Table of Contents

Hi RIPsters,

I know, I’ve been missing on this blog for quite some time. I’m playing probably too much with my YouTube and Twitch channels (check my events page if you want to follow my live streams).

Yeah, I know, I also owe you an update on the mess. It’s coming (hopefully) soon.

Meanwhile, a couple of days ago, on Friday May 28th, on RSI LA1 aired a Patti Chiari episode where I’ve been featured (sorry, Italian language only).

Valerio Thoeny, the director of the TV show, is running a series within the show called “La Resa Dei Conti” (“the showdown“), and in the second episode he’s attacking the Policy-Linked Third Pension Pillars schemes. Those are products that (financially) kills many innocents in Switzerland. I’ve proudly been partnering with him in this fight 🙂

I’ve written about how crappy these products are, and how aggressively they’re marketed by sharks in a previous post, a few months ago.

Anyway, here’s “La Resa Dei Conti” episode two. Enjoy!

In my opinion this 15 minutes episode is really good, especially from a “storytelling” point of view. But it tells a very very simplified version of the 10+ hours long analysis I’ve run on both their Pillar 3 insurance policies.

I’m publishing this post to show you some extra details, and my process to come up with the conclusion shared on the show. And of course, the spreadsheet I’ve used for the simulation 🙂

The spreadsheet is populated with data coming from the documents they shared with me, so I can’t post most of the sources for obvious privacy reasons. And I also won’t mention the actual product names and the insurance companies.

But you can guess 😉

Feel free to navigate the spreadsheet for info, numbers, and graphs.

Let’s start digging!

Hard to Understand

I’ve spent a good 4-5 hours trying to decode the unnecessary complicated wording in their contracts and yearly statements.

There is “exposure to investments”, “extras”, “benefits”, “distributions”, “interests”, “reserves”, “accruals”, “surrender values”… a lot of words and no formula.

It’s impossible to find an answer to basic questions like “How much should I expect as Survival Benefits if the market will perform 5% per year on average?”

No way you can simulate these products performances given a set of input variables.

This pissed me off a lot.

Their Forecasts on your Benefits are absolute Shit

I’ve been reverse engineering formulas based on yearly statements for several hours and I kind of gave up at one point.

Not enough data points.

But the few data points we have indicate that the policies are performing well below their forecasts for the worst scenario so far (both insurances).

Here’s Person 1 (Italian language but I guess it’s easy to understand):

So in the worst scenario this person should have accumulated 91.90 CHF by the end of 2019, 145.10 CHF by the end of 2020, and 203.70 CHF by the end of 2021 as “extras” from exposure to markets.

I have read statements/reports issued on May 2020 and May 2021. So, again, hard to compare Apples with Apples.

May 2020: 14 CHF.

May 2021: 94 CHF in total! 80 CHF between April 2019 and April 2020, plus 14 CHF accumulated in the past as we’ve seen above.

This is pure shit. We’re well below the Bad scenario! Why the hell? Last time I checked the global stock market almost doubled since April 2017.

The policy for person 2 looks even shittier in terms of returns.

They have been contributing for 7 years so far, more than 45k CHF paid into the plan so far, and the “returns” have been… drum roll…

766 CHF in 7 years!

Forecasting for Person 2 was even more optimistic, with a smaller spread between Bad and Good scenarios, and a kind of +106k CHF expected returns as extra Survival Benefits on top of the guaranteed amount after 35 years even in the Bad scenario. What a fantasy!

We’re at +766 CHF after 7 years.

A fifth of the contractual time has passed (7 years out of 35) and we’ve seen 1/139th of the returns of the worst scenario!

Charlatans.

Their forecasts are smoke in the eyes. They’re there to confuse you. To make you believe you’re getting a good deal.

But they’re just fantasies.

The only number you should trust is what’s guaranteed in the contract. The minimum guaranteed value.

Everything else is a fantasy.

Hard to get the required Info from them

We asked.

We called them many times.

At the beginning they were responsive, even though their documents didn’t answer our questions.

Then they went dark.

No way to get any formula behind those numbers, or any simple explanations from them.

No way to get an answer to the question “can you explain me why my balance is below your worst scenario even though the market is performing amazingly since I signed this policy?”

Or “why did you pick April 1st as check-point for my 3A performances? Is this a joke (some pun intended)? In that case my 2020 bonus has ben ZERO because you picked the bottom of the market as checkpoint date, even though both in 2019, 2020, and 2021 (so far) the market has performed amazingly!”

No way.

Survival Benefits are Crappy

I wanted to be nice in my simulation.

I tried to reverse engineer the formulas – because you assholes didn’t answer our questions to unveil the actual formulas.

It seems that exposure to “risk” is zero for the first 3-4 years, as if the entire amount paid for the first 3-4 years is to be considered as anticipated life insurance premiums for the following 35 years. You scumbags!

But even considering the worst of the worst hypothesis AND forgetting about last 7 years of amazing market returns there’s no way current survival benefits balance could reach even your “Bad” scenario for Person 2.

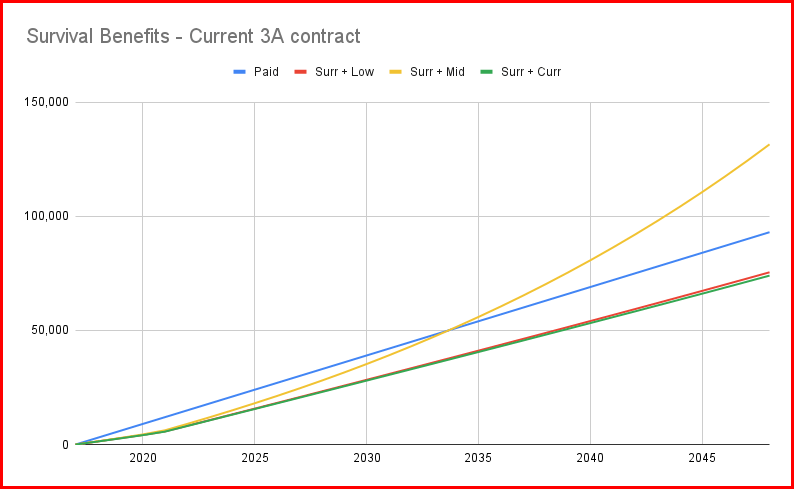

Anyway, let’s look at Person 1 now:

The Blue line is the amount paid into the policy over time.

The Red and Yellow lines represent the evolution of survival benefits over time in the “Bad” and “Mid” scenarios. I removed the “Good” scenario for decency. But also, as we said above, forget about Yellow line either.

The Green line (which is below the Red one!) represents current trajectory, based on end-of-year statements Person 1 received so far. As I said, not enough data points. But those we have signal a crappier situation than their worst forecasted scenario.

Yeah, it will be hard to recoup even the amount this person paid into the policy in nominal terms at pension age…

Now, what would have happened had this person subscribed an external life insurance and invested the reminder into a decent saving/investing Pillar 3A with a Bank or a Fintech?

Here’s my simulation (you can find the graphs in the spreadsheet):

We can see above that the four green curves (investing 25-50-75-100% of the Pillar 3A into stocks) are well above the Red line. And the 50% stocks scenario is comparable to their fictional “Mid” scenario.

The difference is that their “Mid” scenario is pure fiction, while a 50% stocks Pillar 3A that assumes 5% annual return on stocks (so 2.5% for this portfolio) and 0.5% management fees is actually a very conservative scenario.

Person 1 is leaving at least 50k CHF on the table by having signed this crappy policy.

The comparison for Person 2, which is contributing more than double the amount of Person 1 into third Pillar, is even darker. He’s losing more than a hundred thousand CHF compared to a decent Pillar 3A solution.

Life Insurance Part is absolutely Bullshit

You better die right after having signed the contract!

In both their contracts (and in general this is true for all the policy-linked third pillars I’ve seen so far), in the event of death of the insured person, you get only the fixed death benefit (eventually plus some irrelevant “extras” for Person 1).

The saving&investing portion of your contributions are gone.

If you open a saving/investing 3A account with a bank or a Fintech AND you buy an external life insurance (still tax deductible in the 3A framework) AND you die… your heirs would get both the life insured amount AND the current balance of your saving/investing 3A account.

Take a look at “Person 1 Death Benefits” under current policy:

The Blue line is the amount paid over time into the policy.

The Red and Yellow lines represents the death lump sum Person 1 would receive in case of death in the “Bad” and “Mid” scenarios. I removed the “Good” scenario for decency here as well.

The Green line (which is again below the Red one) represents current Death Benefits projection based on the data we have.

This is outrageous!

The difference between “paid” and “death benefit” shrinks with the passage of time, making the policy useless after a few years. Dying after year 2042 mans receiving less money that Person 1 contributed into the pension plan. What kind of insurance is this?

If Person 1 had chosen a wiser alternative, like 194 CHF/Year in a life insurance covering 100k and 2806 CHF/Year in a 3A invested in low cost index funds with minimal fees overhead, the Death Benefits would have the following return profile over time:

The Blue line is again the amount paid into the two products, while the other lines are expected average death benefits assuming a different exposure to the stock market.

Simply stated, your heirs get BOTH the 100k by the insurance policy AND current balance in the investment portfolio!

Of course this is a simulation with constant returns on investments over time, and we all know it’s actually a bumpier road. But there’s ZERO chance the rosier among the return profiles under current policy would cross the worst return profile in this alternative scenario. It’s a pareto-superior alternative

You can check the assumptions on average market returns (5%), investment fees (<0.5%), and return on the cash component (0.15%) in the spreadsheet.

Person 2 has a different policy that allows no extra Death Benefits based on market performances.

At least they’re getting back slightly more (in nominal value) than total amount paid, but it’s still a bullshit agreement where you don’t get BOTH the death insured amount AND the investments balance back.

You’re locked in for Life…

So… let’s get rid of these crappy contracts, shall we?

Not so easy.

They lock you in.

If you quit before pension age you won’t get back the current saving balance, only the surrender value of your policy. Which is way lower than your current balance.

This is a legalised theft. Insurances have political power in Switzerland. But there’s no way to put it mildly: this is a theft.

Person 2 asked for a calculation of their surrender value after having contributed around 45k CHF into the policy:

Yeah, less than 35k CHF back if they decide to quit this contract. 10k CHF less than what they paid, even though we experienced 7 years of amazing market returns.

Their money is being kidnapped.

…But They Should Still Change (in my opinion)

I’ve run the Survival Benefits simulation for two scenarios:

- Scenario 1, where they both keep their current policies

- Scenario 2, where they both quit their policies (accepting to pay the ransom) and they both sign an external life insurance while investing the remainder of their current premiums in a decent Pillar 3A solution.

And here’s the outcome:

The Blue curves represent Scenario 1, the one where they keep their current policies. The “Mid” hypotheses are pure fantasies, as it is one of the “Bad” hypotheses (for Person 2).

The only curve that makes sense is the light blue one, that represents the projection of their Survival Benefits using the few data points we have (that are below both “Bad” hypotheses).

The Yellow curve represents a conservative version of Scenario 2, where they both quit their current contract and just move their money into a saving 3A account with any bank. That would be a bad choice. A saving account would not grow their money much, and the impact of having paid the ransom accepted the surrender value of their current policies would be large and unrecoverable.

Mind that I’m not saying these policies are better than a 3A saving account! I’m just saying that given current conditions (crappy surrender values) they are partially locked in. Moving to a 3A saving account would not be beneficial for them under current circumstances.

But even a 25% stocks portfolio (light green curve) would more than cover the gap, actually returning 40k extra by the time they reach pension age.

If they decide to switch to a more aggressive investment strategy with their Pillar 3A (which I totally recommend, given the tax benefits of investing money into a low cost tax deferred account) in the range of 75-100% exposure to stocks, they’d reach retirement age with at least 200k CHF more in their retirement accounts (assuming 5% yearly nominal average return for the next 30 years and 0.50% management fees).

I don’t even waste time showing you the difference in death benefits in case they’d move their Pillar 3A into investing account plus external life insurance, I guess you got the idea by now.

“Yeah, but investing is risky… and if they want to invest only 25% into stocks the benefits of changing are minor”

First, if you think 40k is a negligible amount… well, good for you dear Billionaire next door.

Second, NOT investing is actually riskier my friend. All the returns we’ve seen in this simulation are nominal returns. If there’s a bit of inflation in Switzerland those policies are going to be worth ZERO 30 years from now. Being invested in stocks is the best hedge against inflation.

Third, does the graph “Stay vs Change” look a bit dark if you don’t want to “take risks” by investing at least 50% in stocks? Does it look like they should think twice before quitting their current policies? That’s just another problem of such crappy insurances and their lock-in effect!

It’s like if you enter into a restaurant that says “entrance is free”. You enter the restaurant and you discover that “exit has a 50 CHF fee if you don’t eat here“. There’s only one meal plan, probably a crappy one, and it costs 100 CHF. Now you’re considering “should we leave and go to the RIP Pizzeria on that far neighbourhood? I heard we can eat with 40 CHF… so we’d spend 90 CHF plus travel time if we want to go there… I’m not sure… it’s a close call…”

Well, no, it’s fucking not!

You should leave that restaurant, volunteer to do shifts on the street warning those who’re thinking about entering this shitty restaurant, and launching a referendum to outlaw these unbelievably legal (so far) practices! That’s how “not a close call” it is!

That’s all for today!

Ciao RIP,

are you saying that a pillar 3A plus life insurance with the same company is always a bad solution? The VIAC pillar 3A offers a 2500,- CHF free (what does free really mean?) insurance every 10000,- CHF you have on your VIAC account. Do you think it would be a good option? Or would you integrate the VIAC pillar 3A with another life insurance?

Grazie!

Of course I’m not saying that.

I’m saying that the policy-linked 3A are crappy products.

VIAC is awesome, go for it.

Ciao RIP,

400 CHF/year for 200k coverage? This looks like a nice occasion to do some self promotion…

as a “side project” (our main business is software as service solutions for life insurance companies) we recently launched a life insurance aiming at offering something transparent and as cheap as possible.

The project is a bit rough on the edges, it still lacks a proper branding and polished website, but it is the cheapest thing you can fine in CH (the product is offered also in Italy Germany and Netherlands), very simple, and has some very cool math behind if you are interested to dig in.

Drop me a message in case.

ps. I am a software engineer, not directly involved in this, it is not like I am getting commissions. Actually, there are no commissions at all, it was the whole point of the product

Where did you read “400 CHF/year for 200k coverage?”

I’ve actually googled very quickly a 250k CHF coverage for 30 years for Person 2 and I’ve found 291 CHF, here’s my source:

I was really waiting for this episode 🙂

Thanks for the extra analysis

Saluti da Ginevra,

Lorenzo

Ciao Rip

Quindi ritieni ancora oggi VIAC un buon 3a ?

Intendo dire che, con una propensione al rischio media, famiglia con 2 stipendi 1 figlio, reddito lordo annuale 110k

Saluti Paolo

Hi Mr Rip, thank you a lot for your illuminating post! Unfortunately I’m a victim of Swisslife, too. I have a III insurance pillar, I will receive 46148 CHF on 01.03.2033. If I leave them for FinPension, I’ll lose around 6000 CHF. Do you think that with a 60% stock Finpension pillar (I can’t put more than 60% stock) I can do better than keeping my money in the insurance III pillar?

Thanks again for your work and best regards

Sono indeciso se fare un terzo pilastro con via o mobiliare mobifond 90 select.puoi dirmi qualcosa? Te ne sarei molto grato, grazie

Ciao Rip, grazie mille per i tuoi contributi sempre utilissimi.

ho solo qualche dubbio sulla definizione di eccedenze di cui parli al minuto 8.42 del servizio sulla RSI. In particolare, mi sembra di aver capito che le eccedenze sono diverse dal rendimento dei fondi legati alla polizza.

Eccedenze: La compagnia assicurativa potrebbe aver ottenuto rendimenti superiori rispetto alle previsioni dai propri investimenti interni o avere una gestione del rischio migliore del previsto. Potrebbero quindi decidere di distribuire un’eccedenza ai clienti, aumentando ulteriormente il valore della tua polizza o riducendo i premi che devi pagare.

Magari in quella specifica polizza considerano eccedenze le eventuali performance positive del fondo, ma mi sembra strano