Hi RIPvestors,

I wanted to write about my favorite internet broker since months, if not years. I kept procrastinating writing this post until March 2018, when I received roughly a dozen requests by readers and a couple of requests by friends in real life. Time has come!

But before we start, I have a couple of things to tell you. First, I’m not a financial advisor, I’m only an amateur investor who learnt a couple of things and wants to share them with you. Please, double check any piece of information and do not rely solely on my advices.

Second, this post is about Interactive Brokers which is the broker that I and most of the people I know here in Switzerland use. I’m not advertising IB out of the blue, I’m a satisfied and happy customer. I’ll mention other brokers, but I’m not going to do a deep and professional comparison.

Ok, let’s get started!

This post is for you if:

- You are a beginner investor.

- You care about low fees.

- You plan to follow simple strategies, like Buy&Hold cheap Index Funds (such as ETFs).

This post is probably not for you if:

- You are (or want to be) a daily trader.

- You’re looking for more advanced investment types (futures, commodities, precious metals,…)

- You’re looking for advanced orders (anything that is different from “buy” and “sell”)

- You’re looking for advanced money management (leveraged/margin investing, shorting, options…)

Essentially: if you’re following this blog, if you aim to meet and not beat the market, if you want to reach Financial Independence and have your portfolio support your lifestyle after Early Retirement and if you’re not here to gamble the system, then this guide is more than enough to meet your needs.

Before IB

But let’s take another step back 🙂

Using Interactive Brokers is the how.

Defining your Asset Allocation and selecting actual ETFs and other investments is the what.

Setting goals like Financial Freedom and writing your Investor Policy Statement is the why.

Always start with why.

So, if you’re here and you still don’t know why you’re investing or what are you going to invest on, please take your time to ask yourself some questions and to do some research. See you later! What? Ok, you need some guidance. You know what? This entire blog is focusing on both the why and the how.

Why? Well… Start Here.

How? Well… welcome to my investing series!

Investing Posts:

- Investing basics

- Financial Investing

- Funds Investing

- Fees & Taxes

- Stock Price and Market Model

- Investor Profile and Lifelong Investing Strategy

- ETF 101

- Stick with it

- My take on Cryptocurrencies – Part 1: The Ugly

- Interactive Brokers 101

Why IB?

Before that: why a brokerage account? Isn’t my current bank good enough for investing?

The answer is usually a big NO, but I must admit that they’re getting there. For example, in Italy one of your best investing options would be Fineco, which happens to also be a bank.

There are several problems with banks. First, they are heavy structures. They’re not born to handle retail investors. Whatever they put together is going to be costly, inefficient and obscure.

Second, they have a conflict of interests. Banks want to sell their financial products. Usually shitty financial products, like actively-and-badly managed funds. They want to sell these products to you. In order to make them shine they artificially raise custody and trade fees associated to “other products” (the good ones). At the same time they tell you that their funds have zero trade fees and zero custody fees. Yeah, cool, can you please tell me what’s that 2.4% Total Expense Ratio I see there? Stay out of my way!

Third, they are used to serve traditional customers like “old people with some money“, “non tech savvy entrepreneurs“, and in general customers that love to be sitting in a room full of expensive paintings, being offered a quality red wine glass by some suited up consultant on the other side of the expensive crystal desk and ready to sign some contract where they are essentially accepting to pay for all of the above, with interests.

Having said that, I must admit again that they’re slowly getting better. Take a look at the PostFinance E-Trading. Yearly fees of 90 CHF, that are credited toward trade fees. Minimum trade fees of 15 CHF for small orders on Swiss Dots (Derivatives OTC Trading System) or 25 CHF minimum on other stock exchanges. Costs to produce tax statements. Costs to transfer securities in and out. Extra trade fees for “Stamps”. And yet it’s not that terrible. Of course IB is 10x better, but finally banks are getting close.

So then why IB and not another brokers?

When I started looking for a broker, in the mid of 2015, I was listening to all the alternatives. Since at Hooli we are all billionaires, I started following some threads and asking questions to more experienced investors. We have a mailing list for financial stuff, so I dug some data from there too. The vast majority was using IB at that time. Today, the shared knowledge is still that IB is still the best, but its solid position on the top is challenged for relatively small accounts (<100k) and low trade volume. If you plan to invest at least 100k USD there’s no competition at all.

Key features of IB

Size and Stability

This is the most important point. A broker between you and your assets is effectively a man-in-the-middle that could be a point of failure in your strategy.

IB is not a random online broker you never heard of. Founded in 1978, IB is the largest U.S. electronic brokerage firm by number of daily average revenue trades, and it is also the leading forex broker, according to Wikipedia.

IB is not a random online broker you never heard of. Founded in 1978, IB is the largest U.S. electronic brokerage firm by number of daily average revenue trades, and it is also the leading forex broker, according to Wikipedia.

It’s a public company (IBKR) and it’s part of the Nasdaq index. It’s actually doing pretty well, its stock price more than doubled in last year! IB employs more than 1200 employees, 1000 of them are software engineers.

Its S&P rating is BBB+ Outlook Positive, which is good but we can do better here and go into “A” territory. Cash in your IB accounts is protected by SIPC up to 500k USD (plus a Lloyd’s extra insurance up to 30M, but collectively 150M which I think it’s not much). Assets are protected even in case of a bankrupt anyway, since customers’ assets and cash are in segregated accounts by law.

Luckily IB is available almost everywhere.

Low Fees

I wrote a full article about the long term impact of fees. Keeping fees low should be your second priority after broker stability.

IB fees are incredibly low, in particular if you invest with them more than 100k USD. Let’s examine them one by one:

Account opening/closing fees

Zero. Well, nowadays if someone asks you money to open an account just walk away.

Deposit fees

Zero. Again, if someone asks you money to receive money from you… run away as fast as possible!

Withdraw fees

Zero on the first withdraw each calendar month, 10 USD (or 8 EUR or 11 CHF) on other withdraws in the same month, more info here.

Yearly custody fees

Zero if your total asset are at least 100k USD, else 10 USD per month credited toward trade fees and waived for the first three months anyway.

Trade fees

Low, but it varies a lot. They offer two pricing options: fixed vs tiered. Fixed mode is simpler to understand but it’s also more expensive on average.

For what I care, fixed pricing structure means 0.1% of the trade (minimum 10 CHF/EUR/USD) for Switzerland. It means trades below 10k are inefficient (still way cheaper than any bank though).

The tiered pricing structure is more complex and unpredictable. It depends on which stock exchange you’re trading, the volume of the trade, actual security being traded and other factors I still hadn’t fully figured out. They also claim “In cases where an exchange provides a rebate, we pass some or all of the savings directly back to you“. Anyway, common knowledge at Hooli (and personal experience) says that tiered is usually cheaper (0.07-0.08% instead of 0.1%, plus lower minimum trade fee).

You can also play with both and switch between then at anytime.

Forex fees

~2 USD, unless you trade more than 100k USD. Actual forex pricing are shown here.

They claim to “combine quotation streams from 14 of the world’s largest foreign exchange dealers which constitute more than 70% of the market share“. Forex prices spreads are incredibly tight and commissions so cheap that I’d recommend opening an IB account even if it’s just to convert 20k from one currency to another!

I personally use IB as my preferred currency conversion tool. Do I need 10k USD for a Maldive trip? Easy, I first upload 10k CHF to IB (latency: less than a day), I place a limit or market order to buy 10k of USDCHF for ~9500 CHF (March 2018 prices) wait for the proceeds to settle (up to a week) and wire back the 9500 USD to my PostFinance USD-denominated account for free (latency 1-2 days). It’s not lightening fast, but if I can wait up to 10 days I can convert money in the currency I need almost for free.

Implicit fees

Negligible. By the term implicit fees I mean all other annoying costs, the fact that traded securities have high spread between buy and sell prices and so on. I don’t have enough experience with other brokers, but as far as I can see price spreads are incredibly tight and market data is by default acceptably delayed. You can buy real time market data for a premium, but I’m not interested in high frequency trading or daily trading so I don’t care.

Product availability

Not every broker allows you to trade every product on every stock exchange. IB claims to let you trade on almost any stock exchange, almost every kind of product. So far, I’ve never found a missing asset on IB, but – as I said several times so far – I don’t go for exotic products.

Other Brokers

This is not a brokers comparison post. It would be interesting to have one, I agree, but it would require a lot more research, time and accounts.

This is not a brokers comparison post. It would be interesting to have one, I agree, but it would require a lot more research, time and accounts.

There’s a very long thread on MustachianPost Forum, with more than 100 replies, trying to answer the question “what’s the best Broker option available in Switzerland“.

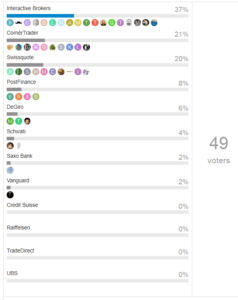

There’s also a poll, with 49 voters (at the time of writing this post), where IB seems to be leading.

Other brokers worth mentioning are SwissQuote, CornerTrader and DeGiro, plus banks (PostFinance, UBS, Credit Suisse).

If you want to consider DeGiro, please, take a look at this post on MustachianPost Blog (a guest post by The Poor Swiss). Please, if you want to support Swiss Personal Finance blog community and want to open an account with DeGiro go over there and use the referral link 🙂

How to Open an account on Interactive Brokers

As a Swiss resident (and I guess the same applies to other European countries), you’re registering an account with IB UK. Once you click the link above you reach the account setup page.

Now, take your time to setup the account. The process is not ultra-complicated but requires a little bit of time and attention. I created my account back in January 2016, but to improve the quality of this post I created a new “fake” account without (obviously) completing the application.

The process was different back then and it will probably change over time, but I assume most of the pain points will still be there.

Here are few hints:

Step 1 – Personal Information

Tax Identification Number in Switzerland is your AHV/IV number.

Select a Cash account type, not a Margin one. A Margin account means you’re leveraging your investing through loans. A Cash account means that you need to have enough cash in your account to perform your trades.

Step 2 – Regulatory Information

I don’t know what’s the impact of the Assets & Income and Investment Objectives on your account. Maybe if you declare a lower net income then you might receive notifications while trying to invest too much. I don’t know. I suggest to be honest here.

On the Investment Experience side, I suggest you “exaggerate” your experience a bit. You won’t be allowed to trade if you have no experience.

Trading Countries, just enable “All” in each geographic section. Anyway, you can always change this later.

Step 3 – Certification of Tax Residencies

This step is very important! Remember to check the box for the tax treaty! Else the IRS (US Federal Tax Authority) will tax you on dividends and you won’t be able to claim the withhold back.

Step 4 – Funding

IB requires you to declare a first deposit. Declare your first deposit and save the wiring information. From now on, you always need to declare each funding event in advance.

Now, mind these two things: first, remember to always indicate “for further benefit to Uxxxxxxx / Your Name” on the communications to the beneficiary section of your wire transfer. Second, to some account IB still shows the GB bank account as the one to wire your CHF to. Wiring your hardly earned CHF to this account is slow and it costs 5-10 CHF. Their Swiss bank account is CH2089095000010569674 (same account number 10569674) and wiring money to this account is faster and free of charge. I don’t know why they keep showing this inefficient bank account to customers.

Ok, I know it sounds scary to wire money to a different bank account compared to the one you have been told, but this is 100% guaranteed to work! You have my RIP word 🙂

Here’s a thread on MP forum that confirm that. You can message IB (or even chat with them from within your account management web page) and have them confirm this information.

step 5 – Application Status

Here you need to follow missing steps, like uploading documents and IDs to let them verify your identity and your address. Nothing fancy.

other steps

Select Subscriber Status non professional, don’t buy any Market Data, agree to all Risk Disclosures & Agreements documents.

For the Secure Login system, I chose IBKR Mobile x Android app. Pick your choice. This is the second factor authentication and it’s mandatory.

Ok, now you can rest and wait 1-2 business days to have your account open and fully funded 🙂

In the meantime you can play with the demo!

The Demo

IB kindly offers you a demo of each one of their Trading Platforms. You can actually run the demo even before starting your account creation! I strongly recommend you play with it, try to fill some orders and see how everything works.

Which platform should I try? Going to answer this one soon 🙂

How to use the demo? Well, jump directly to the Web Trader 101 section and follow my guide, since using the demo is similar to using the actual trading platform. The only caveat is that you’re playing with paper money in the demo and trades are fake. They may get fulfilled easier than expected compared to real trades.

Trading Platforms

IB has several trading platforms where you can place your trades, control your portfolio, watch market data and run analysis tools.

Sorted from the most basic to the most advanced they are:

QuickTrade

A super simple trading interface embedded in Account Management interface.

I just discovered it while doing my research for this post 🙂 It looks like it has all the functionalities I need, but I didn’t see prices updating in real time and I don’t feel comfortable with that. Can’t click on buy/sell and pre-fill an order too. You need to type the ticker (I did that typing CSSPX in the picture above). Anyway, cool and quick! I can’t tell if it’s actually good for trading, since I’ve never used it before.

IBKR Mobile

The mobile app.

I use it every day to check account balance and daily Profit&Loss (yes, I know, I shouldn’t check it every day but… you know… it’s just a click away…).

Apparently you can use it for trading too but I’ve never done that. I’m old enough to consider everything but desktop just gaming platforms 😉

Anyway, the mobile app is my main tool for monitoring.

You can customize columns in the portfolio view, activate notifications on your phone (when a position change% is above a threshold or when the entire account is up/down by a certain %) and so on.

Web Trader

The web interface for trading.

This is the tool I use the most. I won’t spend more words here since we have a dedicated Web Trader 101 section below.

IBot

Chat/voice-based trading interface that understands natural language requests.

Didn’t know about that either 🙂

Well, I’m not using it and I don’t think I will, but good to know it exists. Chatbots are the future apparently, so I better monitor this one.

Trader WorkStation (TWS)

The desktop App.

It’s a Java software (seriously? Java for frontend Apps? What year is this??) that’s claimed to be “our flagship platform designed for active traders and investors who trade multiple products and require power and flexibility“.

Too much for me, I’m not a daily trader and I don’t need superpowers.

Anyway: “TWS includes all of our most advanced algos and trading tools, and offers a library of tool- and asset-based trading layouts for total customization“, which means it could be interesting to try. Don’t know how many “extras” are free of charge though.

API

Do you want to build your own app?

You’re welcome, my fellow software engineer nerd friend! IB exposes APIs in almost all the popular coding languages and web frameworks!

Life is too short for writing another trading app, but it’s super cool they offer APIs!

Recap and Feature Availability

This is the current (March 2018) list of available features for each platform.

I still recommend Web Trader, since it has enough functionality for our needs. Need to investigate more QuickTrade though.

Web Trader 101

You can access Web Trader either from the main login page or from within Account Management.

You can access Web Trader either from the main login page or from within Account Management.

A new window (or tab) pops up and you’re facing the Web Trading UI.

I personally only use Web Trader and – as I said before – I think there’s nothing more you need for our purposes, which are Buy&Hold at a very low frequency (once per month?) assets like stocks & bonds via Exchange Traded index Funds (ETFs).

Interface

Even though Web Trader is simpler to use compared to TWS, it’s still pretty messy. First thing I suggest you to do is making the interface lean and clean, keeping in sight only what you care about.

Let’s start from the top level menu:

Let’s start from the top level menu:

Yours will probably look different from mine, with way more tabs. Let’s click on “preferences” and remove everything but Market and Account. You can’t remove the Market Pulse (useless) and Search tab (somehow useful).

You can also customize each tab. I like to keep everything as minimal as I can, here’s what I’ve got.

In the Market tab, I only keep “Market View” and “Portfolio” modules.

The Market View module is very useful to watch/follow some specific security. You can add/remove/edit watchlists and in each watchlist you can add/remove/edit securities.

Here are my watchlists:

I have 3 watchlists (plus default, which I never use). One for ETFs, one for individual stocks and one for currency pairs.

You can edit each watchlist adding new symbols, changing columns and so on. The process is pretty easy.

Let’s analyze a row in my watchlist. A row is a symbol, an ETF in this case. Let’s take a look at the first one: CSSPX. I’ve talked about this ETF in my ETF 101 post. Anyway, we’re not here to discuss the “what” but the “how”.

In Contract column you find the Ticker Symbol (CSSPX), the security type (stock, yes, ETFs are considered stocks), the stock exchange where the security is traded (SMART means IB merges more stock exchanges data for you here) and the currency which your security is traded.

Last indicates the current price. If it has a “D” in front it means the price is delayed (you don’t have realtime data). If it has a “C” it’s the closing price of the previous day.

Then you have the price daily change and, more important, Bid and Ask prices (and volumes, but who cares about volumes?). Bid and Ask prices gives you an idea of the spread. The more a security is traded (more volumes, more buyers and sellers) the smaller the spread should be. That’s why it’s important to buy ETFs with large size. In our CSSPX case… wow… that’s really uncommon! What’s that ridiculous spread? I assume that’s because it’s Easter, trades are closed and someone just placed a sell order very unlikely to be fulfilled 🙂

Other ETFs Bid/Ask spreads are more reasonable, but trust me: when the market will reopen you’ll see smaller spreads again. You may have noticed that some “last price” is outside Bid/Ask range. Well, this is probably an indication that afterhours trading are going in some directions and when the market will reopen the price will jump in the Bid/Ask range.

So, play with the watchlists and add your favorite ETFs! Mind that sometimes adding an ETF is not straightforward.

For example, that’s what you get if you want to add CSSPX to a watchlist: there are several securities matching your query. In that case pick the stock exchange matching your preferred trading currency and go on.

In the CSSPX case just pick LSEETF, i.e. London Stock Exchange ETF division, if you want to trade the ETF in USD. Ok, this was easy since it’s the only actual CSSPX ticker in the list, but sometimes it gets more complicated. You’ll learn with time to not pick the wrong security 🙂

If you feel scared of trading a product you’re not sure it’s the one you want, you can always click on the top level Search tab and follow the flow:

You can verify security ISIN and other details in IB Security Search, which is very high quality.

Along with the market view (watchlists) I keep just the Portfolio View in my Market Tab:

The Portfolio View is a snapshot of your portfolio and its performance, like profits&losses for each security you hold.

Profits&Losses are usually split in unrealized and realized. Unrealized are “virtual” P&L: they are based on the prices you bought the security over time and current market price. Realized are based on actual completed trades, i.e. when you sell something you previously bought. Or I guess it’s more complicated for options trading and for short trading (selling before buying), but – as always – I don’t care about exotic trades.

Realized vs unrealized matters at tax declaration time since some countries tax capital gain, and you have some capital gain only when you realize profits. Luckily in Switzerland there’s no capital gain tax so I don’t matter.

You’ve probably noticed currencies (currency pairs) in this list, like “USD, Cash, IDEALPRO, CHF“. Again, for taxation purposes forex trading are considered “positions”. I send CHF to IB and then sometimes convert them to USD to be able to then buy an ETF traded in USD. Converting CHF to USD means actually buying USDCHF, which is a Currency Pair. I won’t talk much about that, but if you’re wondering why it’s listed in your portfolio the answer is simple: taxation. Currencies are assets and they go up and down like stocks. You might realize profits by buying and selling currencies and that matters in countries where capital gain is taxed – or if you’re considered a professional investor in Switzerland.

The Account tab by default is a higher level overview of your account. I keep it lean by only having Balances, Market Value and Positions:

There’s also a “Margin Requirements” module that I can’t get rid off, even though I have a Cash account and not a Margin one. It’s a little bit annoying. Please, if there’s someone from IB who’s listening: please, make that module optional!

Anyway, I guess this is pretty straightforward. I come here only to check cash balances and actual positions after a trade.

Ok, let’s do something real, let’s buy stuff!

Placing Orders

Before that, let’s first learn how to play with currencies and do some forex. As I said before, forex with IB is extremely easy, fast and cheap!

You probably want to add in your watchlists some Currency Pair. Let’s say you have CHF and want to trade securities in USD.

You probably want to add in your watchlists some Currency Pair. Let’s say you have CHF and want to trade securities in USD.

Add a row to your watchlist, select “forex” tab, type USD and click Go.

As you can see the USD can be traded against a lot of other currencies. Let’s select CHF and add that to our watchlist.

Note: Idealpro is the IB network, which is streaming offers from several exchanges and providing the best offers to you (so they claim).

As you can see in your watchlist you now have a USD–>CHF entry. You won’t find the reverse one, you won’t find the CHF –> USD one. This is how Currency Pairs work. If you want to buy USD and sell CHF, you need to buy USDCHF. If you want to do the opposite (buy CHF using USD) you need to sell USDCHF. Yes, it’s kind of weird but it makes sense, at least to me.

To make everything more complicated you won’t easily find BUY and SELL. From the watchlist, the right way to start filling an order is clicking on the price under the Ask (if you want to buy) or the Bid (if you want to sell) column.

If you want to buy USD using CHF, you want to Buy USDCHF currency pair, which means you want to click on the “Ask price” of the USDCHF currency pair. Yes, this is unnecessary complicated. I guess Ask and Bid are there for historical reasons.

Btw, this is the same process we’ll use to buy/sell stocks, bonds, ETFs and everything else 🙂 And, of course, you can always enter an order manually, without having to start from a watchlist or portfolio view.

Please, take your time to admire the ridiculously small spread in currency pairs. We’re talking about 0.5 pip. A pip is a 0.0001 change in price, i.e. a fourth decimal change in price. It means you’re living on the table 0.005% on average when trading currencies and that’s not due to IB, but to supply and demand law! It’s 5 USD on average when trading 100k. Try to wire USD to a CHF denominated account in a regular bank and let me know how it goes 😉

Once you click on the Ask price you finally go to the Order Management section, which is dominating both your Market tab and your Account tab.

Time to place our first order!

Once clicked on the Ask price of USDCHF you’re sent here, in the Order Management view and, as you can see, there is a lot of work to do before placing the actual order! We’ll investigate most of the options later, when trading an actual ETF.

For now, let’s just put 10k in the Quantity and place a Limit order, i.e. select LMT under Order Type.

You’ll see the Limit Price changing while you fill other fields of the order. That’s normal, by default IB sets up a Limit Order for you with Limit Price the current market price. As soon as you type in the limit price field it stops auto-updating.

What’s a limit order? According to U.S. Securities and Exchange Commission:

A limit order is an order to buy or sell a stock at a specific price or better. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. A limit order is not guaranteed to execute.

The other popular order type is the Market Order:

A market order is an order to buy or sell a stock at the best available price. Generally, this type of order will be executed immediately. However, the price at which a market order will be executed is not guaranteed.

There are of course other order types but you shouldn’t care if you don’t plan to become an active investor.

Whenever you enter a Market order you get prompted by alerts like: “warning: the price is not guaranteed!” and maybe the cheapest seller for your security at the order placement time is the guy selling CSSPX at 296 USD while the last price is 254. Don’t do market orders when spread is large. Nevertheless it’s ok to go with market orders when trading currencies.

Mind that during the order placement process you will interact with several pop-ups that are there to warn you about risks and other minor issues. Read them carefully, but once acknowledged you may safely torn most of them off forever by checking the box “do not show again”.

Once clicked on Preview Order (and killed some pop-ups) you reach the final stage where you can review your order and finally submit it:

You can finally see the actual cost in terms of CHF of your trade. Yes, this is also a little bit more complicated than it should be. It’s not possible to “buy 10k worth of CHF in USD”. You need to play with a calculator if you know how much you want to sell but you’re filling a buy order.

Let’s say you have 10k CHF and want to buy USD. You divide 10000 / 0.95332 and you get roughly 10489. Subtract a couple of USD for the commission and then you have your order: buy 10487 USD at that price, expected price ~10k CHF.

Problem with this approach is that sometimes the order doesn’t get fulfilled so you edit it and increase the price by some pips and… maybe at the new price you can’t afford 10487 USD but few less. It’s painful, but you can play safe and try to buy ~10 USD less than the calculator said, so you have some edit margin (or you could try a market order). If the order fills immediately you’re left with few spare CHF on your account but who cares? Next month you’ll wire new CHF to your investment account and will do the same game 🙂

I’ve also tried not to do forex before a trade in a currency I don’t own. Apparently IB auto sells your other currencies for you, at market price. I’m not sure how reliable this process is (once IB auto sold an ETF share to fulfill one of my orders), so better to play safe and do your forex before buying securities in a different currency.

Trading other securities (like ETFs) is essentially the same process. You start by clicking on Bid/Ask on your watchlist or your portfolio view:

Here I’m trying to sell some SC0C (Stoxx600 Europe ETFs).

Let’s investigate the Order Management view a little bit:

I’m placing a Limit Order, with the limit price 10 EUR higher than market price, which means I don’t want to actually sell my SC0C 🙂

The Order Type drop-down list shows the already explained LMT and MKT plus several additional order types we don’t want to investigate.

The Time in Force (TIF) of our order means for how long we want to keep the order alive (if not fulfilled) before declaring it deprecated.

By default it’s the current day, meaning that at the end of the day (by some definition of “a day”) the order gets cancelled if not fulfilled, and it should usually be ok for you. Don’t touch this. I don’t even know what the other options mean 😛

If you’re not satisfied by the TIF options, you can go advanced and select exact start time and end time.

In which stock exchange are you posting your order? Things like NYSE, LSE, SIX, EBS… well, sometimes it doesn’t matter. Actually, it doesn’t matter most of the times. So just pick SMART and let IB optimize that for you!

Once you’ve filled all order details, click on Preview Order. As you can see this time there’s a forecast of commission prices. SC0C is only traded in European stock exchanges so it will bring more or less a 0.1% trade fee. Trading on American stock exchanges is way cheaper! Usually securities traded in US are also domiciled in US, which will bring other advantages and disadvantages I’ve discussed in ETF 101.

Once you Submit your order, it moves to the Orders tab of the Order Management module.

Once the order is fulfilled it becomes Filled and moves to the Trades tab.

At this point your portfolio and your cash balance change accordingly.

You can obviously modify or cancel an order before it’s fulfilled.

That’s all for Web Trader 🙂

I heard from colleagues that one can create cascading orders (put a sell order for X, then put a buy order for Y, then a limit sell order for Y at price 1% greater than buy price and so on) or rebalancing orders given an asset allocation but I never tried anything fancier than buy and (rarely) sell limit orders.

If you want to know more, consult the Web Trader guide (or the TWS guide).

Account Management 101

There are other aspects of IB outside the trading interfaces I want to talk about: login, funding, statements and so on. Let’s have a quick look together 🙂

Login and second factor authentication

As any modern sensible account, IB requires you to have a second factor authentication, i.e. your password is not enough. You have three choices here: physical card, security device or mobile app. I use mobile app. They used to have a dedicated login App, now they’re transitioning toward integrated authentication functionalities within the IBKR Mobile App. It’s a bit painful if you change physical device or phone number, but still better than anything physical.

Deposit & Withdrawals

Whenever you want to deposit some money on your IB account you have to inform them.

Every deposit must come from an account with your name on it. You can save these deposit instructions on IB and even set recurring instructions if you want.

Every deposit must come from an account with your name on it. You can save these deposit instructions on IB and even set recurring instructions if you want.

Based on the currency of the deposit IB shows you the right IBAN that you should use to transfer (WIRE, SEPA and so on) your money.

I’ve already told you that there’s a trick for CHF deposit in case they tell you to wire the money to their GB account.

Remember to set all costs to the beneficiary, IB won’t charge you any extra cost for that.

Deposits take regular banking time before you have them available in your account. Usually CHF deposits on their CH account are available on the same day your bank wires the money. SEPA and USD deposits take an extra day (from Switzerland and Italy, I assume in US is faster to wire USD).

Ah, after 2 years of history, they’re becoming less picky about deposit notifications. I don’t have to tell them exact amounts anymore. Sometimes I even forget to inform them about a deposit and it’s ok. Maybe that’s because I’m a “trusted customer” now. Two years ago I once put a wrong amount in the deposit notification and they complained. I had to cancel the notification, create a new one before they accepted it and made the money available right away. It never happened that a deposit bounced back to my bank due to wrong or missing notification. Eventually they keep your money on hold and ask you to provide more details.

The only complex issue I had to manage was with Hooli stocks autosale: when my Hooli stocks vest the proceedings go directly to IB. This is a broker to broker transfer, not a wire from one of my bank accounts. The first time that this happened I received a call from an IB operator that asked me to prove I have an account with the other broker. Problem easily solved after scanning a statement and sending to the IB operator.

Withdrawing money is also super simple and must be performed in Account Management too.

Select the currency, the method and save some bank information. Again, the bank account must have your name attached to it.

First withdrawal in each calendar month is free of charge, others cost ~10 CHF. Try not to withdraw money more than once per month. It should not be hard 🙂

Note that you can only withdraw settled cash. Cash takes some time to settle after a trade, on average 3-5 business days. It means if you sell your CSSPX for cash and try to withdraw the money soon after you won’t be allowed. I guess it’s reasonable. Money is not sent directly to the withdrawing account after a trade but it’s spread on several fast access trading accounts closer to stock exchanges for efficiency reasons (maybe you want to use it directly for other trades).

Let’s see a real life currency conversion use case. Let’s say I have 10k CHF in a Swiss Bank account and I want to convert them into EUR in an Italian bank account.

- I inform IB I’m wiring 10k CHF – Day 0

- I input a wire transfer from my CHF (CH) account to IB – Day 0

- My CH bank actually performs the wire transfer to IB – Day 1

- The CHF transfer materializes on my IB account – Day 1

- I buy EUR on the market, roughly 8500 EUR (used to be ~10k EUR a couple of years ago…) – Day 1

- I wait until the dust settles… – Day 4-6

- I SEPA the money to my EUR (IT) account – Day 4-6

- The EUR amount is available on my IT bank – Day 5-8 (plus a weekend: ~10 days)

If you’re not in a desperate need of money, you can do the conversion in 10 days at ~2 USD cost instead of at least 2% offered from banks.

Reports & Statements

Statements are fun, really fun! Well, I assume they’re fun if you’re a nerd like me 🙂

IB statements generator is powerful and complete, it’s all you need!

Here I am asking for a Year-To-Date (2018) activity default statement. You can customize sections, period, language and format. You can also save your custom statements templates and reuse them for future statements 🙂

Default activity statements contains a lot of info:

Let’s take a look at some of the interesting sections here, like Net Asset Values:

I can see my account grew by 37k CHF since January 1st, which is not good news, since deposits and withdrawals net to 57k… Yes, we all know. If we exclude the first 25 days of the year, the remainder of Q1 2018 has not been amazing for Mr Market 🙁

Let’s look at the Trade report:

Here we can see all my trades for Q1 2018, stocks and forex.

First one is an autosale of 1 SC0C, my mistake. While playing with a buy order for VHYD I didn’t notice I was short of ~20 USD and IB autosold 7 EUR to USD (last 2 entries, zero commission), 1 SC0C to EUR (first entry, 1.25 EUR commission for a single stock… ouch!) and then another 7 EUR to USD (zero commission).

I don’t know how to prevent IB from letting me buy securities without enough cash available and without having to sell other securities in unpredictable order… does anyone know?

Anyway, for the regular trades I’ve spent 40 CHF commissions for 56k CHF trades (bought 60k USD of VHYD, which I just discovered now the ETF is being renamed VHYDI), i.e. 0.07% trade fee on average.

I still don’t know how to control that. I usually pay something around 0.08% fee for my trades with tiered pricing, but one of my trades (2018-02-20, 10k USD) went thru with just 0.40 USD commission! That brought my average trade fee down to 0.07%.

Forex, as usual, is ~2 USD commission unless you trade big amounts.

What about Funding and Dividends?

You can see Deposit and and Withdrawals on top left.

Made a 27.7k USD deposit in January (Hooli stocks autosale), 30k CHF deposit in February (yearly bonus and some savings), 5k EUR deposit and withdrawal in March.

The 5k EUR thing was to cheaply (free) transfer money from Switzerland to Italy (EUR to EUR). If I SEPA directly EUR from my EUR denominated account in PostFinance (CH) to BancoPosta (IT), then Bancoposta will charge me 7.50 EUR + 0.15% of SEPA amount (another 7.50 EUR for 5k transfer). It’s 15 EUR saved, at the cost of ~10 days delay.

Before you scream: it’s all legal 🙂 I’m just moving my money around and trying to avoid such criminal costs (that should be illegal).

Dividends: I’ve received some dividends from my VHYD(I) ETF in December 21st, actually paid out in January. Q1 2018 dividends have been announced: 0.39 USD per share, 706.69 USD total, being paid out in early April.

SPOILER ALERT: Yes, I’m experimenting with dividend investing 🙂 more on this on my quarterly financial update (next post).

Taxes

IB offers Tax forms, but I don’t use them.

For now, my tax situation is simple: I only need to declare trades, profits (dividends) and net asset values at the end of each year. I don’t need dividends withholding reimbursement (for now) or more complex stuff so I take care of my investment taxes documents on my own.

Other

IB is growing a lot. They’re starting offering bank related products like credit and debit cards. When they will issue a debit card that works with multiple currencies I’ll go with “shut up and take my money” 😀

IB is growing a lot. They’re starting offering bank related products like credit and debit cards. When they will issue a debit card that works with multiple currencies I’ll go with “shut up and take my money” 😀

They also offer free webinars in several languages, financial education (I guess for free, online) and a lot of analysis and trading tools based on Machine Learning. I don’t use any of these, since I’m not a daily trader.

A feature I like and use a lot is the App notification. You can customize when to be notified and how. I use it, but you shouldn’t! We’re long term investors, we don’t care about daily profits and losses!

And no, I’m not telling this mainly to myself, that’s not true! 😀

Conclusion

I’m a satisfied customer and I’m here to recommend IB to you, my dear new investor.

That’s all for today 🙂

This is amazing Mr. Rip, thanks a lot for such a huge work!

You mentioned “Cash in your IB accounts is protected by FDIC up to 250k USD” but I think this only applies to US based accounts on IBLLC. For example, europeans get their accounts opened at IBUK, https://ibkr.info/node/2012, which is protected by british FCA, which according to https://protected.fscs.org.uk/About-FSCS/ has smaller amounts (85K GBP) as far as I can tell

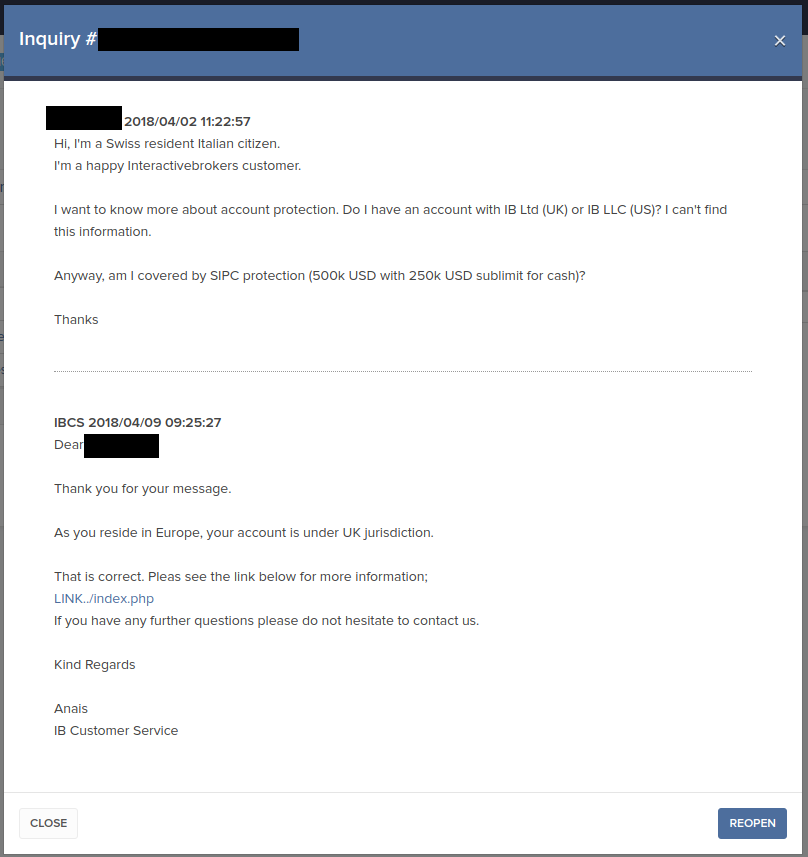

Hi Hector, yes, I made a mistake and I’m going to correct the post.

I didn’t mean FDIC protection but SIPC protection (500k USD with 250k USD cash sublimit) which is actually stronger.

Plus IB has a Lloyd’s extra insurance.

The FDIC (or FSCS) enter into play only on bank accounts with your name on it, which is last resort.

P.S. I’ve spent several hours digging more into this issue and there are several dark corners, including the fact that there’s not much history about SIPC members having had to use the SIPC protection…

Hey MrRIP

Thanks for the great post. I think what Hector meant is that as a client of IBUK, you will not be eligible for the 500k USD SIPC protection at all. If you follow Hector’s link (https://ibkr.info/node/2012), there is a clear indication that SIPC as well as the additional Lloyds insurance are only for the IBLLC clients.

Also, I believe, that the 85k GBP limit referred to by Hector is for deposits only (banks only, I guess). As far as I see investments in UK are insured for only 50k GBP (https://www.fscs.org.uk/what-we-cover/compensation-limits/).

In my view this is quite sad, that such a dramatic difference exists between insurances for IBLLC and IBUK. I would appreciate if someone could point out where I am wrong and Europeans, having a contract with IBUK are still somehow protected by SIPC.

Also, MrRIP I wonder if you came across any useful information while digging for the dark corners in respect of the insurance. I am actually planning to open an account with IB and this uncertainty stops me for now. I understand that broker failure is a very unlikely event, but for a long-term plan something worth considering. As I understand IB uses custodians to keep the securities, so does the custodian has the names of investors in order to reclaim them if IB goes bankrupt or something?

I asked to them directly:

The link points to: https://www.interactivebrokers.com/en/index.php?f=ibgStrength&p=acc

Where it’s clearly stated that accounts are protected by SIPC.

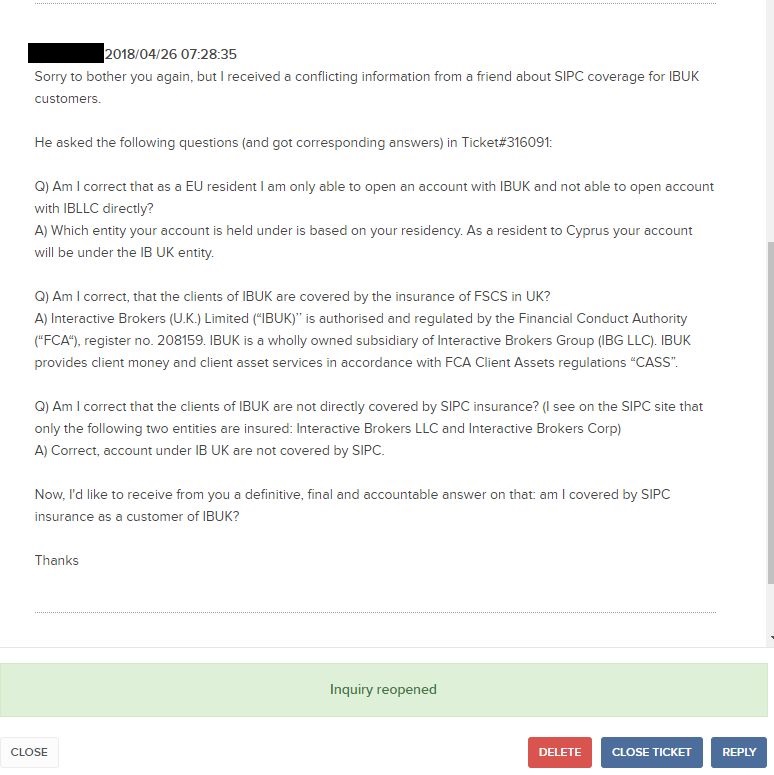

I asked IB regarding coverage and got a completely opposite answer:

1) Am I correct that as a EU resident I am only able to open an account with IBUK and not able to open account with IBLLC directly?

Which entity your account is held under is based on your residency. As a resident to Cyprus your account will be under the IB UK entity.

2) Am I correct, that the clients of IBUK are covered by the insurance of FSCS in UK?

Interactive Brokers (U.K.) Limited (“IBUK)’’ is authorised and regulated by the Financial Conduct Authority (“FCA“), register no. 208159. IBUK is a wholly owned subsidiary of Interactive Brokers Group (IBG LLC). IBUK provides client money and client asset services in accordance with FCA Client Assets regulations “CASS”.

3) Am I correct that the clients of IBUK are not directly covered by SIPC insurance? (I see on the SIPC site that only the following two entities are insured: Interactive Brokers LLC and Interactive Brokers Corp)

Correct, account under IB UK are not covered by SIPC.

That’s laughable and inconsistent with what they told me (and to other colleagues and friends).

I’m going to open a new ticket bringing your questions to them and asking a final clarification.

Thanks, just in case, my question Ticket#316091

I’ll keep you posted

I got an answer from them, and that should be final I hope. Shoni, feel free to ask them again and link my ticket number:

The other account they’re referring to (the one ending with F) is unused. I opened it by mistake when I gave myself permissions to trade precious metals. I never used it and I also asked to close it. It doesn’t impact the point under discussion here 🙂

Hey MrRIP,

I would like to share my further findings on the subject. I have to say that despite of the above I still believe we are mislead in respect to the SIPC coverage due to the below.

THE GOOD:

1) After the “final” answer you posted, I wrote to IB again citing your ticket and their reply was:

“Security positions would be covered by SIPC, not future positions.”

Sounds good, whatever they mean by “future positions”

2) I also wrote to SIPC and among the the other information I got the following text:

“As a foreign subsidiary, Interactive Brokers UK is not a member of SIPC and thus SIPC does not protect against its failure. You are still eligible for some level of SIPC protection, however, if Interactive Brokers UK introduces your account to a SIPC-member clearing broker such as Interactive Brokers LLC. At the risk of oversimplification, the introducing broker provides front-end services, such as opening the account and taking your orders. The clearing broker provides back-end services, such as executing your orders and actually holding on to your investment. In other words, the clearing broker has custody of your investment, not the introducing broker. Because SIPC protects the custody of your investment, this clearing arrangement is important. If the introducing broker fails (in this case, IB UK), then SIPC cannot intervene, but your investment should still be in safe custody with the clearing broker (IB LLC). If the SIPC-member clearing broker failed, then SIPC would protect your account. You should check with Interactive Brokers UK or review your account documents to confirm whether Interactive Brokers LLC is the clearing broker, with Interactive Brokers UK as the introducing broker. From your email and Interactive Brokers’ website, it sounds like this may be the case, but because SIPC does not regulate the securities industry, we cannot independently confirm this arrangement.“

This also sounds good, coz it corresponds to the reply you had from IB that IBUK is an introducing Broker and the transactions are carried out by IBLLC.

THE BAD:

3) However, I started digging deeper and encountered this Q and A session from IB (https://ibkr.info/node/2016) which includes these statements:

Q: What is changing?

A: IB will be expanding the range of client activities cleared and carried by IB UK to include certain activities currently handled by IB LLC. Currently, IB UK clears all client activity through IB LLC with the exception of physical commodities (i.e., gold and silver) and those CFDs which are not exchange listed. To differentiate the IB UK activity cleared as IB UK from that which is introduced to IB LLC, an internal bookkeeping account known as IBUKL has been created to house IB UK activity. This IBUKL account will be used to clear and carry a broader range of product types including stocks, ETFs, options, futures, futures options and Forex.

Q: What type of protection is available to me in an IBUK account?

A: IBUK is a participant in the Financial Services Compensation scheme “FSCS”. Compensation levels are subject to change and for current details, refer to the FSCS website at http://www.fscs.org.uk/

Q: Does IBUK offer additional protection above the industry standard?

A: IBUK does not offer additional protection above the FSCS.

Q: Does Lloyds insurance also apply to IBUK accounts?

A: No, certain underwriters at Lloyds of London provide excess SIPC policy coverage; however this is not available for products held under the IBUK carry broker.

4) So in the end I believe that if IBUK clients are covered by SIPC now, this will probably change soon (I am not sure what is the date of the above Q and A session).

I would like to have your thoughts and maybe another round of communication with support at IB if you wish to.

Thanks

Thanks for your investigation, I’m traveling right now. Will dig deeper in ~10 days

Hi Shoni,

I am a bit late to the party 🙂 Thank you for your investigation and analysis.

I checked client agreements at IBUK site (https://www.interactivebrokers.co.uk/en/accounts/forms-and-disclosures-client-agreements.php) and my conclusion is that IBUK is still an introducing broker, meaning that the securities are held at IBLLC and protected by SIPC 500k insurance. But cache most likely is not.

Disclaimer: I am not a lawyer; I read only the interesting sections of the following documents and not everything.

Specifically,

“Interactive Brokers (U.K.) Limited and Interactive Brokers LLC Client Agreement”

(https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2.formSampleView?formdb=3207)

04/03/2023

”

6. On a non-exhaustive basis, IBUK shall generally be responsible for the following:

6.1. Obtaining and verifying new information and documentation from you and opening and closing your IBUK Account(s).

6.2. Receiving your orders through the IBKR System and transmitting them for execution to IBLLC. …

6.4. Determining the commissions and other fees charged to you

7. On a non-exhaustive basis, IBLLC shall generally be responsible for the following:

7.1. Executing orders received from IBUK…

7.2. Acting as a self-clearing broker for certain of your orders or arranging for the clearing and settlement of the executed transactions by IBUK, IBLLC, another Affiliate or a third party…

7.3. Performing certain cashiering, client money and custody services. Such services include, without limitation: (1) accepting and holding all money submitted to fund your IBUK Account … (2) receiving, delivering and transferring securities … (3) holding in custody and safekeeping all securities and payments so received … (4) paying and charging interest on your IBUK Account; (5) receiving and distributing dividends and other distributions; (6) processing securities as a result of corporate actions; and (7) transferring positions or assets.

”

“Client Agreement for Products Carried by Interactive Brokers (U.K.) Limited”

(https://gdcdyn.interactivebrokers.com/Universal/servlet/Registration_v2.formSampleView?formdb=7301)

”

1.1.2 This Agreement does not Cover Trading in Other Products: This Agreement does not cover trading in stocks or shares, bonds, mutual funds, or any product carried in accounts held at IBUK’s U.S. affiliate Interactive Brokers LLC (“IBLLC”) (collectively, “Other Products”). For transactions in these Other Products, IBLLC provides trade execution, client money and custody services pursuant to rules of the U.S. Securities and Exchange Commission (“SEC”) and the U.S. Commodity Futures Trading Commission (“CFTC”), as applicable.

3.1.1 For transactions subject to this Agreement, IBUK provides client money and safe custody services directly, subject to the FCA Rules.

”

Everything indicates that IBUK introducing broker and IBLLC is clearing broker, and nothing indicates the opposite. So currently IBUK are good.

Thanks for the investigation 🙂

Hello MrRIP!

This thread makes me quite scarry. Did you dig more into the topic after the travel?

I’m also a customer of IB and your colleague in Hooli.

However, I’m not sure I’ll sleep as good as it used to be after reading through this thread.

Insurance must be #1 in selling points.

Hi Krusty, sorry for late reply but I didn’t dig deeper into this.

Hello Shoni.& Mr. RIP.

What are your final verdicts about this one?

My final take on this was to assume no coverage from SIPC. Although this might still be the case (partially) as of now, the US and EU regulations aim to drift apart so I assume they will try to separate IBUK and IBLLC long term, leaving europeans with no coverage from the states.

I’m letting transported by the current. All my friends and colleagues feel safe about this risk, and I got the answer I was looking for from the IB support… and I never hold cash in my IB account.

I feel safe enough.

Dear Mr.Rip,

I noticed that regarding Step 3 – Certification of Tax Residencies, I have a “NO” selected to a tax treaty question on my IB account. I contacted IB and explained that I want to change it to YES, because I invest in US based ETF which will provide dividends but they replied the following:

IB: You are from switzerland and not from US

IB: If you have YES you will be wrongly taxed

IB : To 30% instead of 15%

Can IB be wrong and I should insist for them to change my selection to YES?

Thanks a lot for any advice.

Hey Leif,

as a non-US-person resident in Switzerland (B permit), I confirm you have to say YES to the tax treaty question. If necessary, insist. You pay taxes in CH and Switzerland and the US do have a tax treaty.

Thanks Michele,

Do you think IB misunderstood my request earlier? I’m also a B permit holder.

Leif

Wow, that is some comprehensive review of Interactive Brokers. Thanks a lot Mr. RIP.

No wonder it took you a long time to write.

Thanks for the links too 😉

Thank you for this interesting article.

I am considering switching from Swissquote to IB. However I am not aware if IB charges me some fees for the transfer of my ETF to them. Do you have any information about that? (Swissquote charges CHF/USD/EUR 50 per position for deliveries out but nothing for deliveries in.)

Hi Thorsten, I don’t have experiences with securities transfer, but after a quick search I found this:

https://www.interactivebrokers.com/en/index.php?f=621

It seems it’s for European stock transfer, not US.

Thank you for your response. I contacted IB an they confirmed me, that they won’t charge any fees for the transfer:

“[…] This is to confirm, that you will not get charged any fees for transferring your funds to your IB Account. However, typically Swissquote will charge fees for each position you transfer.

You may want to contact Swissquote directly to discuss their fees for transferring out, if you haven’t already. However, as mentioned, IB does not charge a fee to transfer in positions. […]”

MrRIP, are you sure about the CH-IBAN (CH2089095000010569674)? When I search for the IBAN on https://www.six-interbank-clearing.com/en/home/bank-master-data/inquiry-bc-number.html with SWIFT=CITIGB2LXXX I get the postal account 87-383838-3 which belongs to the IBAN CH29 0900 0000 8738 3838 3 (search for the postal account I mentioned on https://www.postfinance.ch/de/privat/support/tools-rechner/iban-rechner.html/calculator/iban/Index.do).

I’m using it successfully since 2 years now, and everybody I know does the same. I’ll triple check your links and let you know.

MrRIP, I can confirm that using IBAN CH29 0900 0000 8738 3838 3 to send money to IB works.

Cool. It means they have several bank accounts available. I just don’t understand why they keep suggesting the inefficient GB one..

Decided to take the plunge after the markets started plunging. I know, l know, one shall not time the market. But boy, it’s easier said than done. I have made my strategy and glued it on the wall to hopefully remind me when I get the urges.

Hi Mr RIP,

Ive been following you closely and I really appreciate your content.

I am considering investing on IB, however, I would reach the threshold of 100’000 in 3 years. Would you still recommend – despite the activity fees – investing in IB?

The activity fees have been canceled a few years ago 🙂

If you had made this post just ONE month earlier, I could have use your affiliate link!!

Oh noooo 🙂

Thank you TG, I appreciate the intent 🙂

Hey RIP,

thank you for you comprehensive post, as always !

If you want to avoid the hassle of ‘manual currency conversion’, you can “sell CHFUSD” instead of “buy USDCHF”.

weirded

On IB? Are you sure? I can’t find CHFUSD on IB.

Yes, on Forex if I type CHF under Symbol and then GO I find it in the second position (under CHF.ZAR).

I am testing both Revolut and Transferwise debit cards and I am kind of satisfied with them.

Ciao,

d4lamar

Too much overhead for Revolut in my opinion. An extra account to manage and nonzero fees to recharge the card.

Not worth the effort for me.

I have couple questions, sorry if lame. Feel free to redirect me to other posts If discussed before (I am new on your blog):

1) I see you have VHYD in your portfolio. Is there a specific reason you bought a Irish-structured product and not a US-structured one?

2) Have you considered estate planning? I have come across somewhere that the funds with a US-based broker are subject to huge estate taxes in case owned by non-resident

Thanks in advance

I own only not US domiciled securities for estate taxes.

But that might change in the near future, I need to clarify whether of the two rumored thresholds for US estate tax apply: 60k or 2-3 millions.

I couldn’t find a valid source. Among friends and colleagues, two years ago the common knowledge was 60k, so nobody invested in US domiciled funds. Now many people are switching their minds. I still didn’t find any trustable data that confirms a high threshold for estate tax.

Anyway, the VHYD is a world fund. So, even if I switch to a US domiciled fund I only save withholding taxes on dividends on US companies, not the whole dividends distributed by the fund.

Thanks for your insights, MrRIP.

One would think that there’s plenty of cases where investors got burned with estate taxes but I haven’t seen anything. Have you?

People just don’t file. There would be tens of thousands of estates each year that would have give a huge chunk to the USG, especially in countries with the 60k limit, but there are about 150 filings with IRS each year.

MrRIP,

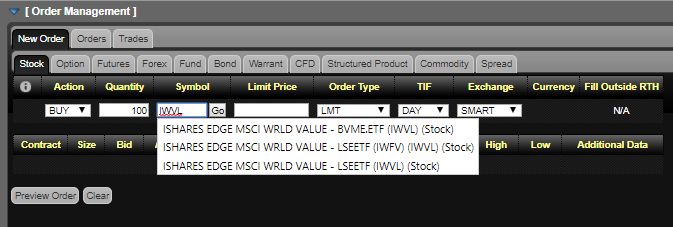

I’m using the Web Trader and I’m searching for the iShares Edge MSCI World Value Factor UCITS ETF USD (Acc) using the symbol “IWVL” but I always get the message “The security was not found”. Do you have any idea why this happens? Could it be because I don’t have any USD on my account?

Hi Thorsten, the fact you have zero USD on your account shouldn’t matter.

As you can see here I can trade the security IWVL:

My best guess is adding trading permissions to the markets and stock exchanges that are involved in the trades, that you can see here:

Hi MrRIP, thank you very much for your advice. I changed the trading permissions and, suddenly, it works. Great!

Wow, what a great post Mr. RIP!

Congratulations. I will surely link it from future posts.

Thanks for the mention too, I really appreciate this sharing mindset.

Cheers

I may actually open a DeGiro account in case I decide it’s better to differentiate among brokers – that thing with the eggs and the basket, you know… 🙂

Thank you for the comprehensive review. You mentioned that there is no fee for depositing money, but I saw on the link below a table of fees for deposit. Am I misreading it?

https://www.interactivebrokers.com/en/index.php?f=14718

Hi Kelly,

what I see in the IB “Other Fees” page is:

Wire transfers:

Fees are determined on a monthly basis. The first deposit of each month is free. Subsequent deposits will be charged a portion of the third-party fees that are charged to IB, as follows: (you pay something only from Mexico).

Personal Experience with wire transfers: have done up to 3 deposits in the same calendar month, never paid a dime. Only mistakenly paid banks routing fees when using the IB UK CHF IBAN, but I’ve fixed that and used the CH one since more than a year

Cash Deposits:

Yes, you pay a fee. But we’re talking about actual cash deposit, I mean, you sending physical bills to them or a check (who uses check in year 2018??). It’s written in the note.

Thanks Mr RIP for the great post! I’ve just discovered your blog, read a couple of articles and enjoyed your clear approach, so subscribed to it to get updates 🙂

I opened an account with IB a couple of weeks ago before reading this post and I left the default “margin” option (instead of cash) for the type of account. By any chance do you know how I can avoid issues with this when making orders?

When playing with the paper account I’ve seen some numbers related to margin:

https://i.imgur.com/5xjf4A8.png

which I didn’t see in your examples and wouldn’t like to avoid any extra hassle. Any suggestion?

Also, being based in Luxembourg and having all my cash in Euro, from your perspective, what would be the negative side of always choosing the EUR version of ETFs instead of the USD ones? (for instance picking SXR8 instead of CSSPX)? In this way I should save the converting fees.

Thanks a lot!

Hi Sik, thanks for joining us 🙂

Margin accounts are something you want to avoid if you’re not going to be a day trader with strong guts!

I assume you know what “margin account” means, so I’m not going into details. If you need details let me know and I’ll explain more.

risks associated with margin accounts are:

– you risk “fat fingers” on several levels

– your cash balance is not insured by SIPC and other national coverages

– in Switzerland, you might be considered day trader even if you are not, and be taxed on capital gain

– leverage investing in stocks is… gambling

If you don’t intend to leverage find a way to ask IB to change account type to cash.

Thanks for the quick feedback! The reason why I choose the margin account is that my understanding which came from few reads I had on that, was that with it I was going to be offered the option to work on margins if I wanted do, but not on as the only option. I’ll talk to IB chat to clarify how this reflects to my account and possibly I’ll ask to swap the account as you suggested.

Would be great if you could provide a feedback on my previous second question which I’ll report here:

being based in Luxembourg and having all my cash in Euro, from your perspective, what would be the negative side of always choosing the EUR version of ETFs instead of the USD ones? (for instance picking SXR8 instead of CSSPX)? In this way I should save the converting fees.

Thanks a lot!

I don’t know exactly (and I don’t want to go thru the hassles of researching on that topic) if there’s a difference between a cash account and a margin account if you don’t actually use the margin.

I know that as soon as you use the margin, i.e. open a credit line with the broker, things are going to be very different.

For the currency issue, there’s absolutely no difference in which currency you trade an ETF. This would obviously be arbitraged away in a heartbeat. Just choose the one that minimized fees and currency conversion costs 🙂

Thanks MrRIP!

I investigated a bit more with IB chat and about the margin/cash account seems there should be any difference unless I actually start using the margin. Full transcript here:

https://pastebin.com/r2tG7ie0

However, I might actually get back to a cash account to avoid putting myself in the situation of risking to use margin by mistake.

Thanks for clarifying about the currency issue. I’ll then try to look for the EUR version of the ETF.

Thanks!

I have a margin account, one of the advantage as far as i understand being that you could trade in foreign currency without having go through forex. More importantly, when you sell your stock the money is readily available and don’t have to wait few days. correct me if I am wrong.

How long does it take for money to be availble on your account after selling with a cash account?

Now have my account on IB LLC UK, but I could not find the reference to “your cash balance is not insured…” if you have a margin account, do you have a link for that?

thanks,

Ps I am also curious on your takes of the currency of the etf.

Hi Hector, I can do the same with a cash account too, just selecting which securities should be sold first in case of negative liquidity (and select a currency pair), but I don’t use it. I prefer to issue orders on currency pairs too 🙂

The “benefit” you mentioned of having cash available “soon” after selling assets is exactly why it’s dangerous.

With a cash account you have physical bank accounts with your name on it and government protections work. On the “cons” of this, you have to wait few days for the money to settle after a trade. But that’s only meaningful if you want to withdraw cash, else you can trade right away with “unsettled cash”.

On SIPC protection and margin account there are so many ambiguities and SIPC page is also shady. Plus, if you actually use margin the broker is allowed to loan from you and stocks you own leveraged can be subject of bankruptcy procedures. I would not go into that.

source: https://forum.mustachianpost.com/t/account-type-margin-at-interactive-brokers/639/6

Well, didn’t dig into SEC Rule 15c3-3, but I found the same reference at least 3 times in my longer-than-I-wanted research for SIPC protection 🙂

Dear Mr. Rip,

I’m having my babysteps with investing and I’m planing to use IB to start with. Your guide is great!

Quick question – if I choose to invest in ETF which accumulates income, is there anything needs to be done in IB setup so the income can be reinvested back into the fund or is it much simpler – I just buy etf shares, hold them and the dividends are reinvested automatically.

Thanks a lot

Hi Mark, if you invest in an accumulating ETF you never see the dividend, it’s already reinvested into the fund. the share price already reflect the value of stocks + accumulating dividends.

The index they track is also different. For example, an S&P500 accumulating ETF tracks the “S&P500 Total Return index”, which takes into account dividends.

This is awesome, so glad I found you RIP. I got an IB account and was collapsing under all their charts and stuff, and their many unhelpful guides. New to the blog, pretty sure will become a huge fan! Thank you!

You’re welcome 🙂

Hi thanks for the comprehensive report. Im currently with Internax being forced onto them via the EtradeUk – TDW – TDW international and now Internax had just been acquired by a Swiss company. 4 broker moves forced on me in 3 years. I’m thinking about moving to IBR because while Internax is easy to use they give no notifications of account activity, no dividend reinvestment, and their app has nothing useful in it beyond buying and selling. And they keep selling the customers to a new broker. However i’ve a few questions on IBR which arent covered in their FAQ and there seems to be no direct support without opening an account. How is their support? I live in Asia and trade UK and US stocks. I want to transfer my stocks in and keep US$ and UKP dividends without taking a currency hit every time. All quite common but i cant work out how possible this is and what it all costs. Also they do ask a lot of personal questions and their privacy policy seems to say they can do whatever they want to comercialise that data. So i’m cautious on using them.

So far I have had no issue with IB support. They are quick to reply and I assume their written responses are legally binding.

Thank you MrRIP for the excellent post!

Somehow I cannot really get a grip on what pricing structure is more convenient. It looks like the tiered one is cheaper, but I feel like I might miss something. Otherwise why would they have a fixed one?

Do you have any suggestion or care to elaborate a bit more? Any direct experience?

I tried both and I still don’t understand which one is better. I’m sticking with tiered now. I think it doesn’t matter much.

If you find something more, please share!

Tiered is generally better for very small or very large volumes of shares. In between, fixed usually comes out on top.

Hey, Nice blog, as far as the withdrawals go, It says 1 free per calendar month, so Oct 31 you can wire out for the 1st time for free, then you can wire out Nov 1st and that is also free? Or do 30 days have to pass from the last wire? Thank you.

I’m not 100% sure, but it should be one per calendar month, so Oct31 & Nov1 should both be free.

If you try that out and get some surprise, please share 🙂

Hi

First, thanks for creating this website, it’s very helpful. I’ve just opened an account with IB and am looking forward to trading soon (my UK bank doesn’t allow online money transfers so I cannot fund my account until I return to the bank in person, very frustrating for an expat). As a newbie to IB I have a couple of questions I hope can be answered.

When I enter VWRL on the IB app, it comes up with three choices of stock exchange (LSE, AEB, EBS) and the ETF named VANG FTSE AW USDD. My base currency is GBP and I would prefer to buy in GBP initially, so I would choose the LSE option. If I bought this, would I be buying the exact same product as Vanguard FTSE All-World ETF (GBP) VWRL that I have seen on the Morningstar website? I am confused by the different names. What is USDD? The price seems to be in GBP, so why the USDD part? I imagine there’s a really simply answer, but to a newbie it is confusing.

PS Sorry I double posted on the wrong page.

Hey MrRip, thanks for the great post. Helped a lot! Do you know if it is possible to setup monthly auto investment for fund/ETFs? I am looking into fund VTSAX and would like to set it up that it buys x amount at the beginning of the month. Is that possible? Thanks a lot and a happy new year 🙂

I do monthly automatic deposit into IB, but I like to do my investments manually.

I don’t think it’s healthy to issue automated market orders on ETFs.

Btw, VTSAX is a mutual fund, not an ETF. I’m not even sure you can buy it on IB. It’s not traded on stock exchanges.

Ok, I didn’t answer your question 🙂

Truth is: I know there are tools for Trader Workstation (the Java IB desktop client that I don’t use) that generate for you rebalancing orders, so I assume there should be a way to automate orders.

Well, IB expose APIs too. If you’r brave enough you can code your own tool 🙂

MrRip – awesome post !

I too am looking for auto monthly investment for ETFs.

Even though I know not to second guess the market, and just consistently buy month in and month out, looking back upon the last couple of years shows a completely different picture.

Any suggestions would be most welcome.

Fidelity is a good place to look, they have zero expense funds.

I’m not aware of any. A friend is investigating into tools for Trader Workstation (the Java IB desktop client that I don’t use) but I won’t recommend auto investments on ETFs anyway. Avoid market orders!

Nice article. This can be helpful

Do you execute your trades manually or did you find a way to automate. I know IB has an API, but I was looking for a lightweight way to automatically by $xxx or stock X each month.

I do execute trades manually. I do almost everything manually. I send CHF to IB, convert manually to USD (open a limit order, copy the suggested limit order price into a browser tab, divide the CHF amount by that price, round up a bit to have room for changes and room for fees, then input the amount of USD I can buy, then issue the order… than wait and maybe modify manually the order few times), then repeat similar steps to buy shares of my ETFs.

Rip, I already decided that if I ever met you, I would bear hug you in immense gratitude for the sheer amount of information you’ve given me (and the occasional laugh or two). But bear hug you I can’t. Instead, I used your referral link and opened an application with IB – which would have been a right royal headache if it weren’t for this post. Thank you so, so much virtual bear hug

Haha you made my day 😀

Thank you for this post.

At the Moment I have an account with truewealth.ch (0,5% fee).

If I would like to move to IB, do I have to liquidate all my assets with truewealth and transfer the cash to IB and then buy the ETF I want or is there a possibility to transfer something like the portfolio that I have with truewealth directly? I can’t imagine how this should work but tought I’m gonna ask someone smarter than I 😉

I’m pretty sure you can transfer assets among brokers.

Transferring assets out is an action that usually costs money, and sometimes it’s pretty expensive. Just consult with truewealth and check if that’s an option. I know for sure that IB accept inbound position transfer (https://ibkr.info/article/1047)

Hello,

Thanks for the comprehensive review. Great job!!

I have one question regarding the currency conversion. I will upload EUR via SEPA transfer, but for some reason i dont see USD.EUR pair for trading? Am i overseeing something?

Thanks!!!

You can sell EUR.USD it’s kind of the same thing.

For some reason i dont see it :/

Can you please provide a screenshot? What do you type in the search bar?

Thanks

Be sure to select “forex” and not “stock” in the order UI.

I think i got it. When i type USD.EUR its not there, but EUR.USD i can see.

that means i need to use Sell order instead Buy order?

Thanks!!

Yes, like Gabriele said in a previous comment 🙂

Oh… got it, sorry

Thanks again both!

I don’t have my computer at the moment but I checked on my phone. Maybe just search for EUR and then select idealpro forex and all the pairings should appear.

I don’t see the tax treaty question whatsoever. Maybe IB has changed its application process since early 2018. Now I had to input my Swiss tax (AHV) and ALSO my US citizenship/tax residency (required since i’m a US citizen) with my SSN.

Any ideas why they removed the tax treaty question? My guesses are either policy change or it is implicit in the tax residency question..?

please disregard. I’m a dum-dum who was so overwhelmed by IB that I didn’t realize you also weren’t a U.S. citizen. Still very helpful blog! Thanks

Yep, definitely not American.

I take the fact that you confused me for an American as a badge of honor for my English quality 😀

Hey Mr Rip, thanks a lot for such an informative and detailed post on IB.

I was so confused with the interface and this is incredibly helpful.

One naive question (either for you or any of the experienced people here): anyone knows the Interactive Broker IBAN for SEPA transfer in EUR? Just like you, I would like to avoid being charged extra for sending EUR to a GBP account.

Hi Matteo.

You can have cash in multiple currencies in IB.

In Account Management –> Transfer Funds –> Deposit Funds you can tell IB that you want to deposit X amount of Y currency. If currency is EUR, they’ll show you an EUR account where to send money to.

How have you been sending money to them so far?

Thanks a lot for your kind answer!

I am quite new to passive investing (your blog has actually been a great source of knowledge and inspiration on this topic) and I got a bit confused with the IB interface.

I think I did not fully understand that one needs to first send them a notification of deposit before the actual wire transfer.

In any event, it is much clearer now. And by the way I can confirm that IB has a German IBAN (German Branch of Citybank), so inexpensive SEPA transfers are definitely possible.

After a while (once they acknowledge you’re a trusted person) you don’t have to inform them of incoming funds anymore.

Hi there!

I am loving your blog, thanks you for sharing all of this! 🙂 I hope to be where you are within the next 10 years, I just turned 35 a couple of days ago 😛

I might have missed it, but I just have a quick question… considering all the craziness around us…how did you hedge your investments with respect to currency risk? What was the dominant currency that you have invested in? I will invest the bulk of my money in ETFs (80-90%), and most in EUR, which is my base currency (am from Slovenia :P), but some of it will go to some stock picks, to maybe build up some dividend income as well…that will be mostly into US companies, in USD, of course.

What would be your suggestion on how to go about it, since you surely have muuuuch more experience as I do?

Thank you in advance!

p.s. I already shared your blog with some of the people that I know, I am sure they’ll love it 🙂

Robert

Hi Robert, welcome to retireinprogress 🙂

Thank you for the kind words!