Hi Swiss RIP friends,

You know how ETFs and taxes work together in Switzerland, don’t you? If you don’t, I’ve touched the topic in my ETF 101 post, more than a year and half ago. Go read it. See you later bye bye.

The central point is that Switzerland doesn’t tax capital gain, while profits are taxed as income. Accumulating ETFs look like a way to cheat on the system: profits are reinvested and your shares’ value increases. Profits disguised as capital gain.

Not good, said the Tax Authority.

So they built a (sorry, nerd talking ahead) lookup table for accumulating ETFs, where “virtual dividends” are listed for each recognized ETF. That table is named “Course listings” (Kursliste in German) and every year a new version is published on the ICTax website (Income and Capital Tax) managed by the Federal Tax Administration (FTA or ESTV in German), usually referred to as “The Swiss Tax Authority” on this blog.

So, dear Swiss index investor, the rules of thumb are simple:

- If you hold shares of an accumulating ETF which is listed on ICTax: you need to report how many shares you owned at the time of each “virtual dividend” distribution when filing your taxes, pay your taxes on the dividends and you’re cool.

- If you hold shares of a distributing ETF which is listed on ICTax: you just report dividends as income, pay your taxes and you’re ok. It’s the easiest scenario.

- If you hold shares of a distributing ETF which is NOT listed on ICTax: that should be similar to the previous case, except that the Swiss Tax Authority doesn’t know how to handle your ETF. Maybe your ETF doesn’t have distributing rights for Switzerland. Or maybe your distributing ETF is tracking a growth index thus yielding very little and maybe (in lucky years) growing a lot. I’m looking at you, 2017 small caps US. in this case the Swiss Tax Authority may decide to tax your capital gain, who knows. In general, not having a security listed on ICTax represents a huge risk: it means you don’t know if the security ever received a “good to go for Switzerland” green flag.

- If you hold shares of an accumulating ETF which is NOT listed on ICTax: that’s the worse situation. The Swiss Tax Authority hasn’t modeled the virtual dividend, so all your capital gain is taxed as profit (income). Well, maybe this is good during bear markets.

So far, among friends and Hooli financial savvy colleagues, we tried to avoid touching ETFs not listed on ICTax. Avoiding both accumulating (of course) and distributing.

Anyway, several US domiciled ETFs listed on my Portfolios spreadsheet are not available on ICTax, and more are coming (like VYM, Vanguard US High Dividend Yield stocks, US domiciled, distributing).

That’s a pity. Why can’t we invest in those ETFs with some peace of mind?

I’ve started investing in VOO, Vanguard S&P500, distributing, US Domiciled, which is available on ICTax. But I also want to invest on VYM and VIOO, and replace currently owned non-US domiciled alternatives like VHYD and CSUSS.

So I took initiative, and contacted the Swiss Tax Authority (DVS division) via mail at dvs (at) estv.admin.ch. Here’s what I’ve written to them:

It was a shot in the dark, I didn’t expect to receive a reply less than a hour later!

Then they attached a screenshot:

So now the fund is visible on ICTax!

Morale: if you’re not sure if your desired ETF is accessible from Switzerland, or how it is taxed by the Tax Authority… just ask them, they are friendlier than you’d expect 🙂

Have a nice investing day!

Dear Mr. RIP,

This is great stuff as always! Regarding the taxes of the rule No. 1, what would you advice for an investor who is a resident in the country for less than 5 years? I’ve been working in Switzerland for less than two years and started investing via IB in March 2018. All my ETF are accumulating and recognized by ICTax. How should I approach the tax thing regarding the dividends as I have never done any taxes here (done by employer, can see tax breakdown on payslip every month).

Thanks a lot

Hi Matt, first of all: are going to file taxes on your own or get helped by a tax advisor? I still don’t dare doing taxes on my own. I assume you’re going to some fee based tax advisor.

You should not care about taxes if you earn less than a threshold (canton-dependent) and you have nothing else to declare. I think with dividends you need to file your taxes, else you’re evading taxes. Double check with a financial advisor if you need to file taxes or not in your specific case though.

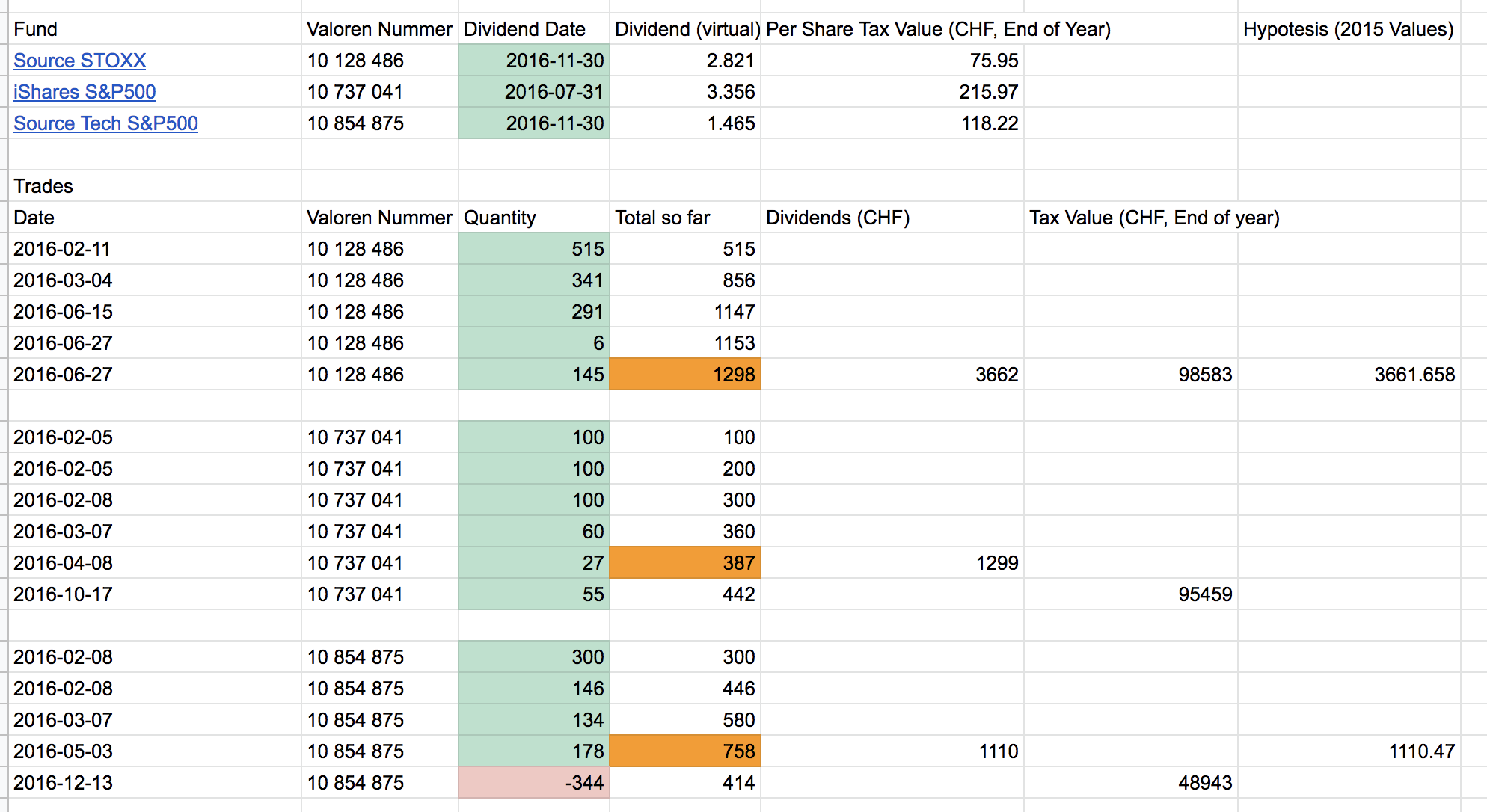

I usually prepare a spreadsheet with the number of stocks I held at any dividend date for each ETF, then calculate the amount of total virtual dividend. Here’s a screenshot:

Hey RIP,

let me ask you this: why do you prefer VIOO for small cap in the US, instead of VB or IJR?

VIOO seems to be slightly more expensive and only 1B $ of AUM instead of 20 and 40B $ for the other two

That’s a very good point, I didn’t even know the existence of VB.

Here’s a good thread about the small cap funds on MMM forum: https://forum.mrmoneymustache.com/investor-alley/what's-a-good-vanguard-small-cap-fund/

Apparently the differences between VB and VIOO is that VIOO tracks an index (S&P Small-Cap 600) while VB tracks more stuff, with some mid cap and more than 1500 companies. Small differences, even in TER (0.05 vs 0.15).

Anyway, THANK YOU for the hint, I’m going to add both funds in my ETF analysis coming later this month 🙂

Hi Mr. RIP

Thanks for the valuable information.

Could you also do a tutorial how to fill a DA-1 form?

Thanks in advance

I’ve never done it so far, and I think my first DA-1 will happen in 2020 tax declaration – in 2018 I essentially didn’t hold any US domiciled fund, except 5k of VOO who issued 28$ dividends (3$ withheld).

But I have plenty of colleagues who file DA-1 since years, I might seek out for a guest post on this topic!

Taking notes, will follow up 🙂

Thanks Mr. RIP, good stuff as always.

I have a question, not sure I understood correctly the point on the virtual dividends distribution for accumulating ETFs: are you saying that now Swiss Tax Authorities will tax anyway also those “virtual dividends”, which I read as “there is no more difference between acc vs dist, because dividends will be taxed in both cases”?

Sorry, still n00b here 🙂

Thanks a lot!

If you own Accumulating and non-US domiciled ETFs which hold US assets, like a S&P500 Ireland domiciled fund (CSSPX for example), you lose the 15% withheld by US, AND pay income taxes on the virtual dividends to Swiss tax authority.

Yes, there’s no difference between distributing and accumulating ETFs.

But, if you own a US domiciled fund which holds US assets, you can reclaim the 15% withheld by IRC thanks to the tax treaty between US and Switzerland.

But estate tax?

Estate tax has been analyzed in a different post (actually more than one).

Try ETF 101

Thank you for your content RIP!

Can I ask your advise on something? I have about 100K CHF in a Swiss bank from my time working there. I would like to gradually deploy this money into ETFs… I would like to pick 3 trackers for now: MSCI World, Europe and Emerging markets. I also would like to keep this money in CHF for now, if possible, but I am struggling to find those ETFs denominated in CHF with my broker (Degiro). I am wondering how you do it? Do you convert CHF into Euro or USD before you purchase those ETFs domiciled in Ireland or Luxembourg? Or is something available in Switzerland? A quick word of advise would be greatly appreciated.

Thank you

Daniele

Why do you want to keep money in CHF?

if you have 100k I’d strongly recommend you to open an Interactive Brokers account. Forex is essentially free and trading ETFs is very cheap.

Anyway, if you really want to stick with CHF denominated ETFs, did you take a look at justETF? usually you’ll find ETFs traded in CHF on Swiss Stock Exchange. Prepare to pay extra trade fees, stamp duties, higher buy/sell spread and generally lower performances for no actual reason.

Thank you RIP! I guess I would like to keep them in CHF for diversification so I do not have all my eggs in my “Euro” basket. I am already investing a lot of my new income in Euro denominated ETFs.

I did take a look at justETF and also a the ICTax Website you talk about in your article. I came up with these 3 funds:

iShares MSCI World CHF Hedged UCITS ETF (Acc), ISIN: IE00B8BVCK12

iShares MSCI EMU CHF Hedged UCITS ETF (Acc): ISIN: IE00BWK1SP74

Vanguard FTSE Emerging Markets UCITS ETF (CHF) ISIN: IE00B3VVMM84

Again, your thoughts would massively appreciated.

Many thanks!

Mind that there are 2 logical fallacies in your answer. First, you’re buying CHF HEDGED funds, which I can find 100 reasons why currency edged funds are sub-optimal.

Second, it doesn’t matter in which currency the funds are traded. You’re putting your eggs into the “underlying assets” basket, not the currency one

Hello, I have read your comments in some other posts on why the currency hedged funds are problematic, but I’m not convinced. Do you have any particular references (studies) to check?

The US are basically accusing the swiss central bank of currency manipulation https://www.cnbc.com/2020/12/17/swiss-central-bank-chief-rejects-currency-manipulator-label-from-us.html and in the past 15 years the central bank had to remove the peg on the euro a couple of times.

If most (99%) of my expenses are in CHF (e.g. mortgage) and I put my money in USD in some world wide ETF, I don’t see how this is not a major risk.

Say that CHF gains 20% on the USD, I don’t see how the market compensates for that because some companies become more competitive (e.g. those that sell in switzerland). The swiss market is too small to compensate for that.

I just read “The Long and the Short of It” by John Kay, which I found very interesting, and he says: “You may have a choice of leaving the currency of your ETF unhedged or hedging these funds into your own or another currency. For a long-run investor I don’t think the choice matters much.”

Hi MrRIP,

I just moved to Switzerland from the U.S. and I have about 25k in ITOT (ISIN US4642871507). I noticed it’s not listed on the ICTax website. When I was living in the US, my employer only allowed us to have an account with Fidelity so I bought ITOT because it was a commissions free ETF. I’ve since transferred that position to an IB account but now I’m worried about it not being listed on ICTax. I’d rather not close the position and purchase a different ETF because I’ll have to pay capital gains in the U.S.

If I wanted to try my luck like you did with having an ETF listed on ICTax, would you recommend just filling out this link on the estv.admin site?

https://www.estv.admin.ch/estv/en/home/die-estv/kontaktformulare/kontakt-dbst.html

Thanks!

Hi David, I’d send an email directly to them: dvs (at) estv.admin.ch

Good luck and please let me know if it works so I can update the ETF List: https://retireinprogress.com/etf-list-2019-part-1-usa/

Thanks, it worked! ITOT is now listed on ICTax: https://www.ictax.admin.ch/extern/en.html#/security/US4642871507/20181231

aaaaand I added the link to the ETF list 🙂

thanks for the interesting article! I’m not sure how to read the infos on the ICTax site, e.g. https://www.ictax.admin.ch/extern/en.html#/security/IE00B8BVCK12/20201231

“Gross return with VSt. into CHF” has 0

“Gross return minus VSt. into CHF” has 0.742

this is an accumulating ETF based in IE, so I imagine this is just untaxed capital gain … correct?

I was also reading

https://www.estv.admin.ch/dam/estv/it/dokumente/bundessteuer/kreisschreiben/2004/1-024-VS-2017.pdf.download.pdf/1-024-VS-2017-i.pdf and (sorry for the italian): “Per gli investimenti collettivi di capitale che replicano sinteticamente la propria esposizione è obbligatorio allestire un reporting fiscale separato ai fini dell’imposta svizzera sul reddito dal quale si evinca il rendimento del(i) valore(i) di base. Determinante per accertare il reddito imponibile degli ETF swap-based con sottostanti indici azionari è il rendimento netto del dividendo (net dividend yield).”

so it looks like they are making a difference between synthetic and physical replication?