Hi RIP friends,

Marry Christmas and happy new year 🙂

Welcome another boring post about my investing paralysis. A couple of weeks ago I told you about my unmotivated November 2019 escape from stocks. If you missed my last post, please take your time to read it before this one, or else this one wouldn’t make much sense.

TL;DR for the lazies: I sold ~300k of stocks ETFs, realizing a lot of (hopefully tax free) capital gains and leaving my portfolio unbalanced and too conservative (35% Bonds, 35% Cash, 30% Stocks) for a wannabe FIRE.

I’m glad many of you found the time to write me a comment or a private message: thank you very much. Some of you found my thought process reasonable for my wealth/health balance, and few even useful for their own situation as well.

So here I am, documenting what happened since last post.

I’m sorry that I’m pushing many more interesting posts further, but this had to be done before EOY. Do not worry, I’ll soon have much more time to focus on my writing 🙂

[Also: before EOY 2019 I’ll set up first meeting with the 6 “lucky ones” selected for my coaching experiment. – for you folks: expect an email before end of the year 😉 – and then I can get back on track with my desired schedule. It will be an amazing 2020!]

Ok, back on topic!

I’m in a messy situation: hosting grandparents for Christmas Holidays, going to Ikea every other day for the new flat, mounting furniture every other day, unboxing boxes, playing with BabyRIP and also…

“RIP, you said back on track…”

Yeah, right. Everyone has a messy life, I’m not the only one! Anyway, I dedicated an evening to read all your comments and reply to them, I let the thoughts evolve in background while doing other tasks and chores, and decided to set aside the entire Tuesday December 24th to make decisions and take actions.

Let’s start with analyzing the alternatives you recommended:

1) Dividend stocks / Dividend Growth: quite a few of you told me I should just put money into “high dividend stocks” or better “stocks who have historical records of growing dividends over time“, the so called dividend growth strategy. Someone mistakenly call this “value investing“.

This has been the most common suggestion.

And I hate it.

But don’t get me wrong. I don’t hate dividend investing, I hate that the “FI Community” is so fond into dividend investing. It’s like a cult I called dividendism.

Dividendism has two flavors:

- the “High Yield” order: buy stocks with high dividend yield. A nice pair of Vanguard ETFs that implement this strategy is VYM/VYMI (US/International).

- the “Dividend Growth” church: buy stocks with historical record of growing dividend over time. Vanguard has also ETFs tracking this: VIG/VIGI (US/International). Mind that VIG Yield is around 2%, like S&P500 Yield… confusing at least.

It’s also common for dividendists to not buy ETFs but pick stocks directly. A cult must have its own dogmas.

What do I have against dividendism?

It’s been proven so many times that issuing dividends is irrelevant – if not negative – for a company. Still people believe into this thing like it’s the only thing that matters in investing. Someone even made a fortune about selling this mantra to others.

Let’s back my claim with some data from real experts:

- Big ERN from Early Retirement Now wrote about the Yield Illusion (or Delusion) three amazing posts, with simulations and data. Plus another insightful post on small cap and value stocks (mind that high dividend stocks are not the same as value stocks), arguing against size and value risk premiums. I’m a bit on the fence about this one, but few decades of history have their relevance.

- A 2017 Vanguard research on both High Yield and Dividend Growth concluded that “Compared with other equities, the performance of these strategies has been time-period dependent and largely explained by their exposure to a handful of equity factors: value and lower volatility for high-dividend-yielding equities and lower volatility and quality for dividend growth equities“. Not the fact that they issue dividends.

- Ben Felix, in his amazing Common Sense Investing (CSI) YouTube channel, demonstrated how dividend investing should just be called stock picking. And he confirmed that the exposure to the factors (value, size, profitability) are relevant, not the fact that a company pays dividends. Enjoy the video, it’s just perfect:

A few more words on Ben Felix and his channel (CuriosiTips time!): if my blog were only a blog about investing, I’d shut it down after having discovered his channel. He’s simply perfect. There’s no need for anything else at this level of complexity. He’s able to reduce complex matters in simple and precise terms. I’m devouring his videos in my spare time. I’m learning a lot of technicalities, and I’m pleased to discover that (1) I know more than I thought I knew, and (2) I agree with his conclusions 95% of the time. Amazing Ben, thank you for your great work! Ah, Ben also hosts a podcast named Rational Reminder, about investing of course.

About the above “dividend irrelevance” video, I have a main concern though: money, and in general the entire economy, has some value because we assign a value to it. It’s a story we tell ourselves (cit Sapiens, Harari). So if there’s a psychological factor at play in “receiving a consistent and almost predictable cash flow from my stocks”, then it has economical value. It can turn dividend investing in a self fulfilling prophecy. Which is both good and… extremely bad! Companies are encouraged to keep issuing high and/or growing dividends even when it doesn’t make financial sense for the company, just to keep shareholders from running away. It can easily turn into a Ponzi scheme. An example: GameStop. Issuing high dividends until… ooops! Fun fact: GameStop stock is up 51% since August, when announced cutting dividends 🙂

Note that the dividend infidels are not detractors of dividend stocks. They are all showing us that following blindly dividend strategies is at best irrelevant, at worst brings in uncompensated risk due to lack of diversification. P.S: here‘s another perfect video from Ben Felix about risks.

TL;DR for the impact of historical (high? growing?) dividends on future returns:

I couldn’t help but laugh at it 😀

But still… I’m one of those victims of psychological effects, with the desire to replace a steady income with an investment-generated cash flow. Yes, I could buy the entire market and sell shares when needed (not allowing the companies dividend policies to dictate my spending – Ben Felix), but I’m lazy and I like passive cash flow so… let’s cherry pick some articles to rationalize my decision to invest in dividend stocks!

Value (not dividend, but let’s pretend it’s dividend!) is underperforming since few decades… but it’s cyclical so YEAH!

“The valuation spread between value and growth stocks has widened. Indeed, as a result of the relatively poor performance of value stocks over the past decade, the book-to-market spread between value and growth stocks is at about the same level it was in 1992, when Fama and French published their research. The potential for outsized returns from value stocks is greater now than it has been for some time“. I don’t understand what it means but… YESSS!

Dividends payouts have been much less volatile than stocks evaluations in last 120 years so YAY! Well, total returns volatility of dividend stocks has been much closer to the global market one, and during the financial crisis of 2008-2009 dividend stocks performed even worse but… shut up! And give me a break!

P.S. saying that a company who keeps issuing growing dividends is better because the cash flow is less volatile is the same as saying that applying the 4% rule to a retirement portfolio reduces its volatility to ZERO, because its “dividends” are predictable, and growing with inflation rate. And if the market goes down the yield goes up!

R.I.P. dividends.

But… as I said, I have a relationship of love/hate with dividend stocks. To add more irons in the fire, dividends are tax-inefficient in Switzerland. Unless your income is low (dividends are taxed as income), and of course unless you’re considered a professional investor and pay taxes on capital gains. Since low income and professional investor might look like 2020 for me, dividend paying stocks become appealing again.

I own high yield stocks (VYM and VYMI) and some supposed high yield bonds (WING and IEML). I’ll keep them and maybe increase my VYM and VYMI exposure.

2) Value investing: a couple of you told me I should look into Value Investing “a la Benjamin Graham”.

According to Wikipedia “Value investing is an investment paradigm that involves buying securities that appear underpriced by some form of fundamental analysis“.

Someone mistakes Value investing for dividend investing, someone else mistakes it for just stock picking based on intuitions. Value Investing is hard work. It’s a job that requires time, skills (very hard to prove one is skilled), and it is very likely to underperform the market.

Of course I’m somewhat tempted to try it, I’m an easy prey to the overconfidence demon. But the facts that (1) it requires a lot of work, (2) increases volatility without an extra risk premium (i.e. uncompensated risk due to lack of diversification), and (3) makes it easy to be classified as a professional investor (requiring higher returns to break even considering capital gain taxes) make me think ten times before stepping into that territory.

Not for now.

Pass.

3) Ray Dalio’s all weather portfolio: why not copy a popular low volatility / decent yield portfolio? Few years ago, Ray Dalio – for those who don’t know who Ray Dalio is, please get out of this blog within 30 seconds! Go! – suggested a simple portfolio with assets anti-correlated in a way to reduce volatility while obtaining higher profits than fixed income strategies.

This is the composition:

I’ve dug into it a bit, and it’s hard to find a reliable source of data on past performance of this portfolio in terms of yields, max drawdowns, and volatility. According to iwillteachyoutoberich, who quotes Tony Robbins who quotes Dalio (LOL): “The strategy has produced just under 10% annually and made money more than 85% of the time between 1984 and 2013“. Nice cherry picking of start and end dates 🙂

In increasing articles quality: lazyportfolioetf shows how the portfolio made money even during the great financial crisis of 2008-2009, with a max drawdown of 6%, while portfoliocharts (the kamasutra of financial nerds) brings the enthusiasm down with just a 5.3% average annual return from the 1970 to today. Even worse: since year 2000, the 10 years rolling average is just around 4%.

Anyway, I have no doubt that it’s a good portfolio for its low volatility.

My complains are:

- His low volatility is kind of magic, I suspect it’s overfitting past data.

- Too much US centric.

- I don’t like Gold (but I might get in love for commodities, that are underpriced now).

- 55% bonds? In a low yield environment like this?

Still, it might be a good temporary choice while figuring out other variables in life.

Not for me though.

Pass.

4) Get back in stocks ASAP: just swallow the pill of a month out of the market, while most indexes grew by 2-3%, and get back in before it’s too late.

Valuations are high, but maybe we’re closer to 1989 than 1999. Getting out now and wait for a crash might mean never coming back without a significant amount of lost opportunities, and decades of regrets.

Don’t time the market! I wrote one of my most successful posts about this, why am I not following my own advice?

It’s time in the market that matters, not timing the market.

Yes, I’m swallowing my pride and buying stocks.

Not buying the exact same assets though, I’ll take advantage of last month weakness to simplify my portfolio and buy VT.

Not all at once: reducing volatility (and accepting lower expected returns) by Dollar Cost Averaging (DCA) during 2020.

5) Hold Cash: cash is king! What’s the problem with holding cash? If you don’t see opportunities around, why not sit on your cash? Warren Buffett is sitting on a lot of cash right now, you can do it too!

Yes, in fact Warren Buffett is underperforming the market since a decade.

But let’s not FOMO, there’s no need to rush.

I feel more at peace with myself if I have some (hundreds of thousands of) cash reserve. As I said in my last post, this is also due to my perception of being running last lap of my career as a software engineer. My risk profile at age 42.5 with a dead end career is probably different than yours. Judge me judiciously 🙂

Ok, I’ll keep holding a lot of cash for FIRE standards.

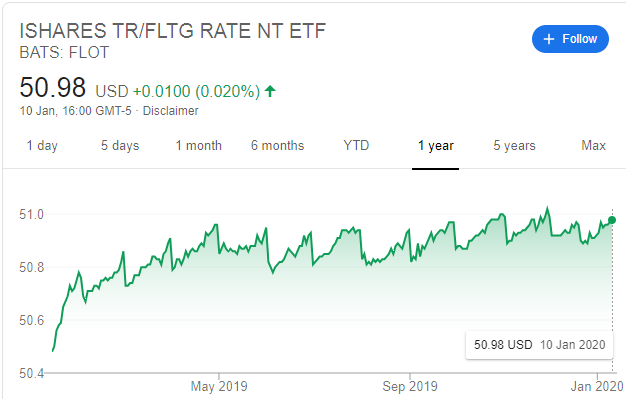

6) Buy better bonds: as reader eagle commented, I should get rid of the bad EU bonds I hold (IBGS and IEAC) and buy USD-denominated Investment-grade corporate bonds (FLOT). I’m sorry I never introduced these bonds before. I purchased some bonds in late summer and fall, and I’m a bit overdue for a Financial Update (one of the next posts) where I’ll explain my thought process back in summer.

Anyway, US bonds were on my target. They still offer 2+% stable returns, which is much better than 1% IB interest rate on USD cash.

I took time to look into US bonds and decided to purchase some of them.

Ok, then what?

I sat in front of my computer on Tuesday December 24th, with a full day of focus ahead of me: no chores, no duties, no furniture to assemble.

First thing I did was write a document with goals and planned actions. As I started writing it, I realized that my goals were not clear. Good! Let’s spend the entire morning clarifying my investment rebalance goals.

At around noon, I was done with a draft of my investment goals.

Is it a new version of my IPS? I wouldn’t call it that way. It’s a temporary doc, that needs to be re-evaluated during next year. The doc lists goals and actions in the immediate, short, mid and long terms. It seemed to me a smart thing to do given my circumstances. I’m in the midst of a turbulent life change, so I’d rather have some fine grained maps for the transition along with the long term vision of an IPS.

This is my doc, please take a look:

Key points:

- I’m going to sell more ETFs this year, and realize more capital gains.

- I’m keeping a huge emergency fund of 200k EUR equivalent (mostly CHF).

- I’m aiming to 50% stocks / 50% bonds for the mid term, then I’d like to implement a CAPE & Age based AA strategy.

- I’m not buying regional ETFs for stocks, just VT (as I recommended in my ETF List).

- I’m getting rid of small cap stocks. It doesn’t make sense to chase lower volatility and hold high volatility assets.

- I’ll put more money into high dividends (VYM and VYMI). In theory, value factor carries a risk premium which means it has higher volatility… so why value is ok and size is not ok? I’ll live with this inconsistency and will figure it out later.

- I’m buying US bonds (at least as a temporary store of value) and getting rid of most of EU bonds. I plan to keep some EU, and EM bonds in the mid term.

There are many more minor decisions taken, take a look at the doc.

Before you say “well done RIP, this is very wise/smart/responsible” (or before kicking my ass) let me tell you that all I’m doing is make our wealth ready to dodge, deflect and bounce back the most insidious attacks from its strongest enemy: myself. I’m the weakest cog in our machine. I’ve been the one who made the accumulation of wealth possible, but I’m also too emotional, weak against greed and fear monsters, and – as I already said – an easy prey to the overconfidence demon.

My time weighted portfolio performance in 2019 has been 20.24%. And this doesn’t count the fact I’ve been sitting on more cash than I planned to!

A dead investor who had all their money invested in a 75% stocks (VTI) and 25% bonds (BND) would have achieved 25.67%. A better dead investor who hadn’t stopped monthly automatic contributions to their investment plan would have performed even better!

I’m not in danger, I’m the danger!

Anyway, on the same day I took a lot of the planned actions for immediate, short and mid term.

Here’s a screenshot of ideal vs real Asset Allocation with actions taken.

This is a screenshot of the investment tab of my private spreadsheet. The public one is not in sync yet. Will do once I connect it with the new 2020 Net Worth spreadsheet, it’s not worth the effort now.

Fun fact: most European stock exchanges closed at noon on 24th, so I wasn’t able to sell CEUS (will try again on the 27th).

Report of the actual trades and fees follows:

As you can see, I purchased 120k USD VT, 70k USD BSV, and 27k USD FLOT. I’m mostly done with bonds until April (will sell IBGS and maybe buy more BSV, not clear though). I will DCA into VT, VYM and VYMI during 2020, need to define the exact deployment though. With the expected future sales of CEUS, EIMI and IBGS (135k EUR) and the current cash above 200k emergency fund (another 115k EUR) I should be able to DCA 20k EUR per month into stocks during 2020.

As always, trading US domiciled ETFs is laughably cheap, while EU ones are relatively expensive.

I don’t know WTF happened with IPRP though. One share was sold at a higher price, but it generated 2.19 EUR trade fee! What the crap??

Anyway, thanks to the sales, I realized another 5.3k CHF capital gains! Let’s celebrate!

I’m at +90k CHF in realized profits for year 2019!

Uhm, let’s wait tax declaration for the celebrations 🙂

You can take a look at my Net Worth by Asset Class evolution. Currently I’m 30% stocks, 43% bonds and 27% cash.

You can also take a look at my Net Worth by Currency, which shows an uncomfortable USD over-exposure (15% EUR, 31% CHF, and 54% USD)

What’s next?

I’m now sitting on 230k CHF equivalent (mostly USD) on IB, plus another 100k on my checking account. More money is coming my way during the next month (Hooli stocks vesting 30k+ USD and yearly bonus 20k+ CHF).

I plan to DCA into VYM, VYMI and VT. I also plan to sell CEUS (asap), IBGS and EIMI in April.

I guess by summer 2020 I should review my strategy, based on how foggy is our family future.

But this is material for a new huge series of posts 🙂

“Wait RIP, did I hear correctly? You ‘quit’ trying to time the market?”

Yes, yes, I quit timing the market (for now) with with my tail between my legs.

If you ever want to try it: please don’t.

Let’s close with yet another Ben Felix video about market timing and why it is wrong (and another one with a lot of data about why index funds are better than stock picking).

Enjoy!

And… Happy new year 🙂

It’s very hard to overlook how the market performs after you perform a drastic action such as selling 300k at the height of the market. I’ve been there! I once pick individual stocks (hey I was young and naive) and sold when they doubled the profit. I felt like I beat the market (maybe I’m also a victim to that overconfidence demon you talked about), but then these stock continued to march on higher and higher and HIGHER. I felt defeated. Now I know better to not pay attention to the market fluctuations and just diligently invest in a board based index fund – I’m still in the accumulation phase.

However if I’m at the last stretch of my career and itching to unplug from the matrix, I would also feel better sitting on a pile of cash/bonds and sleep better at night!

The FOMO on higher gains (greed) is not as destructive as the fear of losing a lot of money (fear) for me. I just realized that and acted (a bit aggressively) on it 🙂

Thank you for a very insightful post and lots of great content to go through for next days!

Qq: I assume you autosale Hooli stocks and convert to ETFs, which consistently underperform them (that should be the case for last 6 years, right?). Did you ever feel any regrets for not holding them? I have hard time selling tech companies stocks for indexes looking at the historical performance.

Waiting to hear more about your future plans! Wealth you accumulated is spectacular, but Switzerland is super expensive and 4% rule wouldn’t be enough for my expanses.

I know about that feeling of regret. I am also lazy so I tend to hold company stocks for some time (but I did end up selling most of them after MrRIP told me why it’s the right choice). Keeping them is a nice bonus with their superb performance, and I also feel less bad about them when their price goes down because I feel like I got them for free (yes, they’re part of my salary, but I get on just fine even with the cash only, so this mental image works well for me). Also I don’t like Hooli’s autosale offering for a few reasons, it feels better to do it on my terms (also it’s simpler and also practically free).

I also sell stocks on my own, but was considering to switch to autosale. Can you give the reasons why you don’t like autosale?

My point on the why I do sell Hooli stocks is simple:

– If Hooli gave me extra cash instead of vested stocks, would I take that cash and buy Hooli stocks?

My answer is NO. If yours is yes, then:

– In case I’d buy some Hooli stocks anyway, would I buy exactly the vested amount with exactly that vesting schedule?

If yours is yes (wow, what a very strange and refresh-dependent coincidence) then keep stocks.

Why I would not buy stocks of my company if I had extra cash instead of stocks? Diversification: I already work there, I already have a lot of eggs in that basket! I’d rather buy competitors’ stocks! If Hooli gets Yahooized I’d lose my job AND my money.

Did my strategy produce good outcome? NO. Hooli stocks outpaced my investments average return by far since I joined Hooli in 2012

It’s been a good decision then? YES, good decisions can have bad outcomes: https://www.youtube.com/watch?v=I8gH5bR3clg

Now, how I do sell stocks is via autosale. I wanted to remove myself from the equation (with temptations to time the market), and be able to also sell stocks when the trading windows are closed.

One can argue that autosale dates are predictable and if a non-negligible portion of employees are on autosale plan, this can be arbitraged by speculators and you’d experience a temporary price drop effect around autosale dates, which make you lose some money. I’ve been on autosale for a couple of year, and 7-8 vesting events. Didn’t experience visible drops, and my sample size is too small.

Thanks for the details. Love the video you linked!

Yes, treating the stocks as cash + autosale definitely helps.

What I did so far was converting stocks to VGT, broadening the exposure to the whole Tech sector (which played very well last year).

Thanks for the comment, will make my transitions to VT easier 😉

Replying to kwl: great choice (in retrospective) investing in tech instead of holding stocks of a single company (where you also work).

It turned out to give you amazing returns, but the intrinsic risk associated with lack of diversification is uncompensated risk.

Thanks for another interesting post RIP! I have been thinking about asking you to perhaps blog your analysis/commentary about the different BONDS (what are the characters of looking for good bonds to invest, what to look for as an EU or Swiss resident, the pro and cons of current available BONDS, etc).

Happy new years 2020 to you and the family!

Will do will do…

Happy new year to you and your family as well 🙂

One other thing you might consider (if you’re going to stay longer term in CH) is doing what I did and buy a house here. Yes, the returns are low, but it could be the stable low volatility asset you’re looking for in place of bonds.

Ben has a video on that too: https://www.youtube.com/watch?v=Uwl3-jBNEd4

My rent is like ~40% of what the 5% rule would give. So it seems much better to rent now. We seem to be in a house price bubble.

Can you please elaborate what do you mean by 5% rule?

Mind that the 5% rule is US centric (mortgages at 3%, while in CH you can get 1% or even less), we should have a 3% rule in Switzerland

Anyway, kudos for having shared a Ben Felix video 🙂

I’ll write about that, and I’m not sure it’s a low volatility asset. Especially since one leverages it 5x on average

Hey RIP,

Thanks for the post.

Some observations from my side:

1. Ben Felix is the GOAT. I also love his stuff. One thing I realized is that reading the original papers he posts is also very instructive. they are easy reads. Maybe personal finance needs a version of “the morning paper” 🙂

Regarding your pick of USD bonds my suggestion would be for you to track how they perform over time on your currency of choice (I assume CHF and/or EUR). I’m assuming interest rate parity won’t allow you to observe 2% returns on your money if you are measuring your returns in CHF or EUR (how you spend them). That said, there is a difference between theory and reality and I’m curious to see how it pans out (I really don’t know). I think it is a good practice to have a hypothesis and still measure to understand if things work out as you’d hoped.

I found the term dividendism hillarious XD

Godspeed!

The currency/bond paradox is interesting. I’m still figuring out if it’s a paradox or just strange outcomes so far.

This is how I define it:

– fact: bonds in CHF or EUR have negative yields. Bonds in USD have 2.5% yields (FED interest rates are higher than EU/CH ones).

– apparent paradox: why buy EUR bonds? Just buy USD bonds and get 2.5% risk free

– solution: there’s no free lunch, USD currency will tend to be weaker compared to CHF and EUR (expected value the difference between interest rates, or the difference between inflation indexes, which are on the same page), so there’s no loophole. Else it would have already been arbitraged away.

– fact: this is not happening: (take a look at the USD to World currencies exchange rate here: https://awealthofcommonsense.com/2019/12/charts-of-the-decade/) … ok, CHF is not mentioned there, but EUR is.

So? So you can make risk free money at a greater rate in EUR than the USD risk free rate on government and municipal bonds.

Paradox

Your observation of the USD actually getting stronger instead of weaker are intriguing.

I’ll have to park that as an “investigation topic”.

I was also considering reading Ray Dalio’s book on debt crisis to get more knowledge on this (https://www.principles.com/big-debt-crises/).

For the Dividend part.

I was the one mistakenly call dividend investing as value investing. That is because I dont care so much about how you call it what Im duing.

What I do is that I am investing into those companies who produce value according to my knowledge and I treat their dividend as bonus. So I am not buying them because of the dividend but accept that they pay dividend since I need steady cashflow.

For the sake of understanding(and I am ok if one does not understand my standing): in my terms, amazon does not create value but ikea does. Why do I say this? Say the world would change its mind and would say from now on that we do not mess with the mother nature anymore and only do things what we realy need then amazon could close its door because noone would order anything from anywhere but only would go to next door and ask a local producer to make something what really needed. The ikea could still function since they have local stores for marketing things in between people and they also produce beds, tables and chairs we really need, and ikea has its own logistics for moving stuff. This is of course a very simplified example but I made it in order to make the contrast. By the way amazon does not pay dividend and ikea is not on stock market but both are good examples for expressing my view.

My way of going is not prooven in time frame we consider in stock market long or short but it is prooven in real life. The population have lived over wars, epidemy, whatever but still people on earth started things ower and ower again. Creating value is the most important thing for me. So far in my conscious life those companies created value could live over hard times but started ower again with no big problems.

Yes, it is hard to pick the right ones. I make my mistakes too. But who doesnt.

And again, the dividend is only a bonus, a premium on the business, and not the reason of investing.

It’s not just you, many people (myself included) made the mistake of confusing “dividend” and “value”. No blame, but it’s important to be precise, else it’s hard to communicate. When you hear “Warren Buffett is a great value investor”, “be a value investor like Benjamin Graham” it doesn’t mean that they bought dividend companies, or dividend growing companies. It means they bought underpriced companies, i.e. companies trading at a price lower than the value that the (subjective) value investors assigned to the companies. Then there’s also the objective value factor, which is measured by fundamentals (Price to book ratio, price to earnings ratio, and so on).

I’m curious to see how your amazon vs ikea bet will turn out 🙂

looks dangerously like Gamestop vs Steam or Blockbuster vs Netflix 😀

The only thing that will matter in the stock market are fundamentals – the company’s earnings power and, eventually, the valuation investors are willing to pay for it. Seneca said, “Time discovers the truth.” This may be painful for those lacking fundamental considerations since the fundamentals are the ‘truth’.

The current mass hysteria is about Amazon conquering the world and ruining complete business sectors. Where there is fear opportunities are sure to appear. My experience says that the song (the panic story) may change but there is always something on sale.

The current market is hard to navigate. Many investors are lowering their requirements in response, so as to widen the group of stocks on their radars. The max out of this approach is the ETF, which includes almost endless number of stocks regardless of their fundamentals. You surely need to adapt to the prevailing environment but this approach will most likely backfire.

Just look at today’s ‘story stocks’ like Tesla! Even if you are excited about the prospects of electric vehicles(including me), it is almost impossible to pick the winners of this revolution.

(The names will only be obvious in hindsight.) Warren Buffett had this to say in 2001, speaking to University of Georgia students: “What you really should have done in 1905 or so, when you saw what was going to happen with the auto is you should have gone short horses. There were 20 million horses in 1900 and there’s about 4 million now. So it’s easy to figure out the losers; the loser is the horse. But the winner is the auto overall. 2000 companies (carmakers) just about failed.” It is almost impossible to pick the winners in an industry that is going through revolutionary changes. Speculators may find this endeavour exciting while investors tend to prefer safer bets.

Amazon or Ikea? Iam afraid my time on Earth too short to see 🙂

Nice comment, thanks for having spent the time to drop it here 🙂

I had the same impression of “why index investing is awesome” watching some data ranker videos, like this one: https://www.youtube.com/watch?v=aOymOiQdNaE

Social media as a whole grew by +inf%, but the top 5 social media platforms in 2004 are long dead (except Linkedin). Good luck with stock-picking!

I made some similar choices recently. My current AA of stock-bond is 50-50 as well.

Stocks: 65% VT, 20% VOO, 10% VEUR, 5% VUG. This is quite similar to 100% VT, with a small bit of weight adjustment of caps and regions to my taste. The small VUG is kind of a long shot experiment and VEUR is also useful for its non-USD currency. I stopped caring about dividends completely.

Bonds: 40% BND, 40% BNDX (I would do 80% BNDW but it’s not on ICTAX), 10% BLV, 10% IHYG. The first two make sense because I’m a Vanguard fan, the latter two are also kind of riskier long shots + some more EUR currency.

To top it all off, I’m also pondering if I should buy some protective put options for VT. Some insurance against the market crash that everybody says is coming. I read about the basics and requested the IB trading permission already. It’s quite simple and safe for cash accounts (just like for stocks they don’t allow you to do stupid shit like they do with margin accounts). Luckily, option trading as a form of protection doesn’t make you a professional investor in Switzerland according to the 5 rules. Still haven’t decided if I want to actually do it and haven’t even checked how much it would cost.

And now based on Ben’s video about small cap and value stocks and the fact that they have risk factors other than market risk (very educational!), I’m thinking about ditching VUG and some of VOO and instead getting VIOV or VBR.

Read more about the size and value factors. Read also the Big ERN article (https://earlyretirementnow.com/2019/06/12/my-thoughts-on-small-cap-and-value-stocks/).

Based on pure intuition (read it: probably wrong) I’m defending the value factor and not caring much of the size factor.

Good point about put options. I will one day investigate it.

In general I don’t like insurances, but given the size it might be worth the effort.

Will investigate maybe later this year 🙂

I think it is much more likely that you will be struck by lightning 5 times on the same day than being classified as Professional Trader (PT) by the Swiss Tax Authorities – provided what you show in your blog is really all you are doing: no derivatives, no frequent in and out, no credit, no stock picking / just ETF‘s, holding periods at least 6m …

In order to alleviate your anxiety, I suggest you directly talk to your Steuerkommissär (you should see his name on your latest final cantonal tax assessment) and ask him head-on if your are close to being considered PT and how far off you are on a scale from 1 to 10 – my estimate is you are a 1. If he says you are much higher up, ask him specifically which of your actions put or could put you in danger, and what wiggle room do you still have before being declared PT.

The Swiss Supreme Court regularly decides on PT tax cases, and those situations are far off from what you are writing about your investments, eg.:

“http://www.servat.unibe.ch/dfr//bger/091023_2C_868-2008.html”

“http://www.servat.unibe.ch/dfr//bger/030331_2A_486-2002.html”

“http://www.servat.unibe.ch/dfr/bger/151201_2C_375-2015.html”

“http://www.servat.unibe.ch/dfr/bger/190509_2C_389-2018.html”

“http://www.servat.unibe.ch/dfr/bger/160509_2C_1131-2015.html”

May I ask just 2 questions about US WHT:

1) How much dividend do you get directly from InteractiveBrokers (IB) for your US Eq Funds? 85% or 70%? If 70%: how cumbersome is it to get the missing 15% and if 85%: did you need to sign some additional forms for IB?

2) I’ve read that US funds holding only bonds or mm papers are allegedly not subject to US WHT – do you know if eg. BSV is really not subject to US WHT?

“http://www.klgates.com/permanent-us-withholding-tax-rules-for-non-us-investors-in-rics–a-new-distribution-opportunity-01-12-2016/”

Some samples from my IB dividend report for tax year 2018, all amounts are USD:

VOO:

45.85 ordinary dividend, -6.88 tax, this works out to 15%.

BND:

11.69 dividend, divided into 1.44 ordinary and 10.25 is classified as “Interest from RIC (Non-Qualified Dividend)”. -0.22 tax on the first (15%), 0 tax on the second.

BNDX:

4.47 dividend, all considered ordinary, tax is -0.67, again 15%.

(Also note, IB tends to change withheld amounts for previous dividends several times during the year, they told me it’s because of changing SEC guidance. But the dividend report, which is a separate document you can get in Feb-Mar or so, should be final.)

Thks – that is interesting.

I understand BNDX contains non-USD Bonds (though hedged through FX forwards against USD) that are not issued in the US. Only because the fund is based in the US, the US government grabs 15% WHT on all distributions! (While BND – which contains only US-based Bonds – is mostly exempt from 15% US WHT!)

Does your BND number cover all distributions of 2019 or does it reflect just one accidental distribution; or in other words: is the average of BND distributions subject to WHT approximately 12.38% (ie. 1.44/11.69) throughout the year(s)?

Is there any reliable/updated list of all US-based bond/mm ETF 1) as to what proportion of the trailing 12m distribution is exempt from US WHT and 2) as to how stable that proportion is related to the current portfolio?

Are there any low-TER US-based bond/mm ETF who commit themselves to exclusively invest in 100% US WHT free fixed income products? This might be useful for Swiss investors whose average income tax rate in Switzerland is below 15%.

Thank you, this is very useful!

More on 1: I think the only thing you need is a W-8 BEN. Plus declare your tax residency status (ie. Switzerland). IB should work out the rest. For Swiss taxes, my advisor filled out the DA1 based on IB’s paper, haven’t heard back from the tax office yet.

Well, I missed the “holding periods at least 6m” condition, but as I said I guess it’s a minor infraction. What makes me a bit more scared (2% instead of 0.5% scared) is that 2019 has been a good year, and the tax authority might be more aggressive in classifying people professional investors. And I made ~100k profits.

Anyway, I didn’t even know I can talk to my Steuerkommissär, thanks for pointing it out 🙂

About your questions:

1) I usually post dividends and withholdings in my updates (last one about Q3 2019 published a week ago). For US distributing ETFs I get 85% on my IB USD cash account, and a notification of 15% US Withholding tax. I had to sign a W8-Ben form on IB to tell IRS I’m not a US resident or national.

2) I don’t know. So far I hadn’t received any BSV dividend, will write about it as soon as I have some data.

Last year I was caught by the same “paralysis by analysis” and decided that it would be prudent to gradually get out of stocks and try to hide in something less correlated to the market, which could still get me decent returns, so I decided to invest a good chunk of my portfolio in other ventures.

I also looked at real estate auctions for example. It’s not bad to diversify when your instinct tells you market valuations are lofty, it’s not “market timing” but simple risk minimization.

In this case, it’s “market risk” minimization.

I am lagging the S&P this year but what happens when there’s a sudden 20% drop in the general market while you are still up your usual 10%?

As Howard Marks says, you don’t want to predict the future, but you need to know at which point in the business cycle we currently are, and where we stand from a valuation point of view

On a side note, have you considered other markets? Some of them are really cheap (like Russia or Turkey) and are worth a second look

Yeah, I was surprised to discover Russian stocks have a CAPE below 8 🙂

source: https://www.starcapital.de/en/research/stock-market-valuation/

Problem is CAPE alone doesn’t tell you if a market is cheap. Best article on this topic: https://theirrelevantinvestor.com/2019/03/26/multiples-are-not-valuation/

I watched the Ben Felix vid because I could not sleep weel without doing it.

He says in the video that the dividend theory is irrelevant and he proves that using a different theory and saying that the theory what he is explaining must be true. What? Why? His theory is also only a theory. Why would that be better than the other one? He claims that because the dividend is paid off the value of the company is lower by the paid off dividend. Simply because of this mathematical deduction. If only that would be that siple.

He also says that: the belief in that the mispricing systematically happens in the stock market is wrong. He is right. It does not happen systematically. It happens time to time. We can not time tis either but it happens. So it happens regardless of the fact that the company pays dividend or not.

Then he comes up with the „comparing 2 companies“ theory. By the way, when on earth has happened that 2 companies were the same? In laboratory probably but not in reality.

He argues that , whether you believe in mathematics or not, and he ellaborates long on this, by the paid off dividends the company values drop equally by that dividend (again). No other way around. I was feeling like he wants us to mess up value with price.

Next argument is, buying only dividend paying stocks holds you back from holding half of the stock market. Consequnce, the less stock in your nest equalls less diversification. Wow. Are you sure?

I was expecting more from this video. WTF. And people just follow him like god. I cant tell why.

The “dividend theory” is not even a theory 🙂

The theory he shows in the video is based on research and it’s the factor theory, which explains almost all the risk adjusted stocks beta. The research he shows says that the returns of high/growing dividend stocks are explained by exposure to factors. You can get same returns, with less risk, just exposing your portfolio to the same factors, ignoring the dividends.

It means you can seek exposure to size, value, profitability and get better risk adjusted returns than chasing dividend stocks.

because of academic research and empirical data supporting it? Not all theories are equal 😀

The fact that paying a dividend implies a loss of capitalization of the company is just math. You don’t see it explicitly because it’s mixed with other normal stocks movements. It’s easier to see in a low volatility asset. Take for example a short term bond like FLOT who issues a monthly dividend, and see the price:

Did you see those monthly drops? Exactly.

Well, how else you would do any research without this kind of analysis? It’s called scientific method. It’s also called logic.

It’s the definition of diversification.

I don’t follow anybody like a god. Not even any of the ~4k gods currently worshiped by humans. I follow reasoning and data. This guy’s level of reasoning is outstanding. If one day he says bullshits I won’t hide that!

Just to check that I understood correctly your point: you don’t think that – all else being equal – the company stock price drops of the dividend per share amount after having issued dividends?

It’s quite simple math to explain. Say there’s a company with an estimated value of $1M (some of that cash, some of that other assets, includes the whole market valuation), and there are 1000 shares. So each share is $1K. Now they pay out $10 div/share, $10K total. That money came out of their cash bank account, so total value decreased by exactly $10K, now their total value should be $990K and the share price should reasonably be $990. That dropped by $10 exactly, wow.

But then you can hypothesize that if the dividend value is less than it used to be, the company may be valued lower out of fear of decreasing valuation, or maybe higher if investors are hoping that the company will be more successful if they find better ways to invest that money instead of paying it out. Can also go up or down if the dividend is more than it used to be. But if the dividend is in line with expectations (what is currently priced in the valuation, i.e. the case of “all else being equal”), then there shouldn’t be any of those movements.

There are also quite direct downsides of dividends: if you want to get your expected market return, you have to spend time and money to reinvest it, and the company will have less cash to work with. Then again they can be so successful that they have more money than they can spend. If you compare e.g. VOO vs VYM vs VIG in backtesting, I can’t see any compelling reason to prefer dividends. I tend to agree with the statement that dividends are mostly irrelevant.