Table of Contents

Hi RIP readers,

This is a short post about what’s happening right now around GameStop company.

GameStop is a US video game retailer company. They sell “physical” video games CD/DVD/Blue Ray/Cartridges for consoles and PC. They’re also well positioned in the used market.

You’ve probably seen their stores in your mall or in your favorite shopping center. Do you remember malls? Those huge buildings where people used to gather? Ok enough archeology for today.

Why am I talking about GameStop?

If you haven’t been living into a cave for the last 72 hours, you’ve probably heard that “something weird is going on”.

Let’s get started!

GameStop Fundamentals

GameStop is considered “the Blockbuster of video games”, and while Blockbuster succumbed against digital delivery and streaming (Netflix), GameStop is getting smashed by Digital Delivery (Steam, Origin, PlayStation Store) and Cloud Gaming (Google Stadia, PlayStation Now, Amazon Luna).

Let’s be honest, where do you find a Millennial/Zoomer who wants to walk into a physical store to buy a physical copy of a videogame in 2021? Come on!

In fact, the fundamentals of GameStop suck a lot.

Take a look at the MarketWatch report for the last 5 years:

I’m not an expert in Fundamental analysis, but it doesn’t take a genius to understand that this company is sinking.

Sales and gross income are sinking, what about profits?

They’re of course in the deep red! Negative earnings per share. EBITDA heading toward ZERO, meaning that financial burdens are eating all the earnings even before operation costs.

It doesn’t take Warren Buffett to understand that this is a dying company.

The weird thing is that the failure of their business model was clear since at least 4-5 years. What were they doing while videogame distributors were growing their digital platforms like Valve Steam, EA Origin, console manufacturers (PlayStation, Microsoft, Nintendo) stores?

A couple of years ago they were already heading toward the disaster, distributing unsustainable dividends and sinking.

I mentioned GameStop dividends craziness in December 2019:

GameStop was issuing crazy dividends (above 10% yield) while its business model was going to thrash.

So, GameStop was (is?) a company heading toward the cliff at high speed, with no intention of hitting the brakes.

GameStop Stock Price

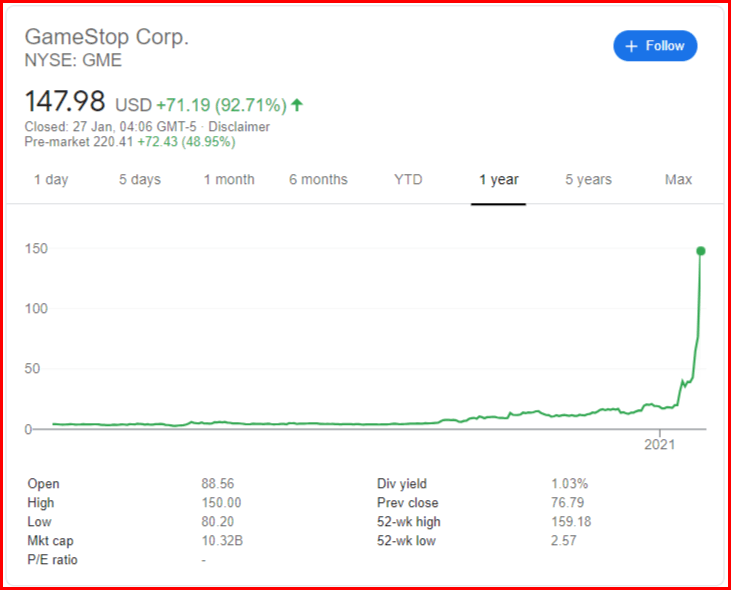

Then 2020 came, Pandemic hit its business model even more (bye bye physical stores), and the stock hit a bottom of $2.57 per share in April 2020.

That’s it, that’s how it ends for a dead business model, centered around obsolete physical products, slashed by a prolonged lockdown.

Let’s take a look:

Surprise!

It’s up 57x since April 2020!

If you had invested 17k in plain vanilla stocks at the bottom, you’d have 1 Million now. We’ll see what happened if you invested in call options later 😉

GameStop Market Capitalization went from 180 Millions on April 3rd, 2020, to 10 Billions at the time of writing (January 27th 2021 morning). Its P/B ratio is now 29. In comparison, MSCI World P/B ratio is below 3.

And it’s not over yet! Afterhours trading is even crazier:

Note that I’m writing this post in the European morning of Wednesday January 27th, with Wall Street closed until 3.30pm CET. Things are changing rapidly these days, this post might be obsolete even before I hit the publish button!

Update: it’s 6pm of January 27th in Europe, and I’m about to publish this post. We’re at $350, 133x growth from the bottom, not 57x. If you invested $8k in April 2020, you would have S1M today. Market cap is 21B, it’s now within the largest 500 companies in US, i.e. ready to join the S&P500!

What’s happening?

There’s a Short Squeeze going on at the moment, a very peculiar one.

Short Squeeze

What’s a Short Squeeze? First we need to understand what’s a Short Position.

Shorting a stock is the act of selling something you don’t have right now, and buying it later to cover the sale. It’s a bet that the stock price will go down.

For example:

- RIP Inc. stock is priced at 100 TS (TombStones, RIP currency).

- I think RIP Inc. stock price will go down and want to bet on it.

- I borrow a RIP stock from a buy&hold investor for T time in exchange for an interest payment.

- I sell the RIP stock on the market for 100 TS.

- After T time I buy a RIP stock on the market for price X.

- I give back the stock to the borrower

If the price went down (if X < 100 – interests) I made a profit, else I had a loss.

Shorting is dangerous, because the downsides are unlimited. If X goes to ZERO I made a profit of 100 TS. But what happens if X climbs to 200? I lost 100. What if X goes up to 1000? What if it reaches 10k? You need to buy it back after T time, eventually until bankruptcy.

Your broker will demand collaterals at short selling time (you need to have at least 100 TS in cash or other assets just to sign the contract), and they will eventually call you on the phone when covering the short position would cost more than your total assets. In the worst case they’ll liquidate all your other assets, buy the stocks to cover your short position, and close the position.

Congrats, you’re now wiped out!

Of course there are other ways to bet on assets going down, and they’re collectively called Bear Positions. The bear position I’ve shown above is called Covered Short Position. Other kinds of bear positions include buying put options, selling call options, and buying Inverse ETFs.

So, what’s a Short Squeeze?

If a company is heavily shorted, short sellers face the risk of not finding enough stocks on the market to cover their short positions.

If the stockholders “agree” to not sell the stocks, the price could skyrocket.

On of the most famous example is the Volkswagen Short Squeeze of October 2008. VW stocks rose 5x, making Volkswagen the largest company in the world by market cap for a day, before falling back to normal after the squeeze. It’s an interesting story to read, but it’s a story where main characters were huge companies and hedge funds, like Porsche and Morgan Stanley. Not me and you.

In the previous example of RIP Inc., let’s imagine many investors bet on the stock falling. A nonnegligible percentage of RIP Inc stocks have been borrowed by short sellers, say 50% of the circulating stocks.

Let’s also imagine that 2 companies, Squeezy and Shaky, acquired 30% each of RIP Inc. They know that if both agree to not sell stocks then the short sellers will not be able to cover their short positions.

Squeezy and Shaky can set the price. They can put RIP Inc stocks on sale for 1000 TS, and the short sellers will have to accept or declare bankruptcy and be wiped out.

The squeeze normally gets resolved at one point because either Squeezy or Shaky decides to sell their shares, closing their profitable trade before the other one, or before short sellers go bankrupt.

Here’s a nice video explanation from Investopedia, please take a look.

GameStop Short Squeeze

The Volkswagen short squeeze is archeology. Welcome to a completely new world, where RobinHood (traders) steal from the rich and give to the poor!

GameStop is going under a short squeeze, maybe the most epic of all times.

I tried to research how it started, who is involved, and where is this going. Please, bear with me. This has been one of the funniest post to write and to research for 🙂

Some newspapers wrongly attributed credits to Elon Musk recently tweeting “GameStonk!!”

Good guy Elon, but he has probably no role in this game. Except of course he gave a lot of visibility to the squeeze, and now we’re all waiting for GME to reach $420. Crazy Genius Tweet!

Everything started with a Reddit user u/DeepFuckingValue (DFV from now on) posting his crazy Call Options bets on GameStop in a series of threads titled GME YOLO update, on the subreddit r/WallStreetBets (WSB from now on).

His first GME YOLO dates back to September 8th, 2019. He held call options expiring on January 15th 2021 (LEAPS, almost a year and half later), with a strike price of $8.

In September 2019 he was doing great. His 1000 options contract were worth $100k (though a very high BID-ASK spread), while he “only” paid $53.5k in premiums.

Now, WSB is a very weird place. It’s a subreddit with 2.2M 3.1M 4.2M subscribers (+2M subscribers in a day and half… oh my god), whose headline is “Like 4chan found a Bloomberg Terminal“, that call themselves “retarded”, “autistic”, “losers”. It’s a sociologically complicated environment to understand.

They troll, they (claim to) invest money on stupid bets, post their screenshots with 7 digits fortunes built and destroyed in a matter of hours, and they make fun of those who failed, but in a camaraderistic way.

DFV

Is this DFV guy real? Are his screenshots real? We don’t know, but the effects of his “message” on the market is visible, a lot!

I don’t understand what it would take for a sane investor to bet 50k USD on stock options of a bankrupting company… and more importantly, how to keep the options once you’ve realized a 100% gain.

Note that his first WSB post was not titled GME YOLO update, but “Hey Burry thanks a lot for jacking up my cost basis“.

It’s referring to Michael Burry, the legendary investor whom you probably know for the movie The Big Short.

In August 2019, Michael Burry owned 3.3% of GameStop, and he urged the company to buy back a lot of stocks. Holy shit how right he was! 🙂

DFV complained that Burry’s words could raise stocks price in the short term, increasing “cost basis” of new LEAPS options that DFV wanted to buy. This is borderline crazy. Instead of thanking him for rowing in the same direction (that earned DFV $12.5k in a day, see the screenshot above), DFV would have preferred that Burry had shut up!

When confronted in the comment section of his first post, DFV said that he was holding GME call options well before Burry’s letter. YOLO!

Anyway, the guy kept posting his GME YOLO UPDATE posts on a monthly basis.

This one is from February 2020, probably the worst one:

77k costs. 44k portfolio value.

This is the end, you’d say, right?

Then something happens: next update (April 14th, 2020 – bro we missed the March Update!) is titled “GME YOLO update following the start of the Big Short Squeeze“:

His portfolio is up big time, it’s now worth $300k. The stock more than doubled its price, from the bottom of $2.57 per share, to $5.95. Volatility increased, also contributing to raising options prices.

You got it! Well done DFV! You were betting on just this, right? You sold all your options right after, didn’t you? You don’t really believe that you’re going to exercise your calls at $12 in April 2021, do you?

He didn’t sell. And he mentioned in the title “the start of the Big Short Squeeze“, without any evidence that a squeeze was happening. This post got way more upvotes than the previous ones, 210.

It was just the beginning…

Fast forward to September 2020. He started posting biweekly, then weekly GME YOLO Updates. Between September 16th and 22nd his portfolio crossed 1M, reaching 1.5M in September 22nd. Still holding Call Options.

Ok this is crazy… but it’s so fun to document!

Updates are getting popular, earning him reddit awards, getting lots of upvote…

This guy is holding on 15k call contracts for 100 shares each. He is in potential control of 1.5M stocks! Well, at this point in time just a few of the options are actually ITM (in the money, i.e. strike price below market price). [EDIT: My mistake, 10k are shares, not call options]

Starting in December 2020 he posted more frequent updates. Here’s how he ended 2020, with 3M+, and 13k options. [EDIT: 10k shares, 3k call options]

GME GANG

At one point many other WBS redditors jumped on the bandwagon. It’s hard to track when the trend took off. I did some research, but given the amount of threads and the uselessness of search engines I had to give up at one point. According to my (probably incomplete) investigation the GME GANG nickname was born in mid November 2020. It’s more or less around that time that GME YOLO updates spiked in upvotes and comments.

Btw, you can buy GME GANG merchandise online… LOL, what a time to be alive!

On January 13th, 2021, the current stock rally took off, eclipsing Tesla, Bitcoin, Nio and other Meme Stocks/Assets:

Around the same time, DFV updates became daily, and they got A LOT of attention

It’s hard to finalize this screenshot, because every time I reload the page… the higher numbers demand a fresher screenshot.

Anyway, let’s take a look at DFV latest GME YOLO update, January 26th:

Ok, since I took the the previous screenshot (2 minutes ago?) the thread got an extra 200 upvotes. EDIT: 102k upvotes at publish time.

On a side note: this is probably the most awarded thread of reddit history. EDIT: nope!

Let’s take a look at… OH MY GOD! 58k Call Options, portfolio value 22.8M (18M in options, 4M in cash). It’s funny to see that the 800 options with strike price $12 are worth 50% more than the 50k options probably bought a various strike prices..

His portfolio went up $9M in a single day, this is nuts!

Tesla has become a boomer stock.

Update January 27th GME YOLO:

DFV is slowly cashing out his options (sold 300 during the day) and holding on his shares. Portfolio just shy of $50M, from $50k invested in August 2019 (or before). This is beyond historical. This last update is a pure character celebration, and a collective hug. I bet this is the last one. WSB is exploding, and experienced some production problems (as a former SRE I recognized some). It went from 2M to 4.2M members in less than 2 days. History has been written. Probably the SEC will write a chapter 2, but it will take some time 🙂

If you’re a data hoarder like I am, save those threads, take screenshots, protect history 🙂

WSB

Anyway, it’s hard to know the real impact of WSB on this very long tailed short squeeze. Is it only a short squeeze btw?

We’re witnessing a 57x 133x bottom to top stock raise, is it only because of the short squeeze?

Is it also because it’s a Meme Stock, a Penny Stock, or maybe the business is more solid than we think?

In the end, Michael Burry – not a random guy on the internet – was heavily invested at the bottom…

Who’s being short squeezed btw?

Enters Melvin Capital.

Melvin Capital

As I started to dig deeper, I discovered that there’s an Hedge fund that was holding a lot of short positions into GameStop: Melvin Capital.

WSB crowd got angry (not clear to me why), and they started taking it personally, fighting with all their weapons against this large Hedge Fund.

Melvin Capital was reported to manage $12.5B at the beginning of 2021, and to have lost 30% so far in 2021, which means ~4B. Holy crap! Two larger Investing firms like Citadel and Point72 Asset Management had to come to rescue Melvin Capital, acquiring fractions of it:

On Monday, Point72 agreed to invest $750 million, and Citadel is investing $2 billion. Both are taking a non-controlling passive revenue share in the firm.

Finally, 2 hours ago, while I’m writing this post, Melvin Capital got out of the short squeeze accepting crazy stock prices and stomaching a huge (undisclosed so far) loss.

Apparently, the WSB crowd is going after other stocks that Melvin was shorting (GSX Techedu, National Beverage, iRobot, and Bed Bath and Beyond), just for the fun of destroying the fund.

Last Days

I don’t know what’s going to happen today, tomorrow, and on Friday.

The main “enemy” got out, but the stock is still going nuts in pre-market. It’s trading at $350 right now, 10 minutes before Wall Street opens.

My simple brain is telling me that the battle is over, and the castle of cards can now crash, causing the death of a shitload of call options (and the end of DFV game), but it doesn’t look like it’s going to happen today.

If a drop is going to be expected, someone will buy put options and assume a bear position again, which in turns will make the GME GANG angry and the stock could keep raising.

In the end, GameStop is still a heavily shorted company:

I mean, it’s a psychological battle, a game of luck and stubbornness… completely detached from the company business. If I were the company I’d announce share dilution, i.e. emission of new shares (EDIT: this has happened). It’s probably a slow process, and by putting more stocks on the market the short sellers can find easier way out – but the company will get a lot of cash, which in turns may resurrect or reinvent their business. It could become a self fulfilling prophecy! GameStop can act like a SPAC, in a kind of huge pivoting!

Ok, maybe this is too much speculation. But when Chamath Palihapitiya is involved, I can’t exclude it.

Chamath Palihapitiya

What has Chamath Palihapitiya, a venture capitalist, to do with this short squeeze?

Well, probably not much. But he poured oil on troubled waters few days ago, and GME GANG appreciated:

Who is Chamath?

I discovered him few months ago while listening to an episode of “The Knowledge Project” podcast (Shane Parrish, Farnam Street) with him as a guest. I dropped it halfway, I classified this guy as a Naval Ravikant clone. Maybe I should resume the podcast, this guy is doing crazy things and he deserves 1.5 hours of my attention:

- He’s the CEO of Social Capital.

- He announced he’s running for Governor of California, with his campaign centered around “reducing state tax from 16% to 0%” AND huge bonuses to students and newborns. LOL.

- He’s the king of SPACs (Special Purpose Acquisition Company), and he’s making a lot of money helping companies to “lightweight IPO”. SPACs are controversial empty companies, and someone consider the raising number of them a bubble signal.

- He ranted many times against Hedge Fund Managers and speculators. He went viral when he said: “speculators should get wiped out“.

I don’t know what to think about this guy, but he’s playing a role in this game.

What about Michael Burry?

Is Michael Burry still long in GameStop?

I’ve read few contradictory statement. Apparently, his words, yesterday he said he’s now “neither long nor short“. But we don’t know when he sold his stocks. He added about the current rally:

If I put GME on your radar, and you did well, I’m genuinely happy for you. However, what is going on now is unnatural, insane, and dangerous. There should be legal and regulatory repercussions.

In this other article on Business Insider it seems his positions grew by 1500% until last Monday.

Where is the truth? Hard to tell.

Who cares? Not really.

It’s hard to accept that a bunch of self appointed “retarded” were able to destroy Billions of dollars from an Hedge Fund, and who knows what else. Maybe there’s a “mind” behind the WSB hands.

I don’t know I’m just speculating.

Market Manipulation

Burry didn’t mention “There should be legal and regulatory repercussions” by chance.

What’s happening in WSB and within the GME GANG might configure as Market Manipulation, which is a crime. The SEC could investigate and eventually go after some of the actors in this game. This will probably lead to some repercussions, and maybe extra regulations.

According to Jacob Frenkel, a former SEC lawyer: “Such volatile trading fueled by opinions where there appears to be little corporate activity to justify the price movement is exactly what SEC investigations are made of“. The top security regulator in Massachusetts is also looking into this.

Maybe it will be hard, if not impossible, to go after individual reddit users, but maybe the platform itself (Reddit) might be held accountable, which would mean at least “GG WSB”.

But this wave is hard to contain anyway. Reddit is just a medium, people will rearrange and find another channel to keep playing this game together.

Quoting a comment I’ve read on Facebook: “Free speech and social media. Good luck prosecuting the small guy“.

WSB Power

If everything is legit, and the “retards” have the power to destroy/resurrect a company, the so called Meme Stocks (amazing article, please take a look), then a lot of energy will go toward manipulating WSB or other similar channels with a proven history of being impactful.

Take a look at this WSB thread. The author warns the community to not get distracted by threads about another meme stock (Nokia):

They fear that once the medium has proven to be powerful, establishment will come and take it over.

Meme Stocks and Collectables

Meme Stocks… this made me laugh a bit, I must admit.

Stocks that are dead are being resurrected just for fun. It happens all the time with Penny Stocks, bankrupting stocks, dying companies. It happened with Hertz, Kodak, Nokia, Blackberry… JCPenney.

Even with Blockbuster!

Yes, Blockbuster is definitely gone, but its liquidating company is still around. I don’t know where you can trade it – I can’t on IB – but apparently BLIAQ went up +2500% in the last 4 trading days.

What’s the rationale behind this trend?

Warning: I’m turning into full speculation mode 🙂

There are various theories:

- Financial (the obvious one): the company has a good value for its price, so I buy it because I think given its fundamentals that the stock will raise. Nah.

- Political: holding a stock is a political expression. It’s a declaration of intent, it’s like casting a vote. Maybe… but Nah.

- Fun/Meme: LOLZ, I’m HigH and DrUNk and alL mY bruThA Are BuyInG TeleFUnKeN SToCks So sHuT Up aNd TAkE mY mOnEY! Maybe, not sure.

- Gambling/Lottery: I’ve got $1k, it’s not going to change my life. I’m going to bet on this penny stock so either I lose everything, or I turn my grand into millions and I’m set for life. Maybe, very likely.

- Misinterpreted Barbell Strategy: Nassim Taleb told us we should invest a small fraction of our money in high risk / high return assets. That’s why I bet my life on pets.com stocks! Nah.

I think there’s more to that.

I know it’s already a long article (who would have told, uh?), but I want to cross the Meme Stocks trend with another apparently unrelated dark corner of human brain and add one more hypothesis:

- Digital Collectibles: I’m a digital collector, I want to own a share of this company because it’s missing in my collection. Bingo!

I discovered the world of Non Fungible Tokens few days ago and it blew my mind. I was reading a thread online (in Italian Language) about a kid who claims to be a Crypto Artist, selling his art pieces on Ethereum blockchain. The kid was asking for investment advices, but it’s not what I want to focus on.

I wanted to dig further: what is a crypto artist?

Here are this guy’s art creations. For example:

This is called River, and I’m sorry, it’s sold out

¯\_(ツ)_/¯

“Wait, what does it mean?”

It means that yeah, you can copy the image, it’s available everywhere… but you can’t own it. there’s someone who owns it. Someone who can prove they own it.

“Are you talking about copyrights?”

No, and here’s where my mind blew up. I’m talking about owning the image like you would own a physical painting. This art piece (not judging the quality) can only be owned by a single entity, via Non Fungible Tokens.

“Yes, but what does the owner own?”

They can prove to be the owner.

Well, they can surely resell the art piece for example.

I don’t know, maybe the (smart) contract can state that the copyrights are owned by the person who has the token? I don’t know…

We live in a world where the most popular and profitable game in the world is free to play, and monetize via selling digital goods that offer no in-game benefits. People are buying digital clothing for their avatars. So why not own a digital unique art piece? Scarcity is a status signal!

“But this is the mother of all fake scarcity!!”

I share your disbelief 🙂

Look at yesterday amazing episode of The Compound with Josh Brown and Michael Batnick.

Take a look at 17:08, when they talk about “Blockchain Collectibles”. Michael trolls Josh with the story behind NBA Shots, “Officially Licensed Digital Collectibles”. Same as above. Videos that are “sold”… but not in the sense they’re private. They’re available on YouTube, on the internet… but you can buy them and digitally own them 🙂

Apparently they got all sold out immediately, and now there are videos trading at $75k!

Yes, Josh is stunned. He doesn’t understand this trend. I’m with him 100%. This is too much for me.

But in the end, what’s the difference between a Bitcoin and a Kobe Bryant’s slam dunk, proven you’re the unique owner of it? Things have the value we collectively give to them.

Wait… did anyone though about collectible digital stamps? Ouch… too late!

If it sounds paradoxical either we’re living in a collective hallucination, or you – like me – are too old.

I think this year I finally accepted I’m too old to be willing to understand a whole spectrum of new young stuff.

But what if Meme Stocks are seen as a cheap form of Digital Collectibles? What if people are buying Nokia shares because they’re missing them in their collections? In the end, as collectibles they have a resell value. They are a store of value. Who cares about fundamentals of the company! They should stop operating and wasting money. They should just “exist” and have outstanding shares. Custody banks are expensive ledgers though… if only we could move Blockbuster on Ethereum blockchain…

Am I crazy? Am I saying stupid things? I mean, if we’re forced to be at this party, why not just dance?

That’s all for today!

(P.S. at 12:41 they also talk about the GameStop frenzy, with Josh being sure that this is a form of Market Manipulation. Amazing Compound episode!)

Great Post !!! Bravo !!!

I had never thought about this kind of concept (the squeeze) and it’s thrilling and scary at the same time. In particular the fact that the users were engaged in provoking the “downfall” of the institutional players… it recalls the old story: “us against them”, a turmoil of low instincts.

Great article, thank you for your time 🙂

thank you Lorenzo 🙂

I had a lot of fun writing this!

I loved your synopsis!

Great post, funny and scary how social media has the power to amplify everything, from fake news, to bitcoin price.

“With great power comes great responsibility”, Voltaire and Spiderman’s Uncle said…

So if market manipulation is a crime, if a huge hedge fund is screwd up, well, it think the probability of the ‘big boys’ prosecuting ‘ the self-proclaimed retarded’ guys is high…

let’s not forget that there were “big guys” on the squeezing side 😉

https://www.investors.com/etfs-and-funds/sectors/gme-stock-gamestop-investors-instantly-make-16-billion-gamestop-stock-squeeze/

An incredible story! But I think that it’s not over yet! We need GameStop Short Squeeze Part 2! 😉

By the way.. Great post!

…aaaand you were wrong 😀

Now we really need an update, haha.

LOL

Actually I have a draft post about “what I would have done with 50M that u/DeepFuckingValue could have had if he sold all the options and stocks at the top”… and it’s becoming obsolete before even having finished it 😀

I didn’t read your whole post in details but I think you missed the part where Citadel is playing both sides of the bet to some extend. There might not be a single mind behind the wsb hand but it sure is being at least amplified by the big guys: https://twitter.com/toxic/status/1353890766800621569

WSB feels just like a nice cover for some hedge funds screwing a bunch of other hedge funds.

New exciting development today was that a number of brokers had to halt trading of GME et al. The most plausible reason I read was lack of liquidity: https://finance.yahoo.com/video/heres-why-robinhood-restricting-users-173049721.html

Sure, for the big players on the squeezing side the WSB crowd was a good façade 🙂

https://www.investors.com/etfs-and-funds/sectors/gme-stock-gamestop-investors-instantly-make-16-billion-gamestop-stock-squeeze/

You mention ‘market manipulation’ from the side of WSB but strange that you don’t mention the coordinated manipulation from hedge funds and brokers, Robin Hood & IKBR (of which you are such a fan). Stopping people from buying shares & options, executing their options for them without their consent. WSB is imitating same techniques hedge funds use. If anything the SEC has to adjust hedge fund shorting practices. Please also put emphasis on this in your post. And post some videos of interviews with the owner of IBKR who openly admitted to market manipulation to protect the hedge funds and himself in his CNBC interview and Cooperman. This whole problem is not cause by WSB but manipulative hedge funds who own the market. Why don’t you emphasis this?

… because I published this post the day before RH blocked GME purchases?

You can edit your post, right? Or add additional info post posting. Since it reads very one sided and uninformed

It will not take too long until there’s a Meme ETF 😛

Or a Musk ETF 😀

I can’t believe I bought around 20k of GME shares early January (after reading the rationale behind it on WSB), and if this thing reaches $1k per share, I’m gonna have the same networth as Mr.RiP.

This is crazy! And I’m a World-index ETF kind of guy.

…without knowing how to multiply two numbers! isn’t it awesome?

?

(not sure I understood what you mean)

“I bought around 20k of GME shares… if this thing reaches $1k per share… I’m gonna have the same networth as Mr.RiP.”

20k * 1k = 20M

I don’t have 20M

What I meant was that I bought $20k worth of shares, not 20k shares! My bad. It’s around $1 million if it goes to 1k. but atm, only quarter million! Wish me luck. This was an experience out of index funds, and I merely lucked out.

Ok, now it makes sense, sorry for having been rude 🙂

Well, good luck!

But I’d also think about cashing your profits out… because this is an amazing fairy tale dancing tightly with a standard pump and dump.

Either DFV is the real Robinhood, or he got an 8 digits fortune being one of the firsts joining a Ponzi Scheme.

great article Mr. Rip, I should add that behind this “dummies” there are some big hedge funds too, with good amounts of CALL options on GameStop exc.

I really appreciate anyway a lot this article, a bit out of the etfs world exc.

Good work

Sure, there were giants playing on both sides.

Io devo veramente ringraziare L’algoritmo di YT che mi ha fatto scoprire mrRip e il suoi contenuti.

complimenti veramente per l’analisi di Gme.

ho 22 anni e e il discorso del “possesso digitale” wow, non ci avevo mai pensato!

Ho visto che hai dichiarato la tua identità da poco (ti ho scoperto da lì ) e a sto punto credo e spero che inizierai a farti vedere più spesso per poter interagire con te.

Buon lavoro!!

Grazie 🙂