Hi RIP readers,

I’m trying to simplify my investments.

I want to get rid of some of the irrelevant ETFs I purchased in the past years, especially in the bonds area, and I want to focus on few core ETFs (global bonds, global stocks). Plus maybe some small bets to add a personal touch to the strategy. Some small cap, value, dividend… I like the idea of factor investing. Anyway, my strategy is still a bit fuzzy, I’m not focusing on that at the moment and it’s not the topic of this post.

Under the umbrella of “simplifying my portfolio”, a month ago I entered a couple of GTC (Good-Til-Canceled) Limit Sell Orders on Interactive Brokers for the ETFs I wanted to get rid of, with limit prices I was happy with.

I know that “I will sell when the price reaches X” is not a good strategy, don’t yell at me.

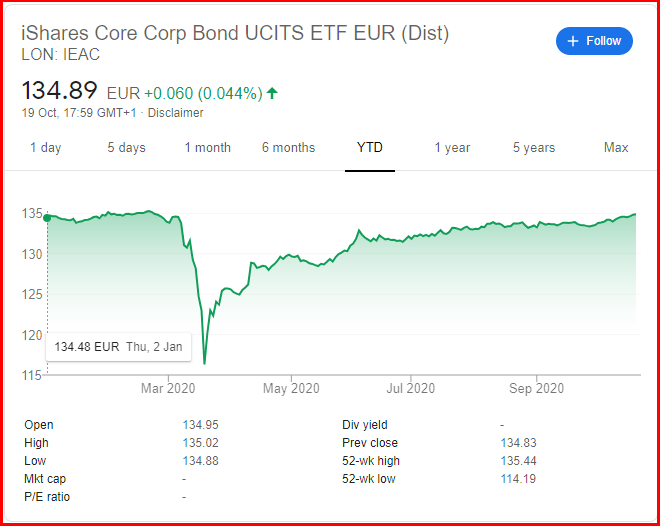

For example, I own(ed) 338 shares of IEAC, iShares European Corporate Bonds ETF. I purchased them between July and October 2019, at an average price of 134.79 EUR/share, or 134.95 EUR/share including trade fees. IB shows you the “Average Price” that includes fees. Profits & Losses also take fees into account.

During the 12-15 months I held these shares I received 2 dividends distributions of slightly less than 200 EUR each (a 0.85% dividend yield, before taxes), and I sold all my shares at an average price of 134.925/share (before fees).

Not the best investment ever, I agree, but I sold the shares at a slightly better price than I purchased them, and got a 0.85% yield in the meantime… welcome to bonds in 2020, babe! Thanks BCE/FED for your heavy market manipulation.

“Yeah, but why did you buy these shitty bonds?”

I purchased bonds in the first place to edge against potential stocks collapse, but it didn’t work during March 2020 market crash:

Max IEAC drawdown has been 15% in March 2020, in your face stocks!

But I’m not here to talk about bonds or my bad investments today.

I want to talk specifically about trading small, EU domiciled funds.

Back to my GTC limit order: a month ago I entered a SELL order of all my IEAC shares at limit price 135 EUR. I wanted to get rid of my bonds as soon as their price reached this funny round number, which was slightly above their purchase price.

Realizing that this piece of shit that brings 50% of the pain when things go bad and a mere 0.85% yield minus taxes when things go well was enough to declare the experiment dead, and get rid of corporate debt in a time where central banks lend money to everyone at negative interest rate.

I entered my Limit order in mid September and forgot about it for a while.

Yesterday, October 19th 2020, 3.30pm, I heard the classical “ding!” of the IB App on my phone. Took a quick look and saw “SOLD XYZ shares of IEAC at 135 EUR“.

“Wow cool! Finally! I forgot I had this pending order 🙂 ”

A positive feeling, and then I moved back to weird prime numbers visualization work.

Didn’t investigate trade details. I assumed I sold all my shares.

Almost two hours after, I heard again the “ding!”. What’s happening? Another bond ETF reached target price? Nope: “SOLD 2 shares of IEAC at 135 EUR“… WTF? Just two shares?

I opened the app and went to “Order and Trades” menu. I saw two trades of two shares each at 135 EUR/share. Each order had a 1.43 EUR fee attached!

“What the fuck… who are those two noob market-order addicted so-called investors, that are destroying my and their wealth with crazy high fees??”

Each of the two 270 EUR sales costed me 1.43 EUR. It’s a 0.53% trade fee. Are we crazy?

Mind that I don’t blame IB for this. These costs are the standard if you trade EU funds, specially small quantities. IB adds almost nothing on top of that.

I had to do something.

I took a look at my pending order, and confirmed that it only executed the sale of 4 shares out of 338.

I had to stop the bleeding. I wanted to sell my remaining shares all at once, not feeding this crowd of inefficient individual investors and their 300 EUR market orders. Btw, market price was 134.95 at the time of the second trade, but given that each of the 4 stocks I sold costed me 0.715 EUR in trade fees I’d rather sell everything all at once at a lower price than get killed by thousand cuts.

I didn’t know how to best execute this strategy though.

I’m getting used to trade mostly US ETFs. Very large US bond ETFs have no spread. If BND market price is $87.99, I know for sure that a $87.98 SELL order will get executed immediately in full, and the same applies for a BUY order of $88.00.

I took a look at the BID/ASK spread for IEAC and it was horrible: ASK price 135.02, BID price 134.89. It means (warning: I’m simplifying here) that the lowest pending SELL order in the stock exchange is 135.02 EUR, while the highest pending BUY order is 134.89 EUR. That’s why my 135.00 SELL order got executed: I was the seller with the cheapest price and someone decided to bridge the gap, or entered a Market order. The market price was of course somewhere in between (134.95).

If I wanted to sell all my shares I had to go down to 134.89, unacceptable. Also being the cheapest seller was not fun: every time an asshole showed up with their pocket money to buy a single share at market price I’d be presented a high fee. It’s like an eye gaze challenge between the two parts.

One solution would have been to learn how to enforce a “minimum quantity order“, but I never installed the full Trader Work Station (the standalone uber-powerful IB desktop client) and I do almost all of my trades directly on the IB App on my phone. I don’t think I even used the Web Trader (IB web app) in 2020. The Android App is powerful enough and it satisfies 99% of my needs. Except the minimum quantity order.

Given that this is not a common issue, I don’t plan to install the TWS after this minor incident.

I decided to do small jumps toward the BID price.

I dropped the sell limit price of my pending order down to 134.95, and a trade with 50 shares executed. Trade fee: 3.75 EUR, 0.056% of the traded amount. 10 times lower than the previous sale. 0.075 EUR/share. Good.

I wanted to close the match, so I dropped the sell limit order down to 134.92 and it got executed on all my remaining 284 shares. Trade fee: 20.95 EUR (0.055%).

Position closed. Bye bye European corporate bonds!

In the end, excluding fees, I made a small profit out of my shares. Taking fees into account, I experienced a loss. Not totally true: I earned 390 EUR (before tax) dividends.

Luckily, IB adds a close-to-zero overhead on top of stock exchange and governments/regulations. But “unluckily”, the baseline fees for EU funds are high, and that’s due to bad EU trading environment compared to US for example. Mostly due to stamp duties on EU stock exchanges.

I’ve spent 27.56 EUR in trading fees to sell my 338 IEAC shares, 0.06% of 45.7k EUR traded. And I’ve spent 25.06 EUR in trading fees to buy the same shares a year ago.

Not extremely bad, but let’s not forget that to trade US domiciled assets I usually pay 10 times less. To liquidate $417k of VT shares I paid 22.54 USD in trade fees (link):

So US domiciled ETFs are good, EU domiciled funds are bad in terms of trade fees.

What about size?

IEAC has 13 Billions EUR Assets Under Management (AUM). Standard Vanguard / iShares US domiciled funds have at least 10x larger AUM. For example, BND has $290 Billions AUM.

Trading larger funds means there are probably more BUY/SELL pending orders, a market BID/ASK spread closer to zero, and larger volumes being traded. Which translates in more predictability for your orders execution.

If we extend the discussion to stocks ETFs, especially ETFs that own stocks all around the world (including US), the EU funds pale in comparison for another two reasons: unrecoverable withholding tax, and potential small overlap between trading hours of your fund vs trading hours of the underlying assets (which is arbitrage and high frequency trading jungle).

Not huge problems if you don’t trade frequently – like you should be already doing 🙂

Have a nice day!

P.S. take a look at my ETF 101 post for more info about ETFs 🙂

Interesting content, as usual, thanks.

Since we are discussing fees and brokers, have you noticed the new Postfinance fee system? It used to have no custody fee and only a deposit fee…

But now it has a 0.15% custody fee starting in January 2022 (so next year is free, at least for existing customers).

I consider it’s small enough to still be interesting, but that’s because I’m comparing it to Swissquote… I know you were angry about PF after some admin issues. Did you move to another bank? What did you do with your 3A? I saw you sold all of your Pension75, but I imagine you don’t plan to have it sit in a PF 3A account, or do you?

I know you like IB, and I’m considering it for Vanguard and co, since Swissquote is overly expensive. But I’ll wait for your final word regarding the recent move of IB Swiss customers out of England… ;P

By chance, did you maybe once do a couple spreadsheets about your costs at IB, your (projected) costs at PF, Swissquote, ZKB, and all, to compare them? If so, that’d be a great post, IMO.

Hi Lery, thanks for stopping by 🙂

No, I didn’t notice the new PF system because I never considered PF to be a place where to invest my money outside of our checking accounts.

I still have my Pillar 3A with PF – and my wife both a Pillar 3A and a Vested Benefits Account.

It’s just never “high priority” enough to move the money out, but I guess I should raise it given the not-small-anymore size.

I wanted to move the money to VIAC, but I’ve seen that we have an even better alternative now: FinPension. They also offer Vested Benefits Account (ValuePension).

I plan to move my money there before the end of the year.

About IB and other brokers, I don’t plan to do a comparison post because I like to talk about what I know and use, and I don’t have accounts at SwissQuote, ZKB, PF (E-Trading) and so on. I know these kind of posts are the most useful in terms of revenues for those affiliate-polluted blogs, usually named “The Best Online Brokers in Switzerland” or “Top 5 Brokers in Switzerland, the definitive secret guide that no one will want to you read” and so on. I’m pretty sure you’ll find them if you search on the internet. Mind that the brokers are usually ranked top to bottom not by quality but by affiliate commissions.

About IB and Brexit, I’m not doing anything. Despite the negative answer I got from them when I called them, someone else got a reassuring one.

I think I won’t investigate more unless I receive an official communication from them. We might remain attached to IBUK 🙂

Or maybe it’s based on investor status with them, and I might be classified as experienced investor and not moved to EU, I don’t know.

Hi Lery,

where did you read about new Postfinance fees? I could not find any information that the e-trading fees will change.

Thank you for you help!

Sure it’s here: https://www.postfinance.ch/en/private/products/investing/investing-independently/fund-self-service.html#2e8d77

I received a letter from PF telling me that they were renaming the product I had into “Self-Service” and were introducing this new custody fee. But thankfully, still no redemption commission.

Thank you Lery!

That is only for the investment funds and not for stocks and etf, The e-trading prices are still the same, though for how long one does not know.

Not sure whether the phone app supports fill or kill orders, but that could help. Otherwise, yes, you could use TWS and use the more advanced options to execute this and avoid small trades.

I had the same issue where I bought 1 share of AVGO… luckily the rest filled a few days later – however, the cost was pretty small for US stocks so it didn’t matter anyway.

I spent an hour or two researching how to input “fill or kill” but I failed. The only option would be using TWS but I don’t want to invest time to learn a new huge&messy UI just for this use case – which should not be impactful in my situation.

I wanted to warn young investors who invest monthly small amounts that fund size and domicile have a non-negligible impact in their wealth creation.

“…who are those two noob market-order addicted so-called investors, that are destroying my and their wealth with crazy high fees??”. Hi MrRIP, one possible answer is: not a noob, but somebody who pays 0 Euro (yeah, zero) in fees. In this way one investor who wants to increase a position of, let’s say, 6kE, can buy 300E/day for 20 days. And this is not so absurd: let’s say you are a passive investor with 300kE portfolio, all in Developed World Equity and Aggregate Bonds ETFs, and you decide to introduce Emerging Markets Equity ETF, for a maximum of 2% (that is 6kE). Emerging Markets Equity ETF presents a high volatility therefore is not so strange to decrease the risk in a period of high volatility. Zero fees? Perfect: the investor starts to invest small orders every day, or every two days, etc., so as to reach 6kE in 20 days or 40 days. This is fasible in my experience (and something that I do, by the way, but here I took it to extremes). Other answers to your question? I don’t know. Hope this can help. Bye. SirRik

Good point SirRik 🙂

These “zero fees” marketing promotions are unhealthy in my opinion, they’re a Free Market distortion.

Hi RIP thanks for another great post! I got interested in what you said about the EU domiciled ETFs.

“the EU funds pale in comparison for another two reasons: unrecoverable withholding tax”. Most EU ETFs are based in either Ireland or Luxembourg for the reason of favorable taxation. Here is a quote about this:

“Irish ETFs can benefit from the US/Ireland double tax treaty which reduces standard withholding tax rates from 30% to zero on US-source interest and 15% on US-source dividends.”

Source:

https://www2.deloitte.com/ie/en/pages/financial-services/articles/taxation-of-irish-etfs.html

That’s good news, but in my personal experience with CSSPX (S&P500) I measured down to the basis points that their total return was exactly 15% of the average Dividend Yield of ~2% less compared to IVV (same underlying assets, same fund manager, same strategy), after TER. It was a full 0.30% lost. I attributed that to unrecoverable withholding tax.

Maybe things are changing…