Hi RIP voyeurs,

It’s been an intense month in RIP neighborhood. Travels, weddings & funerals, babyRIP demanding attention, actual work and so on. I didn’t write a single article in the whole month. It’s not how one builds readership, I know. Things are hopefully going to stabilize this summer though 🙂

“Holy crap, RIP, did you say funerals??”

“Yeah, well, luckily a single one: a neighbor died overnight 🙁 He was sick but still in reasonably good shape… it’s been an unexpected loss for our community 🙁”

“I’m sorry for that RIP… Btw, why ‘Million Impossible’?”

Thanks for asking! It’s been another month of financial roller coaster. I remember on Friday January 26th 2018 our NW in USD touched 960k (before falling back to 940k by end of the month) from 880k at the end of December 2017.

It was almost +80k in less than a month. I remember being very calm: “HOLY SHIIIIIIT!!! HOLY HOLY SHIIIIIIIIIIIIIIIIIIIIIIIIIIIIIIT!!! If February will be like January we’re going to be MILLIONAIRE NEXT MONTH HOLY SHIIIIIIIT!!”

Since then I’m kind of expecting our NW in USD to cross the finish line every week but… it’s not happened so far. We’re now back at 960k, same of that magic Friday.

That’s a Million Impossible!

Let’s look at finances and metrics (and more) now!

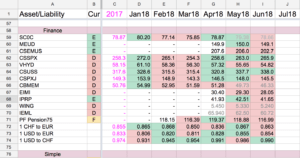

More details can be found in my Net Worth spreadsheet (embedded here).

Metrics

Net worth: EUR 820.6k, +7.8k (CHF 951k , +14k / USD 960k, +10k). Not a good month. NW goes up thanks to income, while investments lost some terrain, in particular during last week of June. At one point mid month NW in USD was close to 980k… did I already say roller coaster?

Income: 33.3k CHF. Yeah, that’s June my friends. In each one of June, December and January we earn more than most of our friends and family members in Italy earn in a year. Anyway, salaries are going down since Mrs RIP pregnancy payments are decaying quickly. Switzerland is an awesome place where to live and grow kids, but holy sheet how crappy are their laws on maternity (and paternity)! The bulk of our income comes from a huge Hooli stocks vesting event (29.2k USD gross, 27.6k after Pillar 1 contribution, 20.6k estimated after tax). As a nice extra, two of our ETFs distributed juicy dividends:

- Vanguard High Dividend Yield (VHYD): 1228 USD. 1.22% yield this quarter. VHYD dividends are not distributed uniformly during the year, Q2 dividends are historically the highest among the year.

- Real Estate European Property Yield (IPRP): 677 EUR. 2.5% yield this distribution. IPRP dividends are kind of crazy. In last 3 years they distributed 3 times per year, with 80% of the profits distributed in June.

I don’t remember if I told you that I love dividends 🙂 I know in the long run growth and small caps seem to perform better than value stocks. Add that in Switzerland capital gain is not taxed and it’s a K.O. for value (dividend) stocks… but a steady cash flow is the best edge against volatility and the fear of volatility, loss aversion and so on. If the investor’s worst enemy is the investor itself, value stocks are a nice prevention tool!

Expenses: 6505 CHF. Holy shit… One of the most expensive months ever. I have excuses and explanations for one-off expenses, but they seem to be there every month.

Savings: 26.8k CHF. I guess it’s still fine 🙂 Anyway, 26k saving and only 14k NW growth may mislead the analysis. I account for “vesting” stocks in the “virtual” section of my NW document. I was not expecting a +26.8k CHF NW delta even in case of a neutral investments and currency fluctuation month.

Saving rate: 80.5%. Definitely not bad 🙂

Saving rate for 2018 so far: 74.5%. Target is 70% (Platinum badass saver), we’re on track!

FI%: 68.39% (+0.65%). A small step for the RIPs, but still in the right direction.

FI Forecast Date: October 2020 (28 months left, +-0 months compared to last month). We move one step forward and the target one step backward. It reminds me the General Relativity:

Current Allowance: Year 28.7k EUR (+274) – Month 2393 EUR (+22) – Day 78.69 EUR (+0.75).

Current Withdrawal Rate: 5.12% (-0.05%).

Years of Ideal expenses accumulated: 19.5 (+0.1).

Success Rate at Current WR, 40 years horizon, 75%/25% split: 56.48% (based on cfiresim).

Swiss FI%: 52.01% (-0.23%). Expenses are growing faster than NW 🙁

Swiss FI Forecast Date: April 2022 (46 months left, +2 compared to last month). We’re below escape velocity in Switzerland…

The new progress bar:

Major Wins

1) Stocks Vesting & Dividends

I know stocks are kind of guaranteed and predictable, but you never know… until you see money hitting your bank (or brokerage in my case) account everything is still “virtual”. Plus, we’re talking about an individual company stocks which may fall by 50% in one day. Right now Hooli stock price has always gone up, but you never know.

Why money and not stocks hitting my brokerage account? I joined the autosale program, so stocks are sold at vesting time and the proceeds are wired to my brokerage account. In retrospective I would have been way better off just by holding stocks, since they went 4x in my almost 6 years at Hooli, but – again – Hooli is my main source of income and putting other eggs in the same basket is not a wise move.

2) Still frugal parenting so far!

Baby expenses dropped by a lot this month! Baby RIP related expenses have been only 263 CHF! That includes a pediatrician visit in Italy and several clothes purchased while in Italy, at a discounted price. Since we got a lot of material from family and friends we allowed ourselves to splurge a little bit on cute dresses 🙂

Insurance costs are not included in baby expenses but in Health category.

Major Losses

1) Expenses are way too high: 6.5k CHF

Details:

- 1888 CHF for Housing. More than 500 CHF are due to Italian apartment. Condo fees and property taxes. Hope to get rid of them one day.

- 701 CHF for Health. Just the baseline. No doctor visits or other medicines. Except a Pediatrician visit for BabyRIP which is in “baby” category. Ok, categories are definitely messed up and need a refactoring. Sone breakdown: both I and Mrs RIP are insured with Mutuel, Telmed model and highest deductible (2500 CHF). We pay 284.40 CHF per month each. BabyRIP is also insured with Mutuel, Telmed, plus semi-private hospitalization and ZERO deductible. She pays 131.70 CHF per month. We chose semi-private for her to better cope with eventual birth problems. Since everything went awesomely we plan to downgrade it as soon as possible (we’re locked in for 3 years). Her insurance costs breakdown: Base Insurance: 109.70 CHF/Mo, semi-private hospitalization: 22 CHF/Mo.

- 351 CHF for Utilities. 150 CHF for three visits of the cleaning lady. Ok, maybe this should be moved into housing. I got it, it’s time for a categorization review 🙂

- 529 CHF for Groceries. A pretty regular month.

- 73 CHF for Transportation. 63 CHF for car sharing (mobility) in 2 circumstances and only 10 CHF for local transportation. Awesome! We love car sharing!

- 112 CHF for Eating Out. Mainly a dinner for our wedding anniversary plus a couple of other events.

285 CHF for Leisure. A concert for Mrs RIP while I experimented spending almost 6 hours alone with BabyRIP (it was not easy), a visit to TierPark Goldau (amazing animal park in central Switzerland, strongly recommended) with friends from Italy and other minor expenses.

285 CHF for Leisure. A concert for Mrs RIP while I experimented spending almost 6 hours alone with BabyRIP (it was not easy), a visit to TierPark Goldau (amazing animal park in central Switzerland, strongly recommended) with friends from Italy and other minor expenses.- 22 CHF for Fees. Banking fees, brokerage fees, postal fees.

- 194 CHF for Gifts. So many friends’ birthdays and newborn kids (and the neighbor’s funeral). It’s a vicious loop. They give us expensive gifts and Mrs RIP feels obliged to reciprocate moneywise. I’d like to break the chain, but it’s impossible. Plus, Mrs RIP finds it funny to shop for gifts…

- 1971 CHF for Travel. Time to face the elephant in the room. 1741 CHF for the two Weddings, and one has not yet happened! That includes clothing for both weddings, gifts for both weddings, travel and accommodation for the first wedding, Mrs RIP make-up, hairdressing (is that a word?), aesthetic things (manicure, pedicure, hair removal). First wedding was 300km east of Milan. It took us two days from Switzerland. A shitload of money gone forever, and I expect another 4-500 CHF next month for the “operational costs” of the second wedding. 230 CHF for FIWE 2018. I spent 4 amazing days in Romania with amazing people, waaaay more on this in my next post.

- 116 CHF for Clothing. Mrs RIP Italian clothing frenzy.

- 263 CHF for BabyRIP. Some clothes in Italy, a pediatrician visit, powdered milk and few toys. Trending down.

RIP, remember this for next time: don’t let Mrs RIP alone in Italy with a credit card. She’d go like “woooooow this only costs half of what it costs in Switzerland?? I buy five of them!!”

Anyway, 2k – 2.5k CHF highly arbitrary expenses, and 0.5k due to Italian apartment. Things could be improved by a lot. This is the third month our expenses float around the 6k bar and that’s not good. I expect July to still be an expensive month, but I can see normality over the horizon.

Most of my ETFs lost terrain.

Now with special effects on my spreadsheet 🙂

Nothing dramatic, but red is dominating the scene here. The worst performing are the Vanguard High Yield Dividends (which distributed dividends this month though) and the Emerging Market. This is definitely not the year of Emerging Markets.

3) EUR stronger compared to both USD and CHF

Not by much, but EUR is going up and that means my growth in EUR is lower than in other currencies. I don’t know anymore if I need to measure my NW in EUR or not, so I’m not sure this is a bad news.

4) Mortgage rejected for my Italian apartment prospect buyer…

That’s a hell of a story and I can’t wait to see the end of it. Prospect buyer was rejected 3 times and now we’re back on base 1. Next month I’ll go talking to the realtor face by face and decide what to do next.

Other financial facts

1) Invested ~11k USD in VHYD

Yes yes yes I know it was not the most unbalanced entry in my investing sheet, but I don’t know… I’m not sure that I told you I love dividends… And my VHYD ETF is ~10% below its Magic Friday (January 26th) peak price. I tried to exploit the deep (never do that!) and bought 210 shares at price 54.15 USD per share.

2) I’m rethinking about IEML and WING (bonds ETFs)

I should invest more in bonds, according to my asset allocation. I’m not in love with them, must admit. But I’m also relatively close to FI and I perceive (never actually tested on the field) that I could go nuts in high volatility. That’s why I also like Dividend Investing (did I tell you already?) even though it’s not tax efficient in Switzerland compared to growth stocks.

Bonds are another tool to edge volatility at the price of lower expected returns. So… why not? the problem is that the two bonds that I selected after the April analysis are WING (High Yield Corporate bonds) and IEML (Emerging Markets Government bonds).

Bonds are another tool to edge volatility at the price of lower expected returns. So… why not? the problem is that the two bonds that I selected after the April analysis are WING (High Yield Corporate bonds) and IEML (Emerging Markets Government bonds).

While WING is not doing that bad, IEML is catastrophic since inception.

In 7 years it has constantly gone down from 100 USD to below 60 per share.

I’m not sure I want to invest in EM government bonds anymore. Or is it a real bargain?

Who the hell knows.

3) Mrs RIP resigned from her job

She hated her job and she was being paid not even enough to afford child care for BabyRIP. She’s now still under paid maternity leave, but she’ll be unemployed in less than a couple of months.

Here in Switzerland maternity leave is 14 weeks. We’re supposed to send BabyRIP to child care when she’ll be 3 months old. Are you kidding me?

How is it called? Fuck You Money? Well, then let’s use it!

She’ll look for a new job when (and if) she needs it.

Other Facts

1) I’m still a father!

BabyRIP is awesome, she’s the best daughter a man can ask! She sleeps a lot, almost never cries and makes funny noises like burps and farts all the time! She can’t really smile yet, even though we pretend that imperceptible upper lip movements are actual responses to our desperate attempts to make her smile. She performs funny faces and cute postures and all the things though!

So far it’s been easier than expected, but fatigue does accumulate indeed. I’m lucky enough I can sleep at night (Mrs RIP handles nights shifts for now) but it is hard nevertheless.

At the beginning of the month we went to Italy for Wedding #1. She faced 3.5 hours by train and 3 hours by car sleeping all the time. Incredible. She was the least noisy person on the train.

In Italy all four grandparents had a chance to spend time with her, all together at the same time, and we realized how lucky we are that we’re living soooo far! Italian grandparents pretend to dictate their theories under the claim that “I’ve been a parent, I know how things work!”. Yes, try to apply for a job that you have experience with 40 years ago. Good luck!!

And then I went to FIWE. Four full days far from my daughter, for the first time. Hopefully for the last time too. I missed her so much, even though I enjoyed FIWE way more than expected!

2) No time for blogging

I feel like shit. I love writing so much but there’s simply been… no time at all! Working, parenting (and husbanding!), traveling… No way.

But things are changing now (for a while). In July I’ll be out of office for 10 weeks, thanks to Hooli generous paternity leave policy. More on this will come soon 😉

I’ve adopted a spreadsheet schedule for blog posts as suggested by Joe Udo at RetireBy40 and I plan to stick with it. 2 posts per week for next 2 months 🙂

3) Put up a lot of weight

Zero sport of any kind in last 3 months. Eating unhealthy due to stress and ok, let’s admit it, a sugar addition. I reached an all time high on Saturday June 30th and I took some action like eating better and get back on a jogging schedule. I feel my knees don’t really like it, but it’s not been a year since I’ve run a half marathon so dear knees please don’t complain.

You know what? This year edition of the same half marathon is scheduled for September 22nd. I can’t run 5k now. Know what? I’ll run that fucking (half) marathon anyway! I’m committing, you’re all witnesses!

Spoiler: I’ve already lost 2.5kg during the first 2 weeks of July and ran 10k a couple of days ago!

4) Paternity is coming

As I anticipated, I’m going on Paternity leave from July 5th to September 16th. It’s something like 74 days without having to go to work. Holy cow, it’s the longest break since I joined Hooli (took 3.5 months off that time back in 2012).

I have (maybe too many) plans and (maybe too high) expectations. I’ve put up together a doc on what I want to achieve during these 2+ months. More on this will appear in its own post.

We changed our original plan and we’re staying in Switzerland until end of August and probably going somewhere in Italy first two weeks of September. It’s almost 2 full months to devote to family, blog, sport, midlife crisis and self analysis (and another Wedding in Italy on July 7th).

5) Theater Teaching

Saturday June 23rd has probably been the best day of my month!

We’ve been preparing the workshops with such enthusiasm that it was very well perceived by the attendants. We offered 2 full immersion Saturdays in June. I guided one of the two, with the help of a couple of “theater colleagues”. 10 hours of deep and fun theater exercises offered as a theater acting buffet “all you can act” for beginners.

We had incredible feedback and strong demand to offer more teaching. An attendant gave us extra money because we deserved more than what we asked! We’re thinking about starting a beginner theater laboratory with a weekly setup and a show next spring.

I’d do that 60 hours per week if time and money weren’t a issue. I’d do that if I were already FI!

Time is a fucking scarce resource nowadays!

That’s all for our June 🙂

Hej Mr RIP

I have a question: why do you call the company you are working for Hooli, and don‘t tell it is XYZ [Censored by Mr RIP]?

You wrote at one point that you would not like to tell, but from your post it is obvious? So why hide it? Does XYZ not want its employees to blog?

Hi Tom, I hope you don’t mind I censored the company name you suggested. If you mind, please let me know and I’ll delete your comment.

I blog anonymously and don’t want to bind my public identity to me private one.

Not mentioning which company Hooli is adds another layer of privacy and avoids any kind of trouble for me and for Hooli.

Thanks to my blog I met so many people and all of them know my name and which company Hooli is.

I don’t have problem sharing it privately, I’m not obsessed to that level 🙂

Actually, at least two blog followers applied for a position at Hooli and I helped them thru the process 🙂

Hooli has no problem with employees blogging or having any kind of side gig, unless this impacts your productivity or any obvious other conflict of interest (like working for a competitor) or – of course – illegal behavior (like stealing data).

Thanks for stopping by!

Sounds like June was quite eventful – enjoy your paternity leave.

And I wish the pound was as strong as the euro – we’re getting very volatile lately – I crossed into $ millionaire club, then was swiftly removed!

That’s my nightmare! But if you think about it, it may be funny!

You got to open more Champagne bottles 😀

Awesome monthly report! It seems like a lot of things happened, but you still have an amazing savings rate – good job. I also had a month without writing due to my own wedding in June, and I learned that there’s no reason to stress about it. Your readers will still be there afterwards 🙂 now I have spent some of my vacation time on writing scheduled posts a few months out in the future to absorb future busy periods.

Hi Carl, welcome to my blog!

Yeah, I know “my readers are still here waiting for me”, but I feel sad if I don’t blog as much as I like because I miss it 🙂