(Disclosure: links marked with an asterisk * are affiliate links)

Table of Contents

- RIP News

- Main Content

- NASA Perseverance rover landing on Mars (10/10)

- Morgan Housel about The Seduction of Pessimism (8.5/10)

- Rational Reminder podcast with William Bengen (8/10)

- The Plain Bagel about Financial Advisors (8/10)

- Nick Maggiulli Dollar Cost Averaging vs Lump Sum (8/10)

- Scott Galloway on Wealth (8/10)

- ITA – Roberto Mercadini about The Gioconda Paradox (8/10)

- More To That “Thought Stop Signs” (7.5/10)

- Paul Andersen’s Conceptual Thinking Mini-Lessons (7.5/10)

- Josh Brown about Twitter and its lack of success (7/10)

- Nat Eliason about being yourself, not a niche (7/10)

- Emilie Wapnick 2015 Ted Talk about Multipotentialities (8/10)

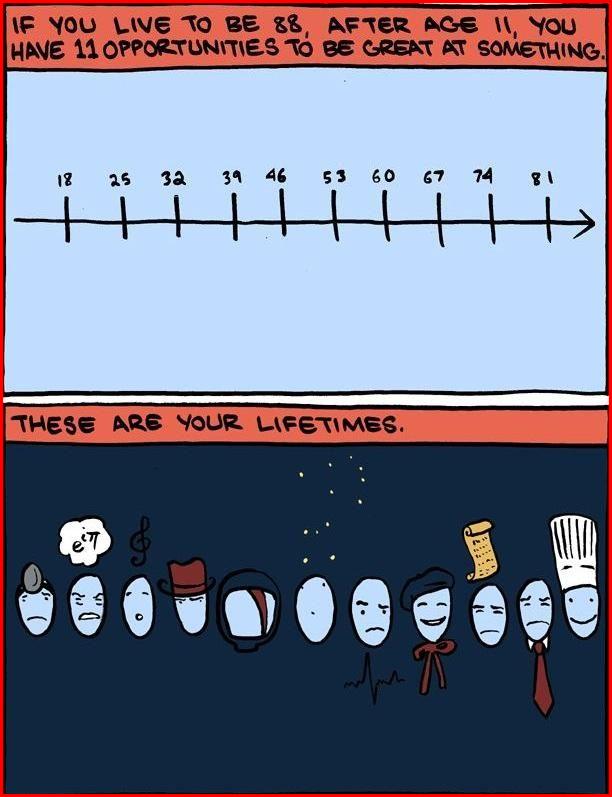

- SMBC about your lifetimes (8/10)

- Michael Lynch about his third year as a solo developer (7/10)

- Ben Carlson about Sequence of Returns Risk (7/10)

- Kevin Simler about Wealth and Guilt (7/10)

- Reversion to the Mean (6.5/10)

- Noam Bardin, former Waze CEO: why I left Google (6/10)

- Beeple – Everydays: The First 5000 Days (ETH/10)

- Cryptopunks (DOGE/10)

- Other Content

- Coming Soon

- Have you Reddit?

- FUN Stuff

- Leisure Corner

Hi RIP readers, welcome to the March 2021 edition of the Monthly Learning journal (MLJ).

Luckily for you, this edition will be shorter than usual. LOL, why do I keep promising the unpromisable?

I’ve had a crazy second half of February (going public, going viral, launching services, hundreds of people reaching me out…) where I had literally no extra time to read, watch, listen and learn. Let’s not even talk about “leisure”…

Anyway, Today MLJ themes are: Wealth, Investing, Thinking, and being a multitude 🙂

This MLJ is also available in my public Roam Database with expanded notes when available, and some extra content 😉

Next Episode on Monday April 5th, 2021. (in 5 weeks this time, with 25% more content!)

Enjoy!

RIP News

What happened in the RIP World during last month?

I’ve meta-talked about my blog too much recently (going public, launching services, 2020 Q4 Update Part 3) so I’ll keep this section short. “RIP, stop!”

I Just want to share with you what happened to this blog since Mid February, I’m still trying to get my head around it.

Metrics

February was hot on the blog.

I wasn’t prepared for this. It’s almost 4x previous all time high month. In February 2021 my blog was visited 30% more times than during the first 3 years of blogging.

And that’s of course due to my interview with Marcello Ascani:

It’s been a crazy couple of weeks since the video came out on Sunday February 14th. The blog jumped from ~1.5k pageviews per day to almost 40k, remaining above previous all time high for 6 days 🙂 Previous all time high which was also a virality-induced spike.

During the first 2-3 days I experienced an overflowing amount of incoming communications. Mails, blog comments, YT video comments, special requests, friends and family messaging, and so on. There simply was less time available than time necessary to try to catch up with everything and everyone.

I have no idea how “real VIP” handle their incoming stream. Ok, I know that they need to prioritize stuff, and probably they don’t care much about replying to (or even reading) every comment/request. I tried to reply to everyone, even just to tell them that I don’t have time to reply properly. I’m sorry about that.

It took the rest of the first week to go back to (2x) normal in terms of “communications”, goodbye cheap dopamine!

A few words about communications: do not contact me asking life changing questions I can’t reply with two or three sentences via email.

Questions like “should I go to college or not?“, “I need help with investments, can we have a 3 hours call with you so I can explain everything to you?“, or “I don’t know what to do with my life and money, can you help me?“.

These are questions that take hours across days, weeks, and months (and years, almost a decade in my case) to eviscerate and come up with some answers, a plan, and usually better (or more) questions. I’m happy to do this, but it’s called work. I don’t have the bandwidth to do it for free anymore. If you’re interested I’ll launch more services in future.

Stay tuned.

Business

Ok, it seems this RIP News section is talking over the quarterly blog update. And I’m kind of ok with it. Who am I to fight this change? 😉

Seriously, I just want to share with you the impact of the first 2 weeks of slightly switching this blog to “business”.

Blog (gross) income in February 2021 (actually just the second half): 2824 CHF

Blog income breakdown (in 4 different currencies):

- Mock Software Interviews: 1342.95 EUR + 350 CHF

- InteractiveBrokers Referral: 1000 USD

- Donations: 82.35 EUR

- Amazon Affiliate: 21.23 EUR + 5.00 GBP

This is way better than I anticipated, and I don’t think it’s going to be always like this. On the other hand I just launched a single service, I do plan to launch other services and sooner or later some product so… it might be just the beginning 🙂

Anyway, we’re far from sustainability: there have been some costs (negligible for now), and I will have to pay income taxes – and maybe Pillar 1, maybe VAT, maybe other insurances – on the blog income. I’ll figure it out soon-ish, since I’m procrastinating a bit too much on the important task of giving my blog activity a legal/official structure.

Enough for today, I’ll write more about business (and my business) in the future.

Walking Group

Few of you are asking me to meet in person in Zurich, and I’m always happy to have a walk in the woods while talking cool stuff!

I’ve already met many readers outdoor (in a Covid-19 respectful way) even during those difficult times. The requests are increasing though, and I can’t handle more than one per week. Let’s group walk in the woods together maybe bi-weekly, or monthly. Send me an email if you’re interested. Signal or Telegram preferred, I can’t handle ten different communication platforms.

Main Content

The most interesting resources I consumed during last month

NASA Perseverance rover landing on Mars (10/10)

We’ve all seen it, right?

Think about it: we threw a piece of metal with thousands of delicate parts from Planet Earth 7 months ago, and it landed with a millimetric precision in the designed spot on ANOTHER PLANET, following a complex autonomous maneuver that couldn’t be really tested on Earth, using sensors and actuators that were sleeping for 7 months.

And if you think your lame Sauerbraten opponent is lagging too much, mind that the Mars landing happened with an unavoidable-due-lightspeed 11 minutes delay (for the next stone in the universe, now try to imagine intergalactic communications), which means while we were following NASA live stream of the seven minutes of terror Perseverance was already sitting on the surface of Mars, probably complaining that nobody was wearing masks. The LIVE event was a re-run itself.

And for the first time in human space exploration we received a video of the “paragliding” phase of the rover descent. It seems “normal”, but it isn’t! That’s ANOTHER PLANET guys!

If this doesn’t make your brain wonder (and wander) I don’t know what it does.

Enjoy!

Morgan Housel about The Seduction of Pessimism (8.5/10)

Excellent old article by Morgan Housel that tells why stock market pessimists (like me) are the way they are.

The difference between pessimism and optimism often comes down to time horizon. If a recession or downturn is the end of your show, you should be pessimistic. If it’s a bad commercial during an otherwise great episode, you should be optimistic

That’s why you (I mean… me) become more pessimistic with age.

Despite an awareness of how powerfully we’ve changed in the past, it’s too easy to underestimate our ability to change in the future. Psychologists call this the end of history illusion. In people, it’s the tendency to realize that your tastes and values have changed in the past while underestimating how much they’ll change in the future.

It’s a reason pessimism is so seductive.

Most things in business and investing have to be pushed to their limits once in awhile, if only to see where the limits are. “Unsustainable” is the most common state that businesses and markets reside in.

So true, bot “not this time” 🙂

Pessimism reduces expectations, narrowing the gap between possible outcomes and outcomes you feel great about. Maybe that’s why we cling to it. Expecting things to be bad is the best way to be pleasantly surprised when they’re not. Which is something to be optimistic about.

I do this all the time!

Anyway, I thank Michael Batnick for recommending this old Morgan Housel article to the audience of this Compound episode with Josh Brown (7.5/10).

Rational Reminder podcast with William Bengen (8/10)

Ben Felix and Bill Bengen, the father of the 4% Rule, together.

In several videos Ben advocates for a 2.2 – 2.5% SWR (actually suggesting more dynamic solutions to retirement spending), while Bill recently said that even a 4.5% would work today. Sadly they didn’t fight 🙂

Enjoy!

The Plain Bagel about Financial Advisors (8/10)

A honest list of pros and cons of delegating your investments to a financial advisor.

He has some good point on how and why hiring an advisor might be worth their fees.

Nick Maggiulli Dollar Cost Averaging vs Lump Sum (8/10)

This is the definitive guide about DCA vs Lump Sum.

Nick Analyzed both expected returns and volatility / Sharpe ratio using historical data, considering current CAPE, and considering other asset classes.

Conclusion is that it’s always better to Lump Sum, eventually Lump Sum into a more prudent investment (like a 60/40 portfolio).

Anyway, read the full post, is pretty well done.

Scott Galloway on Wealth (8/10)

What a great lesson from Prof Galloway! It should be broadcasted in all high schools and colleges!

About the importance of focusing, deliberate practice, passion that follows action (and not vice versa), and positioning: get a certificate, and move into a city to meet and play AGAINST the best.

I disagree with both the urbanization and the competition aspects though.

ITA – Roberto Mercadini about The Gioconda Paradox (8/10)

Roberto is an amazing Italian storyteller. In this video he explores how he picks the topics for his stories. Everything comes down to 2 ingredients:

- Everybody knows about it.

- Nobody really knows anything about it.

When you have both, you have the perfect topic to catch people’s attention.

Like Leonardo’s Gioconda (Mona Lisa): everybody knows what the Gioconda is, but nobody (except of course a small set of specialists and scholars) knows for example that it’s not painted on a canvas but on a Lombardy poplar panel, i.e. on wood!

Do you want to tell stories and capturing people attention? Find other Giocondas 😉

More To That “Thought Stop Signs” (7.5/10)

This is a very good article about Falsifiability.

God, Democracy, Big Bang, Capitalism… they are all “Thought Stop Signs”.

I call this a Thought Stop Sign, which is a word or phrase that is intended to put an end to an otherwise sound line of reasoning. Before this stop sign is present, people are willing to explore and go deep into the thought trenches, navigating all the winding paths necessary to expand upon their positions. This allows for open-minded discussions where claims are falsifiable, which is a prerequisite in any rigorous search for truth.

I find this article connected with the amazing “The Work required to have an Opinion” by Farnam Street (9/10).

Paul Andersen’s Conceptual Thinking Mini-Lessons (7.5/10)

Paul is the person behind Bozeman Science YouTube Channel and website, a high quality educational science portal (think like Khan Academy, or Crash Course).

This new series is about “thinking”, which as you probably know it is a topic I deeply love.

It’s targeted to high school students, so you’re probably too old for this.

But you never know…

Josh Brown about Twitter and its lack of success (7/10)

How can Twitter be worth less than the Meme stocks that Elon Musk tweets about?

Apparently Twitter has been an underperformer stock since its IPO.

Very interesting article that explains why and how it happened.

P.S. maybe the WSB gang put their hand on it after this post:

Nat Eliason about being yourself, not a niche (7/10)

This short article is very timely for me.

I question my writing and blogging activity, I question whether I should focus my writing on a single topic, a single “specialty”… what’s this blog about? Personal Finance? FIRE? Existential Crisis? Learning? My Life?

Well, it’s ok if it’s all of the above and more!

And it’s exactly what has happened (and it’s happening) to my blog!

Let’s keep being multitudes!

Speaking of which…

Emilie Wapnick 2015 Ted Talk about Multipotentialities (8/10)

(yes, breaking the “sort by rating” criteria, but I want to keep Rabbit-holes spatially close)

I watched again this inspiring TED Talk from… wait, it’s only 6 years old?? I remember I watched it a long time ago! Holy crap, was I already living in Switzerland?

Anyway, I got this TED mentioned by a new friend, a RIP reader, and I re-watched few days ago for the 10th time I guess. Not a very actionable TED Talk (like, well, every other TED talk), but a “reassuring” one.

It’s ok not to have a single life mission. It’s ok not to spend your entire life on one thing. It’s ok to live many different lives.

You’re not alone.

I’m exactly like Emilie!

Speaking of which…

SMBC about your lifetimes (8/10)

Amazing episode of this great strip comic website!

This episode is about embracing your multitude, let yourself be more things!

Here follows a selected extract of a couple of images 🙂

Click on the image, there’s much more!

Michael Lynch about his third year as a solo developer (7/10)

Michael quit Google 3 years ago (been there, done that) and tried many small bets after that.

Most of them failed.

Finally, his current business (Tiny Pilot) is finally bringing in some nice revenues, but also high expenses.

My team at Google had an “on-call rotation,” which meant that every two months, you carried a pager everywhere you went for two weeks. If the pager went off, you had to be “fingers on keyboard” within 30 minutes.

Oh, that’s so relaxing bro! Have you tried 5 minutes SLA? 😀

Ben Carlson about Sequence of Returns Risk (7/10)

Very elegant explanation of SRR, what it means, and how to (partially) protect yourself from it.

Diversification, Rebalance, be flexible and have a financial plan in place.

And an amazing example of SRR in action:

Kevin Simler about Wealth and Guilt (7/10)

Kevin’s essays are real gems (he’s the co-author of The Elephant in The Brain*, candidate next book for the RIP Book Club), but this one is too controversial even for me.

The point is that there should be no guilt in accumulating wealth but in spending it.

It’s counter-intuitive and provoking, but it makes a good point. The Congolese Trading Window thought experiment mixes utilitarianism and altruism to demonstrate that the more wealth you accumulate the more value you added to the world. And when you spend your wealth, you’re subtracting value. The opposite of what’s commonly accepted to “keep the economy running”.

I need to re-read it once again. I know this is one of those articles that stick with my brain, and I could find myself increasing the ranking to 10/10 in the future. For now I keep the rating lower mostly because my brain is resisting being attacked at its foundations.

The article is in response of the Aeon essay “Are coders worth it?” (Link) which is about Impostor Syndrome and Guilt for high earners techies who don’t perceive themselves as doing much useful in exchange for the disproportionate salary… Which you know they are topics of high interest in RIP territory 🙂

Reversion to the Mean (6.5/10)

I don’t remember where I’ve first seen this picture:

Where are we in the stock market today? In which phase? What about Crypto?

My bet: “New Paradigm!!!”

The problem is that once in a hundred times humanity hits the “new paradigm” stage, like a genetic mutation out of a gazillion actually improves the species. You don’t want to be among the contrarians on that day.

Noam Bardin, former Waze CEO: why I left Google (6/10)

An executive’s point of view on large corporations problems.

In a start-up there is complete alignment between the product, the company and the brand. The employees, management and investors are aligned as well – product does well, company does well, investors do well, employees do well.

In a Corporation, the employee alignment is to the Corporations brand, not to the product (i.e. Google, not Gmail; Facebook, not Instagram).

The product is a tool to advance the employees career, not a passion, mission or economic game changer.

Being promoted has more impact on the individuals economic success than the product growth. The decision which product to work on stems from the odds of getting promoted and thus we began onboarding people with the wrong state of mind – seeing Waze as a stepping stone and not as a calling.

This is so true.

As much as I tried to keep the team focused, being part of a Corporation means that the signal to noise ratio changes dramatically. The amount of time and effort spent on Legal, Policy, Privacy – on features that have not shipped to users yet, meant a significant waste of resources and focus.

After the acquisition, we have an extremely long project that consumed many of our best engineers to align our data retention policies and tools to Google. I am not saying this is not important BUT this had zero value to our users.

No bro, I’ve been working on Geo Privacy during the acquisition (so I was part of your problem, sorry) and the way you handled user data (storing payment data unencrypted, users lacking access and control of their data, un-auditable logs, and much MUCH more) needed to be taken over. The fact that users have transparency and control over their data HAS value to them.

Plus, there are sharks ready to (rightfully) initiate Billion dollar lawsuits at the news that Google was not respecting Data Protection policies.

It’s cool to be a startup/child, but at one point you gotta go to school and grow up.

While I do hate to be a Google’s advocate, having been a Geo Privacy Champion still has effects on my identity 🙂

Let me also not quote your view on work-life balance here… Otherwise it’s a nice post. Enjoy!

Beeple – Everydays: The First 5000 Days (ETH/10)

The world of NFT (Non-Fungible Tokens) is obscure to me.

I don’t understand what’s the value of “owning” a digital “piece of art” on a blockchain, other than to speculate on it and to be able to resell at a higher price.

At least I can put a Monet on my living room…

Anyway, there is this digital artist named Beeple, who’s producing a new piece of digital art everyday since 5050 days and counting, whose art pieces are being traded up to 3 digits ETH (6 digits in USD). I mean, this thing sold at 110 ETH… am I the only one who blinks at it?

The real news is that the auction house Christie is running an auction on the “Everydays: The First 5000 Days” art piece, which is a composition of 5000 Beeple art pieces. This is the first time in human history that a NFT is being auctioned in a real art auction.

Here’s the art piece being auctioned (highest bid after three days is $3M, still 11 days to go):

Of course this is just a copy, it’s not the original piece… which is an identical image btw.

And while we’re on the topic…

Cryptopunks (DOGE/10)

The Opensea website is full of crap digital art pieces, whose price is growing exponentially in a “currency” that’s also growing exponentially.

What could possibly go wrong?

How can we add another dimension where to grow exponentially?

With collectibles of course!

Cryptopunks are a collection of 10k different “pixel art” bitmaps, that are selling at prices in the 5-6 digits in USD each one.

Anyway, be my guest: here you can see Cryptopunk 6965 of 10000, a 800 ETH ($1.5 Million) piece of art consisting of a 24×24 pixel (magnified a bit) bitmap.

Go collect them all (in your face Pokémon… and Van Gogh)!

Enjoy.

Other Content

High quality resources I’ve consumed during last month that didn’t make into the main section

The School of Life about what everyone really wants. Spoiler: Reassurance.

Pensionsystem.ch comparison between Valuepension and VIAC Vested Benefits Accounts. Very well done my friend!

Mr. Money Mustache opened an Interactive Brokers’s margin account to get a cheap margin loan and bought a 400k house with it. No mortgage or bank required. Interesting. And scary. But interesting…

Cal Newport Podcast about Productivity, Time Blocking, and Career suggestions. Two very interesting questions: (1) definition of productivity and how it fits the Deep Work framework, and (2) How do you extract good career advice from successful people?

Mike Winnet about how to spot Fake Guru’s fake testimonials. Stay away from them please!

Keith Gill (u/DeepFuckingValue on r/WallStreetBets) opening statement at a Congressional hearing over the Gamestop trading controversy. I like this guy. He has nothing to do with the generalized pump&dump scenario we live in. He was invested 1.5 years before the Short Squeeze. Amazing speech!

Coming Soon

Resources (that I expect to be awesome) that I added to my read/watch/listen later for which I haven’t found time to consume them yet. I’ll probably expand them in the next MLJ episode

Ben Felix video about Chasing Top Fund Managers.

Tiago Forte first post (in 2014) about his 10 Days Vipassana Silent Meditation Retreat.

Naval Ravikant Podcast with Kapil Gupta.

Too Good To Go App. I just installed it, it seems promising!

More To That article “staircase to Self“.

Rational Reminder Podcast about Factor Investing in Fixed Income.

Making Sense with Sam Harris episode with Ricky Gervais.

Jacob Lund Fisker presentation “A Systems Approach To Resilient Lifestyle Design“.

The Knowledge Project (Farnam Street) episode with Seth Godin. I’m halfway thru it. The first half is amazing. Seth’s definition of sunk costs is the best one I’ve ever found (a bit rephrased by me, here’s the original): “a sunk cost is a gift from your former self (maybe it’s a law degree, maybe it’s a ticket to the movie, maybe it’s a deposit for some purchase you don’t care more about) that you don’t have to accept“.

Paul Graham‘s essay What I Worked On.

Have you Reddit?

The best of the month on (SFW) Reddit

r/financialindependence thread about a guy who reached -20k NW at age 42 after having been in a shithole for his entire life. He’s now doing his best and merging from the darkness. What an amazing story!

r/fire thread about a guy who thinks the dream of FIRE sucked his motivation to work. This is one of my potential future regrets of having become a FIRE popularizer… I’m not sure it’s good to expose 20yo kids to the dream of “Early Retirement”.

r/fatFIRE thread by the guy who retired in 2006 from Videogame development and Electronic Arts to farm Coffee in Hawaii (Kona Earth). He’s selling the farm and he can’t retire yet in his mid 50s so he’ll have to find a new job!

Some might think I made a huge mistake. I was close to permanent retirement but I blew it. Instead of retiring early I have spent my entire life working and now I need to keep working. “Fail!” they might say.

I look at it different. Which is better, enjoying life while you’re young or waiting until you’re old? I quit a job I hated and created one I enjoyed. Whenever I wanted to go surfing, sailing, play computer games, take a nap, or hang out with my family and friends, all I had to do was ask the boss. Since I am the boss I always said yes.

If I had stuck with it for a few more years, I might be very comfortably retired now. Or I might be a divorced alcoholic with no stories to tell.

A lot of Dark FIRE on Reddit lately…

r/leanfire thread about failures in downshifting your career. Very very interesting! Finally something “Survivorship Bias free”.

ITA – r/Italy thread about Ikigai and Anti-Ikigai. Interesting reply from this guy: Ikigai is not Happiness. Why? Well, Hedonistic Adaptation, the usual suspect…

r/WallStreetBets meme “to everyone that held”

Best meme ever!

Published on February 25th, during the $GME second wave:

FUN Stuff

Try not to laugh!

Lotto numbers? Horse racing? Sport betting? Meme Stocks?

All the same.

ITA – Cartoni Morti about Fake Gurus

Italian Youtuber mocking Contrepreneurs 🙂

Mike Winnet Contrepreneur Bingo with Jordan Belfort

First episode of Season 2, with the Wolf of Wall Street in person!

ITA – Two hours relaxing music with Matteo Salvini enumerating things

At the end of it I felt relaxed and outraged at the same time.

You’re welcome.

Leisure Corner

We need mental challenges, but we also need Leisure time

The Handmaid’s Tale

This is the series I and Mrs. RIP binge watched during February. Well, we’re not done with it, we’re still at 3×05 – no spoiler!

The series is set in a fictional universe, in a dystopian present time United States, where for some reasons fertility is low and bigots took over the government and founded a kind of religiously driven oligarchy regime where women have no rights and people are organized in caste…

the series is based on Margaret Atwood‘s homonymous book. Acting quality is amazing, and the plot is well written and directed.

It makes you think how fragile our democracies are, and how crazy it’s a world where someone has less rights than the others.

We give a lot of things for granted today. There are many Gilead (the new US government in the series) today in the world.

Times Infinity Size Comparison of the Universe, 2021

I’ve seen all previous editions of their “Size Comparison” series, and this time I was pissed off when I realized they cut off VY Canis Majoris, largest known star for several years in a row, recently dethroned.

Canis, I haven’t forgotten you <3

Standup Math about how pi^pi^pi^pi might be an integer

I love big numbers, and I love recreational math.

Matt Parker is the best in this field (sorry Arthur).

Enjoy!

NY Times documentary Ten Meter Tower

I’ve been there! I’ve trained for months to jump from 10m 🙂

It was August 2015, it took me three attempts. I chickened out twice before finally jumping from the 10m. It took me 3.5 minutes of fighting against my own fears on the platform before taking the leap on my third attempt. While I was standing on the platform paralyzed by the height, a crowd of kids jumped over and over, every time leaving disgusting stares at my shaking body.

A friend of mine took a video of that jump 🙂

Anyway, this short documentary revived that forgotten feeling in me.

I understand you guys, I know what it feels like!

Marbula One Season 2

We’re almost done with Season 2, and the Crazy Cat’s Eyes are dominating!

I’m an O’Rangers fan first, but I started supporting CCE as well during last Marble League.

ITA – Il Mulino di Chiaramonte

A Swiss couple decided to settle in Sicily after many years of sailing around the world.

Enjoy.

And dream 🙂

That’s all for this month 🙂

I like even more your blog since you posted the video of Salvini (big laugh)

LOL

Man, it takes a month to process all this great stuff!

Thanks for remembering me about the “multipotentiality” idea. I’ve always had it on my mind since starting university, and I can remember how much it resonated with me when I first heard Emilie’s TED talk.

I totally embrace this idea, and I was not thinking about it enough in this times of change and in my midlife crisis! But this F**king Sunk Cost Fallacy and not being fully financially independent kinda buried this idea deep deep down in me!

So I love the idea of “lifetimes”, I can see 5-to-10 years life cycles in my life up to now. In my case there’s overlap of interest in every “life” cycle. Like in one “lifetime” span of 7 years you achive mastery in a field but start to develop parallel interests, so in the next phase you don’t start from zero..

The problem, in our society, is that nearly everywhere you are forced on a path of hyperspecialization and if you “get otut of the train” do to something else for a few years, you’ll never be able to go back…

So the common fear is “what if I’m wrong and want to get back on that ‘train’, but now it’s too late??”

Anyway I know this is more mental than real, and I know so many people who decided to switch “lifepath” and all of them bless the day they decided to change…

Haha I know, it took a month for me to consume this stuff 🙂

I can feel your existential crisis bro, have a virtual beer with me!

And I like tour overlapping lifetimes: if one can use a “dying” life to help the next one growing up you can build on top your own experience and still not be afraid of changing completely.

The only way to escape the hyper-specialization trap is going the Renaissance Man way as indicated by JLF in ERE: https://www.investitwisely.com/becoming-a-renaissance-man-early-retirement-extreme/

Funnily enough, your last point is also addressed in this MLJ: take a look at the r/leanfire thread about “failures in downshifting your career”.