Hi RIP readers,

Let’s take a break from the Dark Fire series (will come back to it, do not worry) to document my experience with individual stocks during last ~40 days.

It’s a trip into the why of it, the decision making process, the stock picking itself, the emotional roller-coaster associated with high volatility, the outcome, the psychological implications, the risk analysis, the tax implications, and a minor experiment within the experiment: a troll investment just because.

This experiment started on April 20th and ended on June 1st 2020. A little bit above 40 days.

Before you get excited, I won’t tell you which stocks I’ve invested in. Except for the troll investment, because I think you can’t copy that.

“But RIP I want…”

Nope!

Ok, few words on why I don’t want to share the companies I’ve invested in.

This post wants to be a meta-post about investing in individual stocks, with some “on the field” experience, and not just “on paper”. I don’t want to appear to be recommending specific stocks. I don’t want you to take away the following false lesson “RIP invested in X and made a profit, it means X is a good company!“. I don’t want to appear like the financial guru that I definitely am not. I didn’t even put any effort in deciding which stocks to pick, I just “used” the work of other value investor friends who did their own due diligence! More on this later.

Anyway, the ultra nerds among you might be able to guess the companies. I’m going to show buy and sell prices along with dates and graphs. Maybe you can reverse engineer it, good luck!

Ok, let’s get started!

Why

Why did I invest in individual stocks? Isn’t it completely against my passive investing philosophy?

Yes and no.

When I started my passive investment journey I was a total newbie. My model was very simple: there are daily traders and long term passive investors. Nothing in between. Those who invest in individual stocks are the daily traders who are here to speculate on short term fluctuations.

Wrong.

Yes, of course there are many traditional traders around. Those who speculate on prices going up or down in the short term. Those who base their trades on “technical analysis”, i.e. try to find short term price trends and cash out quickly.

Maybe many people made a lot money trading in the past, when stock prices moved slower than today. Today with high frequency trading companies I’d bet the daily trader “professionals” have been wiped out. All the TikTok kids who daytrade during school hours are only doing their best to prove that “a fool and his money are soon parted“.

Trading is something I can safely tell it will never be part of my life. Well… ok, excluding the troll experiment 😀

Anyway, it’s a false dichotomy. There aren’t just day traders and long term passive investor. There are many active investors who sit in the middle as well. They like to call themselves Value Investors. Think about Benjamin Graham, Warren Buffett…

Of course Value Investing doesn’t guarantee positive results. According to SPIVA (S&P Index Versus Active), negative results are much more likely, especially in the long term.

Time to throw a Ben Felix curveball:

(plus this)

Picking stocks is hard, and determining if your (eventual) good outcome happened due to skill or luck is – according to Eugene Fama and Kenneth French – almost impossible.

Anyway, we see success stories all around the world. The above mentioned Warren Buffett being probably the most popular and renown, even though not the most successful. And his above average returns are almost completely explained by factor exposure (before factor investing was a thing), redimensioning his “alpha” into statistical insignificance territory.

Given that there’s someone who’s beating the market (though very few, statistically impossible to determine if it’s luck or skills), one is tempted to think “of course I’m smart enough to be able to pick good stocks!”

Despite the size of my ego, I’m wise enough to understand that:

- The odds of being skilled at stock picking are small if not zero (according to Fama and French).

- Even if you appear to be talented, you must be more skilled than the average player on the market, which is a population composed of PhDs, CFAs, algorithms, data centers, Jim Simons’ & Warren Buffetts… and you.

- Even if you are more skilled than your competitors, you must put a lot of effort into studying companies’ balance sheets, income statements, cash-flow statements, and whatnot. (Want to know more? Take a look at this amazing William Ackman video, or this Plain Bagel video).

- Even if you’re giga-skilled and you put a lot of effort, you still need to be lucky! An active investor doesn’t invest in more than a dozen companies (listen to Warren Buffett), and with low diversification you might experience some bad luck.

- Even if you’re lucky, stubborn, and skilled, you must also be steadfast: you’re probably going to experience higher volatility, and more temptations to get out and run away. If you held Bitcoins from 2011 until December 2017 you’d have had on average four heart attacks before a 2,000,000% return on investments.

- You can’t measure your skills, just your outcome. If you’ve put in the work, endured volatility, and got a positive outcome, you might just have been lucky and misinterpret it as skill. You will be overconfident in your capabilities, and will double down next time, when luck could not show up again.

Even though it might be tempting, I grew up almost immune to the stock picking disease.

Call it loss aversion, or maybe wisdom laziness.

Problem solved?

Not really: I might get tempted in future.

What if I contract the disease in the near future?

Do we have a vaccine for it?

Yes, we have it. And like every vaccine it works by exposing your body to small doses of the (detuned) infectious agent, triggering your immune system to produce antibodies.

What’s the equivalent in our field?

Experience.

Just try it in a controlled environment. Pretend to be a value investor for a while, and see how it feels. Hope it feels bad. Hope you lose a small amount of money.

And that’s why I did this experiment.

Except that I was lucky and didn’t lose my hard earned money.

Since I’m smart risk averse, I’m pretty sure I won’t suffer overconfidence bias. Vaccine worked!

Let’s dig deeper.

How

I wanted to try this “flu shot” for a while, and I wanted to make it fun. Why not during a pandemic? During a bear market? A high volatility regime? It will be 10x more fun, guaranteed!

First question is: how much? It should be enough that I feel the pain but not too much that would put our finances at risk.

I decided to put 2.5% of our NW (~32k USD) in individual stocks. At least 3 stocks to diversify a bit my bets. Time horizon I was thinking about was 6 months. Start in April, get out before end of year 2020 (spoiler: It didn’t last that long 🙂 ).

Why?

Well, the amount of 30k USD is large enough that I’m concerned of what’s happening, but at the same time… no way! If I had lost 100% of it I’d be crying under a shame cube for the rest of my life. I should have invested much less than that. Anyway, to be honest a complete wipe out was unlikely.

Investing in 3 companies (who became 4 thanks to Troll Company) gave me enough diversification, allowing me to have bets on completely different sectors. All of them impacted by the Covid-19 though. Fallen Angels companies, who lost 50+% already. Risk of wipeout was nonzero.

The holding period of 6 months was not only meant for tax reasons (in Switzerland you might be considered professional investor and have your capital gains taxed as income if you hold securities for less than 6 months), but mainly to give me enough exposure to the virus to develop stronger antibodies. I ended the experiment way earlier because I got enough exposure and learned enough in less than a month and half. Plus I wanted to time the market.

What if I’ll be considered a professional investor by Swiss Tax Authority? Well, I don’t think so. My movements and earnings aren’t huge compared to my expected yearly income thru work & unemployment. Plus, given that this year won’t probably be a positive one in all the markets I invest in, I might consider realizing some losses at the end of the year to compensate for these gains (plus dividends), to make tax year 2020 positive for me in case they see me as a professional investor 😉 VYMI, I’m staring at you.

The reason for the Troll Stock is a bit different. I called it an experiment within the experiment for two reasons. First, I always wanted to bet on Penney stocks and see if they’re so horrible as one would imagine (Spoiler: yes they are!). Second, it’s like individual stocks on steroids. Like a leverage investment. Like driving blindfolded on the highway, in the wrong direction. More on this will follow.

What

Ok, what did I invest in?

As I said, I’m not going to reveal the actual stocks, but let’s characterize them here.

Before that: how did I chose those companies? Why them?

Easy: Freeloading 😀

Listen guys, I’ve been throwing a lot of gems for free on my blog since almost four years, now it’s time for you to give back to me! Muahahah!

Among the hundreds of amazing people I’ve met thanks to my blog there are several active investors. They put a lot of effort in researching good value companies. Some of them have certifications like CFA. Many of them devoured Howard Marks memos and Berkshire Shareholders Letters. All of them are very passionate about studying companies’ financials. And all of them shared their portfolio with me, along with the rationale behind the companies they hold. I owe you a beer 🙂

What I’ve done is pick companies who were recommended by at least two different trusted friends.

And no, I’m not recommending you to do the same!

That’s what I did, because I’m lazy and I wanted a quick vaccine. Going deeper would have been closer to “getting the disease” to me.

Well, of course before investing five digit amounts into each company, I performed a 2-3 hours research on each one, to double check and (don’t! don’t!) emotionally attach a bit. The quality of my research was nothing compared to the spreadsheeting of my friends 🙂

I’m not proud of this. And – again – this is not how one should invest.

Ok, let’s define my bets:

Energy Company (EC)

EC is a fallen angel, who had suffered many falls in the last year and half.

The top to bottom drop was close to -90%. Holy crap! But it’s an otherwise solid company that suffered from Oil price decline and other contingencies.

It also issues nice dividends, but it wasn’t for dividends that I bought it.

Last 5 years:

A lot of dead cat bounces!

How’s 2020 going so far?

Shitty, of course!

On April 20th, I purchased 1000 shares of EC at 12.60 USD/share (12.6k USD invested).

Not very far from the bottom 🙂

Real Estate Company (REC)

Commercial REIT companies crashed very hard during the Covid-19 market crash. Business closed, rents weren’t collected, demand for the near future dropped… but we all know everything is going back to normal after the pandemic is gone, right? Well, we can’t be 100% sure. Remote working is becoming a real thing, so maybe companies are no more interested in renting Fifth Avenue NYC offices. We’ll see. For now, investors have been cautious with Commercial REIT stocks after the March 23rd bottom.

REC was founded not that long ago, so let’s see its 5 years performance:

Ouch, losing money… and dropping by A_LOT during current market crash. This is also a hot company for the “dividendists”, since it has issued growing dividends since its inception. Ooops maybe this is going to change soon.

Anyway, how did 2020 go?

Crappy, like all the other companies in my experiment.

On April 20th, I purchased 500 shares of REC at 16.36 USD/share (8.7k USD invested).

Money Company (MC)

MC business model seems to good to be true, that’s why it trades at high multiples, i.e. there’s no free lunch.

Anyway, lost almost 50% during the Covid-19 crash. The dent on its price seems unmotivated by pandemic effect. This is actually a position I was tempted to hold. Also issuing relatively high and stable dividends… it’s a trap!

Last 5 years:

Ok, suffered a bit in the recent past, before current crash as well.

How about 2020?

What a dance!

On April 20th, I purchased 200 shares of MC at 50.96 USD/share (10.2k USD invested).

How did it feel?

On April 20th, after having put ~31k USD into individual stocks I felt really scared. It felt wrong. And that’s the first feedback signal to record. Could I have anticipated it? Probably yes, but let’s not forget that most of our decisions we don’t know if they’re good or bad until we take it. It’s common knowledge that the best way to pick a decision between two options that seem almost equal is to flip a coin, hide the result with your hand, and pick the one whose side you’re hoping for.

That’s nothing magic, it’s my basal ganglia talking to me.

You won’t know how you feel about the decision until the decision has made.

Ok, first signal acknowledged. It feels strange, unfamiliar, weird, risky, WRONG.

But I can’t sell them right away, right? Well, I could, but how stupid would it make me feel? And let’s be honest, those are good companies, with a solid track record and profits. Let’s stick with the plan.

Or… let’s sell all of them tomorrow, maybe I get lucky and experience a nice bump and I can brag on my blog “I made 5% in a day ha ha ha!”

Then, the day after:

All my companies were down. I lost 624 USD in a day. What a stupid I am! Why the hell did I start this experiment? I can’t sell all my shares today, I’d be the proverbial dumb investor. What if I’ll do the same with my ETFs when they are 50% down? I need to HODL!

Anyway, let’s register another uncomfortable feeling: fear. Fear of losing money, fear of being stupid, fear of same behavior showing up again with “real” money… And regret. Regret of having bought these stocks, regret of having tried the experiment. And fear of eventual regret in case I sell the stocks today, and tomorrow they’d bounce.

Why the hell did I expose myself to this?

Ok, let’s not think about it and wait. Remember, learning is the final goal. Ok, I put 31k USD on this thing, it could end up being a pricey lesson, but I’m confident that in the long term this will pay out.

What happened next? Well, some bounces:

And more

And even more!

It felt good. I was “in the green”. I decided that if the stocks would go down I’d sell them before going even. Which is not a healthy strategy.

But they kept going up!

And bouncing down…

Fluctuations in individual stocks are an order of magnitude larger than an index. I don’t want to know how it felt for individual stock owners riding the Feb 19th – March 23rd crash!

Well… I know how to find it out: Troll Company!

But before going there: it felt wrong most of the time. Following my individual stocks distracted me from following the broader portfolio. In the end my individual stocks represented just 2.5% of my wealth, why was I putting so much attention to them?

I guess it’s like gambling. I felt adrenaline and dopamine flowing. It can become addictive. Not good. Not healthy. Hard to keep myself rational. I knew I would have acted instinctively sooner or later.

If my stocks had lost 20% diring the first week, instead of going up quickly, I would have sold them for a loss. And that’s how to be dumb money. Especially if you didn’t pick your stocks after having studied their documents but as an “act of faith”.

Good. I mean, BAD, but that’s the role of a vaccine 🙂

Getting Out

Around mid May I decided I wanted to get out. I was extremely lucky to have learned useful lessons AND been paid for it with positive returns. That’s because the stock market bounced nicely since the bottom of March 23rd, not necessary because my stocks were good picks.

So, on May 26th I decided to get rid of EC shares first.

On May 26th I sold all the EC shares at 17.35 USD/share, for a total profit of 4.75k USD 🙂

It’s 37.7% in 36 days. A percent a day, keeps the doctor away.

Few days later, I decided to close all my individual positions.

On June 1st I sold all the REC shares at 20.45 USD/share, for a profit of 2.05k USD 🙂

It’s 25% gain in 40 days.

Plus I collected 2 dividends distributions of 116 USD each (pre tax), bringing the total profit close to 2.25k USD.

This one I was really tempted to hold for longer…

On June 1st I sold all the MC shares at 56.45 USD/share, for a profit of 1.1k USD 🙂

It’s 10.8% in 40 days, not bad, but it’s been the worst performing of my individual stocks.

These numbers are before fees (and eventual taxes). Trade fees have been negligible: in the order of few dollars in total. Total trade fees for all the buy and sell orders for the three companies above totaled to 10.50 USD. More than 50% of this amount was to trade EC, because I traded more shares (at a lower price per share). One thing I learned the hard way with Troll Company is that the smaller the nominal price of a share is, the higher the impact of trade fees. Trade fees are proportional to number of shares traded. I don’t know if it’s a stock exchange or a Interactive Brokers thing. Negligible anyway.

Troll Company deserves a section on its own.

Anyway, I earned ~8.1k USD on 31k initial investment, it’s a +26% gain in 40 days.

Awesome, isn’t it?

This returns must be compared to the market though. How did my default investment (Vanguard VT, tracking a World ACWI index) perform during the same time frame?

VT went from 67.09 on Apr 20th to 73.86 in June 1st. A +10.1% gain.

S&P500 over the same period grew even less: +8.2%.

So my 26% is outshining. I picked two (EC and REC) outperforming stocks out of three. MC performance have been same as VT.

I’m beating the market, I’m a genius! 🙂

…And that’s the main error to avoid if you’re unlucky enough to achieve positive results with your first small attempt at playing the investor game.

How does it feel to get out?

It feels good. I feel more aligned with my values and my long term passive investing attitude without individual stocks.

Of course I am tempted to check current prices for the stocks I owned, the adrenaline is there. But that would be silly: it would make me feel good or bad for no reason. Knowing myself I’d be full of regrets if I discovered that I should have held for longer. Why should I go checking? To learn what?

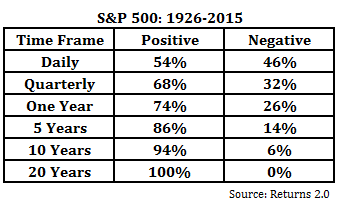

Same can be told for other investments. Why am I checking the value of my portfolio each day? Maybe this experiment in individual stocks is teaching me something more important: constantly checking your assets is not healthy. And if you look at your portfolio value each day, you’re going to be pissed off ~46% of the time. If you check your portfolio quarterly or yearly, the odds of being disappointed go down to 32 and 26% respectively. If you forget about it for 20 years or more, you’re never going to be disappointed.

Me?

I was checking my portfolio several times a day…

Will I invest in Individual stocks again?

Is the individual stocks investing disease (ISID) like the seasonal Flu that requires yearly shots? Is it like the Tetanus, whose vaccine lasts for a decade? Is it like Measles, that once you’re vaccinated you’re done with it forever?

Or is it like the Covid-19, for which we don’t know yet if a vaccine would be useful?

I don’t know.

I want to think that I’m good to go at least for a while, say 3-5 years. Let’s classify ISID it in the Tetanus family 🙂

Ok, maybe I’m going to allow few more (minor) shots along the way, in the 4 digits range. Maybe reinvesting those 8k USD I gained from the experiment. In the end I am a genius, I’m the next Warren Buffett… I will let you know 🙂

Symptoms that I want to avoid are:

- High volatility. Wealth creation is a marathon not a sprint. A stock gaining 12% in a day doesn’t look “normal” to me.

- High risks of catastrophic loss. It happened once in human history that Dow Jones lost more than 60% of its value. Which fraction of individual stocks composing the index lose 60+% of their value and never recover? More than 40%.

- Addiction. I don’t want to end up on r/wallstreetbets.

- Bad emotions: regret, greed, fear, guilt… how much do I value sleeping good at night? A lot.

- High stress, due to all of the above.

- Higher Taxes. investing heavily in individual stocks, or try to make it your main source of income will expose you to income tax on your capital gain in Switzerland. It means you have to overperform the market by at least the taxes you’re going to pay for having played this game. If the index achieves a +10%, and you beat it with an astonishing +14%, if you’re considered a professional investor you end up paying income tax on the whole 14%. If your marginal tax bracket is 30%, your after-tax gain is 9.8%. Less than the index performance! You have to consistently beat the market by a lot to make this endeavor profitable.

So… I guess the vaccine is starting to be effective.

Time will tell!

“Ok, cool, you’ve been lucky RIP. I’m too scared of investing in this booming stock market now”

You.

“Me?”

You. Yourself.

“ 😐 ”

I can see you.

You’re sitting on a pile of cash.

You ask for help because you don’t have guts to enter the market.

It scares you…

But when we break the ice and talk frankly, you start fantasizing about investing in cool companies or sectors… maybe it’s time to invest in Oil, short Tesla, bet (leveraged) on EURUSD…

“But I never…”

You.

Please.

Shut the fuck up.

You’re afraid to invest because you think investing means gambling.

Don’t ask for my help.

Learn to be ok with getting bored by your investments.

Be like Herman Hesse’s Siddhartha.

I can think, I can wait, I can fast.

I can think. I’m a first principle thinker and I don’t follow the herd. I redo my math from basic axioms and draw my own conclusions.

I can wait. This is a marathon, not a sprint. Don’t try to cheat the systems, play the long term boring game.

I can fast. I know that investments returns are secondary factors in wealth creation. Much more important is your ability save more. Get better at it before investing.

“RIP you scared me ._. ”

Haha ok, I got too far. I don’t know if I really believe in what I just said 😀

Anyway, many friends are doing great with value investing, maybe you should listen to them instead of listening to me 🙂

That’s all for today, I hope you enjoyed!

“Wait RIP, what about Troll Company?”

Well, not today.

It deserves a post on its own, stay tuned!

“But give us at least a hint…”

I did it 😉

“???”

Have a nice day 🙂

You are right, I need to get out the individual ones, too.

The market definitely beat me the last 2 months.

“Wealth creation is a marathon not a sprint.”

Nice one!

My initial plan was to sprint ahead with good picks and then go into the ETF marathon.

Did not work too well 🙁

The problem for me is that investing in individual stocks increase the odds of multiplying by zero: https://ofdollarsanddata.com/avoid-the-zeros/

I am not sure this kind of “vaccination” experiment would work well for everybody. Indeed I am not sure at all that the analogy with vaccination is correct.

Gambling is notoriously addictive, so for a lot of folks this could end up being more like “try a dose of opium and see how it goes”. Especially if it goes well – like in your case, where you made a good profit – it could generate unhealthy behaviours. Then if it goes bad, the “loss recovery” fallacy kicks in and more money gets wasted.

I’d recommend this kind of extreme experience only for strong-willed people. The FIRE community is arguably so, although in private I suspect a lot of people behave far less zen and detachedly then they are supposed too.

I myself cannot help but check how the stock market is going almost every day, even though all I have is VT ETFs for my long-term strategy, so it really does me no good. 😀

This is a good point.

But to remain in your analogy, maybe trying some small quantities of a drug – with the goal to prove yourself “it’s not as good as they say” – helps you removing the thought forever.

I don’t know. Maybe I’m wrong.

I think documenting my process here has some value for others.

Ideally it helps in prevention, like an interview with an ex addicted could help drugs prevention 🙂

You’re right that in order to get some benefits one has to join the experiment with a strong will.

I bet the Troll Company was TSLA, bought at 746 and sold at 898 which was the most recent peak. Man you are one lucky stock picker 😀

Hahaha you couldn’t be more wrong!

A Tesla stock is worth ~5000 stocks of my Troll Company 😀

You bought the bankrupt JC Penney

… and we have a winner! 😀

This seemed like an interesting and well paid off experiment. Why not continue? Personally I believe in value investing I just don’t have the time to do the research. If you can use your network to target companies it may be worth it to allocate 2.5% of your portfolio, without much time investment from your side. IMO its give and take, and you give a lot with this blog!

Yes you checked the prices daily, but it was the first time. If you would allocate a % of your portfolio and set some rules for buying/selling you would not need to check it daily any more.

I don’t know. Maybe. But I don’t think I’ll do it.

Hey, I’m looking for others who have become clean, not for drug dealers! 🙂

Just curious, why is selling after a drop “dumb money”? If you believe in un-timeability of markers, the current state of the market is the only thing we should use to predict future, so the history simply does not matter, and the dumbness of selling at any point in time is constant.

Similarly, if you don’t believe that profitable stock picking is possible, it follows that you also cannot pick bad stocks (because otherwise you could beat the market by picking everything else).

While I mostly believe in the efficient market hypothesis, I also think the market is not 100% efficient (Grossman Stiglitz paradox). And in the short term the market is a voting machine (cit. Benjamin Graham).

Selling the day after having purchased, in case of a drop is in my opinion a very dumb move, unless you have reasons to believe that a disaster is coming that wasn’t there the day before.

Plus, reversion to the mean. Ok, not timeable, but if I get 100% in a week I’m sure I got way above the average, and sooner or later the bill is coming.

Your second point, which is a generalization of the first, is a very good one. One I was thinking about and that makes me challenge the efficient market hypothesis even deeply. Essentially you’re saying that it doesn’t make ANY difference which stock you pick. I go even further and say ANY stock in ANY market. I.e. investing in Tesla, Coca Cola, or a REIT firm in Congo is the same. Essentially you can ask you dog, by barking, which stocks to pick and you’d have 50% chances of beating Warren Buffett.

Well, of course it’s not black and white. I think you’d be better off asking your dog which stocks to pick than give your money to a random active investor, and that’s due to fees.

But I also believe that the market is not 100% efficient, so some room for arbitraging is there. Plus, since the historical returns are skewed and the entire surprlus return in S&P500 is returned by the top ~4% of all the stocks, picking one of the rare winners is appealing, that’s why people play. Nobody would buy a lottery ticket for 1$ if the outcome would be a uniform random distribution between [0, 1.5$], accounting for taxes and lottery operations costs.

Anyway, I don’t want to hide behind a finger, my thoughts are confused. I understand the paradox of believing in both EMH and reversion to the mean, but that seems to be the world we live in.

Hi MR RIP

Im a stock picker. Not because of gambling and not because I want to outperform the market.

I like to identify with the company. I like the idea to be an owner of a good, financially solid company. I like to be responsible for chosing the right company to invest in. I buy for the longtime. Im investing since 2015 and I never sold a stock. I only buy them. Hopefully I will only sell them in 20-30 years.

Thats also the disadvantage of stock picking. You need an exit plan. For an ETF its easy, you have X amount of it, you sell for example 1/40 of X. But if you are FIRE and have different stocks and want to take out money (capital gains) which stock you are going to sell?

So maybe when I reached FI, I should sell all my portfolio and buy etfs. Or in the best case dividend income is enough for the cost of livings.

For those who are checking multiple times the stock prices and have a strong risk aversion, stock picking maybe isn’t the best option.

And you need also a good financial understanding and a little stock market experience.

I think one big advantage for non-financial institutions is, that you can do what you want. In big “market-mover” pension funds, hedge funds, state funds, banks, there exist risk tolerance guidelines. So if a share or ETF loses -15% they are forced to sell. Thats what makes the prices keep falling and the private Investor can buy these assets. You need balls for that, but like in your case, it can make good returns (congrats, btw. You made almost the same return in 1Month, than in the “amazing” year 2019).

Im looking forward to meet you again and chat.

Greetings 🙂

P.S. I love Bill Ackmann. He’s the Robin Hood of capitalism. I loved the netflix movie “Betting on Zero” with b*llshit Herbalife. I think then he lost the 1 billion bet, but now he made his billion while the corona crash.

I also do stock picking, I trust that the companies I pick wont die in the next 20-30 years. These companies have good history.

Obviously things can go wrong with a company, that why I have few companies in my portofolio.

I don’t get this point. You know that things can go wrong with individual companies, then you say that’s why I have FEW companies in my portfolio?

Can you elaborate on that?

In an Index fund you have lets say 100 companies..but from those companies only a few are top companies..it’s like those are the locomotive of a train. The better locomotives you have the faster the train will be. My idea of stock picking is to pick only locomotives.

What are the chances for Apple/Microsoft or any other company with history to default to 0 in the next 10-20 years? (I read the article regarding avoiding the zero – good one).

I might be wrong but for me it looks better to have control on which stocks you invest money.

It’s called “illusion of control”.

Really, watch this video from Ben Felix, and if you want you can read Fama and French study on luck vs skills.

I just discovered him watching this video, and he looks very professional. I didn’t know anything about his personal story, will dig deeper. Thank!

I respect and understand your decision, but I don’t like the concept of identifying with a company I work for, I let you imagine how I want to identify with a company I happened to purchase a stock of 🙂

Buying and holding individual stocks is dangerous, because the market returns are driven by few amazing stocks, while many of them will fall and never recover. Like individuals, they live and die. If you bet on the aggregate is much safer.

You made a good point about the big market mover though, but I’m sure there are companies built with the sole purpose of arbitraging this out 🙂

See you soon KM!

You can only chose from a couple of companies to work for, but there are a lot to invest in. And maybe I would not like to work for a company like coca cola but I like their business and I think they have a long history and I think they will exist in another 50 years. While you stock picking, you will have some rotten cherries, but if you have a little bit sense for investing and how businesses work, you will pick also some good performer.

In aggregate maybe you will have not the better result than an ETF, but you have the responsability and you can decide the allocation of your shares. When Apple or Tesla ‘s PE Ratio etc is high, you buy something else. And you dont buy simply an ETF every month with the same 2% in Apple, 2% in Tesla etc. You are more flexible.

And if you are a stock picker you can go to annual meetings and get gifts 🙂

Rotten cherries are 96% of the stocks, according to studies I can link 🙂

The whole return is driven by few amazing stocks, which one of them is unpredictable. Did you guess that Domino’s Pizza would have been the best stock of last decade?

Are you sure Coca Cola is a solid business and will be there for the next 50 years? Well, maybe yes. But you know how many think the same? EVERYONE. Like… do you know how many think that Tesla is the future? EVERYONE. And you know what happens when everyone think X? it means that X’s price already contains this information.

KO CAPE is 25 today, like a growth stock…

We know, Fama French and CAPM are good academic theories, which was proven and valid for a specific period, but not for the whole time. Testing something with historic data is ok and the best we can do, but how predictible and reliable it is for investing decisions, is questionable. We cant take into account all variables. And you know, there are also psychologic variables of Investors, which change with time.

For me Tesla and KO arent the same. KO has a history of >50y. Is solid, pays dividends regularly (they try to grow dividends time to time). And because they are market leader in a market which is very solid, I believe they will exist in 50 years.

Tesla is a very young company with no profitable business. The stock share rose only on base of hope.

In CAPM KO has a Beta of 0.4 and Tesla 1.5-2.0.

Yes, you are right, the price X includes all relevant information. But a Company like KO growing with y% per year is not the same like Tesla.

KO made 180% in the last 10 years (without dividends only about 70%). S&P made about 200%. Yes S&P was better, but for me its ok. A boring but solid company.

Truth is your experiment result and the conclusion you make of it are nonsense.

You had made your mind before.

And honestly, claiming to be a first principle thinker, and at the same time running a very poorly designed experiment (who invests in 4 stocks for 6 months if not a gambler?), drawing nonsense conclusions, what is going on here??

A lot of interesting stuff can be read on stock investing, but this blog post is an amazing effort to reach the pinnacle of mediocrity.

Cheers

For entertainment purposes only

Well, my experiment had not much to do with stock picking, but with the psychology of individual stocks owning and how I felt about it.

It didn’t mean to be a scientific experiment about “how to invest in individual stocks”.

Anyway, I love to receive critiques and feedback, they help me growing and improving 🙂

Sadly, this one was completely useless and borderline troll… what a waste of time for both of us!