This is the second chapter in my financial story series. In the previous chapter I discussed the preteen era and first contact with money, here I’m going to show you how my finances evolved during the 5 years of High School. Next chapter will be about University years and the taste of actual jobs.

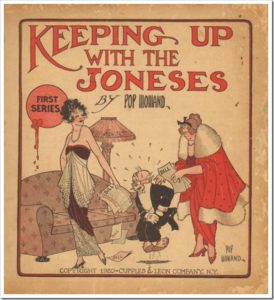

High school years are both  the worst and the best of your life. The best because you’re young and full of hope, the worst because you face the teenager years and the need of approval by the crowd. For a young frugal guy like me it meant balancing my instinct to save and the challenge of keeping up with the Joneses’ kids.

the worst and the best of your life. The best because you’re young and full of hope, the worst because you face the teenager years and the need of approval by the crowd. For a young frugal guy like me it meant balancing my instinct to save and the challenge of keeping up with the Joneses’ kids.

First of all, daily allowance didn’t make sense anymore (but I kept going to the arcade room, till its death in 1995… RIP baretto). My father announced the big revolutionary change: a monthly allowance of 100.000 Lira (50 Euro) for the first year of my high school (1991-1992). It’s a great improvement with respect the 1000 per day, plus I get to access the whole budget at the beginning of the month so… amazing! The problem is: I just underestimated how expenses grow A_LOT when you’re a teenager.

I would like to write a small disclaimer here: I don’t agree with giving children unearned money, even for kids. When I’ll be a parent I do my best to be sure that my kids earn their money. Via small chores, errands, whatever… I just don’t think free money are the right way to go. In early 90s, in Italy, it didn’t work that way, so every kid got free money.

Second, to attend high school you have to buy student books that are not super cheap. I don’t know how it works today, but at that time there were a huge underground market of used books for half price. As incentive to earn more money my father proposed the following deal: I’ll let you keep half of the money you make me save on face value of every book you need to buy. Wow! So here’s my first job: try to buy used books to earn extra money! If a book’s price is 100 and I manage to buy used for 50 then I make my father save 50 that means I can keep 25 for me! I took this challenge very seriously, actually pushing it to the limits! For a couple of books I bought used copies of out of print older versions! World History didn’t change since last year, so why should I accept the professor’s blackmail of printing newer versions to kill the used books black market? On one book I saved up to 80% of its tag price!

Third, I started accumulating money in physical form and it was not a very scalable solution. My father offered a better and more adult-like solution: he’d be my virtual bank. It looked fun so in 1991, November 24th we started this virtual saving account in the form of a notebook (that I still preserve):

This virtual account lasted till year 2000. I started draining it in 1996, when during University years I opened a true bank account and moved savings over there, but that’s another story.

The virtual account helped me a lot in getting confidence with digital money (even though there were nothing digital in it!). I measured the size of my Net Worth without having to keep physical money somewhere. It was nice to picture all the money I had at any given time all over my table. I learned how to decouple earning and spending. I already had a grip on it, but now it was crystal clear that money were like a bathtub with two taps: one (earning) there to regulate the input and one (spending) there to regulate the output. Opening the output tap (making a spending decision) can now be based on the available water in stock instead of the input flow.

I felt rich, with a lot of money saved! Financial life weren’t easy though. Discussing with other guys was hard. None seemed to have spare money. Everyone complaining about everything about the money subject. None seemed to understand the concept of saving some of the money you have in your pocket. “Why should you do this?” or “money are meant to be spent… do you want to bring them in the coffin with you at the end of your life??“. Their money model was not like mine, the bathtub, but a public fountain with no way to store the flow.

Anyway, as time passed in high school I didn’t quite understand what was going on around me. None had money, sometimes not even to buy an ice cream or to take a bus for a single ride. I felt like everyone was extremely poor, always… but with better clothes. On Mondays, every Monday, few had new shoes. High quality shoes. Those that cost three times the monthly allowance of mine! It simply didn’t make sense. The same guy, whoever he was, could be switching from “guys, no, I can’t go to the comics bookstore, I don’t have a dime” to “I need to buy a new pair of shoes, I was thinking Nike Air Jordan or, better, Reebok Pump?“. It didn’t make any sense at all. The question I never asked was: “wait, but how can you buy a 200.000 Lira pair of shoes if you don’t have the 500 Lira for a Nathan Never comic? And, btw, since both seem to be cool shoes, why not to pick the cheapest one? At the order of magnitude of their absolute prices the difference should be in the order of some 10.000 Lira, just cash that difference so that you won’t ruin our group plans to go to the comic bookstore for the next 20 times at least!”. Their fountain of money didn’t allow to stock, but their flows were way bigger than the one flowing out my small tap.

Another disclaimer: I’m using “he” to refer to third person singular not because I’m a sexist but because there were no shes at my school… Technical school with some computer science… zero girls for five years. Very very though days, bear with me.

It took me years to understand why people (not just teenager) think this way. At first I was disappointed. I felt rich no more. If I summed up the assets of anyone of them, just the visible assets like jeans, jacket, shoes,… they were richer than me. All of them. I couldn’t have afforded their shoes all at once. Or maybe I could, but then what about their Scott leather jacket? Am I doing something wrong? Aren’t my parents spoiling me hard enough? It was a problem. Age 15, I’m the only one not wearing a pair of shoes above 100.000 Lira and people are making fun of me. Girls don’t even think I’m worthy their spare gazes.

So there came my first impulsive splurge. Just to be accepted by the crowd. I wanted a pair of Reebok Pump! It was a lot of money. Although I could have afforded it with my savings, using most of them on a pair of shoes didn’t make sense to me so I went begging to my grandma and she bought it to me as a present. It caused fights within my family, since none had ever spent all these money on a f*cky pair of shoes that exist only to show off, to brag. Regret caught me three days after the purchase. All the happiness about the shoes disappeared, leaving my family with less money and few wounds. Avoid luxury, it’s worthless.

So there came my first impulsive splurge. Just to be accepted by the crowd. I wanted a pair of Reebok Pump! It was a lot of money. Although I could have afforded it with my savings, using most of them on a pair of shoes didn’t make sense to me so I went begging to my grandma and she bought it to me as a present. It caused fights within my family, since none had ever spent all these money on a f*cky pair of shoes that exist only to show off, to brag. Regret caught me three days after the purchase. All the happiness about the shoes disappeared, leaving my family with less money and few wounds. Avoid luxury, it’s worthless.

During my second year in high school (1992-1993) I found my first job! Private math lessons. Yes, forgot to say I was very good at it :). My first student was older than me but was repeating first year for the second time. It wasn’t awkward, I felt very confident and I think I did a good job. 10000 Lira per hour, for ~10 hours total. It felt good!

Then a new era of temptations came: the Scooter bikes / moped era of the 90s. Almost every 14-17yo kid owned one at that time. It was a 4.000.000 Lira Thing, i.e. 2k Euro of 25 years ago. Accounting for inflation it should be something like 10k of today’s Euro. Not something you get by adding up spare changes of your mother’s grocery list… It’s another incredible bad example of how to spoil kids with umbrella money. A lot of them. Joneses’s kids were getting harder to keep up with. Now that I write this post, 25 years later, and now that I know in what kind of economic hell most of the shortsighted neighboring families had fallen into in these recession years I wonder how useful that 10k Euro would be in their pocket right now. Was it worth those wheelies?

But I was a kid and a kid asks. Even though my net worth was growing, I was nowhere near to the amount needed to buy one. It was unfair. So I asked my parents to buy one but they rejected my requests. I felt poor this time, angry with my parents. I had to pretend something to not appear different. I told one of the classic stories poor kids used in defense to not own a moped: “My parents think it’s dangerous so they don’t want to buy one for me. But they are going to buy me a car as soon as I turn 18!“. It was a lie, it just bought me 3 more years. I knew purchases were on my own control. I knew my salary, I ran my forecast, I knew I won’t be able to buy my shiny new car (a 10.000.000 thing) in 3 years, even though my “salary” raised to 120k Lira.

The fact that none of my friends seemed to have a vague idea of the value of money made me sad and lonely. I was the one pushing to go having a pizza out together on Saturday night, a 15.000 Lira thing that I valued a lot at that time, but none had money for this. I had plenty. They’d rather spend the entire evening sitting on some bench talking about their mopeds, trying to gather 5000 Lira for the gasoline to use one of them. They had tons of money on demand but no control over them. I had a different relationship with money, but less of them in total. Now I know it was the right way to go, but back then? Nope, it was frustrating.

I was in charge of decisions such “which extra curricular sport/course do I want to follow?”. I had to pay for my Basketball course, Swimming course, karate course. Discussing with friends was awkward: “hey guys, why don’t we try Volleyball? It’s 30.000 per month, not so much, and it seems fun!”, “oh cool, nice idea. Let me discuss with my mom and I’ll let you know”. What the fock… do you really need to have an approval for such an expense?

Money kept growing till I become a multimillionaire! Yes, in Italian Lira though 😀 A million is just 500 Euro. Grandparents helped with that. My Grandpa used to give me 50.000(100.000 Lira) for every vote 9 (10) out of 10 at school. With Math & Physics it was an easy win. Sadly my grandpa died in late 1992, RiP dear grandpa. My grandma kept the habit till my master degree in 2003 and somehow till her death in 2013, even though I was already earning in a month more than her yearly pension. RiP beloved grandma. The bottom line here is that I loved those prizes more than unconditional salary that came from my parents. I was pushed to perform well at school and it definitely helped me a lot.

In 1994 (age 17) I did my second big splurge, but this time it wasn’t an impulsive purchase. I loved leather jackets, but branded versions were at around 700.000 Lira (350 Euro, more than 20 years ago… it was crazy!). I could have afforded, I had enough money saved but it seemed too much to me. I did some research, I went to second hand shops, local shops, several of them till I found the one I loved priced 240.000. I negotiated with the merchant and I brought it home for 200.000! It is a high quality copy of the famous-at-that-time Avirex. Yes, it still is, since I wear it every year since then. This time no regrets, no guilt. I’m still proud of my purchase.

I learned that if you let impulse go and you still really want to buy something then you should get it. Saving is not meant to make your life miserable. Sure, once you decide you want that item, it’s very wise to invest time to optimize your purchase and get a good deal.

As Trent Hamm suggests as rule of thumb (can’t find the actual quotes): for every $100 I spend on an item over the item’s lifetime, I try to devote an hour to researching the purchase before making a move. Your mileage may vary.

Next big economical experience was the windfall of turning 18yo. Before turning 18, my net worth looked like this (Y axis shows Euro, even though Euro was not yet a currency):

You can see a steady growth in the first months and a plateau due to increasing life costs of a soon to be 18yo.

You can see a steady growth in the first months and a plateau due to increasing life costs of a soon to be 18yo.

Then my Birthday came and my parents gifted me with 1.000.000 Lira while My grandma gave me a stellar 5.000.000 Lira to help me building my future. I suddenly had the money for my car. But I didn’t buy it. having close to 10 Millions in the bank made me feel extremely powerful and I moved on the moped thing so I didn’t need a shiny new car anymore. I could drive my mother’s old car, who cares?

At the time of my Diploma (end of high school) in July 1996, my net worth looked like this:

Note that the portion before the 6 million spike is the same as shown before… Ok, yes, I had a drop after the windfall, but my 18yo summer was legendary (and not super cheap). No regrets!

Bottom line here is: once you learn to model your money as a stockable commodity, once you learn to decouple earnings from spendings, once you resist the urge to lifestyle inflation then a windfall is what it really is: more ‘stash into your bank account. I never understood those question like “how would you spend a lottery prize of XYZ?“. Why spend it out?? Just store them (I didn’t know how to invest at that time).

In 1996, 19yo, I was ready to step into the adult life of a University student. Let’s go to the next chapter.