Table of Contents

Hi RIP readers, this is Part 2-BIS of 2020 Q4 Update (here is Part 1, here is Part 2).

Last Friday I’ve published Part 2 of 2020 Q4 update, which is still missing a Part 3 about personal and blog updates, hopefully seeing the light before the end of January.

Part 2 covered my 2020 investment actions and performance, and more importantly my 2021 investing plans.

I’ve published this very long post on Friday afternoon, before a busy weekend with no time to catch up with comments and personal messages. I’ve received a lot of them. I thank you all!

I’m writing this post as a collective answer to the (mostly constructive) criticism, to your questions, and a feedback on your recommendations.

Two things before we start:

- Thank you for your feedback. I really appreciate you spending your time to leave me a feedback.

- Please, comment my posts using English Language. The language of the blog is English (RIP slang 😀 ). If you can read it, please make the effort to write your comments in English. I accept (I prefer, actually) Italian language for mail or private messages on Social Media (Twitter, Facebook, Reddit), but I prefer English comments on my blog posts. Some of the comments in Italian language are very good, and they add a lot to the conversation. Using a language only 1% of he world population can handle isn’t inclusive enough for my standards.

Having said that, let’s get started!

Hooli Value Investor

One of the first feedback I got was a DM on a social media by a former Hooli colleague, with whom I had several chat about Personal Finance, Investing an FIRE while at Hooli (and even after). He’s into Value Investing / Stock Picking, the Warren Buffett style. I’m going to paste here his message almost verbatim. I got his consent 🙂

Here we go (emphasis mine):

Just read your post on the blog. In the interest of improving ourselves, I hope you take the feedback in the right way.

I see two parts of your personality: (a) personal life, (b) financial life.

You are very risk taking in your personal life but way conservative financially.

On top of that, in both lives, you make so many decisions. Just far too many. You look at correcting every little thing and torture yourself everyday with small market movements.

There is something to be said about minimizing decisions. For example: while driving you can play quite a lot with the wheel, brakes and accelerator. You will probably arrive a bit faster, but it will not be comfortable for the passengers. Advanced drivers know how to minimize braking and accelerating and also how to turn the wheels slowly.

I strongly caution against: “every second you are deciding to buy your portfolio at the current price”. No. If Annie Duke says it, I disagree completely.

You want to minimize decisions, not wake up everyday and worry about your portfolio. This will be a terrible way for me to live my life. I would rather make one decision a year. And even then I need to be very sure that my current situation requires me to correct course.

Most of the time, things go back to normal. No decisions need to be made. If you were invested in SPY, the correct response to world wars, sars, covid, russian default, … were the same. Stay invested and if you can stomach it, buy more.

I think you have constrained yourself in your professional life by burning out (maybe). You really don’t want to work.

Furthermore, your portfolio is not so big. 1.5m is not enough for you to be “free” to do what you want.

And maybe you understand this. But one of them needs to change. Otherwise, you don’t really have a way forward.

I would keep doing the 200k job until I have 5mil.

And find a way to manage the emotional troughs I have while slogging through.

— fin —

Sorry, if this comes across as a bit rude. I say it with love.

This is one of the most personal feedback I have ever received on my blog. There are many interesting points, especially about how I’m perceived from the outside, and I’d like to address them publicly.

Two personalities

My friend says I look like an aggressive risk taker in my personal life (I assume it’s because I quit jobs and I don’t fear unemployment) while I act as a conservative with my finance.

What’s interesting to me is that I perceive myself being quite the opposite!

I don’t see myself as a risk taker in my personal life. Yes, I quit one of the best job in the world (and I think I quit 4-5 dream jobs in my life so far), and I’m going to quit another one soon… but I don’t see it as taking much risk. I have something to lose in not taking such risk. And a lot (potentially) to gain in taking risk.

Like Andy Dunn amazingly said:

I’m weighing both sides. I feel the high opportunity cost of working in a job I don’t like. Even though I stopped feeling excited at Hooli maybe in late 2015, it took me almost 5 more years (!!!) to unplug. In your face, RIP risk taker 🙂

My health declined a lot, staying would have been a riskier action than quitting.

Quoting Eric Barker:

Sometimes grit can be a negative. Sometimes grit isn’t even grit – it’s just stubbornness, fear of change, or the sunk cost fallacy working overtime.

Even though I see quitting a job a “minor” risk, it still took me forevah to act and actually do it.

I definitely played with my personal life too conservatively 🙂

On the other hand, I feel like I’m playing aggressively with my finances! Maybe not exactly in this moment, ok, but I come from the most risk averse nation, tribe, family, social environment ever. My father’s knees shake every time I remind him that I own stocks. I’ve grown up – until age 30 at least – cocksure that money must grow in the bank, eventually – if you’re really brave – you can buy some Italian government bonds, and of course a flat with a 30 years mortgage.

It took me forever to start playing with fire, to actually start investing.

Wait, what’s that…

I started investing 5 years ago, at the age of almost 39! After 2-3 years of reading about passive investing, but too scared to jump in. I remember the two trading days after Brexit referendum. Lost 5-6% in 2 days, I got mad! Almost an entire salary! During Q4 2018 I lost 20% (recovered immediately). I didn’t sleep well. What about March 2020? Between a dip/crash/correction and the next one my NW grew substantially, so the stakes were higher.

Today? If market crashed 50% and I lost 500k what would I have to show? In my opinion, according to my mental model, this is much more risky than my “risk taking” perceived attitude with my personal life.

It’s mostly a cultural issue, but it’s so ingrained with me. I’m doing my best to accept the “new normal” of having some money, but old habits die hard.

Plus, having a 7 digits amount of money and being at the end of my career don’t help.

Too many decisions

On top of that, in both lives, you make so many decisions. Just far too many. You look at correcting every little thing and torture yourself everyday with small market movements.

I totally agree with you on this. I’m consumed by decisions.

I do think though, that I’m at the crossroad of many potential futures. I feel that today decisions about work, investments, Italy vs Switzerland, physical and mental health have a huge load of meaning, and a great impact on our future. I can’t just wait for things to fix themselves.

I’m in the process of “sharpening my axe for six hours” before spending the proverbial two hours to chop those tree.

If I had eight hours to chop down a tree, I’d spend six sharpening my axe.

– Abraham Lincoln

I definitely want to cut down the number of decisions I take – I’m already doing it in any unimportant field of my life. You should see how much care I put in my clothing/shopping decisions 🙂

But I also want to make some irreversible important decisions during the next 2-3 years, and I want to be sure that I take the right measures.

I need to stress myself a bit today for a simpler life tomorrow. Today more than ever.

Plus, investment-wise I’m aware that I’m doing things wrong. My July-August strategy of selling all my stocks was temporary. Holding bonds was also temporary. I don’t want a temporary strategy to become long term due to my inaction. I need to be active now.

Maybe this sounds familiar: “previous strategy was deprecated. Current one is not ready yet” 🙂

About the “every second you are deciding to buy your portfolio at the current price” quote from Annie Duke (link), I agree with you that this should not be a self inflicted torture, but more of a thought experiment for when you think your investments are not aligned with your values.

SPY is the answer

Yes, sure, in hindsight you’re right. Historically you’re right. Like Taleb’s Turkey.

Outcome-based analysis, decontextualized, with an infinite time horizon.

When you buy something don’t you take its price into the equation? Well, today stocks (S&P500) are priced 38 39 times their earnings, 35 times their 10 years inflation adjusted average. doesn’t it matter at all? Even if P/E was 100?

Are you sure that during next world war the stock market will go up?

I don’t have an infinite time horizon, in 10 years I’ll be 54. Who said “in the long term we’re all dead”?

Global GDP growth rate averaged to ~3% during last 50 years, while the stock market returned >10% nominal per year.

Maybe, just maybe… we’re a bit ahead of ourselves, no? Maybe we’re too enthusiast, exuberant, optimistic… maybe the 2% population growth is not going to last for long (hopefully, I’d add), and it seems to have contributed to world GDP growth a good half of it. Maybe the “next 5 billions” are already shopping. Maybe we already captured all the low hanging fruits since we started trading companies on stock exchanges. I’m talking about industrialization, technology, women in the workforce, bye bye absolute poverty, “Artificial intelligence”, and so on.

Maybe we’re about to enter a “productivity winter”. Can you bet against it?

Or simply, we’re overdue for a reversion to the mean that will kill the next 2-3 decades or more, like in Japan.

Today, every sector that carries any dust of hope about the future gets overhyped. You got mining stocks, marijuana stocks, tech stocks, electric vehicle stocks, clean energy stocks… Let’s not even get started with anything that has “blockchain” somewhere on their homepage.

Even a stock of a troll company who pushes trucks from mountains and claims they’re autonomous performed +700% last spring.

This is not a scenario that makes me comfortable investing in. A scenario flooded by TikTok traders, that are completely losing their minds and believing things that are not things.

But let’s talk about SPY, i.e. US large cap.

A comment to my previous post by reader Martin pointing to a different source for global CAPE turned out to be another source of terror for today valuations:

Research Affiliates studies and data are eye opening. Please spend some time browsing their data. You need to create an account, but it’s free and well worth your time.

Large Cap US (S&P500) are expected to return negative (real return, inflation adjusted) in USD, over the next 10 years.

US large caps seem to be the worst investment in stocks for the next 10 years:

Other markets are less overpriced. For example the global stock market is expected to grow 2% per year (in USD, after inflation) over the next 10 years.

Of course other asset classes suck even more! We’re in a crappy situation right now, this is undeniable.

Take a look at cash and bonds, this is scary:

And I’m not talking about “noise, fluctuations”. We’re taking a cold look at the next 10 years.

There’s an interesting thread on historical data from a CHF perspective on MP forum. I want to highlight those two contributions (1, 2) by user San_Francisco.

First one is about 10 years of MSCI World index from a CHF perspective:

Cherry picking? Well, here you can find rolling average over 5-10-15… years nominal returns in USD. Rolling 20 years nominal return (before inflation) in USD (which is sucking vs CHF) in 2018 has been 3.74%. Before inflation, before currency conversion.

Do you think we’re in a better market than in 1998? Maybe, slightly…

What about the 70s? Not just in the stagflating US, but in the entire word:

Now, this is index investing and I know you, my dear friend, are a value investor and might use this argument to reinforce the belief that index investing is for losers. But in your message you praised SPY, so that’s what I’m arguing against. And I think we can agree that active investing is not for everyone, right?

“But my QQQ shares are doubling every month!”

Yeah, I know. Adding Investing FOMO on top of everything. But I’m old enough to not fall for it. I’d rather wait and lose “potential gains” than join this worldwide Ponzi scheme as a leaf.

“Then what?”

I don’t have an answer, and this is driving me crazy. I have drown my plan in last post. I’m addressing the feedback, and maybe I’ll change something.

Else, I’ll end up reluctantly following my plan. Buying overpriced stocks, with disdain. Ready to tell myself “told you” when prices will be back to normal.

This other comment by reader fabric is a cold shower though, a reality check:

You’re right, if we want to reach FI we need to believe in “passive income”, in “sending the money to work for us”.

Right now I don’t know if I’m willing to make a leap of faith and believe in it.

Or maybe I need to see a reversion to the mean, a huge shock that would detoxify the market from exuberance, TikTok traders, and dangerous optimism/overconfidence in general.

The plan I shared last week is a compromise between my reluctance to invest in this environment, the acknowledge that T.I.N.A., the faith in FIRE, and a bit of Investing FOMO.

But I’d keep all my money in cash in the bank if they gave me 1% instead of -0.75% while the market is this level crazy.

Lazy RIP

Back to my friend:

I think you have constrained yourself in your professional life by burning out (maybe). You really don’t want to work.

Two things. Let’s start with the second one:

You really don’t want to work.

On the contrary, I think I’m a workaholic. I’m working very long hours, and complaining about coming weekends. I have Friday (not Sunday) Blues. I told my wife that 2-days weekends are unacceptable, I can’t stop working on my projects for two consecutive days.

So maybe we should define “work”… but it would take 5k words so let’s skip it 🙂

But you’re right. I really don’t want to work:

- For The Man.

- On projects I don’t fully believe and love.

- On projects that have not enough impact.

- With people I didn’t choose.

- Without complete autonomy. I need a “do the fuck you want” white card.

- On a field I don’t master.

- As a Software Engineer (for now).

Maybe the only chance I’ve left is self employment? Maybe. Probably.

Then be it 🙂

Burnin’ Around

I think you have constrained yourself in your professional life by burning out (maybe).

This is interesting and I’d like to explore it more. Do you mean that I have responsibilities in having burned out?

Well, of course I have some. I could have prevented it, handled it better, or forced my way thru like a military or a stoic.

But my question is: do you think I chose to burn out? That as the symptoms started showing up (I didn’t realize it at first) I decided to cling to them in a self destructing vicious cycle?

It’s not a rhetoric question, please don’t get me wrong. I seriously fear I have nurtured my depression.

Btw, wouldn’t that be a “normal depressive behavior”? Should I blame myself for having acted “like a sick man” while being sick? Of course I could have done better, but I think I could also have behaved way way way worse. I’m kind of proud of my overall life direction in face of my tendency to let events and circumstances take me down.

Anyway, surely I should have recognized symptoms early on and changed team or company before my passion for the field drained out. I let myself slide off the employability spectrum. I don’t blame myself for the burnout, I blame myself for having let a soul killing job drain my passion.

Mandatory FatFIRE

Your portfolio is not so big. 1.5m is not enough for you to be “free” to do what you want. And maybe you understand this. But one of them needs to change. Otherwise, you don’t really have a way forward.

Yes, 1.5m is not enough (ad I’m short 100k+ CHF) In Switzerland. But maybe you forgot that I keep the Italian hypothesis alive. If we move back to Italy 1.5m would be more than enough even if we won’t earn any income, any pension, any inheritance. Even with an investment strategy aimed to just cope with inflation.

Switzerland? Nope.

Italy? Yep.

If Italy were not on the table, I’d frame my problems differently. I’m forcing myself to find yield in this environment, and a salary at the end of the month to keep the Swiss hypothesis alive, because we think we like it more than the Italian one. If we give up on the Swiss hypothesis, surrender, and check this box off for good… I will have several decisions less to take 🙂

I’m fighting for something we as a family think is valuable, which is essentially a supposed opportunity-richer future for our daughter, and a higher perceived quality of life.

But I can decide anytime that what we have is “enough”.

Retire Early at age 64!

I would keep doing the 200k job until I have 5mil.

I ran some numbers, with an optimistically 3% NW Growth in CHF and 100k net savings per year:

I will reach 5mil in 20 years, at age 64. Yes, we can technically call it “Early Retirement” 😀

Thanks for the suggestion, but I guess I’m going to quit in February 2021 anyway, 19.9 years earlier than you recommended.

This is my response to Mr. HVI, and I hope it doesn’t sound too rude. I thank him a lot for his feedback, it’s a bless to have a honest “third-person point of view”.

There are valid points that I subscribed to (like aim to reduce the number of decisions), and maybe I should take a look again at some “slides” on Value Investing and abandon Index Investing for a while… not today though 🙂

Next!

Mr Laag

This is probably the best comment to my previous post, from reader Mr Laag.

Let’s start by saying that I love your point #4!

…

Ok, jokes apart, let’s address your points one by one 🙂

Writing

I truly understand your need to write and how it clarifies things. Every time I take the time to write, I always think I should do this more often.

Totally agree! This is essentially the main reason I write: to discover what I think.

Improving my writing skills, being a source of inspiration/entertainment/education to others, holding myself accountable, and having a community of therapists ( 😀 ) are nice side effects.

Everyone should definitely write more.

Overthinking

While employed save aggressively and invest everything on Stocks (VTI or VT). You don’t really care about what’s going to happen to your portfolio short term (it may go up, it may go down). Once you’re approaching retirement, allocate a small percentage to bonds and stick to that allocation. I know it’s always tough to do when you’re the one invested.

I don’t want to dismiss your point with “come back when you have 1M invested and a dead-end career“, I’ll do my best, promised 🙂

Yes, it’s tough when you’re the one invested. And it’s even tougher when neither the “while employed” nor the “approaching retirement” conditions correctly define your situation.

I’ve shown above how we might be at the edge of a 10-15-20 years nonpositive returns in real terms, in CHF. It’s not easy for me to invest all my money into stocks right now. Btw, VT and VTI are “a little bit” different.

The impact of market swings on one’s portfolio are correlated with portfolio size. In the early years of wealth accumulation it’s negligible (that’s why someone even recommends using leverage to even out market exposure over your lifetime), at the end of your wealth accumulation phase a market crash would be deadly.

“allocating a small percentage to bonds” is what I’m trying to do with my CAPE based strategy. But I don’t really like it, and buying bonds is not the solution. Bonds suck. Stocks suck. Cash sucks. Real Estates suck (slightly less). Commodities suck. Crypto sucks (even more).

There’s no fucking alternative, and this is driving me crazy.

If you (not you specifically, Mr. Laag) think that “everything is fine” you scare me.

Everything has negative expected yield. Banks in Switzerland are charging negative interest rate on savings. Holding cash is stupid. Holding bonds is stupid. If you think that the only wise thing to do is to invest 100% in tech stocks and bitcoin you really scare me.

Your strategy about F(CAPE) and 1-F(CAPE) seems ok, but I honestly think it overcomplicates things with no certain benefits

Well, it’s similar to “allocating a small percentage to bonds“, with this percentage being higher when the market are overpriced and lower (or zero) when stocks are cheap. I think it’s a defensive strategy that works better than a fixed percentage in bonds. It’s inefficient only in a persistent bull market with CAPE out of control… which means that my portfolio is doing great anyway with 50% stocks.

I think it’s a superior alternative that reduces risk of running out of money, at the expense of a lower expected final NW value on my deathbed. I’m fine, I don’t aim to be the richest man in the cemetery 😉

As you said, you would be just better off by playing dead and never logging in your IB account.

This is again outcome-based decision evaluation. Sure I’d be at least 100k richer if I didn’t sell my stocks in July-August, but we’d be commenting another story if the bubble had exploded in September.

It seems like commenting a soccer match. Final score 0-0, with a missed penalty for the home team in the overtime. “Wasted opportunity!”, “Crisis for team X!”, “Bad match, coach is fired!”

Had home team scored the penalty kick instead of hitting the post: “Marvelous victory!”. “They’re on a strike!”, “A statue of the coach has been erected in the main square!”

The simplicity part is more important than it seems. The more we try to optimize the more likely we are to start making changes to the initial strategy for more optimal allocations etc. For me, a strategy should be kept KISS (keep it simple stupid). The less meddling, the less chances we screw up.

This is a good point, I agree.

But I do plan to set and forget. If my strategy appears to be complicated, well, do you think Bill Gates’s investment strategy is “just invest all in VT!”. It would be complicated, since Bill Gates’s Net Worth ($129B) is 6 times VT Assets under management ($24B) 😀

I think my strategy is a bit complicated but it serves two-three different goals, where every dollar is allocated on a “project”: short term, long term, fun (or placebo / illusion of control).

The long term fund (which is 1M, let’s not forget about that) is my real pension fund. And I want to handle it like a roboadvisor, like a personal index, that someone claimed to be the future of Financial Advising.

The bonds amount (0-50% based on CAPE) and the stocks diversification (World + EM + Small + Value) match my current taste.

I will review the strategy in 2-3 years.

Mind that one can’t be 100% passive, no matter what!

Even your strategy of investing 100% in stocks in VT is not passive. You decided to keep other asset classes out of the door. And you decided to stick with market cap based geographic allocation, which means you’re essentially not owning any small cap stocks. What about your money deployment strategy?

There’s no way to be 100% passive, but this is not an excuse to be 100% active. Let’s not fall into the fallacy of gray. I aim to be “as passive as I can” day to day, but a bit active in the design and evolution of my asset allocation, and goal based investing.

Also, if we’re indeed in a stock market bubble, it doesn’t matter if you hold small cap, large cap etc everything will crush together.

Long term fund is for long term returns. While there’s correlation in the short term (especially during a market crash) between asset classes, long term performances of small, large, value, growth, US, developed, emerging have shown low enough correlation, which is a good thing for diversification benefits.

Stress

Looking at your expressions I can’t help but think that you’re so stressed, that you can think clearly for everyone else except yourself. I’ve been in that situation before and this is the impression I get from your writings the last months. If I asked you for advice, I’m pretty sure you would offer honest and good advice and something close to my strategy, but when you’re the one under the gun, it’s impossible to keep you coolness and approach things the same way.

This is so true. I am stressed. I used to consider “stress” a buzzword, like “happiness”. But recently I looked up official definitions of Psychological Stress and yes, it’s me. I’m the definition of stress.

From Wikipedia (if you think you’re stressed, please make yourself a favor and read the entire entry):

In psychology, stress is a feeling of emotional strain and pressure. Stress is a type of psychological pain.

Stress can be external and related to the environment, but may also be caused by internal perceptions that cause an individual to experience anxiety or other negative emotions surrounding a situation, such as pressure, discomfort, etc., which they then deem stressful.

Anxiety about the future, pressure, a permanent state of instability, and a gazillion amount of microstressors took me down more than I should have allowed them to. I recognize all the symptoms. I was already there at the end of my Hooli career.

I now recognize the long transition in the stage of resistance, and the final – which seems permanent – stage of exhaustion, and the burnout/mild-depression that followed.

Yes, my friend, you nailed it!

What can I do? I’m dealing with my mental inefficiency, and my current job is to “avoid doing extremely stupid things”.

Honestly I don’t think it’s a “clinical” issue, but neither something to underestimate.

Anyway, I’ll keep working on this issue, probably for the rest of my life 🙂

Let go of the past

Do not be afraid to let go of the past. We’re people not robots so, sometimes we need to experience something in order to truly learn from it. So, there should be no shame or guilt in having slight losses in the stock market for just one year, hell others have lost everything! Yes it sucks when we’re wrong, but you can’t correct a mistake (selling VT at

7679) with another mistake (not buying VT at 96), if that’s your strategy.

I agree with you on this one as well.

I know, on paper it’s easy. Committing with your money is hard. That’s why I committed to buy stocks back slowly, 50k per month.

But yeah, I totally agree with you.

Keep in touch

I had more to write here, but this is already getting long enough. Anyway, since I started commenting, we’ll keep in touch.

Sure, I can’t thank you enough for your comment 🙂

I hope my reply didn’t sound rude, I really appreciate your input!

Bonds Make No Sense

Julianek wrote:

This is a valid point in general (why own bonds today?), but I think the CAPE analogy doesn’t make much sense.

Anyway, I will write a separate post (Part 2-TER, holy shit I’ll never get out of this hole!) in reply to a long email that Julianek sent to me, which is about bonds and more interesting stuff. Probably the best non-personal, objective feedback about my strategy from a friend, and a person who knows a lot about investing. Not today though 🙂

P.S. not the central argument in defense of bonds, but I don’t buy that “holding cash doesn’t make sense. Holding bonds doesn’t make sense. It only makes sense to have 100% of your wealth invested in stocks with Earning Yields (1/CAPE) of 3%, in USD, before inflation. Plus of course Tesla and Bitcoins“.

Sorry, I don’t buy it.

P.P.S. I didn’t plan to buy and hold US bonds for good. I just wanted to temporary park money waiting to set time aside to design a better strategy. Strategy that will include bonds, but not 1M like I own today…

Market-induced tendency to change strategy is no good

Reader Ste wrote, as a reply to Mr Laag’s comment:

This is a great comment, thanks Ste 🙂

I try to steel man your argument before replying: you’re saying that both my recent “strategies” made sense, and the correct way to move forward is to stick with one of them instead of changing my mind based on market events. If I do so (and I’m doing so), I’m essentially timing the market and “selling low and buying high”. In general: pick a strategy and don’t change it based on the temporary outcome.

I hope I understood correctly, please correct me in the comments if I made a mistake.

First: my summer “strategy” of selling all the stocks (VT at 79, not 76) wasn’t a real strategy but a strong “impulse”. I didn’t fall at the first discomfort signal with the rising market, I waited at least a week or two then I sold all my stocks during a 2-3 weeks window. It wasn’t a “strategy”. I was just scared I would have regretted not doing it.

It’s called regret aversion. Or if we want to quote Jeff Bezos: regret minimization framework.

I would have regretted not having acted IF the market crashed afterward.

I accepted the risk of being wrong. I didn’t expect to be so much wrong (as of today, January 21st 2021) that the market went another 20+% up in less than 6 months!

I was expecting a crash, or at least a flat market for a while. In the meantime I would have had some time to sit and think about a long term strategy that I would have felt confident in NOT touching for a long while.

Sadly, this 6 months waiting period has been the worst 6 months to be out of the market that I have memory of.

I’m sure had the market crashed right after my “market timing” action we’d be talking differently.

And I didn’t time the market for profits, I just escaped from it due to anxiety.

Anyway, selling stocks and holding US bonds was not a strategy. I didn’t want to stick with that strategy for long.

I think this contradicts your point. It does make sense to change my strategy now because: (1) I was not following a strategy in the last 6 months, and (2) I’m not designing a strategy because the market went up, I’m doing it because at the moment I’m holding bonds with expected negative real return, in a currency which is being printed like there was no tomorrow!

Reduce Volatility

The Italian Leather Sofa (who’s an awesome financial blogger, with real finance skills) wrote:

I’ve only heard about endowment funds in the context of US universities, I can’t find the source but I think it was a John Oliver video.

I did my (superficial) research and what I understood about endowment funds is that they’re expensive “boxes” that invest your money and give you a regular “dividend”. Essentially they offer you services you can build on your own, for a high fee. What you get in exchange is the full delegation of your responsibilities. They’re like trusts. Plus there are many country-specific tax implications, and they are usually associated with charity and donations.

Not sure it’s a thing in Switzerland, not sure it’s a retail thing also.

Anyway, what I “read” between the lines is “delegate your money management”. Maybe, one day. Not today though.

Anyway, I didn’t read the suggested Pioneering Portfolio Management book.

Second suggestion is to invest in a buy-write S&P500 fund (like the recommended XYLD). I must admit that I took a superficial read, but it seems even riskier that just buying an index. And the XYLD has small size, tracks the S&P500 (CAPE = 35), TER 0.65%, and yada yada yada.

But I want to understand the logic behind this fund: it buys the stocks in S&P500 (I doubt they physically replicate the index given the small size of the fund), and they write call options for each security held.

First of all, I couldn’t see the strike price logic: is it “at the market”? Expiration date? What happens if the option expires? Will they re-write another call options for the same asset at the new market price? How do they rebalance when the options is exercised while the underlying asset 10x-ed in the meantime (like Tesla)?

I’m not saying I don’t like the strategy, it’s actually interesting, but I’d love to see some numbers. For example, what’s the impact of cashing all the premiums if the market drops 30% in a year?

I’ll monitor this strategy but I’m not buying right now. Thanks for the recommendation though 🙂

Minor Issues

Real Estate For The Win!

8-12% return from RE in Switzerland… I don’t know guys, you’re awesome! Everyone is getting incredibly rich, EASILY, in this overhyped asset bubble. I’m speechless, huge CONGRATS!

In order to make 12% from a property you should rent it at 1% of purchase price. In Switzerland. Where rents (gross, before taxes, before renovation, before administrative cots) are below 0.2% of purchase price, which makes the 1% per month return impossible even with a 5x mortgage leverage (20% down payment).

I don’t know… as I said, I’m speechless.

But maybe I’m just dumb, and money is falling from the sky and I’m missing out by staying indoor.

Sure, you can always sell and make a profit!

Except… oops, we’re in the RED ZONE of the UBS Bubble index which means BUBBLE. Not OVERVALUED, but BUBBLE.

All pension funds and krankenkasse invest in real estates in Switzerland, and they struggle to carve out 1-2% per year from it (cashflow, not appreciation).

Claiming that you can “easily” get 8-12% looks like a lie. Sorry if I’m rude, but unless you disclose all your data I’m not going to believe it.

P.S. Even if you do disclose, and show your current RE yield, it wouldn’t prove that the strategy is replicable.

High Yield Dividend in Switzerland is Stupid

In 2020, VYM Dividend Yield was 3.17% and VYMI 3.71%. A 50-50 portfolio would yield 3.44%

Also in 2020, VT Dividend Yield has been 1.91%.

The difference in yield is ~1.50%. Which will be my highest tax bracket in 2021? I don’t plan to earn like in the previous 8 years so… say 20%?

We’re talking about a 0.30% inefficiency on 30% of the stocks component, which is 70% (actually 65% after adjusting world CAPE from 22.3 to 24.2) of my long term fund, which is 75% of my NW.

The overall inefficiency on my Net Worth will be 0.04%.

I can deal with that.

I get in exchange exposure to Value factor and a “cashflow” (which I know it’s fake, but it psychologically helps).

Stupid? Maybe. Not a great deal.

I’ve done stupider things 🙂

You Should follow an ENHANCED VALUE INDEXES strategy

Link (it’s a comment in Italian language by Bowman, an Italian blogger).

IWVL, and in general MSCI World Value Index has a lot of Japanese stocks (26%). You should investigate alternative Value exposure. He then listed a few interesting strategies.

This is – I think – a micro optimization. I understand that it might be interesting for insiders and financial nerds, but for me it’s a pass.

Thank you, I’ve watched your most recent video about Value, and I think it’s full of insights.

But it’s too much for me, I got already accused to not KISS enough 🙂

Why not decrease stocks more if CAPE goes above 30?

Asked by reader Mateusz.

Because at the moment I think it doesn’t make sense to go below 50% Stocks even in case of a huge bubble. I might have stretched the MIN_CAPE, MAX_CAPE even more (10-40), or shifted a bit (15-35), but the structure of the function should remain the same.

This is a good compromise between my fighting beliefs (the market is crazy vs the market is efficient).

Of course if something changes permanently and CAPE = 50 is the new normal in a decade, I might reconsider my strategy and be more aggressive. But there will also be other factors at play.

Let’s not forget that my goal is not to maximize my lifestyle, or to die with the largest amount of money but to forget about the existence of money as soon as possible, and, quoting Mr. Money Mustache:

I try to make all spending decisions as if the price were $0.00.

And I make all work and income decisions as if the wage were $0.00.

How do you deploy 50k per month?

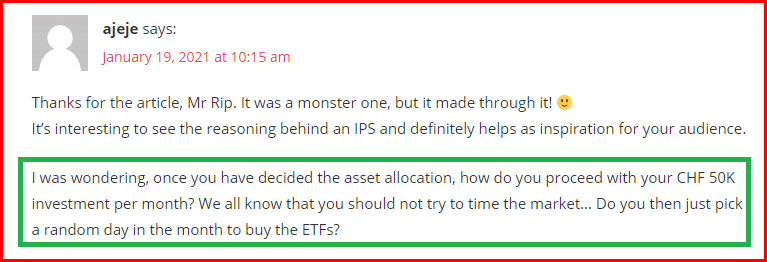

Reader Ajeje (Brazorf?) asked:

I haven’t thought about it yet.

I have built a sheet in my NW Spreadsheet to track what’s unbalanced:

I allow myself to pick each month an overinvested asset (background color RED), sell 50k of it, pick an underinvested asset (background color GREEN), and deploy 50k on it.

I will of course invest first in what hurts less, as explained in my last post:

Plus, I’m not setting a clear “day of the month” for when to make the trades. January is almost gone and I haven’t acted yet… maybe starting in February I will set a specific day of the month. I don’t know.

I might reallocate some temporary assets in the meantime. BND is providing me a nice Italian salary each month, but it’s objectively a bad bet. I might sell all my BND shares and buy BSV in the meantime.

That would make sense, but I’m acting as a dick, as usual: I don’t want to stomach a nominal loss with BND (9k USD unrealized loss, more or less compensated by dividends so far), so I’m holding them longer than I should.

I allow myself a bit of activity in the transition process given that by the end of 2021 my investments are aligned with my strategy.

Ok, of course should something “shocky” happen – like a brutal market crash – I might accelerate the transition phase. I’m praying for it.

Conclusions

I think I covered most of the comments and PMs, except the amazing and long email by my friend Julianek, which I plan to cover in my next post (Part 2-TER).

I don’t plan to change my investment strategy after the feedback received, but:

- I will put more attention to my bad habits of checking the brokerage account daily

- I will do something to reduce my stress level.

- I will aim to reduce the number of decisions in my life, as a mid term goal.

With regard to the last point, I do plan to take a few important and irreversible life decisions in the next 2-3 years, in the hope to simplify my life, my finances, my work. Stay tuned 🙂

That’s all for today!

I’m not sure you should give this much weight to the CAPE ratio, which is meant to cyclically adjust earning. It used to be very useful before the tech revolution, when the big caps were the industrial giants (e.g. big auto, steel, the GE’s of the world etc). Nowadays over half of the US large cap is, IMO, not very cyclical: tech giants, healthcare, consumer staples etc. I believe the earnings of these companies would drop less in a recession than their 1970’s counterparts.

2020 earnings already took a dip vs 2019, and SPY currently trades at ~28x those earnings. Is that cheap? Most definitely not. But keep in mind that things could get back to normal post Covid, at which point we’re looking at a 25x multiple. In a world with negative real rates, I don’t think a 25x multiple, albeit in a good year, is too much. I wouldn’t be shocked if we see much higher multiples than that.

That said, I agree with you that things are looking bubbly, especially in certain sectors. Personally I am trying to replace some of my general market exposure with individually selected stocks. I am especially interested in micro-caps, as large funds cannot touch these, so you can still find decent businesses selling for quite cheap. However this takes a lot of research time and I discard 95% of ideas, so it’s not for everyone.

Historically, EY (1/CAPE) has been a predictor of future returns.

I care about CAPE as I care about the price/quality ratio of things I buy in general.

Quick points:

On timing the 50k deployment, you could use something along the lines of Optimal stopping theorem: https://en.wikipedia.org/wiki/Optimal_stopping#:~:text=In%20mathematics%2C%20the%20theory%20of,or%20minimise%20an%20expected%20cost.

On investments, why not invest a chunk in privat equity fund or something like that. The money gets locked away for years which stops you from chickening out.

It is possible to get high yield on Swiss real estate with leverage and if you are patient to find the right property. However, most property is now overpriced so finding the right property is difficult in the ‘big’ cities of Switzerland. Also, costs can be lumpy and unpredictable which means the true yield is lower than at first sight.. But 3-5% leveraged to 9-15% should be doable. Anything less than 5% unleveraged is not worth the hassle.

Nice suggestion, but that’s way too much effort! (and the optimal stopping theorem is based on independent observations, while market prices are not)

I’ll just allow myself to “try to time the market” in a sandbox environment 🙂

Hi MrRIP,

Let’s get the flowers out of the way, in that I really appreciate your writing and transparency. I’ve picked up quite a few things from you. Thank you and keep it up. At some point in the future I hope I can buy you a real coffee vs just a virtual one.

On to the financial bits and it has two components, my approach and then feedback. This is in the vein of crystalizing my thoughts by writing them down (again, thank you for pushing that), and wanted to share back and it might help someone else here (and help me depending on feedback I get!).

My goal is financial independence when my youngest turn 18, so I still have 12 years to go. And that’s fine for me and my wife as I, well, maybe not enjoy my work, but it is developing and that’s something I value, and I have good colleagues and smart company leadership. I’m well on track to my goal (I think I’m only slightly behind your net worth today). We’re dual income and have approx a 50% savings rate by just being reasonable on our expenses. A very privileged position, I’m aware.

I split our investments into 5 buckets (I’m the one managing the finances in the household as it’s a hobby for me and not my wife, so you’ll see my/our interchangeably):

1) Pillar 2a (not much to say here as again, I plan on working another 12 years), about 30% of net wealth. Will start adding do it in about two years to get the income tax discount for ten years without losing stock market upside (but with today’s valuations, tempted to start today, but that might be changing strategy and the face of our old ghost timing the market).

2) Property. We’ve bought our primary residence (in CH) + a secondary residence (pure quality of life thing and we don’t let out) and assuming flat prices long term (assumption I know, but at least I’m not estimating an increase), we both have the down-payment + ongoing amortization that I see as a saving. (Btw, we lowered our monthly cost moving from a smaller rental, even with a potential significant interest rate hike, and I have no emotional attachment like many French and Germans that “you don’t own your house, your bank does” – find by me, I simply live where I want, don’t mind tying up some capital and cut my monthly cost). Another 35% of net wealth.

3) Company shares & options. I regularly sell stock when they are released to diversify, but keep options long term (unless a I get a 15%+ 10 year annualized growth realized after only a few years). If I count all I could realize at a given moment, another 15% of net worth.

4) Family savings, UBS MSCI World Socially Responsible (thinking of the kids) and Vanguard World High Dividend (my wife is risk averse) Small right now but growing, about 5-10% of net wealth

5) Play money 10-15%. I know you have your opinion about Fool.com, but I kind of enjoy it. So when I diversify from sales of my company shares and also my monthly savings that don’t go to the family bucket, I put here. As I’m up almost 50% on my investments, I think I’m prepared for a 30% drop in the not too distant future (ask me again when it happens). My wife has no say on this. I like learning a bit about the companies and making some decisions on where to invest, giving me the illusion of control – or at least only myself to blame. While it’s a hobby (and thus something I would normally pay to do), I hope I do don’t lose it all. But as I have buckets 1-4, I don’t feel too worried it. I see some similarities to your thinking in your previous blog post.

I’m sure people will want to tell me that we can retire earlier by increasing our savings rate and decreasing my expenses, but that is not my objective. My goal is to enjoy life in the moment and also plan to be healthy and enjoy it with my wife, starting at around 55 with a two year sabbatical, before I decide on what to do with my life when I grow up…

Now, on to the feedback. I can agree with many of previous commentators and also your personal reflections. But in the end, the way I see it is that it’s ok to change your strategy. Yes, we should buy and hold, not time the market, not obsessively check daily evolution, etc. But if your situation or thinking (or feeling!) evolve, simply revise. We learn from it every time. Not saying change on a daily basis, but every now and then (every few years maybe?). And ideally not based too much on stock market indicators (you can put all the metrics in place you want with CAPE etc, but we simply need to accept that investing is not science). Net: chill, and enjoy the experience & learning that doing (or thinking of doing) these changes forces upon you.

Sincerely,

A privileged moderate fatFire hobbyist.

Hi Jonas,

first, huge congrats! If you’re “just slightly behind my NW” with a SR of 50% and 12 years to go there is no way you’re gonna fail at this game 🙂

Your investments are probably considered inefficient by many, but I totally subscribe to them. Just maybe 10-15% play money is too much, but this is (well, has been, we’re always commenting the past) perfect time for momentum and YOLO investing… I’m just scared that it’s early November and we’re all Taleb’s Turkeys…

thanks for your feedback, I appreciate that. I know that sticking to a strategy (being the dead investor) works better, but I’m human. I also know that changing strategy every other day is stupid. I’m trying to find my balance, moving slowly toward the dead investor.

Money should have been a tool for you to reach freedom and it is now taking over your brain. How much energy has it already drained ?

You struggle to define your future and again most energy is put on “first let’s find out how to deal with my stash”. How much does this 7-digit number reflect and define you when you look at yourself in the mirror? This is not normal. How much do the market moves define your mood, your self-confidence, your I-have-to-quit/I-can-quit/I-will-quit/maybe/surely/later decisions ? Not normal either.

We don’t get stronger getting richer but we might feel like we do, and money can beat us.

The stress level around that topic looks like the real bubble that has grown and is quite exploding now. One may even wonder how much this focus has impacted your loss of passion in your job/engineering, how much it has to do with burning out, etc. I am not blaming people burning out, I have experienced it, but I do not share your analysis at all (another topic and each experience is different).

I train myself a lot in loving what I do, doing it well, sharing it with passion, that the very best investment one can do IMHO – and it is not always easy, I have already felt it’s gone- and if we have the chance to get money in return, manage it the smartest way, also with what we can sustain (volatility risk etc…).

It just looks like the whole FIRE stuff is not making you a happier and healthier person.

Sorry this sounds super rude but as for others it is not meant to criticize but to give honest feedback on what I feel as a reader. You open up your thoughts and it is very instructive for all of us readers. Hopefully that helps too.

I agree with you. I wonder what would come out of a ‘5-why’ if he does it.

why FIRE ? then Why, why, why and finally why ?

Does having 5 M chf would fullfill the last why ?

I can go deep 20 whys 😀

While I agree that “money” is consuming a huge part of my brain, I don’t think you have the full picture.

If I hadn’t the wealth I currently have I’d be severely depressed with no idea how to keep going on.

And it’s not the money that’s consuming my brain, it’s the number of options available without a clear Life Design in place. I need to fix some of the moving parts of my life.

These days I’m having a new epiphany, since I came out public, experiencing the impact I had on so many people, and perceiving myself as valuable in the “education” (or call it popularization, inspiration, entertainment, creativity, whatever) field. I’ve not logged in into my IB account for the last 5 days.

It’s not money that’s strressing me out.

Many of the readers’ responses resonate with me but I’ll add my own points:

1. There’s more than 2 countries in Europe besides Switzerland and Italy where you and your family could settle down nicely without the need to pay Swiss prices. This is not a binary situation so you have plenty of choices.

2. All asset classes suck? Pick two asset classes that suck the less to you and have less correlation to each other and use them as the core of your asset allocation. Then stay the course. The whole point of the SWR historical simulation is to go through all the different economic cycles and determine the SAFEMAX. Have you looked at risk parity portfolios like the Golden Butterfly or the All-Weather?

I was actually disappointed (yes that’s the word) when you pivoted away last year from your usual investing strategies without a plan. But now you have come back to explain and at least start planning out what you want to do next – yes it sounds very complicated but still it’s a plan . That’s a very good step forward. I wish you all the best and hope sincerely you can work things out for yourself and your family.

https://www.tawcan.com/live-off-dividends-geo-arbitrage/

Some cost-of-living figures from a fellow FIRE blogger for various cities, including some cities in Europe for your reference.

1) Nope. At our age, with a child that will start school in less than 2 years, we don’t see ourselves going anywhere except CH and IT.

2) everybody extrapolate from the past in terms of SWR but when they see bonds on my portfolio they scream. Why? Haven’t been bonds included in EVERY study about SWR? I mean… we can’t cherry-extrapolate-pick data from the past guys!

Having said that, I know that I disappointed you and many others (and myself!) when I chickened out and tried to time the market.

I’m getting to know myself better these days. A non-negligible wealth of 1.4M, and year 2020 with its crazy market have been too much for me. I need to reframe my belief about market and investing.

In my opinion, real estate is a good investment in Switzerland, so I’d love to be proven otherwise.

Now, I guess there are multiple things that come into play with real estate, the biggest one being “you actually invest money you don’t own” since you would typically get a mortgage to buy.

And most importantly: how do you compute your yearly return? Is it before or after taxes? Depending on how you do the computation, the numbers can be dramatically different. A 7% return before taxes can boil down to almost nothing after taxes since the rent is a revenue, especially before being FI, because of the large marginal tax rates at higher revenues.

But let’s say you buy a flat for 560k CHF, the median price for a 2 room one here, you use 33% equity to get a mortgage for the remaining 77% because you want to fully optimize the taxes benefits of having a mortgage.

Now, the interest rates are low, so you’d typically get away with 1.1% of interest for 5 years, that’s 355 CHF a month. Next you have the amortization because more than 2/3 of the price is a loan you need to get to 2/3 of the price within 15 years, that’s 1CHF a month if you’ve optimized your base equity.

Next: maintenance and all, let’s save 1% of the price for it, that’s 483 CHF a month.

You end up with 839 CHF “fixed fee”, but the nice thing is: the interest and maintenance fund (up to 10% of the rent for new building and 20% of it for 10+ years old buildings) are tax deductible. (There are indirect repayments into pillar 3a in order to keep the same interest rate too. But since the best place to be is exactly at these 2/3rd, it’s not really important, just assume you can have a fixed interest rate for 15 years.)

So let’s do the maths, take the median rent for the same kind of flat (1565 CHF, here) and multiply it all by 12, right?

That’s a 8712 CHF yearly profit before taxes, i.e 4,51% of my investment (193’140 CHF) and that’s before taxes! So with a marginal tax rate between 35% at 100k and 46% at 200k, that means I’ll end up with roughly 2.22% to 1.5% return after taxes… It’s terrible, right? I should have stuck to some ETFs instead. Except rents are really super stable and they won’t “crash”.

But… These are really median prices, and actually you can be picky (just like with stocks, ETFs, etc.) and buy flats that are in the 25th percentile of the cheapest prices, and you can rent high (depending on where you’ve bought, but campus areas are always in high demand for example), so you can pick “good” real estate that will fairly easily cling to a nice 7% before taxes and 4% after taxes.

(And by “good” it doesn’t necessarily means brand new, you’d prefer the buildings that are between 10 and 25 years old or more to enjoy the 20% maintenance deduction, but without having too many risks of having actual big maintenance to do.)

Okay, granted my previous statement in your last post was maybe a bit generous with a 7-12% bracket. My grandfather brags about doing 12% on one of his building and I honestly don’t know how he computed it, but it was definitively before taxes I guess. Or maybe just because he bought it so many years ago.

+1 to real estate. My calculation for my own flat goes like this. I put down 170k for a 850k flat in 2017. Got it re-evaluated this month and it’s conservatively at 1.1M that means my 170k are now 420k. If I sold the apartment tomorrow I would therefore walk away with 250k extra (after 30% realestate gain tax 166k). So more or less doubling my money in 5 years which equals to a 14.4% interest. Add in the saved money because I rent (total of ~12k for rent and renovation fund) which is another 110k over the 5 year period.

Sure the real estate prices might go to shit in the next few years but in that case nobody forces me to sell it and I can keep saving on rental costs. I fully agree with the skepticism around buying apartments just to rent them out, the problem with the pension fund returns are that the rental market is oversaturated and the amount of empty apartments at an all time high.

Duh… -rent +own

You’re evaluating a decision based on your outcome.

Of course if the flat price goes up by 250k in 4 years like yours “it has been a great investment”. It’s nowhere guaranteed that prices will keep going up.

But you’re also talking about your primary residence, which an emotional more than a monetary investment

Reading many comments on your blog on real estate and why you should not overlook them, I’ll add a few thoughts of mine.

You are probably one of the few italians I know who doesn’t go full in with real estate, and that’s totally fine; but indeed real estate is a great asset. It’s difficult to rely only on that to reach FIRE.

I like real estate, let’s consider it the best alternative to “bonds” in my portfolio.

I largely agree with Lery and Mr Cheese’s comments and I’ll make a few examples from my experience, to give some real context.

Me and my wife bought a small apartment in Milan for 180K € including taxes + renovation 35K + furniture in cash, no mortgage. Considering yearly property taxes, manteinance expenses, income taxes and so on, our net yearly return on this investment has been slighty above 5% for 5 years. The property also apreciated in value, and if we wanted we could sell it for a profit.

We were also lucky because even in this covid19 period we had no problem renting it.

Another example: we have another property, total cost + taxes + renovation + furniture 680k € (500K mortgage with extremely good rate + the rest in cash). The net return from the rent on this propery after taxes and after all expenses is 2% if you take into account the total cost of the asset (which now by the way is worth more or less 750K). Considering the leveraged investment and only the money we put in, the total net yearly return is nearly 8 %. I consider rent as a dividend with a good yield, and it covers the mortgage cost and leaves some profit.

Mortgage rates NOW = cheap leverage.

On top of that, if you spend some time in negotiation and careful selection of your tenants you could end up with a much greater return: My parents were renting another apartment to some tenants for 1600€ / month. When they asked us to help them, once they needed to find new tenants, we managed to rent the flat for 2000€ / month, 25% more.

We will not be that lucky every time but… You are in CONTROL for more variables than just hoping that the global market does not crash!

People will say that I should split the returns in half since it’s me AND my wife, so my real returns are halved. I don’t know, we consider us a team and our family economy is one.

Real estate is less stressful than being fully invested in the stock market or holding so much cash.

You have no liquidity if you need it on the fly (you cannot sell right away), but it’s something tangible, with value, that you can improve over time and prices fluctuate a lot less.

The main effort is choosing the right apartment…

for the 680K apartment we searched for 1.5 years before finding something we liked, with discontinuous research and overall not too much time involved (random visits to interesting apartments in our area, at walking distance). The 180K apartment was a good opportunity and we had cash ready.

You have to know your city. You need to consider a lot of variables. You need to carefully select your tenants. So there is some work AND learning involved. But it’s not so stressful. At the moment it mostly goes on autopilot, I just check monthly the the rent is being paid. Once or twice a year I have some minor things to do that take less than a few hours.

I know about RIP’s bad adventure with a flat he owned in Milan: I think he chose a bad area, I know Milan pretty well and I was curious to know where the flat was…

My other consideration is timing:

Ideally you could invest 100 % in the stock market when you are young, in the early accumulation phase, for potential higher returns and higher volatility exposure, and leave real estate for later, as you get near FIRE as a replacement for bonds… I don’t know, in fact I started with real estate and I am happy with it.

I have many other points to say but I don’t want to make this too long.

Of course at the moment RIP doesn’t have a clear plan for where he is going to live in the future, so my advice would be to take real estate in consideration for a future plan revision, maybe in 3 / 4 years from now.

bye bye everybody

Dom

I had the opposite experience with Real Estate in Milan (well, a town near Milan): -35% between 2010 and 2019.

And I know that mortgage rate now = cheap leverage, but it also means inflated prices! If rates will raise by a point or two houses prices will drop a lot. In a leveraged way.

I have trouble investing my money what’s probably a stock bubble, I won’t invest 4-5x leveraged in what’s certainly a real estate bubble.

I realized I overlooked something in my computation: if you decide to consider amortization as an investment/forced savings which you’ll recover when selling the asset, then the above computations are not the same at all again and it might increase the return even more depending how you account for it. (Provided you’re amortizing it.)

Nice realistic analysis, except you forgot property taxes, and fixed purchase/furnishing costs, and vacation risk (you’re assuming 10% occupancy), and tenant management including their solvency risk, and potential appreciation/depreciation (UBS Bubble index put Zurich in the red zone in 2020).

Everything works fine until it doesn’t.

Anyway, I don’t want to say that RE is a bad strategy, it’s just not returning that 12% that I laughed at. We’re talking about a 2% with all the hassles that come with such an illiquid and complex (and taxed) investment. Too much activity in my opinion.

Anyway, thanks for the math 🙂

Hey RIP

Really enjoy all your musings and fully appreciate your concerns of everything being over-valued and in potential bubble territory. The only thing ‘cheap’ is the ability to borrow, but what’s the point of doing that when there’s nothing worthwhile to invest in?

Part of the answer is to think very thoughtfully of asset-class diversification, and no I don’t mean just going from the SP500 to VTI to VT. That helps yes, but not nearly as much as people think it does.

What really helps is investing across asset classes. Someone above here has suggested looking into things like the Golden Portfolio and the All-Weather Portfolio. That is good advice. Also consider looking into stuff like the Weird Portfolio: https://valuestockgeek.medium.com/the-weird-portfolio-99c0154d1c4a

And then, approach your strategy to investing as a quant would. Systematize it. What’s your risk tolerance? What’s the max drawdown you can bear without jumping out the window? The type of volatility you can suffer (standard deviations volatility). Is it equal to the SP500? Half of it? Double it?

Once you’ve answered these questions, that’s when you look into the Sharpe ratio, or high returns PER unit of risk. The point of this is you first define your risk, and then achieve a high return given that risk. You can then choose to lever up OR down depending on the answers above about your risk tolerance. Something like this: https://beatpassive.com/2020/06/06/leveraged-permanent-portfolio/

A simple example of the above. Look at an equal-weight portfolio of the SP500, Long-term US Treasuries and Gold compared to the SP500 alone. The SP500 wins handidly sure. But what about risk adjusted returns? What if you could scale your volatility (standard deviations) to match that of the SP500? Here’s an example. You get higher returns AND lower drawdowns: https://www.portfoliovisualizer.com/backtest-portfolio?s=y&timePeriod=2&startYear=1985&firstMonth=1&endYear=2021&lastMonth=12&calendarAligned=true&includeYTD=false&initialAmount=10000&annualOperation=0&annualAdjustment=0&inflationAdjusted=true&annualPercentage=0.0&frequency=4&rebalanceType=1&absoluteDeviation=5.0&relativeDeviation=25.0&showYield=false&reinvestDividends=true&benchmark=-1&benchmarkSymbol=SPY&portfolioNames=false&portfolioName1=Portfolio+1&portfolioName2=Portfolio+2&portfolioName3=Portfolio+3&symbol1=SPY&allocation1_1=34&allocation1_2=55&symbol2=TLT&allocation2_1=33&allocation2_2=55&symbol3=GLD&allocation3_1=33&allocation3_2=55&symbol4=CASHX&allocation4_2=-65

Finally, keep an open mind… I completely understand the frustration, but you seem to be discounting ideas far too easily without diving in too deeply… then potentially complaining about there not being enough options. The market doesn’t owe any of us a return, and alpha is fleeting and hard to come by 🙂

Really really enjoy the content, and normally I just lurk but your frustration evoked something in me and I wanted to reach out! 🙂 Hope you “Build the life you want, then save for it.” 🙂 Would love to discuss any/all of this further if you ever feel like reaching out.

Buy and hold. Buy and hold.

You just forgot about the most basic FIRE principles and this costing you a lot.

Buy and hold.

Dont time the market.

Just invest long term.

Passive income is passive. You just let it happen. Dont try to be smart it is just a waste of time and money …and stress.

It works.

Stop thinking.

Go back to basics.

It s all there already explained and proved 100 times.

Markets return at least 7% a year on avergage and even more in 2020. Long term you will not lose.

You ee losing money thinking. Just go back to FIRE principles.

Thank you for the reply.

I’ve learnt a ton from the FIRE community about personal finance and safe withdrawal rate analysis but assuming 7% returns forever without even considering that there isn’t a fundamental law-of-nature that guarantees it forever (7% where? the US? Why should we pick that one? In which currency? the US dollar? why should we pick that one?)

Nobody’s talking about ‘beating the market’ or making lots of active decisions. Just recommending an appropriate asset allocation that’s rebalanced according to one’s risk tolerance.

RIP said it best in his post above, we’re talking about a time when world GDP growth (but especially the US) went ‘to the moon’ because of a confluence of fortunate events all happening together like increasing population, women in the workforce, the US’s ascendency as the world’s sole super-power etc. I’m not saying the 7% won’t last, maybe it will, but to NOT question it and think about it is what I would consider ‘risky’.

Thanks!

Sorry actually my message was for RIP. In regards to his last post and the many questions he is raising. My advise to him is to keep it simple. He is already potentially FI and can let his investments work for him should he decide to go full ETF.

Sorry guys, but in my eyes you all look like the Turkey at the end of October.

Time will tell.

Hello and thanks for the kind words 🙂

In a way, I (and I think more readers) see you as someone who is a few kilometers further on the path to FIRE, so we want to know what challenges we’ll face later and prepare for them. Think of yourself as a pioneer showing us how it’s “over there”.

1. I’ll start with the point on stress as it seems to me that this is at the center of all your issues. Anxiety about the future is real and this is also a big reason that leads more and more people to the FIRE path. I don’t think it’s a clinical issue either, but it IS something that can cause some very costly mistakes when left unchecked and with hundreds of thousands of dollars to invest.

I think a small dose of optimism is needed:https://www.mrmoneymustache.com/2012/10/03/the-practical-benefits-of-outrageous-optimism/

2. My point on you overthinking things was that it felt you ‘overcorrected’ your strategy. Going from no defined strategy to an intricate strategy can improve things, but the added complexity can cause unforeseen consequences.

3. The part about not logging in the IB account, was not about outcome based decisions on a certain period of time. It was about following a dead simple strategy, that not only has a good chance of being equivalent (or even better) to a more complex one, but also allows you the luxury of living in peace and not having to think about your portfolio performance etc. In the end is this not the reason we’re doing all this?

4. Your phrase “There’s no fucking alternative, and this is driving me crazy” seems so telling about your current situation. You don’t have to stress so much about it and also, it’s definitely not a good state for making life changing, irreversible decisions.

Also, don’t forget that “The market can remain irrational longer than you can remain solvent”. Are we headed for a crash? Perhaps, but we don’t know and cannot predict when it’s coming.

Your approach, to invest slowly 50k per month is a sound one. It allows you to reinforce your strategy in your mind, so that you can also follow up when things don’t look good. If the market crashes soon, you have a once in a lifetime opportunity to DCA the dip. If there is crash after you’re fully invested in stocks, well, that’s what bonds are for!

5. I was reading some of your earlier writings and these reflected a much calmer person, see here: https://retireinprogress.com/welcome/start-here/

I would suggest going through some of your old posts and see what younger ‘RIP’ was all about and how you felt during this period of your life. Perhaps younger RIP can remind you a thing or two!

6. “Mind that one can’t be 100% passive, no matter what!” . It’s not passiveness that I advocate, it’s simplicity. And I don’t try to accuse you or anything, it’s just that in general simple things work. And even if they’re not the best solution, sometimes it’s just worth for the convenience and ease of mind.

7. Of course you don’t have to (and shouldn’t) change your investment strategy because a few random guys/gals suggested so on the internet. (https://xkcd.com/386/). It’s not like all of the commenters here all agree on a single strategy.

Good luck with your efforts and see you next time!

Thanks LaaG, incredibly insightful as always 🙂

1) stress is a problem these days, but it’s getting better. I think uncertainties about other aspects of life are flooding my money management as well. But it’s getting better! For example I’m not even logging in my accounts since last Friday 🙂 I’ve got other things to do, and my brain is not just focusing on money and fears (which correlate with low confidence).

2) I might simplify it in the near future. Simplify it by making it deliberately messier. I’m thinking about “drop few 10s of Ks on this fund, this other fund, this other fund… and never sell. So I get to make small bets every month, but I need to stick with them for (kind of) ever

3) you’re mostly right about the peace of mind, but that doesn’t help with making your portfolio match your risk tolerance.

4) I know, but that’s where I’m right now. “TINA and it sucks!” (which seems an adult movie title). About “The market can remain irrational longer than you can remain solvent” it’s easier to visualize when reversion to the mean is expected on the upside (after a crash) for me than the opposite. I felt energized in March 2020, I was pretty clear that I was buying stocks at a discount. It’s hard for me to not be fearful now that everything is expensive.

5) I know. I was also poorer 😀 Take a look at the swimming in the current metaphor I made here (https://retireinprogress.com/2020-q4-financial-update-investments-analysis-actions-and-plans/#Reassess_my_Risk_Aversion). But I’ll take a look at Young RIP, thanks for the recommendation 🙂

6) If simple things work there were no software engineering job. simple things SELL. Btw, I’m playing devil advocate because somewhere deep down I know you’re right.

7) LOL

Thank you for your great comment 🙂

Hey RIP! Thanks for answering my comments in the other post 🙂

I think that if you didn’t properly “choose” last time to de-invest everything, then you are right to reestablish your strategy now. I wish you good luck.

Actually I’m also a bit worried of the current “optimistic” situation, let’s hope for the best!

It’s not “optimistic”, what’s happening around us is plain crazy. Either we’re at paradigm shift time and “nothing will be the same anymore”, or we’re where October Turkeys