular one: VSS by Vanguard.

But we’re already stepping into suggested securities, I see… ok, no more bullshit, it’s time to pick ETFs!

Before that, a quick recap:

| Index | # of countries | # of stocks | % of total market |

| World | 23 | 1632 | 77.27% |

| World IMI | 23 | 5976 | 89.99% |

| ACWI | 47 | 2757 | 84.75% |

| ACWI IMI | 47 | 8686 | 98.70% |

| ACWI & Frontier | 76 | 2871 | 85.00% |

| ACWI & Frontier IMI | 76 | 8980 | 99.00% |

Strategy and ETF Picks

Ok, time to talk about ETFs quality and personal picks!

There are so many aspects to consider, let’s start with the most important one: laziness!

Lazy or not?

Ask yourself this fundamental question: “how lazy are you?”

I classify investment laziness into categories, that absolutely don’t correlate with expected outcome. It might actually be the opposite: do you remember the dead investor‘s performance?

Anyway, for the ultra lazy folks, level 0 laziness strategy is: just pick a world ETF and invest all your stock-allocated money there. Developed or ACWI doesn’t matter much. IMI or not doesn’t matter much either.

This is an awesome strategy for everyone, actually. You get diversification, low TER, high trading volume (low bid/ask spread) all with a single fund. No need to buy S&P500 funds, small cap, and so on.

The agreement is that you’re ok with following the global market and its market cap weighted allocation. Right now “the world” is 50+% US, 85+% Large&Mid cap, 91% Developed countries… and if market footprint of countries change, your portfolio will reflect the new distribution of power.

If you’re ok with that – why shouldn’t you? Wanna be smart? Wanna time the market? Wanna bet? Wanna gamble? – a single “World ETF” is your strategy, and you can stop reading right now.

Well, wait a minute! Let me at least offer you my best pick 🙂

My pick for ultra-lazy investors is of course Vanguard VT.

With 0.10% TER you get exposure to 8000+ stocks. Vanguard funds usually track FTSE Index, not MSCI. VT tracks “FTSE Global All Cap“, which is similar to MSCI ACWI IMI.

Anyway, there are alternatives to VT but they don’t seem to be as good as VT.

iShares alternatives are laughable. The best ETF World (US domiciled) I could find from iShares is URTH, with 0.20% TER and less than 600M net assets. A dwarf compared to VT. There’s also the ACWI ETF, which is better sized (~10B) but 0.32% TER triggers a “no way!” answer.

The good news is that iShares offers a UCITS compliant World ETF named IWDA (a.k.a. SWDA), which is accumulating, IE domiciled (you lose 15% dividend withholding tax on the US portion, i.e. 55% of the fund), and nicely sized (12.8B). Beware its evil brother IDWR (a.k.a. IWRD, IQQW), which is the same fund except it’s distributing dividends, that comes with an evil 0.50% TER.

About UCITS compliance and Ireland domiciled ETFs, Vanguard’s alternative is VWRD (a.k.a. VWRL) which I consider inferior to IWDA (smaller size, higher TER and worse performances).

To recap:

- if you care about reducing costs (TER, trade fees, buy/sell spread) and getting back fraction of the dividend withholding tax, go with VT.

- if you care about UCITS (being able to invest from Europe) and US Estate Tax risks, go with IWDA.

So, if you were going to ask me “hey RIP, isn’t it enough to just buy VT and be ultra lazy?“, my answer would be “YES, it’s more than enough!”

“but hey, performances during last 5 years have been inferior to S&P500! I would have performed better just investing in S&P500!”

That’s because US outperformed the rest of the world during last 5 years. That’s not guaranteed in the future. Will the US continue to dominate? Who knows…

US or not?

… but ok, if you’re still reading it means you want to be more active, a “smart beta” investor! Good! I mean… not good! But let’s go on anyway.

Let’s say you’re a classical US investor who wants to invest in US stocks plus “International stocks”, like if the entire world except US is just “international”.

I classify this behavior as Regular Lazy, level 1 laziness: US & non-US, a two funds portfolio (for the stock component of your asset allocation).

Btw, if your desired US stock allocation today is 50-55%, i.e. current US market cap share of the world, maybe your Lazy-1 strategy is an overkill. Just go Lazy-0!

Ok ok, got it. Let’s move on.

So you want to invest in US on your own and buy international stocks. You already read my Part 1 post on US stocks and picked a US ETF like VTI, SPY, CSSPX or VOO. Good.

What are the options for “world without US” (that sounds like a dystopian movie title)?

Vanguard offers a trio of awesome US Domiciled ETFs, with low TER and high volume: VEA, VEU, and VXUS. The differences between the funds is in the underlying “world”:

- VEA tracks Developed countries all caps, like MSCI World IMI excluding US.

- VEU tracks all world, like MSCI ACWI excluding US.

- VXUS tracks all world, all caps, like MSCI ACWI IMI excluding US. Essentially VXUS is VT minus US stocks.

All of them are very good funds, performance differences and dividend yields are very similar.

iShares offers slightly inferior alternatives, not that bad on the IMI side: IXUS for ACWI IMI excluding US, and IEFA for developed IMI excluding US. The non IMI options (ACWX for ACWI excluding US and EFA for developed excluding US) have unmotivated high TERs.

Actually IEFA (which is the IMI version of EFA) is not tracking “world excluding US”, but the MSCI EAFE index. EAFE stays for “Europe, Australasia and the Far East”. Which is essentially the MSCI world excluding US. It’s composed by 21 developed countries instead of 22… no, wait, developed countries according to MSCI are 23. Who’s missing?

Holy shit I just realized I forgot CANADA!

So far I’m not investing in Canada! I personally own ETFs tracking US, Europe, Pacific, Emerging… Essentially I’m replicating an ACWI index except I don’t own any Canadian stock!

So EAFE is “developed world excluding North America”.

If you want to compose your World-Equivalent portfolio, mind that you would have to buy Canadian stocks! I found some “North America ETF”, like VDNR from Vanguard (Ireland Domiciled) that would work as replacement for US ones, but I’m not sure it matters much 🙂

For Americans: before investing in international stocks please read this very good Vanguard doc about it.

For Europeans: being US domiciled, for ETFs that track “excluding US” indices, is just a liability: you don’t get back dividend withholds issued by all the other countries. I’m not sure about it, but maybe US will also withhold an extra 15% (that you can claim back with a DA-1) that you would not have paid in the first place if you invested in IE domiciled funds (no withholding tax in Ireland). Anyway, take a look at this article on MustachianPost forum. User wapiti claims that “If a US ETF buys a UK stock and receives dividends. The ETF provider will beneficiate from the treaty concluded between the US and the UK. In the end, you will indirectly beneficiate from this treaty“. Interesting, I don’t have more data on this. If you want to better understand the three levels of tax withholding, take a look at this page on bogleheads wiki.

More on World ETFs by Vanguard and iShares on seekingalpha.

Yield or not?

The Yield Illusion posts on Big ERN blog (SWR series post 29, 30 and 31) threw some water over my willingness to jump over the dividend and dividend growth investing strategy.

So the question is: is it worth to try to be smart beta by adding some high yield stocks into your portfolio?

According to many practitioners it definitely is, according to few experts (Big ERN among them) it is not – it’s actually worse. Well, to be fair in post 31 ERN showed that on fixed income (bonds) pursuing high yield makes your retirement strategy worse in bear markets, while the equity component seems to be mostly ineffective (but not worsened by high yield).

My personal opinion – as I said in the previous post in this series – is that I know it’s an inefficient bet in Switzerland (dividends are taxed while capital gains are not) but I want to make it. My bet is that high yield stocks are undervalued and they’ll comeback in the near future. Value investing is not dead! Yes, I know, value investing is not dividend investing…

I know, I’m trying to be smarter than the dead investor. But at least I’m aware of it 🙂

My pick for High Dividend Yield world excluding US is VYMI. I purchased a bit of it in February, from the ashes of VHYD.

VYMI is the “international” version of VYM, which I also purchased last month from the ashes of VHYD.

I found another pair of ETFs US & International on dividend stocks: VIG and VIGI. I was surprised to discover that VIGI yield is a mere 2%, similar to S&P500. VIGI is tracking “Nasdaq International Dividend Achievers Select Index”, which according to official factsheet “is comprised of a select group of international securities with at least seven consecutive years of increasing annual regular dividend payments“. It’s more about dividend quality than pure yield. Interesting.

A nice article about VIG/VIGI and VYM/VYMI can be found on investopedia.

Small Cap or not?

Again, to try to “beat the market” with smart beta techniques (i.e. not stock picking and daily trading, but actively mix passive investing and active long term bets), maybe you want to add some worldwide small cap stocks to your portfolio.

I’m not personally doing this so far, but I might add some small cap in the future.

The only ETF I added to the list on world small cap stocks is the Vanguard VSS that tracks small cap stocks in the ACWI region (developed & emerging) excluding US. Performances have been meh (like any other “world excluding US” fund) and dividend yield (thus taxes) has been incredibly high for small caps, close to 3%!

RIP 2.0

I’m glad I took the time to start this doc. I’m doing a lot of research and I’m broadening my knowledge on passive investing by orders of magnitude.

But my actions (investments) still reflect a naive, childish approach.

RIP 1.0 used to own IE domiciled funds and invest irrationally. Someone copied my portfolio and got blasted on MustachianPost forum.

RIP 2.0 is trying to be more informed, more rational, but still probably inefficient: inferior bonds, high yield addicted, too much exposed to stocks compared with how I react when the market is down, too much manually diversified, too much exposed to small caps… but at least more informed and optimized here and there. It’s like first step toward FI in Your Money or Your Life, i.e. financial intelligence: you still suck, but at least you are aware of it. I’m in my financial intelligence stage with regard to investing 🙂

RIP 3.0 will achieve financial integrity, i.e. align my investments to my values: simplicity (less ETFs), risk aversion (less stocks exposure), not trying to act smart beta, and so on.

RIP 4.0 would be financially/mentally/invest-mentally free: don’t even think about investments at all. Just cashing out dividends quarterly, and checking balance once per month. Still far away.

This series is my celebration of RIP 2.0 mindset, and maybe first step toward RIP 3.0.

That’s all for part 2!

Very nicely said and written!

A first comment from a long time reader…

Thanks, and welcome to retireinprogress than 🙂

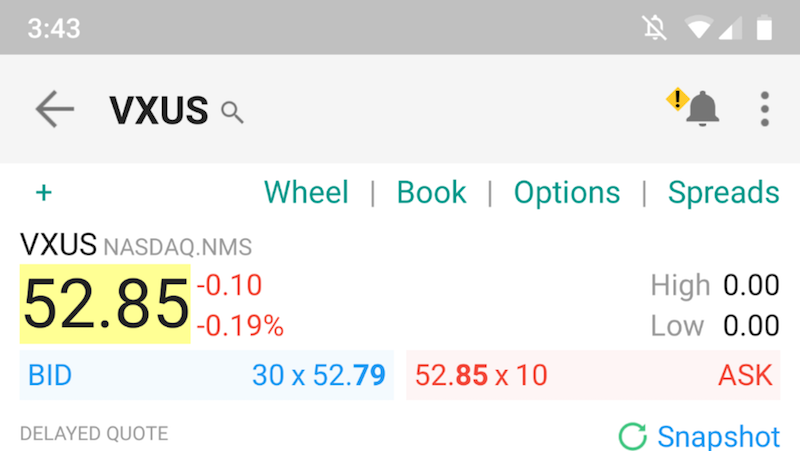

I looked at VXUS with Interactive Brokers today. The bid/ask spread is quite large. What is the explanation?

I see this now:

Maybe you checked outside trading hours and yes, IB shows random stuff outside trading hours.

That is it. After hours.

Dear RIP 2.0,

I would like to give you a big thanks on the time/effort you put on each post. I discovered the Spring clean, and since them I read your posts with very high attention. You already influenced me on my ETF and push me to learn more. I am not a naive newbie one… I have been in stocks for over 10y which taught me “less is more” and that an individual investor misses so much insider info for which it is impossible to win.

About me, my 2.0 is ETFs diversified US/EU/Small and around 30% two main Funds (Fundsmith and Stryx World). My cash today 30%, waiting for a better timing (mistake, I know).

Thanks again for your influence and knowledge-sharing.

You’re welcome, thanks for your comment 🙂

Holy crap, 30% cash!

Hi,

I live in Europe and currently my cash positions are at 100%. I am waiting for opportunities in both real estate and worldwide stocks after a crash. However, I’m thinking to test the waters and start investing in EUNL.DE (the EUR version of IWDA). I’m thinking to begin with small amounts of 1,000 EUR for every 2 months and do this no matter what happens on the market.

What I’m not sure is what to do with my other 100% cash positions. I have 3 options:

a) keep all my munition for depression liquid

b) go all in in stocks no matter the valuations (this seems crazy, not because of the volatility but rather because at current prices, MSCI World has a valuation of about 5% earnings yield, which is a very low premium risk; I can get the same yield invested in real estate and I also have inflation hedge)

c) invest most of my cash into an All Weather Portofolio (30% EUNL.DE, 55% AGGH EUR Hedged, 15% EGLN – all from iShares) and keep a small portion of my funds in cash for corrections

Right now, since I am more conservative with my money and also listened to Nicolas Taleb who says that money are preservation in first place and only in second place accumulation and profit, I am thinking to choose option a). Ray Dalio also considers the assets being fully priced so investing too much in stocks right now might be bad.

Another pattern I’ve noticed in the pattern community however is that some people are thinking to replace the 100% stocks approach with 80% MSCI World, 20% MSCI Emerging Markets or 80% Msci World, 20% Developed Countries Bonds. Which is the best mix in your view, choose simplicity and invest in only one ETF or have a more diverse portfolio and rebalance annually?

“…after a crash…”

I should point you to this post of mine: https://retireinprogress.com/i-will-invest-when-the-market-drops/

I recommend getting into the market with more stakes, using DCA if you’re scared. If you want to hold on more cash or cash-like positions there are not many options for us Europeans.

There are middle territories between a 80/20 portfolio and a “all weather” or “lazy portfolios” (25% cash, stock, bond and gold). You can experiment 50/50 for example.

About my preferred strategy, I started with several ETFs and “rebalance” by investing more in the under-appreciated sectors every month, but if I were to start it over I might go for simplicity and get MSCI ACWI + maybe some bets on small caps and value stocks. But people much smarter than me suggest to not do that: https://earlyretirementnow.com/2019/06/12/my-thoughts-on-small-cap-and-value-stocks/

Hello Mr. Rip,

As I read that you are planning to retire and live in Italy, be aware in investing in US domicilied ETF.

In Italy “not harmonized” ETF (based outside Europe area generally) are taxed according income tax bands (up to 40 %).

Good point, are you sure about that? I will do – of course – all the necessary checks once (and if) we decide we’re coming back.

Great post! I thought I knew most of it, but you clearly did a lot of research and managed to teach me a few things today. Thank you!

As to Canada, I suggest you look into how much of it you want and see if this can be covered by the 3rd pillar. It’s 0 additional fees and 0 extra trading to be done.

You’re welcome Alex!

I’m currently working on third post in this series. Stay tuned!

P.S. Canada covered by third pillar? Which one? VIAC?

Regarding the “all-world” ETFs, VEVE (Developed World, 0.18% TER, 0.35B AUM) would be more of an equivalent of SWDA. VWRL, on the other hand (All-World, 0.25% TER, 2.7B AUM) has slightly more countries in it (47 instead of twenty-something, bringing market coverage from 85% to 90%+).

Didn’t consider VEVE while researching for this post. I might add it in a future update to this list.

thanks Alex!

Mr. RIP;

I’m trying to read all of your posts, running into this blog started my financial education so thank you for that.

I have a question, I am based in an EU country that doesn’t have a tax-treaty with the US.

If I invest in IE domiciled funds, can I still write off the 15% tax through Irelands treaty, or do I pay the full 30% (is it 30%?)?

Thank you!

Hi mris,

IE domiciled funds get taxed from IRS and you can’t recoup that.

I tracked for example VOO vs CSSPX, both S&P500, first one is US domiciled, second one IE domiciled.

VOO dividends and CSSPX (virtual) dividends for Swiss Tax Authority differ by 15%.

There’s no way you can get it back, it’s not you that are taxed, but the fund itself.

Ciao Mr.RIP,

Thanks a lot for sharing all this information with us.

I have a couple of questions regarding the following ETF on your list:

VWRD IE00B3RBWM25 IE Vanguard

First of all, I think that the TER is 0.22% instead of 0.25% that you write in your excel file based on this website: https://www.justetf.com/uk/etf-profile.html?query=IE00B3RBWM25&groupField=index&from=search&isin=IE00B3RBWM25

Secondly, is there any reason that you choose the one that is listed in the London Stock Exchange in USD currency and not the VWRL which is listed in the SIX Swiss Exchange in CHF currency? In my case, even I live in Switzerland I was thinking to buy the VWRL listed in the Euronext Amsterdam Exchange in EUR because my broker Degiro allows me to have a transaction for free each month if I go for this. Please let me know if there is anything that I should be aware of.

Thirdly, is there any good reason that this ETF is not –> RIP Recommended – UltraLazy??

And last but not least, if you had to choose between IWDA and VWRL which one will you buy today? I’m a bit biased in Vanguards favour because of their business model but cost-wise the iShares has a better TER 0.20%. I really want to know your thoughts.

Thank you in advance 🙂

Hi Bill, welcome to retireinprogress 🙂

Many of the ETFs in my list changed. ETFs can lower costs (rarely they increase them), increase or decrease assets under management, and so on.

My list is not actively maintained, that’s why it’s a “ETF List 2019”. Maybe I’ll make a 2020 version, I don’t know yet. And it’s not my priority at the moment 😉

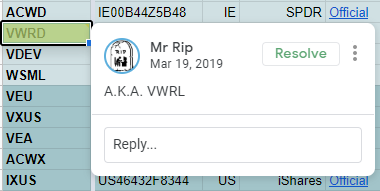

There’s no specific reason to list VWRD instead VWRL.

Actually, I added a comment to that cell “A.K.A. VWRL”:

Comments are not publicly visible because there’s no way to have read-only comments, and people keep adding spam comments and/or resolving mine.

Anyway, mind that buying ETFs on SIX will trigger “stamp duties” which is an annoying extra tax on your transaction.

On the “pro” side there’s the fact that it’s traded in CHF, which means fewer forex costs (which are negligible if you’re using IB)

Why it’s not in the ultralazy?

Well, at the time of writing the post I considered it an inferior solution to IWDA (higher costs and smaller asset under management / fund size) but now that I see it better, it’s a ACWI fund and it’s not that small. Upgraded to “RIP Recommended – UltraLazy” 🙂

Thanks!

And I’d probably prefer it over IWDA, but I didn’t do a proper comparison.

Anyway, this is a micro-optimization – which is welcome – but remember to focus first on your risk assessment, mental training, long term plan and so on.

Have a nice weekend

Hi RIP, All

I tried to create an ETF portfolio here the screen shots:

This is a simplified one,

United States, Health Care

Invesco Nasdaq Biotech UCITS ETF

IE00BQ70R696, A12CCJ

0.40% 10.00%

Equity, Switzerland, Dividend

iShares Swiss Dividend (CH)

CH0237935637, A110UY

0.15% 10.00%

Equity, Switzerland, Mid Cap

UBS ETF (CH) SMIM (CHF) A-dis

CH0111762537, A1CW6B

0.27% 10.00%

Equity, World

Vanguard FTSE All-World UCITS ETF (USD)

Accumulating

IE00BK5BQT80, A2PKXG

0.22% 60.00%

Equity, Asia Pacific

Vanguard FTSE Developed Asia Pacific ex

Japan UCITS ETF Distributing

IE00B9F5YL18, A1T8FT

0.15% 10.00%

The second is a bit more complex:

Equity, World, Social/Environmental

CSIF (IE) MSCI World ESG Leaders Blue UCITS

ETF B USD

IE00BJBYDQ02, A2PW7D

0.15% 10.00%

Equity, United States, Health Care

Invesco Nasdaq Biotech UCITS ETF

IE00BQ70R696, A12CCJ

0.40% 10.00%

Equity, Europe

Invesco STOXX Europe 600 UCITS ETF

IE00B60SWW18, A0RGCK

0.19% 15.00%

Equity, United States

iShares Core S&P 500 UCITS ETF (Acc)

IE00B5BMR087, A0YEDG

0.07% 20.00%

Equity, United States, Technology

iShares Nasdaq 100 UCITS ETF (Acc)

IE00B53SZB19, A0YEDL

0.33% 10.00%

Equity, Switzerland

Lyxor DJ Switzerland Titans 30 (DR) UCITS

ETF

LU0392496427, ETF030

0.25% 10.00%

Equity, Asia Pacific

Lyxor MSCI Pacific UCITS ETF

LU0392495023, ETF114

0.45% 5.00%

Equity, China

WisdomTree S&P China 500 UCITS ETF USD

LU1440654330, A2ANVN

0.55% 10.00%

Equity, Switzerland, Large Cap

Xtrackers Swiss Large Cap UCITS ETF 1C

LU0943504760, DBX0NU

0.30% 10.00%

0.26%

Fees per year

14.14%

Volatility 1 year

33.42%

Return 1 year

Any thoughts reccomandation? How many ETF in general would you reccomend?