Table of Contents

Hi RIP readers,

As you probably know if you’ve read my last two posts (2020 Q4 Financial Update Part 2 and Part 2-BIS) I’m a bit concerned that the stock market is heavily overpriced, in a bubble. A bubble that in my opinion has a lot in common with the DotCom Bubble of 2000-2002. This is making me reluctant of investing in stocks again, in fact I sold most of them in July-August 2020.

I want to quantify my reluctance in this post.

Many readers suggested me to “just invest in stocks, this is for the long term!“, “stocks always go up!“, “don’t care about daily fluctuation, they’re just noise… in the long term stocks will return their promised 6-7-10% per year!“, “time in the market beats timing the market“, “YOLO!“.

I already addressed my fears in the previous two posts: fear that we might be at the bubble peak, and fear that it might take a loooong while to recover from a crash – and I’m not as young as you probably are.

“But look at Bob, who only invested at market peaks and still ended up being trillionaire!”

Congrats Bob, but today I want to introduce you Rolf, the Swiss investor who invested all of his grandma inheritance, 1 Million CHF, in an ETF tracking MSCI World Index on January 1st 2000.

Rolf wanted to invest in an All Country World index (ACWI, which is Developed + Emerging), but since I couldn’t find enough data on EM before 2007, we’ll make a World (Developed only) Index be enough for today study. Anyway, Emerging Markets never accounted more than 10% of the World Market Cap, so it’s not a big deal I guess.

Rolf was also incredibly lucky with his investment instrument: even though he started investing when discount brokers and cheap ETFs were not the norm, he found an ETF with 0.00% TER and a commission & custody free broker! It means that we’ll only focus on the index total return.

Rolf “bought and forgot”, sure that in 20+ years his fortune would have at least quadrupled (at 7% per year) according to common investing knowledge.

How much do you think Rolf’s investments returned per year, in CHF, after taxes on dividends and inflation? Is Rolf sitting on 4M CHF (inflation adjusted) as promised? More? Less?

Make your guess 🙂

Before we math the shit out, two things:

First, I didn’t run this experiment backward, to try to prove something. I didn’t cherrypick the dates. I was genuinely curious to discover “when”, not “if”, the initial investment was recovered in real terms, considering returns, dividends, taxes, CHF vs USD exchange rate.

Second, I don’t think we’re in a December 1999 scenario today. We’re definitely in a tech bubble, but there are markets which are probably not in a bubble as well. We’re probably in a less worse overall situation, but there’s a pandemic running, market valuations are dangerously getting close to DotCom Bubble era, and T.I.N.A., meaning that as soon as an alternative pops up all the other asset classes could clash… what I want to say is that nothing prevents the future 20 years to unroll in a similar (or worse) way compared to 2000-2020.

Ok, let’s get started!

MSCI World Returns

First of all, let’s gather MSCI World returns since Y2K. Official docs list data starting from year 2005, I had to dig a bit deeper to find data back to last Millennium.

In the end, I decided to rely on Wikipedia:

Awesome! Mind that those are total returns, i.e. they include dividends being reinvested in the same Index, which is exactly how Rolf’s 0.00% TER Accumulating ETF works.

Income Tax Bracket

Rolf knows that even if the ETF is accumulating and reinvesting profits, he has to pay taxes on dividends anyway.

Rolf has a solid upper middle class salary in Zurich, say 120k CHF/Year, and his marginal tax bracket is more or less 25%. I’m talking about “marginal” tax bracket, not average. My marginal tax bracket during Hooli years was easily in the 30-35% range.

At 120k CHF per year Rolf would hit the 8.80% Federal marginal tax bracket (7% if married and his spouse earned ZERO), 10% Cantonal Tax (8% if married), and 11.9% City Tax (9.52%) (source). It’s exactly 30%, but let’s assume Rolf has enough deductions to bring the marginal tax rate down to 25%.

MSCI World Dividend Yields

Finding the exact MSCI World dividend yields for the last 20 years resulted harder than I though.

I used for my calculation Vanguard VT dividend yields (source) which are available back to 2009. I know VT tracks MSCI ACWI and not MSCI WORLD, but I assume the impact of the EM (less than 10%) on the dividend yields is negligible.

Since my sources lack dividends data from 2000 to 2008 I also assumed that during the missing years the yield has been equal to the geometric average of the yield for the years we have data about, which is 2.37%.

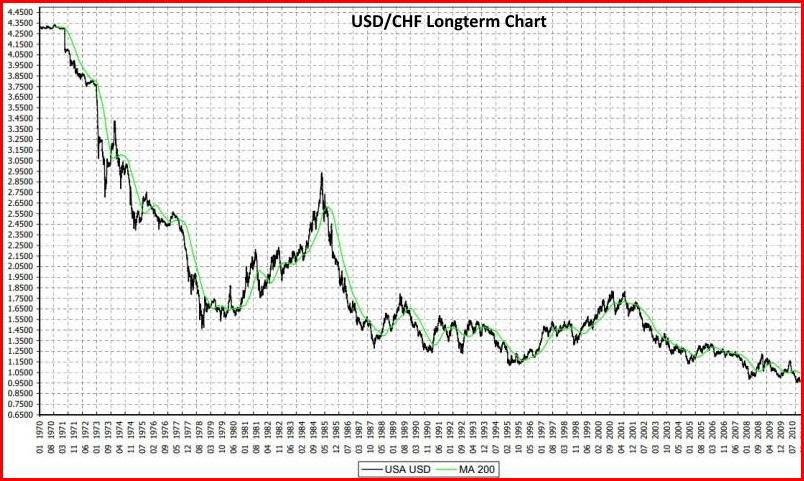

USD vs CHF

Investment performances are expressed in USD, and Rolf doesn’t give a Rösti about the American Dollar. He only cares about returns in his beloved currency: the Swiss Franc!

I’ve took historical forex data from macrotrends website (source)

Inflation Rate In Switzerland

Rolf would love to see his purchasing power grow, not just the nominal value of his investments.

Luckily, in Switzerland inflation has been low for at least a decade.

Let’s take a look at the official CPI inflation data (source), and take that into account for our simulation:

After having complained for a while that his health insurance premiums (along with child care costs, rent prices, transportation tickets, swimming pools tickets, beers, restaurants, grocery stores…) have probably “forgot” to adhere to the “negative official inflation” of the 2010s, Rolf finally accepts the data.

Ok, time to put all together!

December 31st 2020

It’s 21th anniversary of grandma departure, she was one of the few casualties of the Millennium Bug, and Rolf wanted to celebrate the event by logging into his brokerage account!

Drum Roll(f)…

Yes, he made it! Rolf is way richer than he was 21 years before! A staggering 40.95% richer in real terms, in CHF!

Which is an astonishing 1.65% annualized return over 21 years.

Here is the full spreadsheet:

“Well, RIP, it doesn’t seem like a huge win…”

Well, imagine when the tax office will discover that Rolf forgot to pay the Wealth Tax for 20 years…

“What?”

Nothing, nothing 🙂

Anyway, yes, this sucks.

Take a look at the 16 years drawdown, which has been in the below -25% territory for 10 years.

Please take also a look at the cumulative returns at the end of 2018: 4.78% over 20 years, or 0.25% per year. Try to apply the 4% rule!

But there’s more…

March 23rd 2020

Let’s say that Rolf logged into his account at the end of year 2008, 8 full years into his investing adventure. Cumulative real returns so far in CHF: -55.03%, “Holy Fondue! My wealth has been halved (and then some) in 8 years…” But he’s stubborn, he knows that “time in the market beats timing the market” so he HODLs.

He logged in 4 years later, in 2012, and “Crapclette! Why the hell I’m still at -38.40% after 12 years! I heard there’s a bull market going on…”

He then decided to stop logging in for the next 7 years, to preserve his mental sanity. It’s not easy to keep the focus on the long term after a more-than-a-decade long heavy loss.

It’s finally January 2020, and Rolf hasn’t logged into his brokerage account since 2012. It’s his Grandma’s 20th death anniversary, he’s a bit temped. Rolf listens to the news every day, and he knows we’re living thru one of the longest and strongest bull market of the entire history!

“Will I have 5 or 6 millions in stocks? 🙂 ” Rolf asks himself.

Then the Covid happens. At first it seems not to have any impact on the stock market. Then in late February 2020 Rolf heard that the stock market crashed.

“I should not sell! And I must have many millions by now… time in the market beats timing the market ah ah ah!” He laughed while sipping his Glühwein cup.

Then in mid March he got a call from his dad:

“Rolf, the market is crashing! Did you sell Mama’s stocks?”

“No daddy, I’m HODLing… and don’t worry, a correction is normal after a long bull market. I’ve enjoyed a decade of amazing returns, I can take a small loss!”

“So you have more money than Mama gave to you, right?”

“Well, sure… I hadn’t checked recently, but I invested in a perfectly diversified ETF, with zero TER, zero Tracking Error, zero brokerage fees. Trust me, it’s the perfect fund!”

“Sell it now! The world is doomed, we’re all going to die in this pandemic!!”

“But dad, time in the market beats…”

“…Beats my Chocolate Balls! Haven’t you seen the news about tanks carrying corpses in Bergamo?? Sell all the stocks!”

Rolf hands are shaking… he decided not to check his brokerage account yet.

“Time in the market beats…”

“OOps… Maybe daddy was right…”

“Oh shit, let me take a look at my millions, this 32% YTD market drop must have hurt… say I had 6 Millions, now I’m only left with 4”

On March 23rd, more than 20 years after he started investing, Rolf logged in (spreadsheet):

His total portfolio return in CHF, inflation adjusted, over 20+ years is negative 9%, it’s worth less than it was worth on January 1st 2000!

How would you feel if you were Rolf?

Time in the market beats… what? 20 fucking years have passed, and Rolf’s portfolio performed an annualized real return in CHF of -0.47%. Even though he invested in the perfect ETF, with no extra costs (also evading wealth tax for 20 years). Imagine the real return if he decided to use a 1% roboadvisor, or – worse – an active portfolio manager!

I don’t want to be Rolf!

Conclusions

What do I want to say? What did I want to demonstrate?

Nothing in particular.

I just wanted to double check that I’m not crazy when I feel the discomfort in reading comments like: “you shouldn’t care about daily fluctuations, just invest for the long term!“, “just buy an index fund, in the long term it doesn’t matter if we’re at market peak“, “simplify, simplify…“, “be like Bob“, “time in the market beats…”

…Beats the nails in my coffin!

If I lump sum into VT, and the future two or three decades happen to be similar to the last two (mind that we had two amazing decades in terms of productivity, we’re not talking about middle age here), I’ll be dead before I see any return.

The problem is that the Value and the Price of the market can diverge for a very long period of time.

The following picture is an oversimplification but it’s useful to make a point:

While we all believe that the Value of the overall human endeavors will keep going up (blue line), the Price tag we see at any point in time might be out of sync with the underlying value. And maybe after this cycle of exuberance, a depression will follow. Prices will be lower than intrinsic value, keeping your assets flat or at loss for a very long time. Maybe longer than you can stay liquid (or even “solid”, as a breathing human being).

“Does it mean you don’t believe in FIRE anymore? Does it mean you’re not investing anymore, and stashing CHF Bills under your mattress? What’s your address btw?”

I still believe in FIRE, to some extent.

And I will slowly converge to my investing strategy, which is designed to make me invest less in stocks when the red line is above the blue line, and more when the opposite is true.

I’ve finally put some numbers behind my “gut feeling”, and as usual I’ve added more questions than answers to my book of wisdom.

Keep the critical thinking flag flying high!

That’s all for today.

Hello RIP,

Let me tell you what I see in your posts, which I love reading (did not miss any since I discovered your blog :))

(1) You tried stock-picking (temptation is strong I know), but you know that you should edge single stock risk through diversification.

(2) You tried growth investing, but your brain tells you that value is the way to go.

(3) You tried FIRE, but your spreadsheets tell you that you are far from the amounts you would need to maintain your standard of living, and I guess that you want to add value to society with your high performing brain. I think you should read more about the economy of happiness, very interesting field of study that looks at how to maximize the happiness you get from every dollar you spend.

(4) You flag over and over the high taxation of dividends in CH, but invest in funds that deliver dividends.

(5) You know that timing the market does not work. But you try ever and ever to time it.

I fully agree with previous comments from fellow readers about you making too many decisions. And most of all falling into post rationalization. You should have a clear plan, and stick to it. Where is your plan described ? 🙂

My guess that your brain is too powerful for you, so you find problems to solve to keep it busy. And the problems that keep it busy the longest are contradictions, such as the ones I flagged above. Because life is not black and white, and finding a balance between 2 contradictory approaches is an infinite problem – nobody can predict the future exactly. Again, am I completely wrong in thinking so?

What does Boggle tell us that could maybe help? It’s not a religion so we can always challenge his thoughts, yet the past indicates that he was not completely wrong about many things.

hedge your bets: => invest about 40-45% of your assets in bonds or cash (as I think you are in this edge bracket). Invest the rest with the 3 funds portfolio approach

pay attention to value, more than growth. Price is what you pay, value is what you get. There are nice value ETFs out there.

avoid high dividends. They lead to taxes, and they decrease the value of the stock by the amount of the dividend.

Don’t try to time the market, it does not work. Invest regularly.

And behave ethically, which means trying to build a world that is better through hard work (read “Enough” from Boggle for example)

What do you think? Is this absolutely crazy to think these pieces of advice from the regretted J Boggle make some sense?

Good analysis, that can be summarized with “you refuse to unplug your brain”.

I can’t agree more 😉

it’s not pleasant, it’s actually a proven thing that for example religious people live happier lives. I would also sponsor a study about the correlation between happiness in kids and belief in Santa Claus.

But I’m “built” to mine the foundations of everything.

I guess the world needs people who question more. We’re the “market maker” who keep the idea market efficient.

If I recall correctly, you invested during the COVID crisis (after previously getting lucky with market timing), and not at the peak of the bubble like Rolf. Then you got scared, greedy, anxious, whatever and sold everything. End result is that you are holding on to whole bunch of USD and bonds. Did you simulate what would have happened to Rolf if he had kept his Granma’s money in cash? Main thing that your simulation proves is that there is no 100% sure thing in life. I would hope that this is clear to any investor. If you want to be safe then you have to diversify (at the risk of lower returns) because future does not give benefit of hindsight. I am not sure selling all your stocks into cash was exactly diversifying.

You are spreading your anxieties in the wider world. I don’t think it is a good thing. If you were a Jedi, you would be primed for turning to the dark side.

1) If Rolf had kept his grandma money in US mixed bonds he’d done much better.

2) I’m not saying my current portfolio is the answer, it sucks and I plan to make changes as explained in 2020 Q4 Update Part 2

3) I’m not in the business of telling people what they want to hear

¯\_(ツ)_/¯

Dear RIP,

First and foremost, let me say that I love reading your posts and your sense of humour is fabulous.

At the moment they are a bit gloomy but who said we should only hear uplifting stuff!? Exactly as we do with investments, we need diversification in the range of opinions we get into our brain. If then we got confused or even depressed that’s our problem, let’s not blame the author.

I tilt right now to your share your opinion that it is probably one of the worst moments to invest right now in the last x years. Yes, in the long run the market will go up, but also in the long term we will all need no money anymore. Btw RIP, we have the same age.

In my humble opinion market investors are trapped in a catch-22 situation. If you invest you are paying for assets the highest price ever. If you don’t, inflation will nicely erode your wealth, so in the medium term (5-10 years) is not looking good. However, and this is my main point, the world is wide and diverse. What I mean by this? On the one side, that you are completely focused on the stock market. What about property? In the UK there are completely hands-off opportunities yielding 6%. Note that this is just an example, among others, I don’t mean you should shift 1M from bonds to property. On the other hand, you are also completely focused into retiring in CH, or perhaps Italy. We both know the pros and cons of both countries, but thankfully there are many other places where 1.5M would be more than what you would ever need, even if you become 100+ years old. A subset of them wouldn’t even tax you on foreign income and provide a safe and enriching environment for your family.

Hope this helps in some way!

Thank you for your comment!

I’m reading all of them, I have hard time replying to everyone.

This is to let you know that I read your comment 🙂

I loved your comment 🙂

Properties might be a solution in the mid-long term. Right now I don’t have the time and energy to understand that market (and the energy to eventually follow the investment, it’s not very “passive”)

Hello,

Interesting post!

However it seems that Mr. Rolf investment has been jeopardized mainly by USD/CHF exchange (dropped approx 50% in that time laps) and then lacking of regular contribution in the ETF (also considering that it had no costs). Did you try to make the calculations considering exchange coverage and more balanced timing entrance in the ETF?

Exchange Rate should be taken into account, because it was not just a couple of unlucky decades, this is a longer trend:

About the balanced timing… well, of course DCA of the entire amount over the 20 years would have performed better, but am I really considering deploying 1M in 8k/month chunks?

Since the DotCom bubble effectively started on October 2000, a DCA over the entire 2020 wouldn’t have helped much.

Dear RIP

Another very interesting post and a so nicely written. I loved Rolf’s surprise about the low Swiss inflation, which I share:) The post is a very important reminder that risks/costs are not only about stock prices but also about FX, inflation and tax. So despite TINA, we need to remain aware that these risks are real and that we actually CAN lose money, even in the longer term. That’s part of the game and we should not forget about it.

For us here in Switzerland it is particularly crazy to think that the USD was at 1.6 CHF in 2000. And given that this trend started already much earlier, I could well imagine it to persist in the decades to come. Would a conclusion be to increase our home bias? Investing in local ETFs has not been extremely rewarding recently but on the positive side, bubble risks might be lower and the SMI is still below the all-time highs. If moving abroad one day remains an option, returns could be pretty decent if the CHF keeps appreciating against practically all other currencies:)

Lastly, this value and price chart really looks a bit scary. But does it imply that stock markets have been overvalued pretty much all the time during the past 30 years, except for a short period during the global financial crisis? That seems surprising.

… and I saved Rolf ETF tracking error, TER, and trade fees 🙂

Increasing home bias could be a solution, indeed.

Another solution, in my opinion, is to overweight Value Stocks. Value stocks are trading at lower multiples (by definition) and if inflation rises they would take off. But it’s just my opinion, because Value factor doesn’t look to be in a bubble. On the downside, higher dividends equal higher taxes…

Hey RIP,

good Post and Good to read your thoughts. It goes to show that investing is tough – especially mentally. One needs a well thought through plan and then one needs to stick to it. Define abort criteria before executing your strategy.

I heavily agree with you: broad indexing is probably not going to work after the bubble pops. Until then it’s fine. After the pop the overvalued stocks will have a long time to come back. If ever (look at Japan).

My solution is to identify cyclical pockets of the market that are at or near the valuation low. I will give my strategy several years to pan out and will keep rotating profits into other out of favour sectors with low valuations. And sometimes it is also prudent to not do anything. Cash has a lot of optionality value (I know that because I never have enough). Also I am not afraid of direct stock investments. I almost always buy a sector though and build my own diversified „ETF“. I think this is important, as many sectors have many shit-cos that you may or may not want to have in your portfolio (depending on your strategy).

I suggest to look in the commodity space: precious metals had a big retracement (miners are producing Cashflow like never before and nobody cares. Some of them you can grab at a 10% FCF yield), energy cos looks cheap with good FCF and dividend yields, also tobacco stocks is something I am looking at right now.

Opportunities are out there and the downside is so much smaller than with the S&P and broader indices (just look at the % of miners and energy cos of the broad indices, also in historic context – you will quickly see the low risk high reward potential).

Cheers

Finanzr

Hi.

1 point i wanted to highlight here is that as you have been investing on stocks and ETF for a long time, your assumption (ie previous post too) that at any given time you should consider if you would invest 100% of your money on large and diversified ETFs today if you had the money in your bank is not relevant. As your past investments have already returned high interests then in a long term vision these past retuned should indeed be considered. Otherwise you would fall in the day traders category and I guess this would turn in a full time job.

Yes, we know another crash will come but you are in a great position as you already benefited from 10 years of markets growth. I would suggest instead to consider that any investment in ETF is invested “forever” and you will not touch your investment, or only once a year you will withdraw 4% of your investments and the interests you have cumulated.

If you want to play it safe then delay your FIRE by 1 year and still keep your job as an insurance during 2021. If no crash happened this year then you will have accumulated 26++ years of annual expenses and will certainly feel much more confident to make the jump.

Also as i understand your above study is after inflation. Shouldnt it be before inflation as the 4% rule is taking into account a 7% average return. Ie 4% for you and 3% to cover for inflation which is more than generous currently.

Hi Mr RIP, this post shows that FIRE is not easy in Switzerland and the reason is mostly CHF. Inflation in Switzerland measured in USD is crazy high. This may justify buying in Switzerland regardless how expensive it looks but I don’t know if I’m convinced yet.

Regarding valuations I would take CAPA with a grain of salt. Did you read this article from Robert Shiller about current valuations?https://www.advisorperspectives.com/commentaries/2020/12/01/making-sense-of-sky-high-stock-prices

Low interest rates must be discounted when comparing valuations.

https://thepoorswiss.com/updated-trinity-study/

https://github.com/thepoorswiss/swr-calculator/tree/master/stock-data has USDCHF and CH inflation data.

Please add bonds to your asset allocation and see if you still reach the same conclusion as before. I totally agree with your reader’s comment – “My guess that your brain is too powerful for you, so you find problems to solve to keep it busy”

https://backtest.curvo.eu/

Somebody did the work for portfolio in Euro.

heya,

excellent post and thank u very much for the work mr. rip! 🙂

as some people pointed out in the commets, the bad performance is realted to chf/usd exchange rate. i re-used mr. rip’s spreadsheet to perform the same exercise with euro.

results:

total performance (with 25% dividend tax): 61.23%

annualized performance (with 25% dividend tax): 2.3%

total performance (with 0% dividend tax): 82.67%

annualized performance (with 0% dividend tax): 2.91%

please have a look whether i made any mistakes! 🙂

pay attention, i am using eur.usd instead of usd.eur, hence i changed the formular in column j.

Update to previous comment:

i could not post a comment with the url as it was detected as spam. so currently testing how to bypass the filter 🙂

here is the aforementioned google spreadsheet “MSCI World Total Real Return in EUR 1999-2020”: docs.google.com/spreadsheets/d1LE7MbFYbBZ66i37Me8kddFvjI0vDFipGw22meqHWipc

Molto difficile per un risparmiatore (anche analitico ed evoluto) azzeccare il timing. Per una bolla che individui ti perdi un mercato toro (e disinvestendo a luglio/agosto sai di che parlo).

Devi studiare una strategia di portafoglio secondo me.

Se effettivamente ci fosse una situazione alla 2000 comunque l’investitore con un PAC (o in generale in value averaging) non si pentirebbe…

Altre ANALISI:

– Possibilità che non si verifichi (o che si verifichi tra 5 anni, che per chi scommette sull’evento è quasi la stessa cosa): tendenzialmente le banche centrali di tutto il mondo hanno la mezza idea di smaltire l’eccessivo peso del debito pubblico con una ritrovata inflazione. Se questo accadesse potrebbe esserci prima GAIN sul mercato e poi PAIN. In realtà parzialmente questo accadde anche nel 2000 (ricordiamo l’inizio della giapponesizzazione economica in Japan e l’introduzione dell’euro che semplicemente ‘scaricò’ una botta secca di inflazione a due cifre in quasi tutta Europa, almeno sulla base del costo reale della vita e non dei panieri ISTAT).

– Ipotesi di rimanere dentro gestendo i ribassi di mercato. I treasury americani (e tanto debito in dollari) negli ultimi 6 mesi, hanno perso in valuta ma hanno recuperato in redditività. Un esempio: un Treasury Bond trentennale (2050) al 2% si scambia oggi a 103,91, un titolo di stato del Belgio al 2050 a 1,7% sta invece a 135. Tendenzialmente durante i forti crolli il Treasury è stato rifugio a livello internazionale (banalmente ad agosto il Treasury Bond che oggi quota meno di 104 stava sopra 120!!). Quindi anziché uscire e aspettare il momento ‘perfetto’ d’entrata, sperando di azzeccare il mercato futuro, una strategia può essere diversificare, ora che si è in gain in settori anti-ciclici svalutati, che poi se avviene questo crollo che è uno scenario concreto, data la prezzatura dei mercati azionari, si possono “convertire” in azionario mediando prezzi che nel frattempo si saranno svalutati (parliamo di svalutazione e non di ‘perdita definitiva’ quando parliamo di indici… la storia racconta che bisogna solo aspettare, e se costi, tasse etc… non erodono l’investimento, il corso dei valori è ciclico).

Hello Ripers : )

honestly I don’t see anything wrong with this post.

To my understanding, the message here is, do your math and deep thinking, as just by investing in ETFs, diversifying, etc, doesn’t necessarily means you’ll make money after 20 years. That showed with a real life example, including sources of data used.

Correct me, but in the current times your approach would be similar to Nassim Taleb risk driven theories, but investing in currencies instead of bonds. Personally I don’t prefer investing large % in currencies, a I don’t see any issue with paying taxes from dividends or returns, even in cases of high yield stocks/ETF like REIT.

One point I disagree, is the comparison of current market conditions and dotcom bubble. The difference is that now the whole world is very much dependent from technology, all over the places… So the numbers in proportion could look similar, but the reality of how technology is used in the real life is massively disproportional from dotcom bubble. Including the new wave of EV & co, there’s a fundamental societies shift behind those numbers.

A similar factor I see with dotcom bubble, are the low interest rates and the massive injections of capital in the market, but the economies contracted a lot during COVID, so the money injection will be used (oh my… so optimistic) to recover economies, rather just go in the stock markets like in the dotcom b.

Nothing wrong with thinking and rethinking, analyzing, go deep and re balance strategies, it is exactly what most successfully companies do in their life cycle. So why that shouldn’t work for people, only thing, make sure to relax the mind sometimes : )

Thanks,

Daemontool

haha ‘Ripers’ is not bad. Maybe ‘Ripsters’ would be even more flattering for this community;)

If Rip likes it, glad to be a Ripster then : )

update to update 🙂

typo in the url; the correct link to the spreadsheet “MSCI World Total Real Return in EUR 1999-2020”: docs.google.com/spreadsheets/d/1LE7MbFYbBZ66i37Me8kddFvjI0vDFipGw22meqHWipc

This might be an unpopular opinion, and a badly explained one as I suck at talking about finances. It works in my head, it doesn’t work with my mouth!

In case of a bubble burst (an actual bubble like the DotCom or the 2008 housing bublble, not a “normal” panic market crash such as the 2020 one) that will lead to multiple years of negative results, I think there are only two scenarios that will save you from waiting a decade and half to recover.

Scenario 1: you keep adding money to your investment

Best option: Keep buying as usual. You’ll come out of this stronger: you’re buying at a discount price. It might suck for the first couple years, but eventually it will pay off. A lot.

Scenario 1: you have invested a lot of money and want to “forget about it”, without adding more money (Ralf scenario)

Best opion: wait a few months to see if the market recovers, sell if it doesn’t. You probably will have less money compared to when you had started, but almost certainly more money than if you kept it there for many more years. It is now time to re-evaluate your strategy. Maybe invest in bonds, or in other lower risk options: even a 1% savings account (being very conservative, as for nearly the entire time of reference of this scenario, savings accounts had way higher interest rates) would be better than 5 years of losses.

Why? Because this has nothing to do with timing the market. A bubble exploding is not a regular market crash. Recovering from a real bubble will take years, we all know that We are not trying to guess up and downs every 2 months out of thin air, we are reacting to a very real event with a predictable outcome.

What can we learn from this? To not put all your eggs in one basket. We know this already from diversifying our assets, but it has to be done with your net worth in general. Just like our dear Mr Rip has a lot of liquidity, so should everyone. Don’t throw 1m in the market if all you have is 1m and some pocket change: it will fuck you up if things go bad. While if you’re more conservative (maybe you had 300k in bonds, or in savings accounts, or whatever), you’ll be able to capitalize on the “discounted” prices and come out stronger.

Hey there, thank you for your comment.

While we can all agree to not put all our eggs in one basket, wouldn’t be MSCI World ETF diversifying enough?

Well that is still all in one asset type. What about bonds, cash, gold, real estate, commodities? Do you have zero in those and everything in the stocks basket?

Yep, under that point of view it totally makes sense.

I guess we might consider investing in ETFs only, as diversifying within a non-fully-diversified strategy.

Thanks for the analysis.

Could you do the same analysis with bonds? I think the returns won’t be higher due to the USD/CHF exchange rate and more taxes due to higher dividends.

If you really want to continue to „math yourself out“, I’d recommend (as maybe someone else already commented) to start Rolf off with a more conservative portfolio, eg holding some 20+x % in cash (and just maybe some bonds, in case of no bonds increase cash to reflect your risk appetite). Then have Rolf rebalance the portfolio – not on a monthly basis, but maybe once a year, keeping cash % constant. Do not assume additional savings (thatd be against the FIRE assumption). I don’t know the result (yet), but this question is driving me since a couple of months.

I think you just need a good plan you can stick to. I think your previous plan of selling and waiting for a correction, a.k.a. timing the market, could be right. Afterall, nobody can deny the market is ridiculously hight. However, it’s very difficult to be out of the market watching everybody make money – just ask Newton: https://www.sovereignman.com/finance/how-isaac-newton-went-flat-broke-chasing-a-stock-bubble-13268/

The getting back in is also a problem. I know someone who sold everything in Jan after he heard about covid. The problem is that even if he got out early, he’s still down. The question is whether the market will have a second dip (and if he can then buy that dip after failing to buy the first dip) and if not, when to get in if the market keeps extending gains.

I don’t particularly like these high prices but can’t really think of a good alternative strategy. I can easily see large falls from here, but I could equally see further parabolic upward moves.

I read the numbers you put… ok, it is an exercise. Let’s try to deduce something more, just for fun.

Rolf didn’t want to follow the basics rules…and that was the result. Why 100% in equity, when with more than 80% it is demonstrated that you just increase volatility without getting a real result in terms of returns? Hence it was better 80% Equity and 20% Aggregate or Global Governments Bonds. Said that, was Rolf really “ready” to deal with 80/20? Wasn’t it better, a 60/40 or a 50/50? I wonder whether for Rolf also a 20/80 could be fine… The reality seems to be that Rolf was greedy because of the general euphoria before the DotCom Bubble. One-million all-in in a moment of euphoria…I think none of the readers of this blog would behave like that. Obviously, this is my point of view.

Everyone is talking about this crash since several years…one day it will happen, so someone can say: I told you!

Anyway, if you have 1M invested in whatever or cash, I don’t get what’s the problem to put 100k in stocks, that in 2020 could give you 100% profit and save you some years of FIRE

Hi RIP,

Thanks for another interesting post! I wanted to write response below previous posts, but you’re producing them too fast these days 🙂

First, I’m also not happy with the current high valuations and would love to buy more stocks cheap, but..

“We’re definitely in a tech bubble”. I’m not so sure about that. In early 2000s the bonds would yield over 6% -> (almost;) risk free money. And still the bubble got formed. (You’ve linked in one of the previous posts to the ECY indicator described by Ben where it was nicely described.) Compared to the current bond Yields stock market doesn’t seem so bad with the current Dividend yield (and many ppl look for that).

Average CAPE is a moving target and it changes over time. Another Ben: https://awealthofcommonsense.com/wp-content/uploads/2021/01/Screenshot-2021-01-25-100013.jpg From 2000 Avg CAPE is >26. Will it ever go back to Mean 17? Doesn’t seem so. If we assume that 26 is the new norm, than the perspective is a bit different.

Similar to (2). We live now in totally different world than 1900s, 1940s or 1980s. Should we even look at data we have from that time? Surely history likes to repeat itself, but I don’t think its certain. (I’ve read too much Taleb recently..)

On the other side:

4. I believe in one CSI video you linked the bubbles (tech?) were explained as a result of unknown expectations. To me that’s exactly the moment we’re right now. What would happen after COVID is gone? The spectrum is huge -> from ppl won’t fly again to everyone will spend as crazy. There is lot of unknowns, therefore stocks fly, since nobody knows.

btw the poor swiss did a similar study. he basically re-did the trinity study for swiss investors: https://thepoorswiss.com/4-percent-rule-swiss-stocks/

Interesting article, quick calculation suggests that the real return after inflation for a US $ investor would have been a little under 3% annualised, acceptable. The Swiss result is an issue of the currency…

I have been investing since 1990 and went in FIRE in late 2007 ( 90%+ equity allocation throughout)

I have worked on the basis of a real 3% to 5% annualised return over time, with inflation around 3% in the UK. My results have been around 8% real over that period, a lot of volatility, uncomfortable ‘retiring’ in late 2007 and down around around 40% in 2009…

14 years later and the capital has doubled in real terms….this is my experience. Can I suggest, avoid MARKET TIMING, I have always stayed in the market, don’t buy individual shares. I have mostly used ETFs in recent years but the MSCI World is a great idea when the US market is doing great, if not then lower the allocation to the US and increase the allocation to the ‘hated’ regions. Don’t trade too much.

period

With all the due respect to your sharp intelligence and great financial knowledge, this looks pretty much like a cherry-picking exercise to support you personal fears.

You happened to pick a 20 years period that:

– ranks 24th out of 32 for compound annual growth, amongst the 20 years rolling windows, from 1989 to 2020 (MSCI World, same data from Wikipedia).

– that saw one of the biggest USD/CHF declines from 1.6 to 0.88, so more than 50%. CHF was at 1.6 only for around 2 years and 0.88 is the fourth top trough, in the last 30 years.

Also, I’m not sure why you’re adjusting for inflation, given that you’re comparing a VT portfolio to less risky investments. Bonds or cash would need the same adjustment.

This could be the story of Mr. Rofl, who took that plane which crashed 20 years ago, so please, don’t just tell me “it’s safe! planes never crash!”.

“Rolf knows that even if the ETF is accumulating and reinvesting profits, he has to pay taxes on dividends anyway.”

Wait… what!?! By ‘he has to pay’ you mean the taxes would be deducted by his ETF provider right? I am an EU investor, investing in EU domiciled ETF, let’s say the ETF is domiciled in Ireland. When the dividents are payed, they are being taxed in Ireland (favourably) and the tax deducted there. There is nothing further, I should be paying as divident tax, right? Only corporate tax once and if a profit is realizied.

Hi RIP !

this post open my mind a lot and highlighted clearly the risks related to equity investing even if you consider broad based indexes. The problem indeed is that we do not know what the long term is.

Nevertheless , solution to mitigate the risks are already there:

1) Diversify across asset classes : including bonds (hedged in your currency ) and cash. 50-50 portfolio protected also during 1929 great depression.

2) Rebalance : this is a powerful tool that can smooth the ride, the more you do the better.

3) Diverify across time : dollar cost averaging forever….

Back test this strategy to Japan and you will feel more confident.

Wonderful blog , keep going .

Complimenti!