Hi RIP friends,

I knew you would have noticed.

Some of you wrote me emails, some commented on random posts. One went as far as sending me a PM on facebook. It didn’t go unnoticed, that’s the beauty of transparency!

What am I talking about?

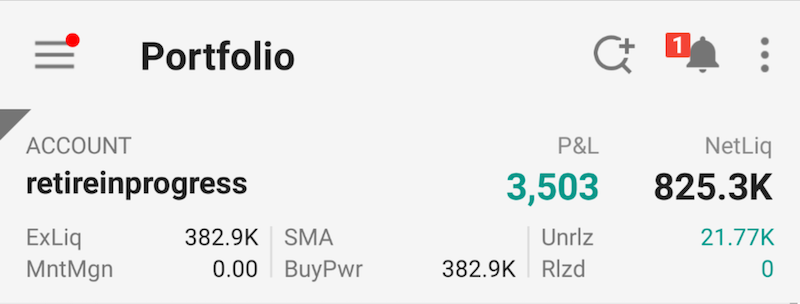

This:

Before moving on, I know many new readers are not aware I share my Net Worth document on this blog. And they have a valid reason: I don’t post a Financial update since June 2019. I plan to post a 2019 Q3 soon-ish (it’s half written), and a 2019 Q4 update in early January, so stay tuned!

Ok, back to the Elephant in the Room.

What happened to my investments in November?

I did something I’m not proud of!

But for the sake of transparency, accountability, to share my narrative and ask for feedback, here’s what happened: I chickened out!

On November 26th 2019 I sold ~320k CHF of stocks: all my VOO (S&P 500), MEUD (Europe STOXX 600), and CSPXJ (Pacific excluding Japan) shares.

Here’s my trades summary for Nov 26th:

“Oh shit, RIP, what the f**k? And you are supposed to be my financial coach?? Are you serious?”

Wait, wait! Let me explain, then I’m more than happy to kick my own ass and have you kick mine as well.

What actually happened?

November 26th, two days before Thanksgiving. The market was hitting all time high every day, since the beginning of November. Every day a positive market day. S&P500 is up 26% since January, excluding dividends…

“Wait RIP, you’re not going to tell me you wanted to TIME THE MARKET, are you?”

No. No. Definitely. No. I’m not that crazy! Definitely!

I am not timing the market…

… I am a bit!

But let me explain.

The market in 2019 has been unbelievably crazy. Best year so far in my limited investing experience. Thanks to that, our NW is up 315k EUR so far this year. I didn’t earn 315k EUR! If I hadn’t worked this year we’d still be wealthier than a year ago. That’s crazy to think about.

Anyway, like everybody I’m waiting for the inevitable since months. Every day I log into my Interactive Brokers account and check the “Daily unrealized Profit&Loss”. I tried to track my feelings while checking the balance. When the balance is up by +X I just shrug. When the balance is down by -Y I shiver. The intensity of the feelings is very asymmetric.

+5k? Uh, ok, just a regular day in the market.

-2k? HOLY SHIT THE APOCALYPSE IS COMING LET’S RUN AWAY!!

That’s called loss aversion, nothing new.

I’ve already been preparing myself for the inevitable during this crazy 2019 by gradually reducing my stocks exposure. I sold some MEUD in June and September, some VOO in July and September, some CEUS (small cap Europe) in October, some IPRP (REIT Europe) in May, and some PostFinance Pension75 (Pillar 3A, 75% invested in stocks) in April and July.

“Wait, RIP, WTF?? one of your best post is the one named I will invest when the market drops, where you said that there’s no way one can tell that there’s the ‘inevitable’ approaching… what about the efficient market hypothesis?”

I know, and I still believe the market is efficient in the long term, even though I smoothed my opinion about the matter, and let my behaviorist side (the Robert Shiller within) have a say. Anyway, I’m not here to tell you that you should do like me – in fact you should not do what I did! The exact opposite!

Or… should you?

In truth, you can’t reduce your investment strategy to just maximize “expected returns”. In my situation, loss aversion is getting stronger, and the equity risk premium has become physically taxing. I experienced pain when the market dropped. I need to place myself in a safer position in the Risk/Reward efficient frontier.

That’s something unexpected though.

In 2019 the market is up 28% (S&P 500 Total Return), with nothing bad happening during the year. Except May and August, the other 10 months have been amazing! Despite this, during the whole year I felt pain for the minor and temporary losses.

It didn’t happen during Q4 2018, when the S&P 500 lost almost 20%, getting an inch close to the formal definition of a bear market. I actually put the “documentarist hat” on, and documented what happened to my wealth (and my health) during that quarter. That helped me to stomach the 20% loss. After that, I thought I’d be invincible! I’ve trained myself over a 10% loss a couple of times before (like the Brexit Referendum days, or the beginning of US-China Tariff war), and over the 20% Q4 2018 loss. I felt like King Mithridates, who immunized himself to poison by swallowing daily increasing amounts.

Then in 2019 I felt scared by the idea of a crash.

Probably the burnout, and the perception of being “close to the end of my career” contributed to it.

When you’re in accumulation phase you might have little money saved, and you plan to contribute on a monthly basis to your investments for long time to come, you should be aggressive and hope for a bad sequence of returns. But when you’re close to the end, a bad sequence of returns scares the hell out of you.

It’s also a matter of size. I was not that loss averse when my Net Worth was in the 5-6 digits world… When you want to grow rich, you want to make more money. When you are already rich, you want to preserve wealth and not lose money. Loss aversion to the next level.

Anyway, I was already playing with my fingers on IB a week before. Telling myself “This can’t go on forever. It’s like Bitcoin in Dec 2017. C’mon, CAPE is above 30. How can the stock market return almost 30% this year? Ok, tomorrow everything will crash!”

I also instructed unrealistic limit orders on IB a couple of times: “Let’s try to sell my shares at 3% above their price. Let’s see how I’d feel just having the order hanging around…”

Do not do that at home!

On November 26th, after maybe 10 consecutive positive market days In told myself “I have to do it!“. I set a limit order to sell all my VOO shares (161k USD) just a bit above the market price. I felt excited. Then I canceled the order and I logged out. I let the feeling sit for a while.

Then I told myself this very important question: “how bad would I feel if I sold all the shares today and the market will be up tomorrow or in a week/month/year (proving myself wrong)? How bad would I feel if I kept all my shares and the market would crash 10+% in the following weeks/months (proving myself wrong)? What would minimize my regrets?”

My genuine answer was: “I wouldn’t mind if I sold the shares today and they keep going up. I would feel like an idiot if I wouldn’t sell them and the market would crash soon.”

I was sure I’d be devastated by not having took action.

So I logged in again and sold a lot of stocks.

Was it a good move? Was it a bad one?

Bad question to ask. We don’t know if it was a good or bad financial decision. Time will tell. Good or bad aside, it was a WRONG one from a probabilistic point of view, but maybe a GOOD one from a risk tolerance point of view.

That’s what happened to S&P500 since nov 26th:

I’ve lost money. I’ve underperformed the famous dead investor so far!

But I feel my portfolio is more in balance with my current risk tolerance. Daily swing on my brokerage account are in the order of hundreds or few thousands (which is still a bit crazy). Before the chicken-outing, 5 digits daily swings were pretty normal.

… And I loved that feeling of “crystal ball genius” on Dec 3rd, when the S&P500 was down 3% after my sale! I told myself “Yes! Let’s hope it continues so I can get back into the market at lower prices hahaha!”

But then: “wait, when am I supposed to get back? I forgot that to time the market one has to be right not once, but two times!”

That’s why there are many things to learn from my experience. If you plan to permanently alter your asset allocation and to reduce stocks exposure for reasons like “loss aversion” then it’s ok to get out when you feel comfortable. But if you plan to get out, wait for a 5% / 10% / 20% / 50% crash and get back in you need to be lucky two times!

Let’s assume it’s October 3rd 2018, and you perfectly timed the market and sold all your S&P 500 shares! Extremely lucky, the day after the market would start a 20% descent until Dec 24th 2018. Let’s say your genius doesn’t stop there: you actually predicted a 20% drop! So you set your threshold to get back in once the price dropped by exactly 20%. You instruct a limit order and just wait. The market follows your predictions each day. Awesome, genius, Jim Simons! On Dec 24th you prepare the Champagne, since your limit order is going to be fulfilled… but the market bounces back before touching -20%! And you wait… but your order will never get executed, and you lost opportunities!

So, NO, don’t time the market because you think you’re smart! Even if you succeed, you’re just lucky, not smart. And if you got lucky, don’t try to repeat the pattern or else “a fool and his money are soon parted“.

“Wait RIP, I don’t understand. Did you sell to adapt to a different Asset Allocation (and what’s your current AA), or you wanted to sell and buy back at a lower price (timing the market)?”

Yeah, that’s a great question.

That’s more to it. Yes, this post was supposed to be a quick one but it wont’ be 🙂

Let’s first answer to “what’s your current AA”:

My AA right now is ~40% Cash, 35% Bonds and 25% Stocks. You can monitor it in realtime in the “Net Worth by Asset Class” sheet in my NW Spreadsheet.

Before you ask: No, this is not my desired AA long term. I still want to have an AA that can sustain a safe withdrawal rate in the neighborhood of 3.5% for ~40 years. This can’t be achieved with anything less riskier than 60% stocks /40% bonds. Stretch 50%/50%.

So current AA is not in line with ideal AA.

“So what’s your ideal AA? Why are you not there? Why you sold all those positions? What does you portfolio look like now?”

We’re getting close to the core. Let’s first answer the last question: my portfolio looks like shit right now! I only have small caps (EU and US), emerging markets, high dividends (US and not US), EU REIT and some bonds. No US and EU Large cap stocks. It’s a complete shit out of balance!

“But why? Why??”

Ok, let’s get to THE point: I think my accumulation phase (at least at the rate I got used to during last 7 years) is coming to an end soon. Spoiler? Not yet. But I think I will earn substantially less in 2020, and in the years to come. This is my nest egg. I’m done building it up. Now I should focus on both preserving it, and letting it produce fruits to feed the family. An almost impossible goal, but in the short term I prefer to favor preservation in lieu of aggressiveness and ability to “feed the family”.

“I still don’t understand…”

Let’s assume in 2020 I will earn a lot less. What would happen then? I have a decent Net Worth, I’d earn money from my investments and dividends. It is very likely that the Swiss Tax Authority would consider me a professional investor. So I will be taxed on dividends AND capital gains. I actually sold all ETFs with high unrealized capital gains. I realized 45k CHF of (tax free?) capital gain!

So… let’s celebrate a bit! 45k from this sale, 45k that would have not been there if I hadn’t invested!

Actually, all the 2019 sales totaled 84.5k CHF realized P&L. More than we spent this year! And it doesn’t even include dividends (another 12k).

Now, what are the consequences of all the sales of 2019?

Unless I will be considered a professional investor, nothing. 84.5k CHF tax free!

“Are you afraid you will be considered a professional investor?”

A bit, yes. I think I can defend my “I’m not a professional investor” position, since… well… I’m not a professional investor! But it could require some actual effort, since the capital gains are high enough to be a non negligible fraction of our total earnings (~25%) for the year, and I made a few mistakes and violated one of the 5 rules to be 100% sure you won’t be considered a professional investor (DE, FR, IT). I violated the rule that “I should hold assets for 6 months at least”. I think I sold something before holding it for 6 months. Maybe more than once, but small amounts. Anyway, those are just “sufficient but not necessary” conditions, and I think I can easily defend my case.

If I hadn’t sold my ETFs in 2019, and assuming next year I would earn much less, then realizing capital gains would have been harder to defend, since (literal translation of the third condition): “profits from trading would compensate for the lack of a salary or other means to maintain one’s standards of living”

So I preferred to realize now and play an easier game to win in 2019 than maybe realize in a time where capital gains would have been harder to cash tax free.

“Ok, that makes sense I guess. But then why didn’t you just buy back the same shares the day after the sale?”

Well, that would look suspicious I think. Plus… yeah… I still wanted to refactor my AA and maybe simplify the ETFs I own… and that takes time… and that’s one of my cleanest rooms in my new flat:

I’m cutting sleeping time to post this, I don’t have time to shave myself. Rebalancing a portfolio and investing ~400k that I have sitting on IB demands few days of dedicated time and focus.

But I know that the size of the problem deserves (and demands) time and focus.

There are a few questions I should just stop everything else and focus on:

- Should I get back in the market before EOY?

- All at once or DCA?

- Buying back the same ETFs or… what else?

- Simplifying (just buy VT) or not?

- What about the other ETFs I own? VYM has also 10k unrealized P&L, and if I sell it before Ex-Dividend date I can avoid paying taxes on (high) dividends…

- What if I wait until Jan 1st? What if I won’t be allowed to buy US domiciled funds anymore?

- How to actually adjust my AA to match my loss aversion and at the same time be aggressive enough to sustain a 3.5% SWR? The 4% rule with just 25% stocks is doomed to fail. There’s no Bengen around to save you!

- What if I would benefit from being classified as professional investor in 2020? Let’s assume I earn some money (less than half compared to 2019) and the market crashes. I could benefit from being classified professional investor since I can deduct losses… in that case it may be beneficial to wait until Jan 1st to buy assets back.

I will set aside Dec 23rd and 24th to take decisions and act upon them. In the meantime, suggestions are more than welcome 🙂

Fun fact: this was (and still is) my cash balance on IB after the trade:

A way too large amount to let sit on my brokerage account.

First action I took was to join the Insured Bank Deposit Sweep Program on IB, to allow them to open many accounts in my name to spread the deposits among more banks and enjoy a larger FDIC insurance amount (up to $2.5M).

Second action I took was to convert the excess of 100k EUR from the sale of MEUD into CHF (you can see it from the screenshot). EUR cash balance carries a negative interest rate above 100k on IB. Take a look at IB interest & financing page. CHF also carries a negative interest rate above 100k, but I’m far enough. The huge (218.5k) USD balance provides a positive interest rate of 1.05% above 10k. I’m earning some interests while waiting, not bad. It’s not free though: inflation rate in the US is more than 1% above the inflation rate in both EU and Switzerland, so – all other things being equal – USD is expected to lose compared to EUR and CHF. No free lunch, sorry.

So… two questions for you:

- How wrong was my action?

- What would you recommend me to do next?

Have a nice workweek!

And remember: do not try this at home! If you have just started earning real money, you should be 100% aggressive! I’m close to the end, and a drop of 2-300k for a market correction would have a huge impact on my well being.

And now… time to celebrate the realized profits 😀

Have a nice day!

That’s the way it is with investing in to the convenient ETFs. What could happen now? Further up with less- or (from now) down with higher probability.

If it goes down, you won, whatever happens after that.

If it goes up, it is up to your nerves how far it goes up until you start buying (again). You lost.

Countless money lands on the market and that rises itself like never before and that makes the ETF for now „the best of the bests“, when it comes to investing. Anybody could do positive result in the past 10 years and that was enough for the many to feel hero. Anyone could profit from it. Is that going to be the case further more? We do not know. Until the sea level goes down and wracks are going to be emerge again.

Now it is up to you what sort of capital allocation you figure out but most probably it will not look alike. You may start value investing. It means you will not follow the crowds simply buying the market (aka ETF) but you will only buy those represents value. I know you will not do that because that would be stock picking in your terms, but only for the sake of curiosity, what if you would have been already invested only in to value stocks? Within that x years you have been running through the same bulls and bears. You would trust your portfolio withstanding the deepest dip and recovers faster than the market. So you would not sell due to risk of bear market. You would only sell for different but more logical reason, and not at the time of peak market.

The simple reason you jumped out from a large portion of your investment is simply fear. It is hard to handle. You need to have another kind of portfolio what is already proven to be better for you than the market. I know it is another debate what makes an individual portfolio better than the market. It is not necessary better for me but it definitely must be better for you.

Thanks for you comment baseldon, but I’m not sure I got what you wanted to communicate.

I don’t think I’m going to quit ETFs and passive investing, because Value Investing is a full time job and that’s not what I want to do in the future

Thanks to Pedro!! He wrote his comment some lines down in two sentences, exactly what I would have liked to suggest . Now you can see how clever I am in writing. Anyhow, dividend growth stock is your way to go (I call it “value investing”). It is not even that hard full time job. You only need to find the right sorce and filter out the noise.

Dividend growth is not Value Investing.

Dividend growth is dividendism 🙂

I see we are running parallel lives again! I also sold some in November, but not to time the market: I needed to raise the deposit on a house purchase and so I didn’t want to sell the shares and it really pained me to do so. Actually, just now, I saw that I ‘lost’ > 10k in less than 3 weeks as a result of this sale.

Thankfully, I’m still happy with what is left and my asset allocation is still intact (not difficult as I am 100% in stocks). I also had to do the currency dance to avoid negative interest rates but I wasn’t aware of the market sweep option so I will check that out (thanks!) – though typically I do not hold large amounts of cash.

Honestly, with a (temporary) reprieve in Brexit and the trade war, I think conditions are set for big upwards moves in stocks and I will remain fully invested. After two unexpected cash requirement shocks this year, I’m considering to build a bigger cash buffer too.

So in your position, I’d buy back in immediately and fully. Not easy to do (psychologically) given the recent upward moves.

I’m in this weird situation where I don’t know if I should be happy for yet anther awesome market day 🙂

Btw, you’re going 100% stocks? Wow, that’s brave!

I’ve been 100% stocks* for the last 3.5 years and doubled my money in that time.

*liquid investments (i.e. not counting real estate)

Well done 🙂

You should put the money into dividend growth stocks. Then you just take out the dividend at any time (even during recession) and never sell a whit of your nest egg. Simple as that.

This is one option.

I’m reconsidering the world of value stocks. Value Stocks, not to be confused with high dividends, not to be confused with dividend growth.

I’d like to invest in companies with reduced growth expectations in favor of consistent profits.

I look for low price to book ratio and low price to earning ratio. Having high dividends (or growing dividends) is not a must.

I don’t like the “dividendism” attitude, I leave it to those who don’t understand math, and to those who love Ponzi schemes.

The rationale is: except last financial crisis, value stocks have better reacted to recessions and market crashes.

Things like affordable luxuries, basic staples, commodities… People are going to drink Coca Cola even after a Zombie Apocalypse!

Anyway, I don’t want to become a Value Investor myself, it’s to much of an effort.

Still need to find a valid proxy for moderate expected return and low volatility in this field.

Maybe I’ll end up buying some high dividend anyway, as a proxy if I don’t find anything better and more value oriented.

” This can’t be achieved with anything less riskier than 60% stocks /40% bonds. Stretch 50%/50%.”

Did you consider Ray Dalio’s All Weather Portfolio? Historically it had small drawdowns compared to standard portfolios (Bogleheads Three Funds, Simple Wealth, etc.): http://www.lazyportfolioetf.com/allocation/ray-dalio-all-weather/

When I saw it for the first time I was super surprised that you can get away with only 30% in stocks.

It is very US and USD centric, but the benchmarks say that it has a low enough volatility.

I might consider it.

In general I don’t like Gold (and 55% of US Bonds is definitely not wise if you don’t live in US), but I will consider. Thanks.

I’m actually also considering a Permanent Portfolio (25% stocks, 25% bonds, 25% Gold, 25% cash) but… maybe no.

Thank you 🙂

Out of curiosity, I just had a quick look at your portfolio – I’m not sure if leaving the equity market (at least until the 2020 US election) is a good idea – however, i think you definitely should sell these 2 ETF:

IBGS

CHARACTERISTICS

Weighted Average Maturity 1.68 yrs

Weighted Average Coupon 0.27%

Weighted Average Yield To Maturity -0.42%

Effective Duration 1.68 yrs

IEAC

CHARACTERISTICS

Weighted Average Maturity 5.61 yrs

Weighted Average Coupon 1.71%

Weighted Average Yield To Maturity 0.60%

Effective Duration 5.25 yrs

If you want to stay out of the Equity Market, there’s a better solution for sending your USD to some vacation:

FLOT

CHARACTERISTICS

Weighted Average Maturity 1.60 yrs

Weighted Average Coupon 2.65%

Weighted Average Yield To Maturity 2.32%

Effective Duration 0.14 yrs

If you want to keep CHF or EUR, the best option is to store them at one or more banks below their respective negative rate threshold.

I know, I know… I’m just playing with bonds ETFs to experiment a bit. I know they don’t have good expected performances, but investing in bonds is slightly more complicated than you think.

I recommend this nice read from The IndexFundInvestor on Negative Yield bonds.

Actually I like IEAC, but I kind of hate IBGS. I wanted to try some short maturity EU bond ETF, betting on a interest rate raise without receiving the leveraging effect of long maturity. But it’s an experiment, it’s not impacting much and I’ll keep going. The minor losses in case interest rates don’t go up can be compensated with “loss tax harvesting” in case I will become a professional investor and subject to capital gain tax.

I’ll take a look at FLOT, which should definitely be better than just holding USD cash on IB. Same currency risk, better returns 🙂

Thank you!

“Actually I like IEAC, but I kind of hate IBGS. I wanted to try some short maturity EU bond ETF, betting on a interest rate raise without receiving the leveraging effect of long maturity”

Can you elaborate why you bet on an increase?

Personally, I perceive this to be EXTREMELY unlikely.

First, Christine Lagarde is known for her attitude in favor of low interest rates.

Second, the EU economy is, quite frankly, f*cked. Historically, failure rates of companies have been around 1.5% (normal and desirable process of weeding out old/uncompetitive/bad companies). Now, it has been ca. 0.5% since 2009. This is 10 Years of 1% “too few” failures. This can be explained by the low interest rates (you essentially make capital expenditures low, keeping alive bad /uncompetitive firms).

=> Add this up in a simplistic way and you arrive at 10%+ companies that are uncompetitive and would go bankrupt in case of any interest rate increase. Firms are associated with jobs, so in a simple assumption this corresponds to 10% jobs.

=> Basically, shortly after increasing interests a likely consequence is 10% additional unemployment resulting from the loss of 10% businesses. (Of course this is again simplistic, you can try to do cost restructuring etc. But this helps you only so long.).

=> Do you really think ANY politician would want to be responsible for that? With the mindset of Lagarde I rather think the previous policies will continue: More quant. easing, lower rates.

Thirdly, our economy is BOOMING. Why has no interest rate already happened? (see reason 2, among others)

Fourth, with the UK leaving the southern, more lavish states in the EU become more influential, i.e. hawkish policies are unlikely

PS: The 10% are extremely conservative and only result of this most basic calculation. The number of these companies is tricky to assess, but experts think the number is closer to 15% (see Markus Krall for reference).

All in all, I believe in low interest rates for a while. See Japan’s economy for an analogy: They have seen this absurd policy going on for 4 decades now, resulting in a large deficit, low interest rates, and the “zombification” of their industry (a zombie refers to companies kept alive artificially by cheap financing described above). So low interest rates do work (at a huge, slow longterm cost!), and unfortunately I think this is the (“convenient”) way the EU is headed.

wow, what an amazing analysis! Thank you for having dropped the bomb.

It will take time for me to elaborate an answer, and I don’t think I can come up with anything more solid than “current situation looks unsustainable and simply wrong”. In the past my intuitions based on a huge, visible misalignment between things that make sense and things that are ridiculous lead to bubbles exploding that were obvious in hindsight (dotCom, subprime mortgages and subsequent financial crisis, Bitcoin).

I think negative rates don’t make sense. We’re paying a wealth tax imposed by central banks, and not states. With no raising inflation, that means sooner or later (after few more interest rates reductions), people will withdraw cash and put money below the pillow – and that has devastating effects.

I sincerely hope for a slow increase in interest rates. We can stomach the losses today and avoid zombification.

Anyway, as you said, this is not the scenario any short sighted politician would want.

Hey RIP, pretty interesting move indeed. If I was in your position I would have setup stop loss orders instead maybe some 5% under the current price. That way with regular adjustments you can keep reaping the profits but don‘t loose too much when there is a market crash.

Maybe you can set 50k a side to run a value investing experiment, I recently learned about the „Magic Investing Formula“ which basically bets on undervalued stocks reaching a median stock price quicker than regular market movements.

I personally will do a P2P investing experiment with the savings next year. I started a blog too, heavily inspired by you 🙂

That’s just another way to time the market, and still I would have felt stupid if the stop loss would have triggered in my case.

Anyway, I’m OK with having sold and the market still going up. I’m still invested enough to profit from market going up, but also in a position of celebrating an eventual crash 😀

I’m sincerely ok.

No regrets so far (just a bit).

But that’s illogical, using the same reasoning everyone who invested since 2009 should be kicking their own asses for not having invested in a 5x leveraged S&P500 fund (max drawdown <20% so far)!

About P2P: maybe I’ll make some steps into it next year, but I know it’s not a totally passive endeavor, and I would love to see how P2P lending correlates with stocks during a recession. P2P lending is a “too optimistic word” for me.

About Value Investing, it’s too much work and it’s not what I want to do with my time.

Nice blog, but Raclette would have been a better choice 😀

Hi Rip 2.5,

I was one of the ones that commented on this move before the post…

To your questions:

1. How wrong was my action? not at all, Big Ern already alerted of the risks of the mantra around “Always 100% in”. In your case, you have already created enough wealth to allow yourself being more conservative. Cash is part of Allocation too, now that part is with 0% risk. Buffet, has a bit more Cash than you do, he is patient, he has been here before… just wait. It is not about market timing but future returns based on projected earnings and safety margin.

What would you recommend me to do next? Partially answered above. Re-consider your allocation to your new position, your risk tolerance, etc. In my case, I have a wished allocation in the future of 10% Cash, 20% Pillar 2 and 70% Stocks. However, my current allocation is 35% cash, 20% Pillar 2 instead as of early November. I just could not handled the irrationality in stocks anymore, I am not fully out, but decide to protect the money that I plan to use for retirement, buy a house, heritage to my children… it is not about 100% invested but about index funds strategy. Even Boggle reduced in 2000 (I think or 2008, not sure) his exposure to only 25% stocks! so… you are fine.

Well, I agree that one should not always be 100% in, but not even 70% out if they want to live off portfolio yields 🙂

Good ol’ uncle Warren is already FI (I guess :D) and can allow himself to be as conservative as he wishes (and in fact he’s underperforming the market in last few years).

And mind that he has access to deals we humans have not.

I dream about a CAPE-based stock allocation.

Imagine this:

CAPE 10 –> 100% stocks.

CAPE 50 –> 0% stocks.

Linear in between (CAPE 30 = 50% stocks)

It’s a dynamic allocation that tends to over-rebalance more prudently when the market is expensive, more aggressively when the market is cheap.

I don’t have data to back up my hypothesis, maybe Uncle Big ERN might help?

To be honest – Im doing the same since months! Just check the chart of the MSCI World of the last year, it looks like a crypto AI blockchain chart xD facing the sky like a rocket. Yes, Ive made awesome profits the last years. But like you I cashed out the stocks, that I don’t want to hold on a lower price because Im not sure they will survive a crash and all the other stuff that is coming up the next decade. Value stocks are still there, still paying dividends and I will buy more when prices fall. But like Warren Buffett Im holding stacks of cash just waiting for winter (?) sale. You’re doing it right! In my opinion the best investment not only for wealthy, but also for aggressive investors is to sit on a good amount of cash and wait at the moment. All the best from Schwiizerfranke.com (german speaking area of switzerland) Eric

Warren Buffett underperformed the market by a lot in last few years.

But in general I like your approach, if one can handle the greed / FOMO.

One thing that makes me think we might still be far from the fall is that fundamentals are still good and on the rise. Earnings are growing, unemployment VS job posting is laughable (take a look at this amazing post by Ben Carlson). This was not the case at the time of the Bitcoin Frenzy 🙂

Thanks for stopping by Eric 🙂

Hello RIP,

Thank you for your posts, I am learning a lot about investing. So much to learn. 🙂

Could you clarify a bit about 5 rules to be 100% sure you won’t be considered a professional investor?

Sure:

1) When you sell something, you should have held it for at least 6 months

2) Total volume of transactions in the tax year should not be above 5 times your wealth at the beginning of the year

3) profits from transaction should not be more than 50% of your net income (not clear if it’s enough that income > investment profits or income > 2x investment profits) (also not clear if net income means after tax or after AHV / social security contributions… in the worst case – net income after tax and income > 2x profits I’m actually borderline on this criteria this year as well)

4) no borrowed money to invest, no leverage, no margin account

5) derivative products are covered by own titles (if you’re an option trader, you might be at risk)

Anyway, these are sufficient rules for being “safe”. Violating one or more of these rules might put you at risk of having to defend yourself in a fight with the tax authority, and I heard it’s very hard to be classified as professional investor if you have a real full time job and are not making a fortune with investing. AFAIK, None of my colleagues are professional investor for the Tax Authority, and we have many option traders, value investors and so on.

I would add that whereas one can never be sure what the tax authorities have in mind (the situations we are talking about are exclusively dealt with on a case-by-case basis) in practice day-to-day trading, volume of operations and finance profession/background are some of the main triggers (I would hardly see that happening here with MrRip). Plus, for what it’s worth, the Swiss tax authorities have a variable interpretation of said concept, as in they tend to be more tolerant in appreciating the notion of professional investor when shit hits the fan (welcome you 2020). Vice-versa in a bullish market. This is because as a professional investor (vs non-) one can tax deduct their losses… sending shivers up them tax collectors’ spine!

“I would hardly see that happening here with MrRip”.

Cool, that relaxes me a bit 🙂

Do you have any kind of experience with tax authorities and professional investor? Can you share how do you know what you know about it?

“Vice-versa in a bullish market”

This one makes me a bit scared though. Considering random people professional investors in 2019 will bring a lot of money for the tax authority. I’m above 90k of realized profits (+12k of dividends) this year…

No direct practical experience but I work in tax in Switzerland. I think you already covered yourself the topic very well in your post above.

The 90k amount has no/very little impact (and don’t forget we are in Switzerland, all is very relative when it comes to that :). Generally those are the main criteria that lead to a qualification as professional investor:

_Link between the investment and professional activity

_Use of professional knowledge

_Use of financing

_Use of complex or structured financial products

_Frequency of transactions

_Planned actions

So not really so random people. And unless I am missing something I don’t see you actually meeting any of those.

At the end of the day all of this is at the authorities’ discretion. There are generally accepted principles and safe harbor rules but it is worth reminding that circulars are not the law. And the tax authorities are not in the fair and square business either (courts and tribunals are on the other hand). Yes, sometimes in their pursuit for tax money the authorities may overreach. But it should normally be equally easy to defend yourself and prove them wrong 🙂

Thank you for your “on the field” contribution 🙂

Now I need to decide if to take offense for “I don’t see you actually meeting any of those”, after having mentioned “Use of professional knowledge” and “Planned actions” 😀

This will be an interesting one to watch how it plays out Mr RIP. Thanks for sharing your thought process leading up to this decision.

No judgement here, but I do have a few questions for you to think about.

If the market continues to surge, will you be contented with the profits you have taken? A locked in win, as opposed to an uncertain future. Or, with the benefit of hindsight will you lament further gains forgone?

Conversely, if the market dips will you celebrate your remarkable foresight and claim credit for being an investing genius? Or will you concede that good luck is different from good management, and recognise that belief is a very different thing from certainty? How long will you be content to sit on the sidelines, waiting for the markets to prove you right?

It is great that you are recognising potential sources of stress and anxiety, then taking action to address those.

Yet I can’t help wondering if there isn’t an underlying inconsistency present here, where actually attaining your financial goals is at odds with your mental health and wellbeing? Today it is hitting eject from your investment holdings. A couple of months ago it was seriously considering pulling the pin on a well paying career.

Both are wealth contributors necessary to attain your stated dream of early retirement. Yet both are things you have sought to escape. A little bit like the doctor who claims success for putting an end to the pain, when they have done so by killing the patient.

Is that driven by seeking happiness? Or is it a form of self-sabotage, blinking when staring into the void of what comes next?

Hopefully I’m imagining things that aren’t there. Something to think about.

Thank you Indeedably for stopping by 🙂

I will document what happens next, of course.

About your questions: well, I’m still invested so I’m still profiting a bit (Like on Friday my account was up by 3k!), but I’d lie if I say I’m not biting my fingers a bit. But just a bit. I’m ok. It’s a nice temporary status to be in: being happy if the market goes up and being even happier if the market crashes 😀 It’s volatility freedom! It’s just not very efficient in the long term.

About how to interpret market crash: if the trend after the first two days would have continued I might have fallen into the trap of defining myself the genius of all geniuses, and lost all the money in a next attempt to double down backed by my deluded geniusness. Luckily I was proven wrong at least in the short term, so even if tomorrow the market crashes I can still tell myself “RIP, you should have sold on December 20th, not on November 26th, you noob!”

You got it right though: there’s an underlying inconsistency between financial goals and well being. It may be situational (feeling at the very end of my current career), but here it is.

The solution will probably be to put the extreme pursuit of FI on hold for a while, and rearrange the (mental) troops.

I felt richer a year ago with 300k less in my NW but a better confidence in my skills than I’m today that Net Worth is skyrocketing.

That’s the key question I guess, I’ll take time for an adequately elaborate answer 🙂

Thanks for your deep comment, as always.

Hey RIP

Great post – very detailed and it captured your thought process really clearly.

In essence, you had an investment plan, recent gains and your resulting decision to sell means you come off your plan.

No harm, no foul, it’s your plan and you should be able to adjust it at any time.

What happens next is important – develop a new plan and implement it. Don’t enter the market at random, or exit at random. Be deliberate yet always make sure you are following a well-defined plan. It’s the discipline of the plan that will keep you from making what I believe is the biggest investing mistake of all – selling when markets are down. You sold when markets are up – not so bad, but I agree with JL Collins that most people lose money in the stock markets, when they realize what are otherwise temporary, unrealized losses.

Looking forward to hearing your new plan!

Thank you, amazing comment 🙂

Indeed I’m trying to be deliberate, set time apart for making a new plan, refuse to feel any hurry / peer pressure / greed, and more importantly avoid acting emotionally now.

I can wait, I want to set time apart to make a plan, it can take months and I’m fine with it.

It’s just “weird” to hold 380k CHF (converted from EUR and USD) in my brokerage account. I’m more scared by this than anything else on the market.

Mh,

Overall I would advise 3 things:

1) I read you dont like Gold, but with a well-sized portfolio as yours, it will complement. It moves anticyclic and provides desired balance and security. Why not ETF associated with physical Gold? They will move up in value when the market goes down.

2) Keep a well-sized portion of cash (Buffett’s cash position is at 40% too, though Berkshire also needs some extra cash for other purposes such as insurances). Something 20-30% seems reasonable awaiting a prospective downturn. It is only smart to slightly increase the cash position as the bear market matures.

3) Indeed put some cash back. You say you don’t want investing to be a fulltime job yet your portfolio is extremely complicated (my definition is that it contains more than 5 different ETFs).

– I am not sure why you don’t like more VT based on the US argument. I would invest more into it. (BTW: I believe we, being CH based, should pivot away from Europe being so dependent /exposed to it already. US companies are well-diversified and produce/make cash around the globe providing sufficient diversification. I think a position of >40% in US stocks is absolutely OK for us).

– More apartments? They make a good, continuous dividend in the form of rent + the low interest environment really invites us, doesn’t it? (BTW: Italys housing market is special in that it has not seen a large increase in prices compared to the rest of Europe).

I hope tomorrow I’ll publish a post on my investment paralysis evolution.

Sadly your comment arrived too late to be included in my plan and actions, but let’s try to answer it here now:

1) Gold? Nope! Take a look at this video: https://www.youtube.com/watch?v=ulgqlQWlPbo

2) Cash, yes, a bit. But not for catching opportunities (timing the market), just because I don’t know where my career is heading and I want a buffer

3) I’m going to simplify my portfolio, and buying VT 🙂 … but still holding too many ETFs

4) Yes, I buy the US argument, but I also don’t buy the “EU is screwed” argument 100%. EU is lagging behind, and stock fundamentals (P/B, P/E, CAPE) are very low for EU. But I won’t act upon this intuition (will just monitor it) and move heavily into US territory

5) apartments? No no no! I sold the Italian flat, and I’m ok with not owning a roof. Maybe one day, if I move back to Italy, I’ll consider it again. Not today.

1) I like that the video is based on numbers / analyses. It convincingly shows Gold not to be a productive class and I could not agree more!

But the end of the video is a bit light on dismissing it as a good insurance (/carrier of value), is it not? Stocks are prone to crises, currencies have failed in the past, and properties have been impacted/seized (e.g., mandatory loans on German Houses following WWII). All these things have happened, and getting into yet another class (which is not correlated, keeps its value) is a true form of diversification. I do not champion a large proportion of Gold in a portfolio, but reading from your posts I see a somewhat lowered risk profile and gold, as an insurance offering extended diversification, is worth considering (I would also not recommend any position exceeding 10% though).

4) Yes, I don’t want to be Mr Doomsday 😉 (although I do believe there are multiple risk factors beyond the zombies mentioned before which Europe faces. If your German level is good I can point you to 1-2 great lectures on this).

The reason I mentioned it explicitly is a post that I thought I remembered (but not sure) in which you stated you wish to actively reduce your US exposure compared to the VT mix.

5) Out of personal curiosity: Why actually? The effort associated with a flat (tenants, tax complications etc)?

1) Still Gold doesn’t convince me.

It may be an “insurance” for long term and doomsday scenarios, but I still don’t see the intrinsic value of it. I don’t like things without an intrinsic value.

I only accept “money” in this category.

Else why Gold and not… Bitcoins? What if the world admits that Gold is essentially useless and not worth 49k USD per kilo based on its intrinsic (nonexistent) value?

I’d rather buy an art piece, at least I can enjoy its presence in my house 🙂

4) My German sucks but I can also paint few bad scenarios in my head 🙂 Still, EU companies (not nations or governments) might be undervalued a bit. What if the “self driving cars” turn out to be bullshits? Maybe good old European car manufacturers will raise. If there’s another AI winter, or if Tesla sucks (not unlikely)… good old brick and mortar Europe can have a say.

5) death by a thousand cuts. Bureaucracy is infinite in Italy. And find tenants who actually pay the rent (stats say 51% of tenants don’t pay rent in Italy: http://www.ilgiornale.it/news/politica/scatta-lallarme-abitativo-met-degli-inquilini-non-paga-pi-1356807.html) is not easy. If I were living in Italy maybe I’d have invested time and effort to start a Real Estate (rental properties) gig, but never from remote!

Hey RIP, this was a pleasant read! I’m glad I’m not the only one who find myself torn between sticking to the strategy or the gut feeling 😛

As you have already stated in your previous comments, I think it’s natural to get a little more anxious and “jumpy” when you’re towards the end of your goal. Your priorities shift from “growing” to “sustaining”.

I have the exact same problem – only I’m not nearly as close to the goal as you – so my “protectionism” his highly illogical at this stage! Haha. I know you’re supposed to be in the game to win – not to protect yourself from losing, but it’s just so damn hard! If only we could turn off our emotions and play the “dead mans” portfolio, I think that would be great. But we can’t, can we? So I guess we’re gonna have to accept our fate of being forever in (a bit of) doubt, whether we’re acting according to our strategy, or our emotions. I have come to accept that in my case, it’s often the former 😉

Happy holidays from Denmark!

Hi Nick, welcome to my blog 🙂

That’s why I tell people that optimizing a 0.01% TER is irrelevant, and the same time should be invested in getting your mental health in order. Investment classes should have meditation sessions instead of company statements analysis 😀

Hey RIP,

Long time reader, first time poster. XD

Thanks for writing this. It talks about a couple of things I have been thinking but haven’t found a way to convey as eloquently as you did.

Anyhow, this will be long but let me try to be as succinct as possible.

I think most people overestimate risk. Most only consider the magnitude of the loss but few consider the length of it. It is easy to tolerate a 50% loss over a couple of months. Hard to tolerate it over a decade.

Another aspect, is that it is very easy to take in risk if you don’t have much money at stake. Your post described this perfectly. Only when your annual contributions are significantly lower than your annual investment returns, is when one starts realizing the real impact of the market and how risky it is.

the phase you are going through reminded me of what Bernstein calls the “middle game” in his book “The Ages of the Investor”. he describes this as the hardest phase because you have to switch between aggressive and conservative. And you have little margin for error because of sequence risk. If you haven’t read it, I’d suggest you read it. I think it will speak to you.

There is this great book “Thinking in Bets” that talks about how people usually judge a decision by its outcome instead of judging it by its process. it is better to judge process. I empathize with the trigger for your change in AA: upcoming changes to your income source, a higher sense of having a lot to loose, being able to sleep at night, tax considerations. Probably I would have preferred having a clearer idea of the next steps before taking action: mostly to ensure the whole strategy is coherent. that being said, this stuff takes time so, I can understand you want to take your time thinking about it and wanted to cash out ASAP.

Godspeed!

Hi IFI, your comments ended up marked as SPAM for some reasons, I just resurrected them now 🙂

Overestimation of risk. Interesting. Well, “risk” (when it’s compensated risk) is the fee we pay for the expected returns. If risk were not there, who would give us the “7% expected returns after inflation”?

About the “length of risk”, this is a good point but… what about the 60s and 70s in US? What about Japan in last 30 years? What about US during the first decade of this century?

John Maynard Keynes once said: “The market can remain irrational longer than you can remain solvent”. Which is fine if you’re in your accumulation phase, not much fine if you’re close to the end of it.

I’m more and more convinced that the optimal investment strategy is one that exposes you to constant amount of risk over your lifetime. Which means going 10x leveraged when you’re young, and 0.5 leveraged (keeping 50% of your money away from risk) when you grow old.

Anyway, amazing suggestion for Bernstein’s book. I’ll check it out (sooner or later).

I’ve also heard of TIB by Anne Duke many times. A rationalist like me, which is in love with Bayes rule and probabilistic thinking, would love it!

Do not forget that I also had some contingencies to handle, like cashing out capital gains before they had greater odds of being taxed next year. If it weren’t for that, I would probably took some more time for a better plan. I had few days to act upon.

[…] I LOST something (by not gaining it). It’s stupid, I know – but even Mr. RIP himself did something he wasn’t proud of this year (he “timed the market” by cashing in some of his gains. BUT MR. RIP, YOU […]

Hi Rip. I am quite impressed by your intelligence and the ideas you have. But now you pressed the panic buttom and waste you time with what if when questions. Don’t waste your time with thinking about what is the market doing or not.. What I would do if I were you? I would move back to Italy and buy a nice house there, spend time with your kid and wife. You can invest the rest in stocks and get 3.5% Dividend income. It is no good sign that you had a burnout. So something is going wrong. Maybe it is just too much what you are doing. I do not know. I just know one guy who never got rid of it.

You achieved alread FI, but not in Zurich. But I see no risk. Maybe you can continue to work for your company in part time? I have a friend living from Friday to Monday in Hamburg and working from Tuesday to Thursday in Basel. Could also be a solution for a while.

Thanks for your suggestions, they all make sense.

We’re going to try something different as “Option A”.

Going back to Italy or getting a part-time job are “Option B”s, and will always (?) be there