Table of Contents

Hi RIP readers,

Welcome to 2021 Q1 Personal, Professional, and Financial update for RIP family.

This update is a special one: I’ve conducted the financial part Live on my YouTube Channel (in English Language) on March 31st!

It’s 2h40 long, more or less the time it takes to read a post on my blog anyway 😀

I will not repeat myself in full in this Financial Update. I will link the video (hopefully the right timestamp), and add screenshot and extra considerations when necessary.

Do not mind, we’ll end up above 5k words anyway 😉

Conducting a EOQ Live has been a pleasant experience, and I will continue doing it on a monthly basis. I think I’ll run my Live Financial Update in Italian Language one month for each quarter (maybe the second month of each quarter, i.e. end of February, May, August, November), while keeping the other two in English.

“Yeah, cool, your Ego is satisfied… but how did the quarter go?”

It’s been a great quarter! From almost any point of view 🙂 A lot of exploration, exploitation, going public with my blog, launching a YouTube Channel, earning some money thanks to this “side hustle” of mine, and taking some steps in the low frequencies of my FIRE Spectrum.

And a +100k quarter, financial-wise. Definitely not bad 😀

Let’s get started.

Enjoy!

Financial Update

Here’s “RIP Net Worth” Spreadsheet.

… and starting from this quarter I now share my entire detailed 2021 Expenses Spreadsheet (more on this later)!

More about how I track my finances using spreadsheets here.

Net Worth

Total Net Worth on March 31th, 2021: 1.338M EUR (or 1.481M CHF, or 1.569M USD).

Net Worth Change (Q1 2021): +62k EUR (or +104k CHF, or +20k USD).

This is pretty good! I especially love the +104k increase in CHF.

I used to look at our NW in EUR first, but I’m starting to move toward CHF. We might want to stay in Switzerland for a long time, which means our focus should shift toward CHF currency.

I will definitely remove the total NW in USD next year, it’s completely irrelevant.

Of course most of our quarterly “success” is due to a strong USD, that went up 6% compared to CHF. We’re too much currency fluctuations dependent.

If you want a detailed explanation of the entries in my Net Worth, I’ve conducted a survey in the Live video liked above, starting at Timestamp 15:10 (also answering a lot of questions about it).

NBW Totals and quarterly analysis (and celebration!) begin at timestamp 1:12:27.

Cash Flow – Income

Total estimated Net Income (after Taxes and Pillar 1 contribution) for 2021 Q1 is: 55.1k CHF.

Compared to previous quarter we’re down by 2.5k. Mostly due to less dividends being distributed by my investments, and the end of unemployment support for Mrs RIP.

Monthly income is more stable compared Hooli. No bonuses, no 13th month, no stocks… kinda boring. Compared to those December and January spikes of the “good old days”, a normal salary doesn’t provide that adrenaline/dopamine boost.

Luckily there’s a new player in town: my Blog!

The blog is earning us some nice side income. Actually, my “entrepreneurship” activities, not just the blog. An income that’s above the average salary in a good fraction of the planet. I guess it could grow more than this, in the end I just started monetizing my blog 🙂

Take a look at the Monetization and Transparency pages for more info about my ethical and practical guidelines on money.

I think it’s interesting to break blog income down.

Total (gross) Blog income for 2021 Q1: 4980 CHF (minus 480 CHF expenses):

- Affiliate Marketing (IB, Amazon): 1800 USD + 32 EUR = 1697 CHF

- Services: 1918 EUR + 888 CHF + 144 USD (yeah, it’s a mess) = 3140 CHF

- Donations: 50 CHF + 133 EUR = 197 CHF

Not bad, in line with the 10k revenue goal for year 2021. Actually on its way to 20k CHF revenues!

Time to go to the SVA and give this thing a legal structure 🙂

Another nice “bonus” came from my March salary: I got reimbursed UVG and KTG insurances, as a happy ending for the story I documented here.

Good.

Income, Expenses, Savings and Saving Rate are addressed at timestamp 1:16:50.

You can see a full income history and income source breakdown in the Income sheet of my Net Worth Spreadsheet.

Income history:

Income sources breakdown (Net, in CHF):

Let’s take a look at where it hurts.

Expenses.

Cash Flow – Expenses

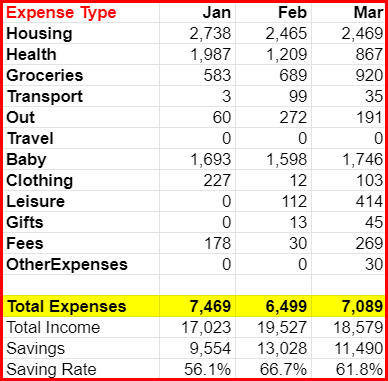

Total Expenses in 2021 Q1: 21.1k CHF (7.5k in January, 6.5k in February, 7.1k in March).

Like in the previous quarter, we’re spending exactly 7k CHF per month. But this is not going to last. The world is reopening, and spring/summer flights and hotels need to be booked! I expect a bloodbath in Q2. First 20 days of April: 8.3k CHF…

It would be a miracle to end the year below 90k CHF expenses (7×12 = 84k baseline, 6k extras).

Here‘s a link to our expenses sheet.

And here follows a visual comparison of the three months that compose Q1, compared with the average monthly expenses in 2020 (green bars):

Not-so-fun fact: travel expenses 0 CHF, for the first quarter in… in my entire history I guess 🙁

Sadly, more than compensated with baby and health expenses. Aging sucks.

I won’t do expenses deep dive this time, take a look at the video at timestamp 1:38:57.

“Hey RIP, I heard you shared your private detailed expenses spreadsheet during the live… can we take a look?”

Yes, and this is the “big news” for this update!

I’m sharing (a copy of) my private 2021 expenses spreadsheet today!

There’s nothing left unshared in my financial life now. It’s a bit scary, but I think there’s a lot of value for the audience. Btw, I’ve explained how I track expenses in my private spreadsheets here, in my spreadsheet post series.

I’m now deprecating the expenses sheet in my Net Worth spreadsheet (which was just a copy of my private expenses summary plus graphs sheets), leaving it there because I added more graphs and analytics tools there. Will be moved over to the new public expenses spreadsheet soon (according to some definition of “soon”).

How do I track individual expenses?

Well, I explained it in the video at timestamp 1:44:34.

TL;DR: I assign every single expense a primary and a secondary category, and use spreadsheet magic to sum things up and produce the summary sheet.

Take a look, I think it’s interesting.

Cash Flow – Savings

Total Savings in 2021 Q1: 34.1k CHF (between 9.5k and 13k each month)

Saving Rate in Q1: 61.8% (between 56.1% and 66.7% each month).

Good!

The problem is that the savings are driven by a high salary that might go away soon should I decide to quit my real job. And at the same time expenses are expected to go up.

I’m rich (am I?) but I can’t relax yet.

Anyway, savings for the quarter are 34k CHF while NW grew by 104k CHF. How come?

Easy, thanks to Mr. Market.

Actually, thanks to Mr. USD. Finally.

“Do not worry, I’ll take everything back in April 😉 ”

Ouch, thanks Mr. USD 🙁

Mr. Market

Our NW Growth in CHF has been “meh” in January, “awesome!” in February, and “OhMyGod!!!” in March.

As we can see the market didn’t do well in January, but it went up a lot (some ETFs are up 10+%) in February and March.

At the same time, the USD finally recovered some terrain compared to both CHF and EUR, especially vs the CHF. 6% in a quarter.

That translates into a very good quarter for our finances.

“Hey RIP, but you were completely uninvested in stocks at the beginning of the quarter, how did you profit from a good market? Also, tell us about your bonds 😀 ”

Well, this is not the best environment for bonds, but things are getting better. Interest rates are slowly climbing up in US, and after Bond ETFs bottomed in mid March they’re going up.

Luckily I sold all my BND shares (global US bond market) in January, at price $87.55, at a small loss more or less compensated by the dividends I earned during my holding period. BND bottomed on March 18th, price down to $84.36. It touched $90 per share in summer 2020. Not a great performance for a “fixed income” asset class.

My BSV shares went down a bit, but they also distributed regular dividends, not a huge deal. I’m getting rid of them anyway, I’m slowly selling at least 50k of bonds each month, according to my plan.

Anyway, let’s take a look at my investments!

Investments

As you can see I’m slowly (and uncomfortably) investing my money back into stocks. More or less 300k diverted from bonds and invested into stocks during Q1.

I’ve drawn a plan in Part 2 of last quarter update, and I’m religiously following it… of course not! I’ve changed it and simplified it. I got rid of the “short term fund”, and I’ve also reviewed the asset allocation among stocks, tilting my portfolio toward Value & Dividends, even though I know it’s an inefficient strategy in Switzerland.

I’ve talked about why I purchased KO (Coca Cola) in my first covered calls post – more posts on the topic will come, promised!

“RIP, why VT? Didn’t you sell all your shares at $80 months ago?”

Yeah… I accepted the sunk cost, and decided to get back in April.

My spreadsheet screenshot has been taken in mid April, at the time of writing this post, and the VT entry was already there (but you don’t see the April column in the screenshot).

Fun fact: I wanted to buy VT at 99.99 for fun, but sadly IB found a better match for my order and I got it at 99.89. Don’t you dare again!

Anyway, the new target AA is expressed in the “Long Short and Fun” sheet.

Here’s a screenshot:

So:

- 100k target cash (I have too much cash now).

- 35k target Fun Money (not used so far).

- The remainder gets split between Stocks and Bonds according to a formula based on CAPE. Current ACWI CAPE is 25.3 (source) so ~62% should be invested in stocks (need to invest 450k more in stocks) and ~38% should be invested in bonds (need to uninvest 320k)

- Within stocks I’m also tilting my investments toward Value (VTV), High Dividends (VYM, VYMI, KO), and Small Cap (VSS and soon VBR).

Slowly converging there, I will align Ideal and current AA by the end of 2021.

I’ve shown and explained my AA sheet at timestamp 31:37.

Current NW by asset class split:

Part of the “blue Stock zone” is in our Tax Deferred Accounts, i.e. Finpension Pillar 3As and VIAC Vested Benefits Account.

My Finpension accounts (same for my wife account) are doing good, benefitting from no dividend withholding taxes, no wealth taxes, and a good quarter in the market: +11% since December 2020.

“RIP, what about Options?”

Yeah, I’m writing options like crazy… I don’t know how to account for them. They have negative value of course (I sell insurance, I own liabilities) but they’re not in my spreadsheet.

The solution I’ve found with Covered Calls is to put a ceiling on stock price on the spreadsheets:

As you can see my KO entry (just the price entry, not the asset entry) is capped at current covered call strike price (53.50). so if my calls are ITM I don’t see my shares being worth more than the strike price (I will talk about Rolling an option in future episodes to avoid getting the option exercised).

This is not my favorite solution for several reasons. Main one is that this solution assumes I always sell covered calls for the entire number of shares I own (that must be a multiple of 100).

The alternative solution is to put the same limit on the asset entry:

Here you can see that in April I sold 5 call contracts on VTV at strike price 135, while I own 600 shares of it. In this case I can monitor the real share price in the finance section of my NW sheet instead of the capped one.

I like this second alternative more, so I’ll stick with it.

But I don’t have a strategy to account for cash covered puts, that I’m also writing a lot of.

Essentially, every time I want to insert a limit buy order I sell a put instead. I’ve sold something like $1500 worth of puts in March, all expired (sadly?), mostly around individual “boomer stocks” at prices I’d be happy to buy them at. Mostly Financials (UBS, AXA, State Street) and Consumer Goods (Nestlé, Pepsico), and some tech (intel). Plus of course ETFs.

The problem with cash covered puts is that you need to keep your cash liquid in your brokerage account (unless you have a margin account – I don’t recommend it), but so far I experienced that you can earn ~6% per year on your cash staying far enough from danger zone. Plus, if you sell puts only for securities you’d happily hold at the strike price you sold the options at… it’s a no brainer for me.

Disclaimer: this is not financial advice, derivatives are very powerful tools that need to be handled with care. Do not try this at home, do your homework… or do the fuck you want, I’m a sign not a cop!

Investing plans for Q2 and 2021? Keep investing according to my strategy, move at least 50k each month from bonds to stocks, maybe look for boomer/dividend stocks, and keep selling options until shit hits the fan. If there’s a huge crash, accelerate the re-enter into stocks.

Anyway, I commented my investments at timestamp 56:38.

FIRE Metrics?

Apparently I reached FI in Italy again, even after having lowered SWR to pi (3.1415…%).

Starting from April I’m raising monthly Ideal Expenses in Italy to 4k EUR (gross withdrawals) to move the carrot few months away.

Months left before FI in Switzerland dropped from 138 (11.5 years) to 51 (4 years)… it’s tempting… but we all know why: I use a 12 months moving average for NW increase and expenses. February and March 2020 are being rolled out from the moving window and their impact on forecasting was huge 🙂

We currently sit on a nest egg almost 18 times our yearly spending. I could drop everything, earn nothing, store all the money under the mattress and we’d be ok until year 2040 more or less. Soothing.

FIRE Metrics have been discussed at timestamp 1:56:51.

Anyway, let’s repeat why FIRE Metrics are irrelevant once more:

- FIRE is Dead: “constant dollar” withdrawal method (the SWR, the 4% Rule) is popular for its simplicity, but it’s inefficient.

- My formula for the ideal (in Italy) FIRE model doesn’t take into account real expenses, but an estimation of the desired ones. Plus I don’t take into account taxes and future pension streams. I just pretended to model everything in the “pi” SWR.

- My formula for current (in Switzerland) FIRE model doesn’t take into account mandatory pension contributions, income tax on investments, maybe income tax on capital gains (if that will become my main/only income), wealth tax, future pension streams, future expected expenses.

- I don’t know (yet) if we’re going to stay in Switzerland or not.

Other Financial Facts

“Provisoriche” Bundessteuern

Bundessteuern are Federal Taxes.

In Switzerland we pay taxes to 4 entities: State, Canton, City, and Church.

Church is optional. Yeah, you guessed right, I don’t pay any church tax.

Cantonal and City are joined into “Staats- und Gemeindesteuern”.

So we receive two tax bills: Federal, and City&Cantonal.

As I said several times, the tax offices (both of them) are behind on my final tax calculation. I have five tax years still open, and it’s not fun.

Anyway, I received two “provisory federal tax bills”. I received the one for tax year 2019 in January: 14’443 CHF “estimated federal taxes”. What a huge forecasting effort bro… it’s identical to my 2018 final federal tax bill, it’s not based on any actual calculation. I paid it in January 2021. I expect my 2019 tax bill to be similar to 2018 anyway.

In March I received another “provisory federal tax bills”, for tax year 2020: yet another 14’443 CHF. This time I got nervous, because I earned less in 2020 compared to 2019 or 2018. I didn’t want to pay too much taxes in advance, and wait years to get my money back.

The 14’443 CHF tax bill was based on a Taxable income of 216k CHF.

I called them.

“Steueramt (tax office), how can I help you?”

“Hey, listen carefully to me… you sent me a huge tax bill advance based on my income but I lost my job, I don’t work at Hooli anymore, I’m poor, I have earned way less in 2020 YOU CAN’T DO THIS TO ME THIS IS UNACCEPT…”

“No problem Sir, what’s your expected taxable income for 2020?”

“Ah… Ok… well, I don’t know… I’d say 160k?”

“Great! We’ll send you another provisory federal tax bill based on the new expectations. Have a great day!”

“Thanks ._. ”

Three days later I received a 7’111 CHF bill.

25% less income = 50% less expected (federal) taxes. Good.

I love Switzerland!

I’ve discussed Taxes and this funny episode at timestamp 1:03:23.

To those who asked: I don’t consider taxes as expenses, I’ve explained it several times. It’s something that’s outside my control. I’d rather play with and monitor net income and expenses. They’re under my control. Kind of.

I know that in Switzerland one can control taxes a bit (like moving into a different canton), but given that we don’t plan to move within Switzerland taxes are just a fact of life and I’ll keep playing with expectations, calculations, advances and final tax bills as “income events”.

RIP Update

Well, Q1 2021 has of course changed my own perception of my content creation activity.

This thing is real, it’s no more just “a blog I write on in my spare time mainly for myself”.

I used to just write on this blog, be mostly anonymous, meet some readers in person, and that was it. For 4.5 years.

Until February 14th.

Marcello Ascani published the video interview with me (in Italian Language), and at the moment of publishing this post it’s getting close to 600k views on YouTube.

Retire In Progress

That video sent my blog in the stratosphere for a while, and 2x-ed the baseline number of pageviews until today at least.

And for the following 4-5 days I couldn’t keep pace with the amount of mails and personal messages I’ve received. It took me two weeks to clean the queue. I’m sorry if I’ve been rude with some of you.

February of course ended up being the record month, 4x-ing the second best month on record:

I knew it was a viral spike, impossible to maintain. But I kept working hard on my blog to not drop to the previous 50k pageviews per month baseline (which was already a 2x improvement compared to 6 months before).

I set the arbitrary goal of reaching 100k pageviews in March, i.e. 2x previous baseline but 0.5x compared to Viral February.

Well, mission accomplished:

I forgot to take screenshots at the end of March, but I remember yearly pageviews (2021) crossing 2020 pageviews at the end of the month.

By the end of March, the blog received more visits than the entire 2020 (which has been a great year for the blog):

At the end of 2020 I set the goal of reaching 1M Pageviews in 2021, we’re perfectly on track for it.

April numbers are degrading a bit though.

I’m focusing on way to many things at the moment (check RIPFLIX), and the blog output is suffering. Writing requires long stretches of undivided attention, and I’m having hard time in this regard.

I know, and I feel guilty about it… but I need to give myself time to pick the right battles. I don’t have time and energy for everything: Blog, YouTube, Podcasts, Services, Outreach, Learning, Family, Friends, Self…

Plus, we now have a geographic problem…

Most of my audience is Italian now, which is influencing my content production Language – not on the blog, of course.

YouTube

Let’s talk about the elephant in the room: in early March I launched a YT Channel and it’s taking off seriously. I plan to produce content in both Italian and English Language, but so far Italian content has dominated the scenes.

This will change. It may even be that I will create a channel in Italian and another one in English, but it seems an overkill at the moment.

The channel reached monetization time (4k watch hours) in a month, and it’s currently, in April, generating some extra revenues. 4 days of monetization so far, “exponential growth” 😀

Well, $6 on my fourth day is not that bad, considering that I just started, and that it seems to be growing exponentially at the moment. Let’s see. I don’t mind another income stream 🙂

Anyway, I’m not producing content at the quality level I’d like to. I’m just doing live videos about FIRE/Personal Finance and Critical Thinking/PKM/Learning. I’d love to increase the quality of my videos, upload edited videos and so on, but as I said… I’m exploring, and then I will have to pick one or two battles. I can’t do everything.

About the content: while I do like talking about PF, FI, Investing I really do see a huge opportunity in producing content in the Learning world. I plan to run my next Friday (April 23rd) Live in English Language, about how I use Roam Research, with a Live Reading & Note Taking Session.

Join me if you like, and feel free to ask live questions 🙂

I do love this. I see myself teaching high school and university students topics like Learning, Taking notes, Managing you Personal Knowledge, Critical Thinking, Writing. If I have to bet what will my next Lifetime be about I’d say this. Teaching how to Learn and how to Think.

… but my subscribers are pushing me toward Personal Finance, FIRE, Investing, Career Development and live Coding sessions:

I do love YouTubeing.

I like the immediateness of the feedback, the vibe in the community, the reach and penetration that videos have, and the relative “simplicity” compared to writing long form articles.

I’m getting in love with producing video content, and I’m getting pulled toward Italian-Language content production. The novelty factor, and the relative success of my videos so far (with such a low effort) are posing a danger to my blog.

This is something I need to think carefully.

But if I listen to my heart now, I’d increase my YT presence and quality and in a few years I’ll be doing mainly that.

Weird… a YouTuber again. But for 1/200th of the salary 😀

Outreach

April will be the Swiss TV month.

On Tuesday April 20th, I’m on Borotalk (recorded on Saturday April 17th):

And on Wednesday Valerio Thoeny will come to my place to record more material for Patti Chiari, another Swiss Television show. I guess I’ll be on air in May.

I’m also participating to Podcasts, experimenting being a co-host on a couple of them, but I plan to reduce this activity in the summer.

I’m really fragmenting my time too much, and it’s not the right time for exploitation. I need more exploration.

And I plan to become slightly more unreachable.

So, I’m sorry in advance if I decline your podcast or interview invite. Ain’t no time for that.

Monetization

I’m devoting so much time to my RIP activity. The time invested and the size of the audience demand some monetization effort.

We’ve already seen that the blog earned ~5k CHF (before expenses and taxes) so far in 2021. Not bad, considering that I’m barely pushing on the green pedal.

I love the real-passive income streams (donations, affiliate, YouTube ads) because they let me focus more on content creation. I might join Twitch for example to increase passive monetization opportunities.

I would also love to create products (books, maybe courses, maybe other kind of products) that require deep work, creativity, and focus. Something to be proud of, something that sends me into Flow State. Ain’t no time for that at the moment, and that’s not good.

What’s fragmenting my time at the moment are the services I launched (and the one I haven’t so far). I do like the money they generate, of course, but I need to time box them if I want to keep working on them. And the Financial Education service could bring more hassles than benefits due to my lack of professional certification in a (rightfully) regulated environment, where sharks are everywhere.

The goal of the services in my current plan is to provide a sort of “stable income” to give me confidence in my income-generating ability while doing things that I like (helping others). It’s working, and if we move back to Italy I can easily generate an Italian salary by working an hour per day doing 1:1s. But it’s almost irrelevant in our Swiss Cashflow. Unless I decide to 4x the effort, assuming I can reach enough people, this endeavor is not covering our expenses.

As you can see, I’m trying to design my content creator life, prototyping things and listening to my gut feeling. I recommend you to approach your life in the same way: it’s a design problem!

And it’s a nice adventure, I must admit 🙂

Personal Update

It has been a never-ending winter in Zurich.

Even though the calendar disagrees, we’re still in Winter mode in mid April.

With nothing much to do outside, and no indoor space available, we spent too much time at home.

We realized how much easier it was to experience time passing back when traveling was possible. I can’t put myself in the shoes of people living a century ago or earlier but now I can empathize a bit.

Traveling used to break the long winter in manageable chunks.

On the positive side, I’ve got to spend a lot of time with my 3yo daughter, which is a huge privilege.

A privilege for me, not for her.

It’s not fun to play Lego with an engineer:

On Saturday April 17th, a couple of days ago, I traveled to Lugano (to record the Borotalk episode) and came back in the same day. It took 6 hours of commute time, including trains, trams, and local buses. Even such a small “trip” regenerated me and removed a bit of the fog that pollutes my brain. But at the same time I wanted to go back as soon as possible to hug my daughter, and my wife.

It’s weird, I don’t spend a day fully alone since September 2019, and you have no idea how much I dream about spending a few days completely alone, with no responsibilities of any kind, eating leftovers, letting thrash accumulate, and sleeping all the time… but I think I would feel like having a leg amputated. I need some freedom crumbs, but I don’t want them. Stockholm Syndrome anyone?

So we haven’t done anything spectacular in Q1, and our Travel budget for 2021 Q1 spoke clearly: ZERO CHF. But we’ve spent a lot of time together, which is spectacular, a privilege. Something my father couldn’t have done due to rigid work schedule.

I miss indoor spaces. I want to go to the gym, to the swimming pool, to the restaurant.

I’m positive (not covid positive!), I think we’ll get rid of this virus by the summer. I hope think we won’t have a third o fourth wave next fall. Let’s hope for that.

Before you scream: I don’t want to appear like I’m complaining. Yes, of curse we’re all destroyed inside by this longer-than-a-year nightmare, and our Spaceships You are giving in, but I had one of the most amazing quarter in my professional life, and March was genuinely one of the best months in my recent history. I feel almost guilty for feeling so fulfilled while many people are giving up.

No, I’m not talking about the official job, I told you that I’m on a sabbatical until almost the end of May. I’m talking about my content creator activity. I finally feel the urge to work more, the scarcity of time available, the overwhelming amount of projects on my plate, and the endless possibilities associated. It’s all there, easily reachable. I just need to work my ass off!

And I’m working an unhealthy amount of time. It’s amazing, I don’t remember last time (if it ever happened) that I’ve been so engaged in my work activities. I feel like I can have a lasting impact on people’s lives. If this thing scales an order of magnitude or two, I can leave a huge leap on this planet.

I wasn’t designed to have a boss. I’m now more convinced than ever. I love to collaborate with people on a peer basis. I don’t like hierarchies. I don’t want to live in hierarchies anymore.

I’m 10 times more productive if I have full autonomy, including the autonomy to decide to completely pivot my activity or to do nothing for how long I desire.

Technology tends to separate normal from natural. Our bodies weren’t designed to eat the foods that people in rich countries eat, or to get so little exercise. There may be a similar problem with the way we work: a normal job may be as bad for us intellectually as white flour or sugar is for us physically.

– Paul Graham

So I’m working like crazy, happily doing so for 60 hours per week on average. Definitely removing any doubt about how to answer to the question “am I just lazy?“, a recurring question I had while working no more than 2 hours per day during my last 2-3 years at Hooli.

It’s an amazing sensation. Craving to work.

If you do what you love, you’ll never work a day in your life

– Marc Anthony

But also:

Find what you love and let it kill you

– Charles Bukowski

Which is my fear now: Creator burnout.

I’m having the time of my life, but I can’t slow time down.

I’m cutting anything non-essential (actually, cutting some essentials as well). I’m not being a good household person. I’m leaving chores behind. I think I don’t have many summer clothes available, and I know that I will fix this in “urgency mode” as soon as good weather comes. I need to clean my desk, I need to take care of my personal inbox. You got the idea.

This is amazing, I’m so engaged in my activities, but I’m sleeping 5 hours per night. I carry my thoughts in the bed with me, and I can’t fall asleep relaxed. I have too many things to do with so little time. I’m working 60 hours per week, and they’re not enough.

We’re planning to go on vacation in June, but I know I can’t stay two weeks without working on my activities. I need to find an agreement with my family, something like: one wee I’ll work, one week I’ll only maybe reply to work-related communications (so essentially I’ll work all the time).

I know this is dangerous.

The body could suffer as well. I restarted running in February, and I’m getting in a slightly better shape. But if I sit down and type for 4 consecutive hours my shoulders hurt. I’m not 20yo anymore.

And I have a family. A daughter that needs me as a father, and a wife that needs me as a husband.

I don’t know why you 20yo are wasting so much time. Go out and hustle like Gary Vee is telling you since years. At age 40 you won’t have enough time and energy. And you’ll have responsibilities.

I’ve built something I’m proud of, like a “successful” (or at least “well paying”) career and good financial habits, and I can now consider becoming a full time YouTuber at age 44, with a family to provide for, in the most expensive city in the world. This is awesome. If you’re young and don’t have kids don’t waste your time, you’re sitting on a goldmine! But I’m old, and I probably can’t do that for the reasons I’ve shown. Plus a couple more, that have nothing to do with the money.

Well, something to do 🙂

That’s all for today!

Congrats for the twins!

That was quick…

Hi G… ops Mr Rip, i’m seeing that you’re keep growing on YT, gift for the subscribers at 10k? ahah

good job

Thanks 🙂

Well, if my channel reaches 10k subs I will be forced to produce content of better quality 🙂

With your cushion of 17 years of expenses in net worth you should really consider just dropping your job and focus on your passion fulltime. I’m optimistic you generate enough revenue with the full Ripflix portfolio to make a living.

Also try to set clear goals/deliverables for each day so you’re not ending up with putting tons of hours into thinking.

Thanks Cheese for the encouragement 🙂

Kind of hard to generate enough NET revenues to cover our GROWING expenses. But I should allow myself to not think about the financials for a year or two given our nest egg.

I’m working on my productivity routine, I think I’m going to “protect” my mornings (no meeting, no mail, no IM, no replying to comments… oops, starting tomorrow 😀 ) for deep work and use the afternoon for 1:1s and other chores/duties. Then sport/family between 6-9pm.

hey, great post as usual. Might suggest my 2 cents?

– not sure if you mentioned in the video (I hate financial content on youtube, cannot understand why they moved “What are your thoughts” from podcast to YT…anyway, personal choice) but you should highlight that taxation in Switzerland is really low, especially compared to Italy. I’m putting myself in the shoes of someone who sees 70% saving rate and wonder how it is possible: part (not everything) comes from there. Same thing in the US, where the movement started; appreciate that Americans think that only America exists so they will never mention this in their posts…or at best they will suggest to move from Cali to Texas for tax reasons.

– what you do with your investments looks like 90% Portfolio Construction: stocks or bonds, small or large, US vs International, value factor and so on (even KO and other dividend paying stocks are a proxy of value as you say); I bet lot of the video audience is about stock (or stonks) selection: Tesla or GameStop or Dogecoin etc. Both strategies can be profitable (RenTech does portfolio construction and is the best performing HF in the world…before someone thinks that long Tesla is an unbeatable strategy) but it is important to understand which battle you and your audience decide to fight; it is already difficult to be successful when you know what you are doing, mix the two things and you have the perfect recipe for disaster. I am not sure how to express this concept, just feel weird to see you talking about CAPE and then someone asking about the next moonshot 😉

Hi Nic, thanks for stopping by

About low taxes: I think I highlighted it so many times in 5 years of blogging (it’s also modeled in my spreadsheet) that I think at one point it would be tedious.

Plus, high saving rate has nothing to do with low taxes. I calculate my SR on my net income.

SR has more to do with high income and low spending. Then taxes (that impact net income). In Romania taxes are even lower but it’s hard to achieve similar saving rates for average people.

I’m not sure I fully understood you comment about my investments being “portfolio construction”. I don’t recommend buying stocks or other assets directly. I don’t care that my audience wants to know more about moonshots I don’t have any recommendation for them. I’m a passive investor.

Do you think I’m not clear enough? Are you talking about my videos or my posts? It would be great to get a pointer to the actual unclear sentence(s).

Btw, in this post series I’m just documenting my journey, not addressing any of the audience “questions” 🙂

Ciao Mr Rip! Tutto preciso e perfetto tranne una cosa. Buoni postali ITA non sono low risk ma high risk visto il mal governo italiano degli ultimi 30 40 anni e il relativo declino socio culturale della popolazione 🙂

Ciao

I miei buoni scadono nel 2024, credi siano ad alto rischio?

I also sell puts in order to buy stock and tend to go for a further away expiry date because these are the juicy puts. E.g. VT 97 expiring in November 21 delivers around 3.5%. What’s your take on it?

Additionally by selling a remote expiry date I don’t get so many transactions and minimize the chance that I will be classified as a professional investor. It would be interesting to know if anyone had experience with declaring such trades and the income statement. Do you declare the trades (separately?) or you don’t declare them at all?

I’m still trying to find the right time frame for options. Apparently you can earn more if you write short term options, but it’s much more work.

And on longer time frame you can really overpay or miss opportunities… say VT drops to 60 by November, you’d have lost quite a lot of money. Mind that drops are much sharper than appreciations.

About the “professional investor” risk, I don’t care at the moment. I’m a small fish and I have a salary. There are close to zero chances to be classified as a pro.

dear RIP! first, you need to know that none of my words are meant to hurt you. i’m an avid reader of your blog and i do very much appreciate your very personal way of communicating your thoughts and feelings to an anonymous audience. but having read a big part of your writings, i’m getting worried about you. i can literally feel how hard you’re trying not to feel your being more and more exhaused. how you’re fighting to wipe away any parallels you might notice, now and then, between the state of mind you’re in today and the one you were at when slowly stopping loving working in your once dream-job. RIP, you have achieved so much in your life! please, do yourself (and your readers) the favor not to ruin it all for nothing but some more bucks. man, you urgently need to slow down! now! there’s a great quote that might help to reframe your perspective: “it’s a marathon, not a sprint!”. as the mindful thinker you are, i do not have to spell out all the different messages lying in these words, do i? wishing you well, alex

Hi Alex, your words don’t hurt me, I actually need these kind of “slaps”.

I’m becoming workaholic again. I know that many successful people are a bit “obsessed” with what they do, but I also know it’s not healthy.

And trust me, it’s not about “more bucks”. I just want to “feel safe”. I want to see that I can work on what I love and not have money problems for the rest of my life. And experiencing constantly growing expenses is killing me. Maybe I’m to anxious, and maybe “I’ll be ok”, but it seems the harder I try to get rid of money problems the more life becomes expensive…

I will find a middle ground.

Thanks for your comment 🙂