Table of Contents

Hi RIP Friends,

This is the third and last post in a short three posts series about my experience with a Financial Advisor.

Your can read first post here, where I explained how I was cold contacted by her assistant on LinkedIn, and what happened during our first 1h-long video call.

You can also read the second post here, where I analyzed the two Structured Notes that she thought would have been the perfect investments for a risk averse person like “me”.

In this third post we’ll take a look at her final weapon: a Pillar 3A/B with a linked Insurance Policy.

Swiss Third Pension Pillar

For those who are not Swiss: the Pillar 3 (A or B) is one of the three pillars of the Swiss Pension System. While the Pillar 1 is tied to your residence in Switzerland, and the Pillar 2 to your employment, the Pillar 3 is fully funded by your voluntary contributions.

For this reason it’s unmatched by your employer, and it’s much more customizable (and potentially more exposable to risk) than the other Pillars.

…It’s also where the sharks thrive!

Not all Third Pillars are alike though. There are two categories: 3A and 3B.

The Pillar 3A is a tax-deferred (you save taxes at contribution time, and you pay lower taxes at withdraw time), yearly capped (~6.8k CHF per year if you’re already contributing into a Pillar 2, ~34k CHF if you’re self employed), locked (until statutory pension age, 65m/64w) Pension Plan.

Fun fact: you won’t get a “pension” at age 64/65. You can only cash the final balance as a lump sum, and pay taxes on it.

About Pillar 3B, I must admit that I struggle to find any reason for it to exist. Pillar 3B is called “flexible” third pillar. It’s “uncapped” but with no tax advantages. It’s “unlocked” in theory (you can access your capital before or after retirement age), but read 10 times your contract fine prints before unlocking it. If you’re buying into an insurance-linked Pillar 3B your surrender value is going to be way lower than your accrued principal!

As I said, I don’t see any reason why you should subscribe a Pillar 3B solution. The surrender value counts toward Wealth Tax! I don’t know… In absence of any valid reason, I consider Pillar 3B an inefficient way to “invest” only good for someone who doesn’t know how to open a brokerage account and invest on their own. Change my mind if you can!

As we’ll see, The Advisor’s selling point for their 3A/B solution is that “you can’t contribute into a Pillar 3A if you move out of Switzerland, but you can keep investing in a Pillar 3B“. More on this later.

About Pillar 3 (A and/or B) accounts: there’s a saving portion, an investing portion, and an insurance portion. I mean… the insurance portion is only present if you subscribe a Pillar 3 (A or B) Policy.

If you open you Pillar 3A account with a bank (or with one of the FinTech companies registered to operate in the Pillar 3A world), you usually have access to the saving and investing portions.

The investing options for a 3A are limited compared to the open market: you can only invest in the products offered by your Pillar 3A bank/company, which are usually products that meet a set of regulations imposed by Swiss Authorities. It’s a kind of US 401(k), except that it’s not company matched.

Maxing out your Pillar 3A contributions every year is usually considered the top no-brainer tax saving action you can take, which will result in 1.5-2.5k CHF per year in tax savings, depending on your marginal tax bracket.

For example, I used to have my Pillar 3A with PostFinance. I’ve contributed the maximum amount for both me and my wife every year, except in 2012 (I relocated in Switzerland in November), and I’ve invested part of it into Pension75 and Pension100 funds, and kept a part in cash. I recently moved all my and my wife accounts to Finpension.

If you open your Pillar 3A account with an insurance company they’ll sell you a 3A Policy, which means that a fraction of your contributions will be unrecoverable insurance premium payments (you get a Life Insurance), and only what’s left goes into your savings/investments.

I’ve never subscribed a 3A Insurance Policy, even though I’ve been pitched one 3-4 times during my 8 years in Switzerland so far. Every pitch came from someone who would have benefited by me investing in the policy, i.e. from a salesman.

Never ever a friend, a colleague, or a fin-savvy person recommended me to invest in a 3A Policy.

Mind that I’m not saying that Life Insurances are bad!

You might want or need a Life Insurance (which is not a bad idea), and you definitely need to save and invest money for retirement.

What I’m saying is: do not mix the two. Go shop for them separately.

So, again, don’t fall into the trap of a 3A (or, worse, 3B) Insurance Policy!

The tax saving feature of a 3A Policy is what sharks will use as “bait” to manipulate you into subscribing a crappy overpriced insurance. Remember that even a standard 3A saving/investing account has the same tax saving feature.

Having said that, let’s take a look at the actual Pillar 3AB offer from The Advisor.

“Wait RIP, why you keep calling it 3AB? Is there a thing called Pillar 3AB?”

Because it’s a product that combines a Pillar 3A and a Pillar 3B, which is called…

SwissLife Premium Vitality Duo

During my second call with The Advisor, the one where I told her the Structured Notes she shared with me sucked, she tried hard to sell me the idea that I needed a Third Pillar Policy contract.

This second call with was very short. I think we were done in less than 15 minutes. Five minutes to destroy the Structured Notes, and 10 minutes for the 3A Policy sales pitch we’re going to analyze today. I nodded during her pitch, then after 10 minutes I cut it short asking the usual shark-killer question: “can you send me the contract/proposal/something so that I can take a look? Please, send me the most detailed version of this offer that you have, not a flyer”

Right after our call she sent me a very long, 41 pages contract.

Good.

The Sales Pitch

Before talking about the product – and why I think it’s a crappy product – let me tell you what were the selling points that The Advisor used in her pitch so that you can recognize them when a shark swims nearby 😉

- You need a Life Insurance! Right, in most cases. Especially if you are the breadwinner of a single income family and/or if you don’t have enough money saved up. But guess what? My Second Pillar already has a life insurance and a survivor pension embedded. If I had to pass away, my wife will get 200k CHF lump sum and 90k CHF/year survivor pension from Pillar 2, a Pillar 1 pension starting at age 64, and ~1.4M CHF of our assets. Does she need your extra 132k CHF? What she would eventually need is an annuity, a “salary”, not another (relatively small) lump sum.

- You need a Pillar 3A to save on taxes! Mostly right, if your salary is above 100-120k CHF per year. But I’m already maxing it out, thanks 😉

- You need a Pillar 3B if you move abroad and you want to keep investing in Switzerland! Mmm… what? Yeah, you’re right that one can’t invest money into a Pillar 3A if they left the country… but why would they want to keep contributing to a pension plan that has no tax advantages in the new country? “To keep the money in Switzerland! Everyone wants to have their money in Switzerland! Switzerland is a safe country for your money!“. Well, I can keep the money in Switzerland in many ways, for example by not cashing my Pillar 3A immediately. Not the best strategy IMHO, but if you’re concerned about safety in your new country you can keep your Pillar 3A account in Switzerland as long as you want.

- This Policy has infinite customization possibilities for the investment part. We can create the perfect asset allocation for you! Yeah, but not impressed. I have already enough freedom with the many currently available Pillar 3A solutions. And Pillar 3A is just a fraction of my Net Worth (and you know it, dear Advisor), so I can compensate any eventual misalignment within my ideal asset allocation with my after-tax, brokerage account – assuming the assets in my Pillar 3A are not rubbish. I mean, if 20% of my Pillar 3A portfolio is in Swiss stocks, and I only have 5% Swiss stocks in my ideal Asset Allocation, then I could balance my portfolio buying less Swiss stocks in my brokerage account. Assuming, in this specific scenario, that my Pillar 3A total value is less than 25% of my investable NW.

Mind that these strategies are usually targeted toward expats who recently moved to Switzerland and who have no clue about the Swiss Pension System. They are the ideal preys, busy people who have always heard that “Swiss is the land of Insurances and Bankers and I want to take advantage of it!” Mind that this is the land “of the Bankers”, not “of the Bankers’ customers” 🙂

Take a look at a few threads on the MP Forum, and a few more threads on EnglishForum, and this detailed analysis by reader Dominik (he lost 24k while surrendering the policy). It’s a very common pattern: you move to Switzerland, you sign shitty insurances, shitty pension plans, open a bank account with an unnecessary expensive bank and then, after few years (if you’re lucky) you try to undo everything.

Problem is that quitting a Policy based Third Pillar is a pain in the ass, and it’s going to cost you a 4-5 digits amount!

Ok, enough preliminaries. Let’s go to the actual product!

The Actual Product

The actual product The Advisor wanted to sell me is called SwissLife Premium Vitality Duo.

The “Duo” in the product name means that they open for you both a Pillar 3A and a Pillar 3B account, so that “you can switch from a Pillar 3A to a Pillar 3B and vice-versa” in case you’re no longer able to contribute into a Pillar 3A (like moving abroad or taking a sabbatical).

Here you can find a dry factsheet, with no relevant information (here a copy on my website).

This Pillar 3AB is a fund-linked insurance policy Third Pillar, meaning that part of my contributions would fund the “saving” portion and another part fund the “risk” portion, i.e. the Life Insurance.

I must admit that I’m still not sure if my policy had any disability benefits apart from the “Premium waiver” (I wouldn’t have had to pay policy premiums in case of disability), and even in case of “premium waiver” it is still not clear to me if it’s my entire monthly contribution that would be waived or only the “risk” component – which is nowhere stated. Confusing.

The “saving” portion gets invested, and this is where customization comes in play. You can build your ideal portfolio by picking funds from their Funds List (here a copy on my website).

I don’t know how “freely” you can chose, I was offered a specific three funds portfolio by The Advisor based on my risk aversion.

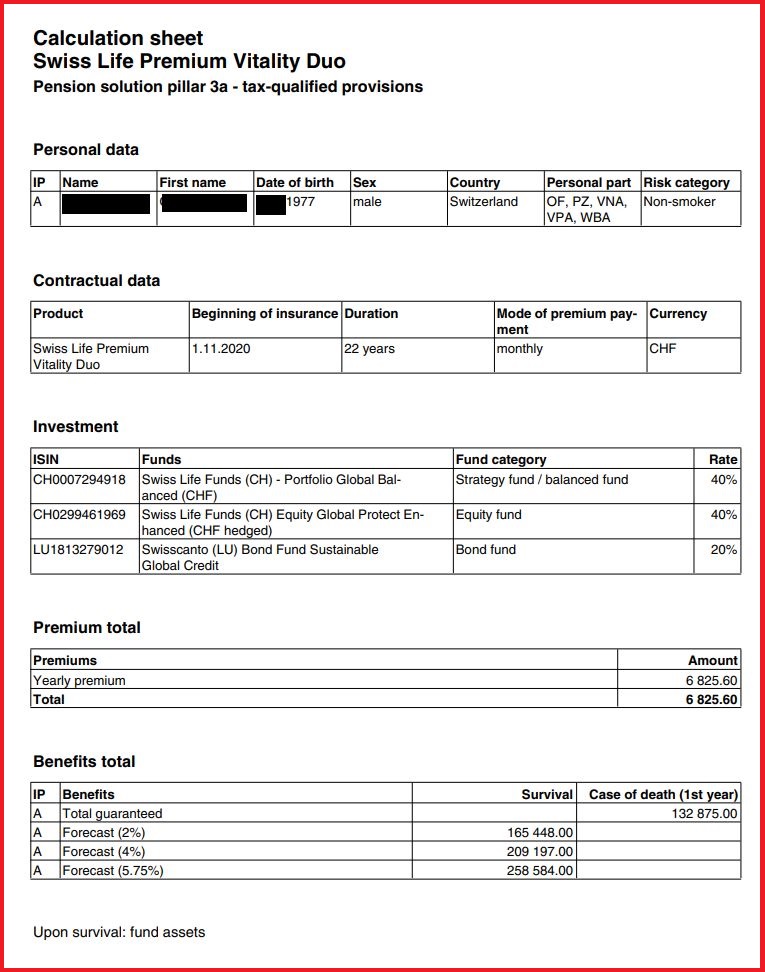

Let’s take a look at my offer!

Few obvious things: I told the Advisor that I’ve already deposited the maximum amount for 2020 (6826 CHF) into my current Pillar 3A, and that I would eventually be interested in a new Pillar 3A(B) starting from January 2021. She obviously “forgot” about it, and sent me a policy contract starting on November 1st 2020.

Second: I don’t see any “guaranteed” survival amount, just projections based on investments performances forecasts..

Like our friend The Poor Swiss said:

Well, according to Page 1 of the contract, my policy has no guaranteed survival benefit! What a huge red flag!

Ok, after having dug into the contract fine prints I’ve seen that the Death Lump Sum value is also the guaranteed survival capital: 132’875 CHF. Note that in 22 years my total contributions would be more than 150k CHF.

Next…

“The funds! I want to see the funds!!”

Calm down my friend, we’ll come to that. I don’t want to reduce this analysis in “the underlying investments are suboptimal“. I want to show you (with data) that the entire category of policy based third pillars is inferior, when not openly a scam.

We have a long way to go 😉

Premiums

I see that my total contribution is fixed: 6825.60 CHF/Year, paid monthly (568.80 CHF/Month). I wonder what happens when the tax deductible Pillar 3A limit is raised, like it happened every two years on average since I moved in 2012. For example, in 2021 the new maximum amount will be 6883 CHF (instead of 6826 CHF in 2020).

In our third and final meeting I asked The Advisor if I can contribute more to the policy, up to the future limits (which could be significantly higher in 15-20 years). She said “No, this is a fixed policy“.

Just to discover few days later, somewhere in the contract, that she has no idea about the products she’s selling:

Plus… WTF!? What do you want to do with my asset allocation during the last three years? And where is the “exit management” in this contract, I don’t see it! Which “low-risk investments” will you put my money on?

Ok, let’s move on.

Insurance vs Investing split

if I signed this contract I’d be “investing” in a product that ties together a Life Insurance and a saving/investing scheme. The saving/investing scheme would be a “Dollar Cost Average” investment plan over the three funds in the contract for the next 22 years.

But… what’s the split? How much goes into “insurance” and how much goes into “investing”?

The Advisor couldn’t tell. The contract doesn’t answer this question either. Why is it so hard to get an answer to such a simple question? I want to be able to judge the two products independently.

I know how to get a quote for a Life Insurance, it takes 5 minutes and a search engine:

Note: I’m not claiming this is a good Life Insurance, it’s just the first one I’ve found Googling for it.

Anyway, I can’t see how much am I paying for the insurance component of this policy, and it sucks.

But I’m a software engineer, and I have enough data points to reverse engineer it 🙂

According to the forecasts on page 1, I know what the final redeem value will be if the portfolio performed +2%, +4%, +5.75% on average over the entire duration.

I tried few hypotheses (constant percentage of monthly payment goes toward insurance, first N payments go toward insurance, and a couple more), and the one that seems to match the final outcome closer is the “monthly constant percentage split” (here the full spreadsheet):

Playing with the insurance% variable I’ve found the percentage of my yearly contributions that goes “wasted” in insurance premiums is somewhere between 12.10% and 12.40%. Every year, less than 6k CHF goes into saving/investing, while the insurance premiums eat up 830-850 CHF.

And that sucks! I’m paying 800+ CHF per year on a ~20 years Life Insurance that pays out 133k CHF in case of death, while the Generali offer above (again, not the best one just the first one I’ve found) would cost me roughly half of that to insure the same amount for the same duration!

Not good. But there’s more.

R.I.P. RIP

If you buy a Life insurance AND you drop money into a separate Pillar 3A (not a policy one, just a saving/investing account), guess what happens if you die? Your survivor spouse (or the next beneficiary in line) is getting the insured amount AND your Pillar 3A balance.

What happens if I buy this policy and I die?

Wait, what does it mean?

Death: if the fund assets are above the guaranteed benefit, the fund assets are paid out.

In any case the guaranteed lump-sum death benefit is paid out as a minimum

Are you joking?

You’re not paying BOTH the lump sum death benefit AND the fund assets?

Seriously, are you joking?

What am I paying the Life Insurance for 20 years for?

After 10 years, even assuming a 2% return my fund assets should have reached 80k CHF… After 15 years I should have crossed the lump-sum death benefits, what am I paying the insurance for?

This is outrageous!

I demand to receive BOTH the lump-sum death benefit AND the fund assets at the time of death!

I expressed my perplexities to The Advisor on our third and last meeting, but she hadn’t any answer for me: “Mmmh, I think there are products that are good for some people and products that are good for some other people…”

…And there are products that are only good for you, shark!

I Surrender

Ok, let’s say I get incredibly drunk that I start doing crazy/subversive things according to Swiss standard, like: putting the wrong zip code in an official communication, mixing green and brown glasses in the recycling bin, accompanying fondue with beer, and signing this crappy policy.

The day after, once I’m done dealing with the hangover, while re-triaging the recycling I suddenly realize that the policy I signed is crap, and I want to stop contributing to it.

Nope, you can’t. The policy will be transformed in a “paid-up” (i.e. all the future premiums are subtracted from current fund assets and you get the reminder paid out). We can only accept a delay up to 14 days.

Ok, I want to contribute less.

Nope. Same as above. Well, you could ask for a “premium interruption”, which means you stop paying your monthly contributions for one year, but we’ll take the insurance premiums from your fund assets, and reduce death and survival benefits as well 😉

Ok, I want to quit!

Sorry, it’s a Pension fund… you can’t quit and cash the money out, unless you’re moving your assets to another Pillar 3A, buying a house, or leaving Switzerland… btw, in the latter you can keep the policy because your contributions will go into the Pillar 3B. that’s why it’s called Duo 😉

Ok, I want to move the money somewhere else, you thieves!

I take that as a compliment 🙂 Yes, sure, you can quit. It’s called “Surrendering“. We take a huge cut of your fund assets and you take the rest. Please, consult the table below:

Ouch, its’s a lot less than my total contributions! At least during the first 15 years, assuming a 2% return on the portfolio… I don’t want to see the surrender values if the portfolio performance is zero or negative!

You’re welcome 🙂

So if I want to buy a primary residence and I need my Third Pillar…

You’re welcome, my surrendering friend 🙂

This is unfair! I want to fight!

You’re… welcome 😀

I Declare War!

I took time to read the 21 pages long General Policy Conditions. We’ve covered most of the weird aspects of this policy so far, it’s time to take a look at the actual funds…

“Wait RIP, you forgot a page in the printer”

Yeah, it always happens when you print 20+ pages out. Anyway, what is it about?

“War”

Whaaat? 😐

Yeah, the Swiss government can take money from your policy in case of War!

Say you left Switzerland more than a quarter of a century ago, finally sipping Mojitos in Guatemala, waiting for the crappy policy you subscribed 30 years ago (because an advisor told you it’s better to keep your money in Switzerland, invested in this policy) to reach Expiration Date… and Switzerland suddenly decides to invade the Canton Marittimo!

You’re going to fund the war, even though you’re a Belgian citizen that only set a foot in Switzerland for a few years, and relocated to Guatemala years before before your old Half-Canton of residence was even considered a Full-Canton!

Ok, it’s a bit unlikely to happen, but even just reading it triggered a nervous laugh 😀

The Funds

Finally, let’s take a look at the investments. We can easily forgive these “minor” inefficiencies if the available funds are the Medallion Fund, the Legg Mason IF Japan Equity Fund, and the Baillie Gifford American Fund!

I’m sorry to disappoint you.

The list of available funds for my product is available on the policy website.

Here’s a screenshot:

First, note the 1% “commission on purchase”… why? Seriously, why? Which year is this, 1990?

Btw, I just noticed it while screenshotting. I missed it at first sight. Accounting for 1% subscription fees the math for insurance/investing split changes a bit, and the new reverse engineered insurance percent is 11.20-11.60% (link to my spreadsheet).

Second, I see few funds quoted in EUR and USD. I don’t want to know what is the currency conversion spread. “Luckily”, the portfolio that The Advisor prepared for me only holds assets quoted in CHF.

Third, let’s talk about the proposed portfolio 🙂

RIP Portfolio

- 40% – CH0007294918 – SwissLife “Global Balanced”.

- 40% – CH0299461969 – SwissLife “Equity Global Protect Enhanced (CHF hedged)”

- 20% – LU1813279012 – Swisscanto “Bond Fund Sustainable Global Credit AA”

Let’s quickly analyze them one by one.

Global Balanced

First one is an actively managed mixed fund (27% stocks, 16% bonds, 10% currencies and 47% other), with a 1.44% TER, that’s underperforming its index by a lot.

There’s not much more to say about it. +15% during 5 years of bull market… next!

Equity Global

Second one is an actively managed global stocks fund (57% US, 35% stocks ex-US, 1% bonds, 7% other), with a ridiculous 1.51% TER and these performances since march 2016:

“Well, it seems not too bad!”

Really? It up by 18.9% since inception… while the market has gone up like crazy.

Morningstar doesn’t show a benchmark, so I have to make one up. The closest benchmark I can think of is Vanguard VT, the best global stocks fund. Let’s see how it performed during the same time frame:

It’s up by 60.64% before dividends. But this is in USD, and USD sadly lost quite a bit compared to CHF during last 5 years. VT performance measured in CHF since March 2016 is only +48.8% plus dividends.

Oh, I forgot to mention that the crappy active fund is supposed to be “distributing” but I can’t find documentation about distributions anywhere. And all the websites (swisslife itself, swissfunddata) show the same performances that I’ve shown. I suspect these are the performances including the distributions…

Plus, I think currency hedging for a global stocks fund is inefficient. The global market in a globalized world is already self hedging against every currency simply because companies earn profits in all the major currencies. If your reference currency skyrockets, the profits that the global companies make in your currency boost their stock price. Ok, Switzerland is small enough that the CHF strengthening won’t visibly boost global companies revenues. On the other hand a dropping USD or EUR will have a more visible counteracting effect on stock prices – like we’re experiencing in Q3 and Q4 2020. Currency hedging is inefficient and expensive for stocks.

Bond Global

Third fund is an actively managed global bonds fund, with 1.11% TER which is incredibly performing not as bad as the other two.

Anyway, the gold era of long maturity bonds performing amazingly while interest rate dropped is over now, good luck performing better than its own cost from now on!

Conclusions

One of the Advisor’s selling points that I forgot to mention was that “with solution like VIAC, or Finpension, or even PostFinance Pension75/100 you’re too much exposed to market risk, i.e. you might lose money… with this Policy 3A solution we can customize the offer to match your risk tolerance and protect your principal!”

Yeah, I see. And I’m of course better off with your crappy funds, high fees, high TERs, and an inefficient Life Insurance!

But she’s right. Volatility will be lower if I invested in this crappy Policy instead of a global stocks portfolio within a normal Pension fund like those mentioned above: I’d be losing my money on a predictable trajectory 😀

To sum everything up, this offer is particularly crappy, but in general you should never sign a Policy Based Pillar 3A (or worse, a Pillar 3B).

A Pillar 3A with a Bank or a Pension Fund (VIAC, Finpension, Frankly,…) is the way to go.

You have the freedom to fund your pension when and how much (with a capped tax advantage) you want. You can stop contributing if you want. And nobody is going to slash your asset after “14 days of delay”.

You have the freedom to move your savings out at anytime, with no extra fees (except usually for home purchase). You can catch a better opportunity offered by a different Pillar 3A provider and put your original contributions on hold, or reduce them, or split the total amount by the several providers you have an account with.

You have the freedom to pick an investing strategy with transparent fees, and no subscription fees.

You have the freedom to open up to 5 different Pillar 3A accounts to save lump sum tax on withdraw.

You won’t have to give your private and sensitive medical data to these guys, and their marketing partners.

You won’t have to fill a Health form naming every single doctor you visited during the last 5 years, and have your insurance claim rejected had you mistakenly filled the form in an imperfect way.

Instead, by opening a Pillar 3A account with a Bank or a Pension Fund you’ll have all your contributions working toward your investing and retirement goals, with nobody taking a cut for a crappy life insurance. Every Rappen you put in is a Rappen you see in your account balance.

And you can always pick a Life Insurance on the market, at a cheaper and more transparent price.

The Advisor

I’ve of course declined this offer as well.

On our third and final meeting, after having asked a few clarifying questions I told The Advisor that this solution was inferior to my current one for the following N reasons: blah blah blah (see above).

She listened to me, and probably acknowledged that I wasn’t a catchable prey. Why wasting time with me when the world outside is full of lower hanging fruits?

I don’t know how she found the courage to ask me for a recommendation to my circle of friends and acquaintance (which I didn’t forward), but that was the end of it.

I didn’t hear from them again (yet).

That’s all for this series, I hope you enjoyed it.

Have a great day and a merry 2020 Christmas! 🙂

Hi RIP, great work and important message to all the high-earning youngsters out there, expat or not. I signed up a similar life insurance plus pillar 3 savings product in 1998 and got the surrender amount prematurely after 10 years. Like you mention, I lost a shitload of money and they (Generali) even charged me a fee for monthly payments (as they had more effort with it, obviously…). Never did someone mention that it would be cheaper to pay them annually. I documented everything here (http://schweizer.pm/lv/) and hope this will deter the last of you to buy such a product. Very dishonest insurance industry and dearly in need of more regulatory oversight.

There is enough prey, don’t worry. It must have something to do with the indoctrination happening in the western school system where children are taught about how important is to have insurance(s). Health insurance, travel insurance, accident insurance, house insurance, car insurance, liability insurance, life insurance, you name it.

You buy the illusion of safety and in exchange you accept to stay poor. Money that could be used to build wealth is spent on something which doesn’t exist. Even “educated” people with phd or mba do it. You tell them it’s a scam and they look at you as you were crazy – “but everybody does it. so it must be good”.

imho insurance caters to poor people. additionally it helps them to stay poor by taking their money. once you have money you won’t find a reason to buy insurance. if something happens, you just pay. a high earner who accumulated some wealth won’t buy insurance. a high earner with little no wealth might fall into insurance trap. but there is a reason why he has no wealth/he is poor. For the same reason he buys insurance. for sure, this won’t be taught in any class.

Hi Ramos, I share 95% of your opinion about insurances.

Insurances – when you can afford the worst case – are inefficient, even if they worked as intended. Add to that that you’ll have a hard time with your worst case claim when you really need it…

I’m anti-insurance by nature, but after a discussion with my dear Mr. VCF one can see insurances as bonds: you accept a negative return, but you get zero volatility (in theory… in practice we have the same “good luck with your 1M CHF claim” problem above).

If you look at them this way it might make sense to get some kind of insurances. Do you want X expected costs a distribution between 0 and 10M CHF, or you want X+5% costs guaranteed?

Not a trivia answer 😉

Ouch, it hurts… I’ll give visibility to your page.

Thanks for your contribution, and I’m sorry to hear you lost a lot of money (24k if I understood correctly)

Merry Christmas, MrRip and MrRip’s community!

Thank youuuu a bit late though!

So…happy new year 😀

Great post MrRip, waiting for the finpension one.

Buon Natale 🙂

I hope I satisfied your hunger 🙂

Buon 2021!

Dear RIP. Really nice peace of writing once again!

Though, I have a counter argument for life insurances like the one you where offered.

Yes I am biased. I work for an insurance company. Though neither in as a sales agent nor in the life insurance part of the company.

But I have thought a couple of times about these products. You are completely right with your article, that there are a lot better ways to invest money than buying such a product.

I also had some exchange with people working there and the counter arguments I find to hold are the following two:

The whole system helps people to follow a savings plan that would otherwise not do any savings.

Obviously any saving plan is better than no savings plan. Most people know that they should save but don’t do it. A gentle push from this kind of financial consultants or insurance sales agents makes these people start saving. Also most people lack the discipline for long term saving. An insurance policy for 30 years forces them to do this saving. So for many people this kind of products are a very good thing because the alternative is not a “better kind of long term savings plan” but no savings at all.

The insurance products are not worse if compared with equivalent bank products.

But here you have to carefully define “equivalent bank products”. An equivalent Bank product to the offered insurance policy would be some kind of fond from a big bank (UBS, CS) with a cost of 1.5% p.a. If my simulation is correct if you invest 6’826 for 22 Years with a performance of 5.75% and costs of 1.5% you get less than the aprox. 256000 the life insurance is offering. And you get additionally the death insurance (which has some value for the years that your investments are less than the insured amount).

For people like you and probably all the readers of your blog, they are definitely not good enough. Exactly as you described them.

But you and probably more of your readers are people who take their financials seriously, plan ahead, invest time and energy to this topic and take responsibility for their finances.

My experience is, that most people are not like that. They know they should save, but if nobody knocks at their door and pushes them to do so, or if the process during the investing period is not super easy and binding they either will not start or will not keep up investing. For this kind of people these products are good because the alternative is not an optimized “RIP-Portfolio” but just no savings at all. Of course this comes with a cost. Something like 1.5%. Exactly like every super easy solution from a big financial institution where you don’t have to do anything than sign the paper and pay the annual bill…

Please don’t understand me wrong. These products are by far not the best solution. Nor am I trying to defend them.

I’m just trying to short this out for me and understand if these arguments hold or if I’m biased myself because I work there…

I am not sure I understand your line of argumentation here. Sure, some people dont save at all however I doubt that anyone is doing any service by offering these crappy products. There are numerous case in CH where people actually lost.money from these 3a insurance schemes… Especially when actively pitched by a financial “advisor” who is getting a fat commission from the insurance company. We would simply speak for a very bad product if Mr. RIP has not pointed out that in case of death you are getting only the life insurance and not life insurance AND accumulated capital! This is an outright scam and I am amazed that FINMA has allowed these kind of structures. I get that you may want to justify your industry (we all do) however there are several insurance products that are very helpful and make sense so there is no need to try and justify scam products.

These products caters to private persons not to banks. The banks are on the sell side here and making a healthy profit (commissions, kickbacks, risk hedging). So nothing to do for finma, as finma is working for banks by taking care of them. Finma is similar to HR in a company. Many people go to HR to complain about their bosses/the company only to find out that HR is working for the employer and not for them. The same for finma. As long as the banks take advantage and their is no disturbing noise, finma is going to stay put.

“The whole system helps people to follow a savings plan that would otherwise not do any savings”

This is a fair point.

“Obviously any saving plan is better than no savings plan.”

This is not true. Well, of course it’s “literally true” if we talk about savings, but we’re talking about investing here. problem is that nobody would buy an overpriced insurance without a false expectation of 5% returns on the “saving” part. Nobody would buy an overpriced insurance with extra 6k per year of “blocked money” you’ll pay a huge ransom to get back.

So insurance companies sell crappy products exploiting ignorance.

Why is this not happening anymore among non-insurance Pillar 3As? Why are Frankly, Vic, Selma, Finpension fighting with incredible benefits for the entire market?

Why can’t insurance companies join venture with roboadvisor low cost Pillar 3As and add on top their crappy insurances instead of selling me active funds with 1.5% TER?

I know why: because their business model is based on exploiting ignorance, and it’s closer to an MLM than to a real company with real products on the market

Hi, in the first bullet point of the Sales Pitch, You need a Life Insurance!, you write that your current policy includes a of 90k CHF/month, it should probably read /year. I guess otherwise you would at risk 😉

Haha thanks, fixed!

I’ll let my daughter taste the food first at dinner time 😀

I was writing a long answer… But as I told I’m not tryiing to defend the insurances.

I keep comming to the point, that people should not buy financial products they don’t understand. If they do and especially if the “financial advisor” offers his service for free then they defentelly don’t have the best solution and could potentially loose money.

But still I’m not sure that most people that have bought these products would be better off, if the whole industry would not exist. If they didn’t had the pich, would they start at some point to save themselves and get a low cost VIAC 3a or would they just consume 6’000 more each year?

How lucky we are that the scammers exists. Why should people keep their money and make use of them? It’s better to hand them over to the sharkies.

“People should not invest in products they don’t understand”

AND

“Those who understand Policy Pillar 3A will classify them crappy, borderline scam”

==>

“Nobody should ever invest in Policy Pillar 3A and this industry should not exist”

Do you think those people who you’re not sure they would be better off without this industry and “would they open a VIAC account or spend extra 6k per year” understand the policy 3A they signed?

The biggest problem with these products is that they are illiquid. There is no market for them. You recognised the problem when you said they are hard to price. An existing market would price them for you. That’s why no sane people buy them and it needs special trained scammers to get rid of them.

It’s not very hard to price these products… maybe you’re confusing my posts 🙂

I said it’s hard to price a Structured Note (but it was the previous post)

Thank you for this series! You have a real gift for writing entertainingly about this stuff. You would probably make a great podcaster.

I almost got scammed with a similar offer a few years after arriving in Switzerland, and I definitely agree that immigrants make an attractive target for the insurance industry. I was clueless at the time and might have taken the offer had I not been instinctively repulsed by my “advisor’s” smarminess. So glad I dodged that bullet and signed up with VIAC instead after learning a bit about personal finance.

Thank youuuu I’d love to start a podcast, but I don’t think I have room for it in 2021 🙂

It’s a project I’ll keep procrastinating for another year 😀

I also dodged a bullet on my second week in Switzerland, and it was a policy pillar 3A. It seemed very stupid to me even though I knew not much about Pillars, insurances, Switzerland… just math. and a binding contract for the next 30 years with a final guaranteed capital lower than the sum of premiums seemed so scammy… let alone the “financial soundness” of the Santo Domingo lady with south Italian husband who wanted to sell that crap to me 😀

As they make a lot of money, the insurance could afford to spend a lot on marketing.

Things are changing as banks are more aggressive with their ads. The ads campaign from Frankly was/is pretty big.

It’s the closest thing to an MLM I can think of. At scale.

To be honest – unless you are near a cashing out opportunity (retirement, house purchase, leaving CH) (with the definition of “near” depending on your marginal tax rate), I wouldn’t buy 3a at all.

For your average person 20 or 30 years from retirement, you would probably be better putting it in a high performing fund, and recouping that tax “loss”.

Switzerland – why o why is it that for a completely optional savings we aren’t allowed to buy any stocks we see fit. I don’t understand this at all.

No. I brutally disagree.

With a 3a you get exposure to Global Stocks (say Vanguard VT) with a small extra fee that is compensated by no taxes on wealth and dividends. Plus an instant bonus of up to 35% of saved taxes.

What are you recommending as an alternative?

RIIIIIP Ho bisogno del tuo aiuto!

Interessandomi alle finanze dei miei genitori, ho scoperto che mia madre, frontaliera ha sottoscritto nel passato uno schifosissimo 3b assicurativo. Come posso levarglielo o qual’è la migliore soluzione in questo caso.

l’ha sottoscritto nel 2015 e finirà nel 2033 a l’éta di 64 anni.

Grazie mille dell’aiuto.

Eh, dipende. Sei sicuro che non valga la pena aspettare che arrivi a maturazione? Mancano 12 anni… fatti calcolare il surrender value e fai i tuoi conti, di più non so dirti.

Hi Mr Rip,

Thank you for this last detailed post on your meetings with this financial “advisor”. My girlfriend and I had Pillar 3A with insurance companies… until I made the computations, summarized below.

— La Mobilière:

Only 90.7% of the bills I was paying was effectively going to be invested. 38% in Swiss bonds, 7% in Foreign bonds, 9% in equity, 11% in real estate, and the rest (35%) was in “cash and other investments”.

2.9% to cover administrative costs

2.7% to cover commission/selling expenses

3.6% to cover “invalidity risk” (=the insurance would pay the yearly bills of the policy if I become invalid, there is no rent or lump sum payment in case of invalidity)

–> La Mobilière was actually not that bad compared to what I discovered with Zurich Insurance. At least they were responsive when I asked questions, and there was no difficulty to go into details to make the computations.

— Zurich Insurance:

During the first 3 years, only 19.6% of the bills was effectively being “invested”. (There is no typo, 19.6% is the effective amount)

12.7% to cover administrative costs

63.6% to cover commission/selling expenses

3.5% to cover “invalidity risk” (same as above)

0.7% to cover death risk (very small capital in case of death, same as yours: not on top of investments).

After 3 full years, 86.5% of the bills was effectively being “invested”. There was no need to cover commission/selling expenses anymore since she was already ripped off. Last joke regarding the “investments”: after 4 years, 95% was still in cash, and 5% invested in a leveraged (3x) certificate on SMI index.

Through the years, I bet they would aggressively allocate a larger portion to the leveraged certificate and hope that the high risk would reward and make forget that the whole contract was totally crappy. It cost my girlfriend 4-digits amount or around 50-60% of the paid amount to break this contract and that’s what she did… the loss was a sunk cost anyway and paying 12.7% administrative costs for the next 30 years would have been silly.

After the first letter to complain, the answer was “you know, markets are tough since the financial crisis”. After the second letter where I was comparing the performance of the SMI with the return of their shitty product, the answer was more expeditive: “our fees are approved by FINMA”.

It’s a pitty that these complex products are not subject to fair and transparent disclosure requirements before signing a contract ! It requires many hours of analysis to come out with the real cost of such product and 99% of us are not willing / not able to do it.

Oh shit, this is really bad.

You know, I’m helping a director of a Swiss Television show on exactly this topic, and in month we’re going to declare war to policy-linked Pillar 3As on TV. He and his wife have similar contracts, where for the first 3-4 years 0% goes toward investments, then they have “projections” (good, normal, bad) for future returns and so far they’re lagging behind their “bad” scenario even though we’re experiencing a long bull market.

They should go extinct.

Good on you, I fully support the fight. When I exited such a solution in 2008, I was particularly dismayed to see that I had been punished with a fee of 6% for paying monthly installments instead of yearly! This alone would destroy any investment returns. More transparency will be a good thing! See here, in case TV guy can use old example: http://schweizer.pm/lv/

I would be happy to contribute, feel free to contact me if you want.

I had earlier this year a discussion with a friend who contracted a policy-linked Pillar 3a two years ago for CHF 3’000 per year. After these two years, he would not get a cent back if he stops the contract now… it’s very very difficult to make people realize that those CHF 6’000 are a sunk cost and that the best advice is to realize the loss. It sounds very counter-intuitive !

Is this “comment box” working ? Have you received my very long comment that I have not saved before clicking on “post comment” ?

Hi An4log, I’ve received a long comment on a different post (part 2) and I approved it. It’s visible.

I don’t know if I have time to address it, since it would require a lot of analysis, but I think it’s a valid comment and a nice testimony of a use case for Structured Notes that’s working for you 🙂

no wait, I see a comment in the SPAM folder and it’s yours. Unspamming and approving now.

Hi there Mr. RIP and Mrs. RIP,

Thanks a lot for this post. Unforthnately, I read it 2 years too late. I myself was caught as a pray of this sharks and signed up for a 3rd Pillar A with SwissLife.

Of course, the person who sold it to me was very nice and was definitely looking out for myself (ejem ejem….).

Now, I want to quit. And I believe it is better to do it than later (I do lose a 4 digits number but I will lose more if I do it in the following years). My question is: is there any way to do this in a smart way? Any way there that I get more money than the surrender value? Please let me know, it is so hard to realized that you have been part of a scam when you felt it was the first steps to have your life in Switzerland…

Thanks a lot for your blog, always helpful!

Best,

Mireia

You are doing it again by asking someone else for financial advice. The only smart way is to learn to use your head, google is your best friend. Otherwise you are going to be easy prey for the hungry roaming masses of marketeers.

If you see someone wearing a tie, just run away. Beware some are quite skilled. I was looking to buy a sofa today (not really to buy, just to get some information) and the guy was trying to sell me a very expensive product. He used all the tricks in the book: being pleasant, lying to me – ” I have the same sofa at home”, “Swiss quality”, ” support for 10 years”.

Dear RIP, we recently moved to Switzerland and got contacted through linkedin by a personal advisor. After some interactions we sent him a link to your article and this was his reply (with some underlined keywords for added drama):

“Thank you for emailing me with this blog information.

I have to say that I am disappointed after spending time with you over the previous weeks- during which I helped you to understand the system we are part of and the things that I could have done with you in the future – that you don’t want to spend 15 minutes with me to allow me to respond to the information you have read online.

I was looking forward to taking you through the inaccuracies in the article written by an individual with limited knowledge.

I assume you dug deeper into the articles and didn’t just leave it there. If you have, you will have found that this author looks to write emotive articles. As a qualified adviser, it is a terrifying notion that an individual can have such a strong influence about a random alleged interaction.

As you would have seen through my LinkedIn, I have 35 personal reviews about my service and my advice written by people who have experienced this firsthand. These recommendations come from clients in a variety of industries and include Senior professionals in their fields.

I can assure you article is not representative of myself or xxxxxx.

Bearing this in mind I acknowledge your response and wish you a good day.”

We told him that he was free to write down a list of inaccuracies, but never got a reply… I think we dodged a bullet there.

it looks like a ChatGPT canned response 😀

Well done. Looking forward to listening about my “inaccuracies” while they scam customers in the worst legalized financial scam industry in Switzerland, the one of Insurance Policy Pillar 3A

Ciao MrRIP, spero tutto bene!

Innanzitutto mitico per il blog il servizio ed i post sul III pilastro, sono fatti molto bene con informazioni stra utili!! Io nell’ottica di diversificare stavo iniziando a dare un occhio per un III Pilastro, ho subito sentito puzza di cose poco chiare ed é così che facendo ricerche sono imbattuto nei tuoi canali.

Avrei alcune domande risorte ma dovrei ancora fare chiarezza. Stavo anch’io da parte mia provando a fare alcuni fogli di calcolo su Excel per ritrovare le cifre, un casino… Ti ringrazio dunque per le spiegazioni e il tuo foglio di calcolo messo a disposizione:)

Magari banalmente ma mi permetto inizialmente di chiederti perché nel tuo foglio le percentuali di rendimento dei 3 scenari (+2%, +4%, +5,75%) sono divisi di 1/2 nella prima linea di calcolo ‘anno 2021’ i quali si sommano come contributo annuo anno per anno?

Nel tuo caso mi è sembrato di capire che nella proposta cera l’assicurazione che ti garantiva al momento della pensione almeno (132’875 CHF) ed allo stesso tempo garantiscono in caso di decesso prima della pensione la medesima cifra. Questo è garantito grazie all’assicurazione sulla vita la quale quota sei riuscito ad approssimarla a 12,25% del contributo versato corretto?

(chiedo anche questo perché ci sono offerte in cui un capitale garantito non c’é ne in caso di vita ne in caso di decesso, ma ce ”il capitale corrisponde tuttavia almeno al valore delle quote del fondo a tale data” in questo caso non ci sarebbe un assicurazione su nulla, pago l’assicurazione solo in caso d’incapacità di guadagno..?!)

Infine mi permetto di chiederti in merito hai TER (costi di gestione dei fondi). Hai trovato una “commissione all’acquisto” dell’1%” la quale hai tolto dai costi assicurativi sulla vita e aggiunto nella prima linea (anno 2021) del foglio di calcolo, il quale si somma come contributo annuo. Le TER non hanno niente a che vedere con questo 1% di costi d’acquisto? Non capisco bene dove intervengano i costi in un fondo d’investimento attivo ese quest’ultimi sono i TER.

Ti ringrazio anticipatamente per il tuo tempo