Table of Contents

Hi RIP readers,

Here’s a quick 2020 Q2 (April, May, June) Financial Update. I plan to keep it “short”.

April has been covered in a previous confused post, so this is essentially a May-June 2020 update.

I think you should know by now, but let me repeat: I keep my main financial spreadsheet public. Feel free to copy it, adapt and use it for your personal (or professional) purpose, take inspiration from formulas and concepts, and feel free to ask questions via commenting on the spreadsheet.

But please do not delete or mark my comments as resolved. Google sheets don’t allow to just ban a few users, so if someone acts like a dick (and someone recently did, resolving 19 of my comments…) I will be forced to make comments private. I think there’s a lot of value in the comments, so let’s not act like dicks.

Thanks 🙂

Net Worth

NW (in EUR): 1.242M (Delta: +101k), one of the best quarter on record, second only to Q1 2019.

In both last quarter and Q1 2019 we experienced a V-shaped recovery after a bad previous quarter. But last quarter performance was even more remarkable because I didn’t work in Q2 2020 (quit Hooli on March 31st), and EUR has been the strongest currency during Q2 2020, while it was the weakest in Q1 2019. A strong EUR makes it hard to get a NW bump in EUR given that I’m mostly exposed to USD and CHF.

Anyway… wow! The good old “million” is very very far in the rear-view mirror now 🙂

NW Delta in April has been crazy, and it’s better than I documented in my April 2020 Update because I recently (early July) received unemployment insurance money for April and May. I wasn’t accounting for April money. Pessimistic as usual.

Investing-wise, having caught the falling knife between February 19th and March 24th seemed to have been a bless for now. Very good.

Here’s historical Net Worth since 1991 (LOL):

As you can see, the Coronavirus crash left an almost insignificant dent in our Net Worth, thanks to my underexposure in stocks (always between 25% and 50% since November 2019), and a very good cash flow.

I’m aware the recession just started, and the stock market might experience a lot of volatility for the rest of the year and probably the following one but… you know what? This is always the case! I’m an efficientist, I believe in the Efficient Market Hypothesis, and I think today’s high valuations are completely rational. They’re just consequence of current monetary policies, which are destroying bonds returns and forcing investors to accept lower Earning Yields, i.e. high P/E ratios. Take a look at these 3 posts by Ben Carlson. Maybe CAPEs of 30, 40, or even 50 will be the new normal, and stocks could still go up a lot, even in this recession scenario. At least until “cash is thrash” Ray Dalio prophecy plays out. Ridiculously high public national debts, ridiculously low – when not negative – interest rates, central banks printing money all the time, almost no inflation… I bet we’ll have some problem in the mid term. The entire fiat money system will have problems. I don’t know how to edge against that though. And no, don’t say crypto or Gold, please…

Ok, I promised to keep this short. Back on track.

Cash Flow – Income

Total estimated Net Income (after tax and Pillar 1 contribution) for the quarter is: 33.1k CHF. The worst quarter since I moved to Switzerland. But it’s not bad after all, it’s 11k per month! And we managed to save a huge chunk of it 🙂

Estimated Net Income (after tax) by month:

- April: 10.4k CHF. Unemployment Insurance for me (with 5 days waiting period, 17 days paid out) and for Mrs RIP, March 2020 Hooli SRE bonus, and some dividends. Not bad.

- May: 9.7k CHF. Unemployment Insurance for me and for Mrs RIP (21 days paid out), and some dividends.

- June: 12.9k CHF. Unemployment Insurance for me and for Mrs RIP (22 days paid out), and a lot of dividends. It’s been all time high dividends income month.

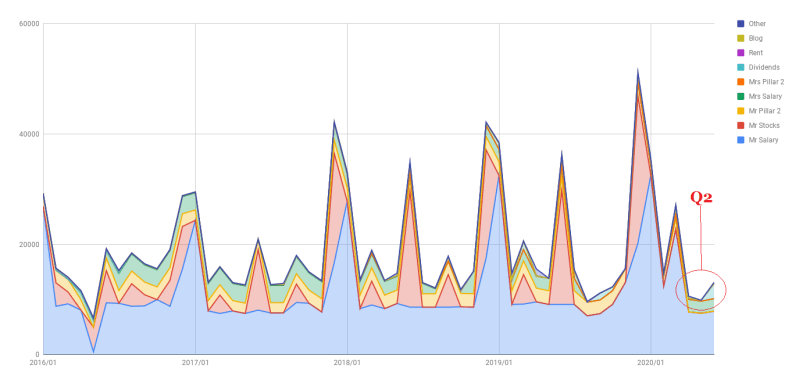

Income history and breakdowns:

Yeah, I think I should say goodbye to those June, December and January funny “spikes” in the 30-50k territory. A flat income will be the new normal for our household 🙁

Maybe dividends will provide some quarterly spikes though. But we know that they’re just an accounting trick and don’t matter in the long term.

But just for fun, here’s my June record dividends payouts:

The censored security is one of the three individual stocks I played with during April and May.

Cash Flow – Expenses

Here‘s a link to our expenses sheet.

April “below 5k” has been memorable thanks to Coronavirus lockdown, and I’d say May and June have been pretty good as well. Yes, May went above the 6k psychological bar, but that’s because we purchased some furniture for the new apartment that we procrastinated on for months (also thanks to the lockdown). Not counting for them, it would have been another 5.5k month. I can see that we can sustain a 6k CHF/Month expense level pretty well.

But…

Child care costs are going to bump up in October, when BabyRIP will go to KinderKrippe 3 times per week instead of 2, i.e. 1386 CHF/Mo instead of 924 CHF/Mo. We think she needs it, especially to have enough exposure to (Swiss) German. What relieves me a bit is that childcare is a temporary expense. In 2 years Baby will go to Kindergarten, which is free… unless we have a second child, which would make our costs explode in unpredictable ways. Let’s be honest, I have no idea. Those who plan to leanFIRE with 300k at age 29 have no fucking idea what life looks like.

Few considerations after taking a look at our quarterly expenses:

- Grocery spending baseline is now 750-800 CHF/Mo. It’s increasing. It used to be 500-600.

- We didn’t go out much, and we don’t miss it. Ok, spoiler, July seems to contradict this so far.

- We didn’t take many public transportation, and we don’t miss it. Our future in terms of work will require less public transport than we used to. Good.

- On day 3 of each month our expenses are already 4100 CHF (2315 Rent, 700 health insurances, 925 Childcare, 100 Internet and TV, 50 Electricity, (coming soon) 50 Phone). Add to that the ~800 CHF of grocery spending and we’re close to 5k. On most months we spend very little outside those fixed costs. Which is good, but it’s also ridiculous how high our fixed costs are.

Expenses highlights in Q2

- (April) 663 CHF suspect Asthma visit bill for me, back in January. I already documented it in my last update.

(May) 500 CHF for a new (used) leather bed. Mrs is addicted to Facebook Marketplace, and she loves to find high quality stuff sold at bargain price. We bought an amazing (used) design leather sofa for 1.1k CHF. I love it, really. Same model but new it would have costed us 7-8k. This time we bought a leather king size bed, with mattress included, for 500 CHF. I didn’t negotiate down, my fault! In Switzerland people buy everything new. The used market is amazing, you can find almost new stuff sold for ridiculously low prices. And our new bed is really beautiful 🙂 Mrs was actually even able to sell our old bed for 100 CHF. A bed I got from the previous tenant of my old small flat almost for free 7.5 years ago. I gave him 300 CHF for all his furniture, which included two tables, 8 chairs, 2 couches, 2 bed, a large Ikea Pax wardrobe, several bookshelves, lamps…

(May) 500 CHF for a new (used) leather bed. Mrs is addicted to Facebook Marketplace, and she loves to find high quality stuff sold at bargain price. We bought an amazing (used) design leather sofa for 1.1k CHF. I love it, really. Same model but new it would have costed us 7-8k. This time we bought a leather king size bed, with mattress included, for 500 CHF. I didn’t negotiate down, my fault! In Switzerland people buy everything new. The used market is amazing, you can find almost new stuff sold for ridiculously low prices. And our new bed is really beautiful 🙂 Mrs was actually even able to sell our old bed for 100 CHF. A bed I got from the previous tenant of my old small flat almost for free 7.5 years ago. I gave him 300 CHF for all his furniture, which included two tables, 8 chairs, 2 couches, 2 bed, a large Ikea Pax wardrobe, several bookshelves, lamps… (May) 400 CHF for 3 lamps. Ok, Mrs RIP was unmovable on this. We made a “move” spreadsheet with budgeted expenses and actual expenses. Since she made us “save” a lot of money buying used and selling our old stuff, she demanded to buy a design Lamp for the living room and two good looking lamps for our shared spaces and corridors. Fair enough. We purchased a large Kartell FLY Lamp (pink color) online from Pfister, using a couple of coupons, for ~200 CHF, and two other lamps for another 200 CHF. Not bad, I like the lamps. But in my studio I mounted one I got for free 😀

(May) 400 CHF for 3 lamps. Ok, Mrs RIP was unmovable on this. We made a “move” spreadsheet with budgeted expenses and actual expenses. Since she made us “save” a lot of money buying used and selling our old stuff, she demanded to buy a design Lamp for the living room and two good looking lamps for our shared spaces and corridors. Fair enough. We purchased a large Kartell FLY Lamp (pink color) online from Pfister, using a couple of coupons, for ~200 CHF, and two other lamps for another 200 CHF. Not bad, I like the lamps. But in my studio I mounted one I got for free 😀 (May) 135 CHF for a “Baby Books and Jigsaw Puzzles” frenzy on Amazon. Baby is showing a passion for jigsaw puzzles and I bought something like 10 of them. 12 to 36 pieces, recommended for ages between 3 and 5. Baby is 2yo but can handle the 3 and 4 years old recommended puzzles. Plus books. A neighbor gave us the Frühlings-Wimmelbuch (by Rotraut Susanne Berners) as a gift for our daughter and we were all sucked in with the amazingness of it. It’s a picture book of a daily journey in the imaginary city of Wimmlingen, with its characters and stories. Amazing pictures and a lot of imagination at play. I couldn’t resist… I bought 4 books from the same author on the same subject! And now that I’m writing this post I’ve just switched to amazon and purchased 2 more books. Baby loves the books, and always asks me to “read” them. I found many connections between characters, and hidden gems. I think it has infinite “replay value”, since the graphic is incredibly detailed, and characters connect one another over the four seasons. Plus I make stories and names up! I – seriously – took some time to research and answer weird questions about the Wimmlingers: What the hell is wrong with Oskar? Are Yvonne and Daniela dating? Is Tom Susanne’s boyfriend? Does Lenzo secretly hate Manfred? Amazing!

(May) 135 CHF for a “Baby Books and Jigsaw Puzzles” frenzy on Amazon. Baby is showing a passion for jigsaw puzzles and I bought something like 10 of them. 12 to 36 pieces, recommended for ages between 3 and 5. Baby is 2yo but can handle the 3 and 4 years old recommended puzzles. Plus books. A neighbor gave us the Frühlings-Wimmelbuch (by Rotraut Susanne Berners) as a gift for our daughter and we were all sucked in with the amazingness of it. It’s a picture book of a daily journey in the imaginary city of Wimmlingen, with its characters and stories. Amazing pictures and a lot of imagination at play. I couldn’t resist… I bought 4 books from the same author on the same subject! And now that I’m writing this post I’ve just switched to amazon and purchased 2 more books. Baby loves the books, and always asks me to “read” them. I found many connections between characters, and hidden gems. I think it has infinite “replay value”, since the graphic is incredibly detailed, and characters connect one another over the four seasons. Plus I make stories and names up! I – seriously – took some time to research and answer weird questions about the Wimmlingers: What the hell is wrong with Oskar? Are Yvonne and Daniela dating? Is Tom Susanne’s boyfriend? Does Lenzo secretly hate Manfred? Amazing!- (June) 300 CHF for… nothing… “cmon, RIP, tell them what you did!” ok, fine. I paid a handyman to come to our place and mount a lot of furniture, including the lamps, the bed, and few leftovers from the move back in November. This guy spent 5 hours and fixed all our problems. It would have took me 2 full days and a lot of curse words. I know, this is completely anti-ERE. Jacob Lund Fisker would yell at me. But I’m not sure I won’t call this guy back again if I need to.

- (June) 130 EUR for my father’s flights ticket from Rome. He’s coming visiting us in July.

- (June) 80 CHF for swimming pool 12 entries ticket. Yeah, goodbye lockdown (for now), life is back to normal!

Cash Flow – Savings

Total Savings for Q2: 16.0k CHF. Saving rate 48.2%.

Not bad, not bad at all! Almost 50% savings, while not working 🙂

Absolute numbers are a bit less impressive than what we used to save in the recent past, but still… it’s more than 5k per month!

Mr Market

As you can see, the Jan-Feb-Mar columns are all red (except for US bonds BSV and BND), while the Apr-May-Jun columns are all green. It’s been a very good quarter, even though in absolute terms most of the ETFs I own are still in the red for 2020. That doesn’t include dividends though.

World, as a whole (Vanguard VT), is just 7.5% below 2019 December 31st valuation (excluding divdends).

Emerging Markets recovered very fast from March 23rd bottom, luckily for me because I overweighted my portfolio with EIMI. It’s still 10% below end of 2019 value though.

High Yield Dividends (VYM and VYMI) are sucking asses, especially the “international” (non US) one. Since I started investing, in early 2016, all the “high dividend” investments I’ve done resulted to be shitty. I lost money with VHYD, and I’m losing money with VYM and VYMI. Same story for the high yield bonds. IEML (Emerging Markets Government) is a sucker, and I managed to sell all my WING (Fallen Angels Corporate) shares as soon as I broke even. Sadly their price gained another 4% since then. I’m learning the hard way that chasing high dividends is very inefficient.

As you can see there are a couple of new entries here: VBR (US Small Cap value stocks), and BND (investment-grade U.S. dollar-denominated bond market. 60% government, 40% corporate).

VBR lost a lot during the crash, and recovered like crazy soon after (link). It’s still 22% below EOY 2019 value, but historically small cap value stocks led recoveries from previous recessions. When I jumped in, they were already up something like 90% from the bottom. Did I join the party too late? We’ll see. Factor investing for the win!

BND is there just to park the “lot of cash” I had on IB. I don’t plan to hold on it for long, just to earn some money while the USD depreciates…

Investments – Analysis

It’s been a very good quarter!

As we saw, all the assets surged up in price, and we benefited from it.

Few things to be noticed:

<

ul>

Overall, our Asset Allocation looks like this:

Target is 60% stocks, 40% bonds and a 100k EUR emergency fund.

Currently we are 50k over-invested in cash and bonds, and 100k under-invested in stocks. Erring on the conservative side of an already conservative investing strategy. Probably inefficient, but I also need to come to terms with my risk appetite. At this size, daily swings of 5 digits are becoming uncomfortable again. I don’t want to chicken out again like I did last November. But I still need to take some risk if I want to sooner or later be able to live off our investments.

Plus, the 100k cash cushion was a conservative measure assuming no income was being generated once I quit. Since I’m earning unemployment money, and in September I’ll be employed again, I might lower the cash cushion to something like 50k. Maybe. Not today though.

Here’s a Net Worth by Asset Class breakdown over time, both in absolute and percent values:

FIRE Metrics?

I don’t track much the FIRE metrics anymore. I believe FIRE is a Spectrum, and I could, and I should, (and I actually am) take advantage of the freedom I earned so far. If we decide to stay in Switzerland I can’t “forget about money” yet, but I can take a lower paying job – like I recently did… well… not that much “lower paying” though – or work less (50-80%), or take long sabbatical like the 5 months I’m taking off now.

Happiness and well being are at local maximum since at least 5 years, and that’s very good.

Anyway, there are still a lot of rows about FIRE Metrics in my spreadsheet but I don’t look at them anymore. Just for fun I lowered my SWR to pi: 3.14159265359…%. So I’m back to ~93% FI, assuming 3.5k EUR expenses per month in Italy, or ~50% FI according to current, real expenses in Switzerland.

Also, the StupidiFI plan I drew back in February seems a bit outdated and already declared obsolete after less than 5 months:

We’re not moving back to Italy based on the The Ravenna Threat anymore. I’ll let the baseline curves grow by 2% per year (instead of 1%), but in case I quit the new job sooner than expected we’d need to draw new plans.

We’re not moving back to Italy based on the The Ravenna Threat anymore. I’ll let the baseline curves grow by 2% per year (instead of 1%), but in case I quit the new job sooner than expected we’d need to draw new plans.

My guess is that even if in this supposedly “perfect” working scenario I can’t function as a Software Engineer (actually, Principal Research Engineer) anymore, a tombstone will have to be put on my career and I need to live with that and move on.

My pessimistic bet is that it’s really unlikely for me to function as an employee anymore. I consider myself almost unemployable. Which sounds crazy to me, but it’s probably the default mental state of every millennial, even those with less than 10% of my ‘stashed amount 😀

Time will tell.

Well, speaking about that…

I signed the new job offer!

I’ll start working again in September 2020. I think I announced it in a previous post.

I’ll be Principal Research Engineer for an Academic Institute in a neighboring country, working on Artificial Intelligence in close contact with professors, researchers, and the industry 🙂

It’s a remote position. I can work from home if I want, but I also have access to a coworking space 5km from my flat. I’m also encouraged to visit the main office (prohibitive via train, 1h via plane) on a monthly or bimonthly basis, and encouraged to go to conferences!

The salary is 200k CHF per year. Not Hooli (in 2019 I totaled 280k CHF), but holy shit who knew one could earn that much working in an academic environment!

If this job will engage me, I can see myself there for a long time. Even getting involved in teaching again. I love teaching. Let’s see. There’s enough hope to call this Dream Job #6 and add it to My Story sequence 🙂

“But RIP, Hooli was your dream jobs #4. Why this is #6? What happened to #5?”

Dream Job #5 is this Funemployment I’m enjoying right now 🙂 I’ll write a post about it.

Other Random Facts

The weather in May has been good while ultra-shitty in June, I’m spending a lot of time on my blog and I like it and blog visits are growing, Baby is getting hard to handle and very demanding but amazingly rewarding, working from home with a 2yo is a real challenge, my physical and mental health are improving a lot, I have no time for all my planned leisure activities like binge watching series (I’m so behind) and play videogames or solo boardgames, we have not enough time to meet all the social obligations we’re putting in our schedule, we love our new flat, our love for our neighborhood and neighbors is spiking up, I still use Roam a lot and not yet paid a dime because I was an early adopter in their closed beta, I’m still reading and learning a lot but I’d like to read books again, balancing inputs and outputs is hard, handling the freedom of an intentional life is hard, finding the 20% of the work that will provide 80% of the results is hard, writing is hard but I love it, understanding that what you think you want is not what you (or your body) actually want is challenging, aging is challenging, parenting is challenging, parenting 2yo kids after 40 is ultra-challenging and not necessary a good experience for everyone, I’m tempted to move my Hooli Pillar 2 money into a Vested Benefits Account with VIAC and “forget” to move it back to the new Pillar 2 provider at the new job, I still need to do tax declaration for tax year 2019 holy shit holy shit but wait I didn’t receive 2017 and 2018 final calculations yet seriously WTF, we’re flying to Rome at the end of July and if we won’t have to self quarantine once back we’ll bike on the Donauradweg starting from July 31st or August 1st probably from Donaueschingen (or Tuttlingen) without a plan to reach any specific location just taking some train back home around August 10th, I rule at Terraforming Mars be ready for a public call to action to come to my place and play, what did I say about parenting and the desire to fill my time with things like game nights and mastermind meetings? Life is too short, Seneca was wrong… but I promised to keep this post short and I’m already at 3.7k words, which means let’s call it a day 🙂

Breathe.

And this post has been designed, written, edited, and published within 24 hours, yeah!

Have a nice day!

Congrats on the new job! I’m sure you look forward in learning a lot of new things in AI and discussing with people. I’m pretty sure there will be a day-and-night difference to your previous job!

BTW, in an academic setting, 200k / year is a lot. Even for Swiss standards, let alone a “neighbouring country” :- ) See for example https://www.academics.com/guide/professorship-switzerland#subnav_salaries_as_a_professor_in_switzerland for a rough idea.

Wow, thanks for the link! I’m devouring the content on that website 🙂

Just to note that the list shows salaries for full professors, so that is actually the pinnacle of an extremely selective career. I’d wager less than 1 PhD student out of a 100 become full professors, and even then after years of trials and tribulations.

Btw, in the US star professors can earn more than the listed amount, typically at private universities (e.g. MIT, Stanford) where there is more leeway in negotiations, but those of course are quite exceptional cases. Also, on top of “regular” salaries there’s also the summer supplement by means of grants, which is probably not considered in that calculation.

Anyway, salaries of professors at US public universities are published in the open (although not always trivial to retrieve) so if one wants to compare salaries at Berkeley vs UC Davis, it’s possible.

To be fair, I’m joining an Academic Institute as a full time employee, and I’ll not be on track for a career as a professor, I guess. Never say never though.

Howdy,

I like the breakdown of dividends. It puts things in perspective.

Were you searching for a job or you got contacted?

I expressed interest on a job posting by a friend on Linkedin, and my friend contacted me… and 3 meetings later I got their initial offer. I negotiated a bit and got the final offer.

Ridiculous high fixed costs? Come on..

We pay 2800 rent + soon 3200 childcare + 900 health insurance + 900 grocery + 300 food delivery.

That is 7200 CHF and only covers the most basic stuff, really. (ignored the car which is pure luxury)

So which TV series and which Videogames did you finish in June?

3200 childcare HOLY SHIT that’s too much!

Congrats for the new job!

Very high salary for an academic institution indeed!! Is it an employee contract or a contractor? Does the fact that the employment is outside switzerland change something in your right to live in switzerland?

Enjoy your vacations!

I’m an employee, and my contract is a Swiss contract, even though the Academic Institute is not Swiss.

Evitando espressioni gergali scurrili, posso solo dire: complimenti!!! 🙂

Hai fatto, e stai facendo, un percorso notevole.

ciao – leguf

Speriamo, da dentro non lo percepisco come tale.

E’ una continua lotta tra intenzionalità e “vado dove tira il vento”.

3 mesi fa, dopo 7.5 anni, ero riuscito ad “unpluggarmi dal sistema”. Ci sono ricascato dopo neanche 3 mesi 😀

Tu dirai “ma sei cascato bene!”, e io invece mi dico “non è che non so più vivere da uomo libero?”

E’ complicato 🙂

Banalmente (e superficialmente) vorrei anche io avere i tuoi problemi 😀

Ciao – leguf

Sono consapevole di avere “bei problemi”, ma è sempre tutto relativo.

Buona parte della propensione alla “felicità” è genetica, e credo che da quel punto di vista ho rollato i dadi a cazzo di cane. 😀

Mi tocca compensare con tanta pianificazione e intenzionalità.

Well, first of all congrats on the new position.

Based on experience, academics jobs are the best bet for unemployable people like myself (the only problem being that it is extremely difficult to get permanent positions, so people live in constant anxiety and pressure to apply and relocate – but you have neither of these issues since you are largely FIRE and can work remotely).

By the way, 200k CHF is an enormous salary for academia, at least in the fields I am familiar with. I guess that a lot of money is being poured in AI now and they can afford to pay handsomely.

In general, I am aware that computer science related fields pay PhD students and postdoc significantly better than other STEM fields, simply because they have a lot of competition and would lose everyone to industry if they paid PhD student ~1000 EUR/month like some German universities do with physicists/mathematicians (a lot of PhD students in humanities do not even get stipends, try reaching FIRE while doing a PhD in philology with 0 EUR/month salary for a real challenge).

Anyway, bottom line is that to get 200-250 USD/year salary in physics you’d need to be Kip Thorne, so you got a very swell deal.

Kids out there: don’t try this at home, your academic position won’t pay you as much unless you move to Switzerland or Singapore and are in the right field.

PS: I have a quick question on your NW spreadsheet. What exactly is “Coast date” (under FIRE date)? What’s behind that formula?

PPS: Oh man, I’d love to have a regular boardgame group to play Terraforming Mars. There’s also some nice new expansions out there so it has a huge replayability value. Where do I sign to move to Switzerland now?

Btw, have you tried some asymmetric style boardgames like “Root” (excellent design btw)? I find it very interesting and engaging, my main limitation is that I don’t get to play it often enough to fully appreciate it.

PPPS: I second the comment just above. “Vorrei averli io i tuoi problemi”! 😀

I think it should be the headline of this blog, replacing the FIRE progress bar. Italian readers would understand! 😛

Hi Sidus,

as I said I’m not joining a “University”, but an Academic Institute, fully funded by a corporation.

Two of the funding directors of the academic institute are also directors of the corporation who funded the academic institute.

I don’t know yet how “academic” my job would be, even though the head of the Institute is pretty clear we’re independent and the only goal is to do scientific research. Yes, using data from the corporation, which will get some insights back I imagine.

I might contribute to some publication, I will go to conferences, but I don’t see myself becoming a tenured member of a University 🙂

200k is on par with the Industry, not the academia, for my skills and my seniority I guess.

About your Post Scriptum(s):

– Coast Date means: “when would I reach FI if I let my NW grow untouched, assuming a growth equal to my SWR?”. It means: if we take all our wealth and invest it in a tool that generates SWR% per year, and int he meantime we live paycheck to paycheck, saving rate zero, when will we be FI anyway?

– Terraforming Mars is AWESOME, I and Mr VCR are proselytizing and got another friend of us addicted. It’s a virus, and it’s spreading fast! I tried Root and I didn’t like it at all. Sincerely. It’s not about asymmetry, for example I like Terra Mystica a lot.

– LOL sossempresoldi!

Thanks Mr RIP for sharing all the wealth of information , questions about the Unemployment Insurance (RAV), I was under the impression this insurance is only given after 3 Months wait period if you quit your Job, I guess that is not true. Do you know what is the actual policy if you quit your employment ?

It’s usually the case (3 months waiting period), but given my previous year burnout I was able to reduce the waiting time to just 5 days 🙂

Thanks for the explanation, all the best on your future role.

Considering that most of your investments are in USD-based ETFs, what happens now that USD has gone downhill? If you are unemployed and have to sell your investments to live, and you’ve lost like 7/8% in 1 month due to USD/EUR or USD/CHF ratio, what do you do against this? How do you hedge this massive depreciation?

well, you can check real-time on my doc, but we’re nw delta positive even with this USD

Went to check, and noticed right now that you:

” Jul 17: chickened out again. Sold 3300 VT at 78.40 per share = 258720 USD

Realized 24360 USD :)”

It’s never bad to take profits! However, what was the rationale behind this sell and transition into bonds? (“ul 17th: purchased a shitload of Bonds with the proceeds of VT selloff. BUY 3260 BND at 88.815 = 289536 USD.”)

Does that bond sort of functions against USD depreciation?

Btw, having the comments there explaining things is a great, great functionality and idea.

… I actually double-chickened out on Wednesday as well and zeroed my VT positions (sold at 79.06).

the rationale is that I need to reassess my risk attitude with some calm, and BND is a way to Park money in the meantime…

I don’t have a concrete plan, but I think there’s too much optimism right now.

But isn’t this equivalent to “timing the market”?

Or was it just a planned rebalancing action anyway?

Yeah, I “timed the market”.

I’m not proud of it.

I’ve been lucky once, I don’t know what to hope for this time.

I don’t have a re-enter strategy for now.

Hi Mr RIP,

Follow-up question. Could you kindly do a post sometimes on your bond strategy/research? Even a quick post with bullet points (which hopefully saves you some time) would be great!

You have a large variety of bonds listed in your NW document, and it would be very interesting to understand the rationale behind them. I suspect you have researched them to great detail as usual before investing! 🙂

Specifically, why are moving so heavily on BND starting from June? You have 0 BND before June 2020, and now it’s the biggest chunk.

Also, does a euro-equivalent of BND exist? Just like VWCE is the euro-denominated equivalent of VT (usually much easier to buy for EU-based investors).

Thank you!

I will write about bonds sooner or later, I have a long draft about the math behind bond ETFs already ready.

The rationale behind the “high yield” ones is “stupidity” 🙂

The rationale behind BND and BSV is “money parking while I wait to re-enter the market”.

Not the best strategy, I agree, but I don’t feel confident in this crazy time investing much in stocks. In no parallel universe we’d be back to all time high during a recession – and the market was already very high right before the crash.

As Michael Batnick wrote last week, “If shoe shine boys are giving stock tips, then it’s time to get out of the market.”

https://theirrelevantinvestor.com/2020/07/24/why-everyones-trading/

I’m sure you know, but holding bonds long term in foreign currency is risky. This is not such a problem with stocks since a lot of profit by US companies is still made all over the world. For parking your money short term, I guess BND is fine.

That being said, I have some SHV myself and I am surprised it returned 1.2% last year. I guess we can thank the SNB for that (trying to make the CHF weak vs the USD).

Yes, it’s risky. But I don’t plan to hold long term.

And well, I assume USD is not going to become the new Zimbabwe Dollar even though it lost 6% against EUR in July 2020

Ciao,

Avresti tempo di spiegare il tuo Excell un giorno?

Onestamente e’ fatto davvero bene, ma ho problemi con certi calcoli che falliscono (funzionavano fino a ieri) ed a capire certe formule/campi per cosa sono.

So che potrei sviluppare il mio, e probabilmente lo faro’ con calma e crescendo in questo percorso di FIRE, ma vorrai anche gia’ sfruttare un excel cosi ben fatto, in modo tale da notare o migliorare certe cose immediatamente, piuttosto che tra qualche mese e non sapere come mai.

Complimenti per il nuovo lavoro, e goditi questo chomage!

è da una vita che ho in cantiere un post che spieghi il contenuto dei miei spreadsheets.. prima o poi uscirà fuori 🙂

Sarei anche interessato a capire il tuo punto di vista sulla diatriba renting vs owning … Spero tu abbia messo in cantiere anche questo topic! 🙂