Hi dear readers,

my last post FIRE is DEAD sprinkled many interesting discussions in the comments area, and in my personal inbox(ex).

Thank you so much for raising the debate to such high quality! I’ve received many personal messages and emails, some just to thank me, others to show me aspects I might have missed, and one (user FIREstarter on MP Forum) who just asked me a simple question:

have you come to a conclusion for yourself, at least somehow? The conclusion in the blog post is more of a cliff-hanger 😉

I replied to this message with a quick “flow of consciousness” / “word vomiting” as I usually do, even for writing my posts. But I thought maybe I was not clear enough with my conclusions and I wanted to add a short appendix to that post. And here I am.

Promised, this is going to be a quick one 😉

“But RIP… don’t you want to share “that”? 😉 ”

Oh, yeah, of course! Ben Felix liked and replied to my twit about the old post, and he said “I also involuntarily read my portion of the dialogue in my own voice 😀 ”

Which means I’m here to announce my first book: “How to spend 1 Million CHF by asking Ben Felix to read the audiobook version of this book“. Ben Felix will be the audiobook narrator, and the book contains just the sentence “in a 2013 paper, Eugene Fama, and Kenneth French…” repeated a thousand times. Regret nothing!

Ok, back to the main question: what are my conclusion on the death of the 4% rule?

Preamble: I’m on a lifelong mission to try understand more about the world that surrounds us, and the universe that lies within us. The more I expand my understanding, the more I discover I know nothing and the more I realize it’s hard to have an opinion about anything.

One thing only I know, and that is that I know nothing.

– Socrates

The strongest opinions I have are those against people who have strong opinions, certainties, and who navigate simplistic maps without knowing territories.

I’m here to destroy your certainties, to add complexity to your models, to ask you (and myself) tough questions, to try to teach you how to live with an opinion and its opposite both in your brain, to tell you that everything is 100 times more complex than how your brain craves to simplify.

That’s why I seek questions, rather than answers.

Judge a man by his questions, not by his answers.

– Voltaire

I’m probabilistic thinker as well. I don’t like to decide between black or white. It’s always a spectrum that spans over many shades of grey.

“Yes RIP, but you said this was ‘a quick one’. What’s your opinion on the death of the 4% rule?”

There’s no way I can overestimate the complexity of the problem we’re trying to “solve”, or at least to “face”.

My conclusion is, as always, “don’t draw any conclusion” 🙂

“Ok, RIP, but what’s your plan? how are you going to change it with this new evidence?”

I like the More To That’s model of Money, and I’m personally moving from scarcity to freedom. From the lowest levels to the middle ones.

And I’m not talking about finances here. My finances are already there!

I’m working on the psychological aspects.

I’m convincing myself that I will never be in dire need of money, I’ll never be homeless, I’ll never lack food. I’d go even further: I’ll never experience a lack of small luxuries I and my family like.

I’m free!

I now need to convince myself of that.

My “scarcity mindset self” always fears of one day being broke, homeless, and in poverty. Things that will never happen to me and my family no matter how bad I screw it because I’ve developed above average skills that will prevent me from having huge financial problems in life. Even if I lose everything, I can rebuild most of it – if not more – in less than a decade.

As a paradox, the only things that could send me into darkness are my fears and anxieties themselves! Fear of falling into poverty, and anxiety in anticipation of what would happen in that case. They could keep me slave of unhealthy behaviors (like working a job I hate just for the money) and a roadblock for an intentional and free life. In this context, fear and anxiety are self fulfilling prophecies.

So if I can convince myself that I’m “already there”, no matter what the 4% rule says, I won’t need any 4% rule.

More than focusing on finding the perfect SWR and optimize my investments, I should be doing exercises like:

- Fear Setting to get to know my fears, as a first step to fight them.

- Fear Rehearsal to experiment small doses of them, and fight the associated anxiety…

- …Which in this case could be Seneca’s Voluntary Poverty exercise, to become friend with the money-related worst case scenario.

- And at the same time I should work on increasing self confidence, that I can place myself wherever I decide to be in the money spectrum 🙂

Which means I can already focus today on what I love. Enjoying freedom. Maybe taking some steps on the Power levels of the More to That’s money spectrum, and try to leave an impact in my family, my communities, and maybe even above.

All of this to say that “the 4% Rule doesn’t work anymore, but if you’re FI according to the 4% Rule you don’t need any rule to grant you Financial Independence: you’ll never have financial problems, not because of the 4% rule but because you fucking ROCK!”

“Awesome. So, RIP, you’re behaving like a Financially Independent person, working on your passions, and not caring about an income?”

I’m not there yet, but it’s not money that’s lacking. It’s the confidence that I will never lack money that’s lacking.

“…So?”

Last Friday (3 days ago, the day after I published my last post) I accepted a new job offer for what it seems another “dream job”.

Let’s see how it goes! 🙂

I’ll go back to work in September, still 3+ months before re-plugging myself into the system… Well, I’ve never really unplugged, let’s be honest.

Of course I’ll keep you all posted on this 😉

“RIP! You’re a lie! You’ll never “retire”, why the hell are you blogging about it at all??”

I don’t agree with you, my dear friend.

Because what you might see as a descent into Scarcity, I see as a climb into Power 🙂

- I’m taking my time: 5 months off, last time I worked a single day in July it was 2016.

- I’m picking a position that I really like: developer/researcher for an academic institute in Artificial intelligence!

- I’m not letting compensation be the main driver, even though the offer is very good for the position: ~75/80% Hooli total compensation!

- I’m getting out of giant corporations and back to academia-like environment, suspiciously following LivingAFI work history.

- I’m able to work when I want, from where I want, with a coworking space rented for me in case I want an office.

And in case I discover that even in such amazing conditions I don’t like to work with computers anymore… then I’ll shrug, quit, and move on 🙂

Ok, I buy it. But you have to promise me that in October you’ll ask a 80% work reduction and in January you’ll consider a team change!

– Mr. DIP

Haha sure I’ll do. Plus, a sabbatical month in July 2021 to not break the strike for sure! 😀

Have a nice week!

I’ll go back to work in September, still 3+ months before re-plugging myself into the system… Well, I’ve never really unplugged, let’s be honest.

I’m picking a position that I really like: developer/researcher for an academic institute in Artificial intelligence!

I’m not letting compensation be the main driver, even though the offer is very good for the position: ~75/80% Hooli total compensation!

I’m able to work when I want, from where I want, with a coworking space rented for me in case I want an office.

That’s great news Mr RIP!

Thanks!

Let’s see how good it really is, in slightly less than 100 days 🙂

Hello RIP,

do you know Nassim Nicholas Taleb, author (among other things) of The Black Swan? If not, I think you should take a deep dive into his books and, since you should have the math skills, also into his technical work. It has to do with fragile systems, power laws and fat-tails. I am 99% sure you would enjoy it.

On a side-note, he has a very “abrasive” twitter-persona, but if you get past that and into the message, he is very interesting to read. And it might help with your (and mine) lack of understanding of a complex world!

of course I know Nassim Taleb, but I’ve not read any book of his so far.

I started Antifragile but I wasn’t in the right mindset last summer.

I think I know the main messages in his books though, at least superficially.

Is there anything you want to summarize to me to try to start a discussion about?

I find his way of thinking about extreme events particularly interesting, especially now in this virus-time. It really gives another perspective on how to look at what happens around us (both locally and globally) and how one can prepare (talking about anti-fragility: I found his(?) definition of anti-fragile system one of the most interesting concepts that I discovered lately. It is one of those things that seem “obvious” after you know it, but when you read about it for the first time it triggers a lot of questions/eureka moments).

From a more investing point of view, he talks a lot about having “insurance” against catastrophic events (example: the recent covid-market-crash); I didn’t manage yet to fully grasp how a retail investor could purchase/obtain/develop such insurance, but the concept makes total sense. In the same way that one insures a house, hoping to never collect it, it makes sense to insure the investments: the theory is that while normally you are bleeding a bit (i.e.: paying the insurance fee every month) the gains obtained during crashes are so huge that they might actually become the driver of your total return.

In this sense, the white paper of the Universa fund (advised by Taleb, they supposedly got a 3600% return thanks to the crash) are a very interesting read.

Cool! Thanks for the pointers 🙂

I should re-start Antifragile then.

About “insurances” for market crashes I’m not sure. First principle reasoning tells me there’s something that doesn’t click. Who insures the insurance companies? And what about quantifying the costs? insurance companies aren’t charities, they make profits out of the insured. Anyway, I’ll take a look.

Thanks!

I cannot really explain in detail the concept, since I lack the knowledge: what I understood is that you are not really purchasing an insurance product (hence why I put insurance between quotes), but you are actually hedging your investments with other products (OTM options is what I could gather). These products are supposed to cost you a bit but they should indeed provide the hedge against a catastrophic event.

Again: take it with “le pinze” 😀

Yes, of course “insurance” = options. Options trading is a field I never got my hands dirty with, nor I want to do that for speculation reasons.

Insurance can be a valid use case, but it’s hard to find quickly some quantitative metric around that.

For example, what’s the price of a put option at -5% of current VT price in a year from now?

Ok, googled a bit and found two similarly looking resources.

take this one: https://finance.yahoo.com/quote/VT/options?date=1605830400

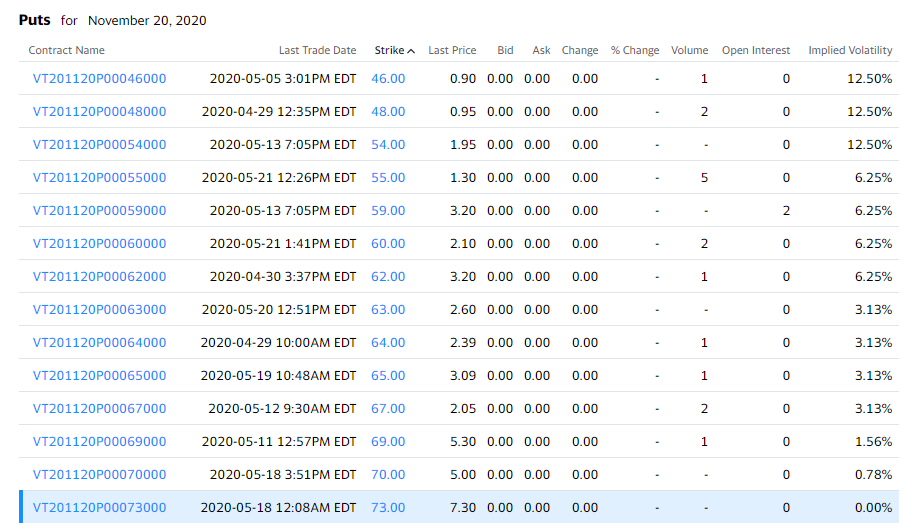

Here are VT put options prices for put options for November 2020 (the further in time I was able to find, only 6 months away) by strike price:

Did I understand correctly that if I want to be able to sell my VT shares on Nov 20th, 2020 at price 65 USD/share (-8.8% compared to 71.35 USD current price) I’m going to pay an insurance of 3.09 USD per share?

It’s a 4.3% premium, and it covers me just for 6 months!

Who would want such a product, if not for speculation?

I’m sure I did some mistake, it can’t be like this.

Ok, we’re in high volatility, and there’s a good chance that the market is going to collapse again, but this is always true.

P.S. “take it with le pinze” made my day 😀

I was 100% sure that you would accept a new job this year. But that this news comes already in May is a little surprising 😂

Yeah, in May – but starting in September… does it still count as surprising? 😀

Hi Mr. RIP,

I think congratulations are in order and, not that you need that but I support your decision and welcome it. 🙂

If you really are the great mind I think you are, although all the other problems (I’m teasing you), I think if you can really contribute to mankind and help to solve the most complicated AI problems out there you should, don’t waste your brain for small things like money.

And I think you will fell better about yourself and all things around, it’s always satisfying to contribute to bigger causes.

Coasting FI FTW. 🙂

Regards,

Luis Sismeiro

You’re growing my impostor syndrome by 100x, just wanted to let you know 🙂

Time will tell how big and important the cause is, and how big my impact will be.

I’m flying low, as always.

Already been disappointed by too many dream jobs.

Let’s see.

More than coasting FI (I bet saving rate will get back into the 50% territory) it’s more like Surfing FI, one wave at a time! One job at a time 😀

Oh man, I have to admit that I‘m a bit disappointed. I really hoped you could resist falling back into the slavery of work forever. I just think that some of your projects and ideas would have helped more people than „AI Research“ will in the short term.

I’m also a bit disappointed.

It took me a long time to reach a point where I had the perception of living an intentional life, but the machinery of all the life duties makes me wonder if there even is a thing like “intentional living”.

But on the other hand, this is really a “special” opportunity, and if it won’t work there’s no leash locking me to them.

They say second retirement is way easier than first 😀

Hehe, how many retirements will there be? 😀

I still hope you can pull of one of the many projects in these next 100 days like the EERG. Now with the pressure of finding a job gone you hopefully have more time at hand.

I want to make it into the Guinness World Records, so it will be a long retiree career 😀

I received at least 4 pushes to restart the EERG project in last week. Is this mail bombing? Apparently there’s demand… maybe it’s the right time.

I will think about it – but it was not in my top priority before all the pushes

Congratulation Mr. RIP,

I have to say I am not surprised by your decision, Several Software Engineers / FIRE bloggers has done the same after a period of time [I call it a decompress FI period] .. The beauty of FI it does provide the ability to take a break period without dealing with any financial stress.

Examples of FIRE bloggers who has done the same recently : (Mad-Fientist and FI180 Joel )

Thanks ATM!

As my dear friend Mr. HCF from http://www.haltcatchfire.com privately told me: “I am a little bit disappointed that I am not disappointed”

But I agree that I should have given myself more time to FI-Decompress.

It’s just that… I wasn’t expecting so many people interested in hiring me this moment in human history, with a recession coming and millions of freshly unemployed.

Call it opportunity inequality if you want, but it felt unfair to myself to not consider some of those options. And once you taste, it seems weird to reject everything. To be honest, if the Academic Institute wasn’t around, I had another offer for a completely different role that I would have accepted. And it came from a reader of my blog!

Too many good looking low hanging fruits to pass on this time.

What would my profile look like in few years? Maybe I won’t be so hot on the market, or the market itself won’t be… but as we say in italy: “Beat the iron until it is hot”

I should write a post about my short unemployment…

Livingafi accomplished his mission- to free himself from the pitiful drudgery Of mandatory work. Although you seem bright fella you still overreact on The whole thing. Go on man, enjoy your life well earned. Extending life like Einstein said is never elegant . PS. to read Livingafi is still like to read the real shit. Search on and it’s enough

Not sure I understood your message.

Livingafi accomplished his mission… well, we don’t know. He’s not blogging since 4 years, and we have no clue if he’s happy, bored, depressed or back to work. We can only speculate and have opinions – generally based on our confirmation bias.

“Although you seem bright fella you still overreact on The whole thing”

What does it mean?

“Go on man, enjoy your life well earned”

That’s what I’m doing.

“Extending life like Einstein said is never elegant”

I did search for Einstein quotes about extending life. Found none.

“PS. to read Livingafi is still like to read the real shit. Search on and it’s enough”

Didn’t get this either.

Is it just a troll comment or you wanted to deliver a message?

If the latter is true, can you please be more explicit?

I gotta say Buddy Holly – from a fellow bald eagle in CH to another- If you think you can or you can’t your are right.

Oi man- greed is greed. Geeko or Belfort- it’s never enough.

What’s this?

Is today the international cryptic troll day?

“I’m convincing myself that I will never be in dire need of money, I’ll never be homeless, I’ll never lack food. I’d go even further: I’ll never experience a lack of small luxuries I and my family like.”

This is imo THE statement, keep working on this mindset !

“…Which in this case could be Seneca’s Voluntary Poverty exercise, to become friend with the money-related worst case scenario.”

Or you can re-watch Pozzetto’s ‘un povero ricco’ ! 🙂

But signora, I don’t fear that the dog mi si inculi, I fear that the dog mi morda!