Table of Contents

Hi RIP readers,

Welcome to our latest Quarterly Financial (and Personal) Update!

It seems centuries have passed since my previous quarterly financial update. I had to re-read it to get a sense of “where I was” three months ago.

I’ll first analyze our finances – as always – then few aspects of my personal life.

I’m sure you’re now better equipped to follow the financial aspects of our quarterly updates, right? What? Didn’t you seethe 5 posts (so far) series I published on my spreadsheets? Very bad…

Anyway, our main financial spreadsheet is public. Feel free to copy it, use it for your personal (or professional) purposes, get inspired by formulas and concepts, and ask questions via commenting here, or on the spreadsheet.

But please do not delete or mark my comments as resolved. Google sheets don’t allow to just ban a few users, so if someone acts like a dick I will be forced to make comments private.

Thanks 🙂

Let’s get started, there’s a long way to go!

Net Worth

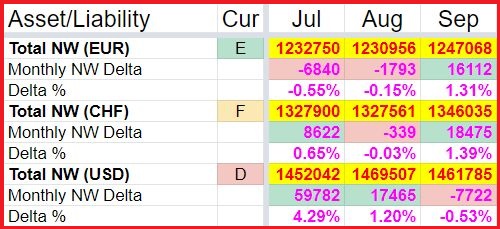

Total Net Worth on September 30th, 2020: 1.247M EUR.

Net Worth Delta (Q3 2020): +7.5k EUR.

I guess this can be classified as a bad quarter. We managed to stay afloat though.

As you can see there are significant differences among months and currencies.

A weak USD killed the otherwise good performances of July, and a strong USD saved our finass (financial ass) in September. Our financial trajectory is now strongly tied to USD vs EUR, and that’s not healthy. More on this later.

Spoiler: we sold most of our stocks ETFs, and put the proceedings in bonds (in USD currency) to park the money while I come up with a new financial plan. Bonds are performing meh, and USD lost something like 6% in July-August (compared to EUR), and recovered 2% in September.

Anyway, from a USD point of view… we’re close to 1.5 Millions! 🙂

This is the currency exposure of our NW:

As you can see, 61% USD, 34% CHF, and only 5% EUR.

Not a good split if you plan to live in EU or Switzerland.

It would be ok if we were invested in USD denominated assets, with global underlying exposure, for example a world stock ETF (like VT, IWDA, or VWCE). In that case, a fall of USD currency would be compensated by higher valuation of non-US assets, and even higher earnings of US companies abroad. A world stocks ETF is the best currency hedge. But we don’t own one at the moment.

“So RIP, why the hell you’re not following your own advices?”

Later, kid. Be patient for a few sections.

“Yes, but let me quote what you said in the previous financial update:”

I’m aware the recession just started, and the stock market might experience a lot of volatility for the rest of the year and probably the following one but… you know what? This is always the case! I’m an efficientist, I believe in the Efficient Market Hypothesis, and I think today’s high valuations are completely rational. They’re just consequence of current monetary policies, which are destroying bonds returns and forcing investors to accept lower Earning Yields, i.e. high P/E ratios. Maybe CAPEs of 30, 40, or even 50 will be the new normal, and stocks could still go up a lot, even in this recession scenario.

Did I? Oh shit. Internet doesn’t forget – and doesn’t forgive either… é_è

Ok, more on this later.

Cash Flow – Income

You know how I track my cash flow (actually this is an income statement, not exactly matching cash flow), right? No? Go check my Spreadsheet series out!

Total estimated Net Income (after tax and Pillar 1 contribution) for the third quarter is: 42.6k CHF.

Not bad, considering I’ve been unemployed for two out of three months.

Estimated Net Income (after tax) by month:

- July: 11.1k CHF. A 23 working days month, i.e. higher unemployment benefit for both me and Mrs RIP, and some dividends.

- August: 13.5k CHF. Unemployment benefits, more dividends, and a 3k better than expected 2018 final tax calculation, that I consider as income here (should be attributed to year 2018, but it’s complicated). Plus, this blog earned me something: 292 EUR of donations! It would have been 306, but Paypal is taking a larger cut that I expected… Not fun.

- September: 18.0k CHF. I started working and earning a good salary again. Mrs RIP is still taking unemployment benefits. It’s a end-of-quarter month, a lot of dividends (2.5k USD) as usual. Plus, the blog earned 105 EUR of donations. It’s a good feeling, it motivates me to write more – and work “a traditional job” less. More, much more, on this later.

Income history and monthly breakdowns:

And Dividends / Withholding tax report for the quarter:

Not bad, but still not enough to live in Switzerland.

Cash Flow – Expenses

Total Expenses in Q3: 23.5k CHF (9.2k in July, 6.8k in August, 7.4k in September).

It’s almost 8k per month on average…

Here‘s a link to our expenses sheet.

Here follows expense breakdown by month, and by primary category.

And here follows a visual comparison of the three months that compose Q3.

We’re spending a lot of money and I’m not ok with that.

There are always extra expenses coming our way… yes, we have a positive saving rate (of course!) but holy shit how much we spend. Few years ago my baseline was 4k CHF per month. Now it seems to be 7k CHF per month. We had few months at 6k or below (even a below-5k April 2020), but that was during lockdown.

We’re still spending money to furnish the new flat. We moved in mid December 2019, we still haven’t fully set up the new flat. Baby RIP’s room is not furnished, and the living room is half empty as well.

In October we’ll be sending Baby RIP to child care 3 days per week instead of 2 days, which will increase our baseline spending by 460 CHF/month (child care 924 –> 1386 CHF/Month). Plus, they told us they’re raising their prices by 10 CHF/Day starting from January 2021, which means extra 126 CHF/Month in our case (child care 1386 –> 1512 CHF/Month).

Which means baseline will raise by ~600 CHF/Month in January 2021.

Plus, we want to lower Mrs RIP Health Insurance deductible down to 300 CHF/Month, which is the lowest deductible available. She has some routine checks that needs to perform on a regular basis, and we found that she never spends less than 1.5k per year in doctors and medicines.

Which means she has high chances of crossing the break-even point where the lowest deductible is more convenient.

As a side effect, that implies an increase in premiums by ~120 CHF/month.

In 2021, by the third of each month, after rent, utilities, health insurance, and child care have been paid, we’ll be down by 4.7-4.8k CHF. I don’t like it. I really don’t like it.

I confirm what I said last quarter:

Those who plan to leanFIRE with 300k at age 29 have no fucking idea what life looks like.

Q3 Expenses highlights

Let’s take a look at some of the expenses above the baseline for this quarter.

July

- 2000 CHF: we had to flight to Rome and Naples for a surprise party to my in-laws for their 50th Wedding Anniversary (in Naples). We also stayed few days in Rome with my parents (and two days seaside). Six days, 2k. The three in-laws’ children (one of which is my wife) split the expensive celebration bill, and that accounted for a good chunk of our travel expenses…

- 700 CHF in furniture. 300 CHF for the living room table new chairs (6 of them). We replaced the old ones I got for free from the previous tenant in the old flat, in 2011. They were falling apart. 200 CHF for the baby bed, and 200 CHF for two shoe racks.

- 700 CHF in restaurants, take away, and eating out. WTF! Well, we hosted the in-laws in early July and we celebrated Mrs RIP Birthday with a restaurant lunch, which accounts for more or less half the budget. We also had few (cheap) restaurants visits with friends. It seems everyone was waiting for restaurants to reopen and invite us. We passed on a few invitations but… we can’t hide in a cave forever.

- 300 CHF in clothing. Long overdue. I’m actually lacking long pants… we compensate our uncomfortable spending in the main categories (housing, health insurance, child care) with trying to be “cheap” on things we think we have more control over, like groceries and clothing. We spent more or less 100 CHF each on clothing.

- 280 CHF in leisure. I bought several books, we bought children books for Baby RIP, and Mrs RIP discovered a “cheap” estetist/beautician in Zurich.

August

- 1200 CHF for our Donauradweg 6 days trip. We went cycling along the Donau river, from Tuttlingen to Riedlingen, and it’s been an amazing experience. 35-40 km per day, slow pace, following Baby RIP rhythm… After 3 days I forgot where we came from, and I felt like I would go on pedaling forever. Sadly, train tickets that included cross border bike transportation and hotels weren’t very cheap.

- 350 CHF in restaurants, take away, and eating out. Yeah, better than July, but that’s because everyone was on vacation, including us. Of course restaurant expenses during our bike trip are accounted in the travel category. Btw, I let Mr VCF family, very close friends of us, convince me to try Uber Eats and we had a brunch together at our places. They insisted to order food from this “awesome Lebanese restaurant”. Price per couple: 99 CHF. Yes, I paid 100 CHF for take-away food for the first – and last – time in my life. Ok, food was “good”, but cmon! I don’t like to spend 100 CHF to eat at a restaurant, where at least I get served and someone else cleans the dishes and prepares the table… can you imagine how pissed off I was to see this bill? Never again! Uninstalled the app.

- XYZ EUR in wedding gifts for someone we didn’t even go to their wedding. “That’s how it works in south of Italy. They came to our wedding, made us a monetary gift, now you give the money back to them“… “but we didn’t even go!“… “it doesn’t matter“.

- 50 CHF/Month in mobile phones subscriptions. Free months with Wingo are over, we now pay 25 CHF/Month each (August, September, and for the foreseeable future).

September

- 800 CHF in furniture, a minor repairing, and a negative Nebenkosten final calculation. Housing & utilities costs got close to 3.4k this month. I want to live in cave, seriously.

- 750 CHF in groceries. Dangerously growing, but we hosted my in-laws for 2 weeks.

- 320 CHF in restaurants, take away, and eating out. Pretty stable. This month highlight have been a couple of brunches with friends, and ~100 CHF of my lunches at work. I count the visits to Migros and Coop while at work in this category, not in Groceries.

- 300 CHF in extra doctor visits and medicines. Bills come months later, I think this bills were from May.

- 230 CHF in consulting fee for my 2019 tax declaration. I changed consultant last year. I picked someone with hourly rate less than half my previous consultant. But they bill me double the time…

- 210 CHF in clothing, mostly for Baby RIP. She’s growing, and winter is coming. Well, ok, now it’s time to stop buying stuff, right?

Cash Flow – Savings

Total Savings in Q3: 19.1k CHF (1.9k in July, 6.7k in August, 10.5k in September).

Saving Rate in Q3: 44.9% (16.8% in July, 49.7% in August, 58.5% in September).

The saving rate in July, 16.8%, is the worse since May 2016, when I took unpaid time off. Luckily, things got better in August and September.

Saving rate YTD: 59.3%. Not bad, given all the changes, and the unemployment time we’ve been through. Of course, without a steady paycheck (either from work or from unemployment insurance) we’d be screwed. Let’s keep stashin’ while we can.

On the other hand, our NW grew by less than our absolute savings, if you convert them in EUR.

- NW Delta = 7.5k EUR

- Savings = 17.7k EUR (19.1k CHF)

That means our wealth management (investing) had negative returns in EUR. I screwed something.

But if we see it from a CHF point of view things look different:

- NW Delta = 27.4k CHF

- Savings = 19.1k CHF

Yay! Positive returns!

How easy it is to lie with statistics! 🙂

Btw, do you want me to show how alpha I have been in USD? 😀

Mr Market

As you probably know, the US stock market reached new all time high back in August, and kind of peaked at +12% YTD for S&P500, and +43% (!!!) YTD for NASDAQ in early September. Then we had a minor correction (so far).

This image is taken from Ben Carlson‘s blog:

It’s a kind of weird year this 2020, isn’t it?

But what I really don’t like is the artificial bondification of stocks, the artificial cashification of bonds, and the thrashification of cash.

Thanks to central banks and government policies, which care more about the short term benefits of altering the market than the long term health of the overall economic system. Good job!

Btw, this is an expected returns consideration, not a risk assessment. Bonds will keep carrying bonds risk, and so will stocks.

We, investors of the 20s, are screwed.

What do I mean by that?

Stocks are now bonds, yield-wise. Since bond yields went to thrash, investors are now happy with all time high (excluding dotcom bubble) CAPE values.

Apple doubled its market cap since its bottom in March, while revenues per share are flat. It’s just a multiples adjustment! From Macrotrends:

Investors were cool with a P/E ratio of 20 back in March, now they’re ok with a P/E of 35.

This means that Earning Yields, which is 1/(P/E), or E/P, is below 3%.

Earning Yields is the best predictor of inflation adjusted long term returns for the asset, like Ben Felix (and the research papers he quotes, like the one from Aswath Damodaran) constantly tells us.

That means that in the long term we should expect a 3% real return on stocks! This piece of information can’t be used to time the market, because markets can stay irrational for a long time before reverting to the mean, but it can and should be used to make financial planning decision, like admitting that the 4% Rule is broken.

It’s a shitty situation! 3% expected real return (in USD), with the associated rollercoaster experience of market fluctuations.

Same for bonds. The 10s have been a great decade for long maturity bonds. You know why? Because interest rate all around the worlds dropped by several points. That boosted immediate value of bonds at the expense of future expected returns. We’ve used all the fuel. Bonds yield ZERO now, with all the rollercoaster experience of bonds market fluctuations.

What about cash? Well, cash is taxed by negative interest rate above certain amount where I live. And leaving your cash on brokerage account as a bond alternative exposes you to “brokerage bankruptcy risk“, which is getting worse now that IB is moving EU accounts out of UK.

And sadly, T.I.N.A.! There Is No Alternative. Low future expected returns on each asset class.

That’s why even Gold peaked, and the housing market didn’t crash. And the fact that not even in these circumstances cryptos flourished should tell us something… I call it: short the cryptos!

Everyone I know that earns a good salary is begging for a place where to shovel their money. Many friends are exploring home purchase here in Zurich, where you need 2M for a decent flat.

I blame monetary policies for this. Irresponsible governments are full of debts. Raising interest rates will turn them belly up. They need to be FED (no pun intended) with free (when not negative) access to unlimited credit to keep behaving unwisely.

If Italy were a person, she’d have problems finding a bank willing to lend her money below 8% interest rate with her crappy balance sheet. Instead, as a BCE subsidized nation, it can emit bonds at negative interest rate, and even bully/renegotiate old 20/30 years bonds that are yielding 6+%.

Stop altering the free market, please! As George Carlin would say: “let them go gracefully!“.

The 10s started from a high expected yield position after a couple of market crashes and recessions, and they performed even better than that. Most importantly, the 400% return on stocks was not paired with a proportional growth in fundamentals, most of the returns came from multiples (P/E) expansion.

Which means when the roaring 10s left the stage, what was left is a low expected yield scenario.

2019 has been the fireworks year, where we scooped out the remaining yield. Then 2020 happened, with its V shaped crash, and we sacrificed another piece of our future to cope with the present.

The market quickly cashed all that was left on and below the table, and now we have to live with a crappy financial future.

Yes, I don’t see any light for the coming decade.

That’s why I kind of quit the stock market again.

I had hope for this September correction, but it seems to be already over.

Btw, before we move on: it’s ok to be scared of future returns, but it’s not wise to try to time the market. Don’t do like I do. Well, let me explain myself better. While it seems I’m kind of “timing the market”, what I’m actually doing is looking for a way to protect my principal because I’ve already earned most of the money I’ll ever see in my life. I feel old, I have a good amount of money, and my career is declining. And I’m a risk-averse person: I’m more willing to miss on great returns than I am willing to erode my capital. If you’re in the accumulation stage, if you have years or decades of career waiting for you and peanuts to lose, you need a different approach! You shouldn’t care about current market valuations and bond yields, and should invest in stocks like crazy! And celebrate a market correction even if it happens the day after you invested your first 5k.

Ok, cool.

Now let’s take a look at my investments in Q3.

Investments – Analysis, Actions, and Plans

I’ve highlighted in green the relevant trades. You can also take a look at the comments on the spreadsheet for individual trades.

Yep, I closed all my EIMI, VT, and Pension100 positions between early July and mid August.

I also sold all my Pension75 shares within my Pillar 3A, leaving only Mrs. RIP’s Pension75 shares invested. Of course she performed better than me, she’s the perfect dead investor! No, it’s not true. I sold my shares at 132.70 CHF each, and the share price on September 30th is 132.34 CHF. A close call (so far).

I bought a bit of VYM and VBR shares (forgot to add green rectangles in the picture above), and some BSV shares with the monthly 5k CHF deposit on IB.

Ok, what’s the rationale?

Back in Q1 I was catching the falling knife:

My rationale back then was “if VT reaches all time high again in 5 years, I’m getting 7% annualized returns plus dividends on my share priced now at 60”.

I actually kept buying the dip down to 54 USD per share.

Problem is: VT reached all time high in 4 months.

I wasn’t prepared for that. With the virus still around and its impact growing over time, the world economy in recession, many workers unemployed, and earnings of the fastest growing companies not increasing at all (just their P/E increasing) it felt like a bubble to me. The caricature of a bubble.

I cashed my expected 5 years return in 4 months, i.e. sold all my shares in VT, EIMI, and more.

Here the profits I realized:

58k USD (or 54k CHF). Not bad. Plus 9k CHF from Pension100, and a slightly harder to measure amount from the sales of Pension75 shares, since I purchased the shares over a period of 2 years, at share price between 110 and 115, and sold all my shares at price 132.70.

Let’s say that I realized ~65k CHF of capital gains, plus another ~5k dividends in the meantime.

Not bad. Remember to always celebrate a profit. Hold my beer 🙂

But I’m out of the market now. I chickened out again, less than one year later.

As I said above, I can’t make sense of today valuations. During last 4.5 years ride on a dying bull market I’ve experienced ups and downs that didn’t make me sleep well at night sometimes. But I got 2017 and 2019 in the pack, who boosted my returns! I was able to stomach the volatility because of high returns. Now returns are expected to be low, and the volatility won’t disappear tomorrow. I can’t stomach that. I chickened out again.

In the meantime I raised my exposure to “value” stocks. Purchased a bit of VYM and VBR. I know Value is underperforming growth since a couple of decades, and it’s inefficient in Switzerland where dividends are taxed while capital gains are not… but it’s the only approach to investing that I can accept in this regime.

If a market crash will happen, like I hope, I might reconsider my strategy. Else, I might jump into value stocks, low P/E stocks, solid and boring companies with nice cash flow and so on.

Current portfolio is unbalanced, and too USD currency exposed. When I open my IB app I follow closer the USDCHF and USDEUR quotes than everything else.

So… I don’t have a concrete well thought plan for now.

The placeholder plan is the following:

- If VT drops below 70, sell bonds and buy VT

- Maybe in the meantime buy DCA into value/high dividend stocks: VYM, VYMI, VBR… explore US Value ETFs like VTV, VOOV, VONV or a world-equivalent value like VVAL… Need to dig deeper.

- Cry, and pray for a drop in the stock market.

Here’s a Net Worth by Asset Class breakdown over time, both in absolute and percent values:

80% bonds, a Million EUR of our Net Worth is invested in (mostly USD denominated) bonds, in an environment where bonds yields are kept artificially low. Not good. Why aren’t good old 3-5% AAA+ bonds around?

FIRE Metrics?

Cut&Paste from previous Update:

I don’t track much the FIRE metrics anymore. I believe FIRE is a Spectrum, and I could, and I should, (and I actually am) take advantage of the freedom I earned so far. If we decide to stay in Switzerland I can’t “forget about money” yet, but I can take a lower paying job, work less (50-80%), or take long sabbaticals like the 5 months April-August I took this summer.

This is still relevant. I don’t care much about FIRE metrics anymore. But let’s take a look at them for entertainment and educational purpose:

The interesting bits are those in green.

The Italian (Ideal) FIRE metrics are worthless. I achieved 100% several months ago, and I’ve lowered my SWR to pi (3.1415…%) since May 2020. Both to reflect lower future expected returns, and to avoid formulas breaking the spreadsheet (like the -1 months left in April).

According to current SWR, we’re at 93.28% completion. I’m too lazy to update the progressbar in the homepage, let’s live with that.

If we decided to retire in Italy today, withdrawing 3.5k EUR (gross) per month, adjusting for inflation, i.e. the constant dollar withdrawal method – the same used by the Trinity Study and William Bengen, which we know nobody really adheres to in retirement, and which we know it is both inefficient, and rigid (ask Ben) – we could afford a 3.37% SWR to meet our “desired” spending regime. Good.

In other words, our NW is almost 30 times (precisely 29.7) our target expenses. Cool! Well, we don’t know how realistic our target expense level is, since it’s 8 years we don’t live in Italy anymore. Maybe it makes more sense to at least adjust the initial target (3.5k EUR) with inflation.

We’ll eventually review Italian retirement plans if/when we decide to move back. Not worth my (limited) mental energy at the moment.

The Swiss (real) FIRE metrics track our progress toward retirement in Switzerland, at our current spending level (same constant dollar model though). And they’re depressing.

That’s because our expenses keep going up, and our NW growth is not fast enough this year. Target initial yearly withdrawal amount is growing (85.7k CHF in September) because our monthly expenses are growing. So the FU Number is growing as well. above 2.7M CHF. This is actually an optimistic number: it doesn’t take into account wealth tax, and mandatory (based on wealth) Pillar 1 contributions that an early retiree is forced to pay in Switzerland anyway. Switzerland is not a country for Early Retirement.

So the projected Swiss FIRE date of January 2029 is an optimistic forecast. Well, not exactly. Linear forecast is influenced by a “not exceptional 2020”, both in terms of NW growth (in CHF), and growing expenses. Forecasted Swiss FIRE date at the beginning of the year was February 2023. This high-expenses and low-returns year (plus SWR down to pi) added 6 years to the FIRE date.

Depressing.

Our NW was equivalent of 16+ years of expenses at the beginning of the year, we’re now sitting on 15.7 years of saved expenses. Our NW is growing slower than our expenses are expanding.

If you’re interested in the calculation details, I described in detail the rationale and the math behind FIRE metrics in my spreadsheet series.

Something more aligned with my FIRE Spectrum philosophy is the Ravenna Threat metric, as I explained in my old StupidiFI post. Essentially we can pretend we don’t care about money until our wealth drops below a certain threshold. It’s a kind of coarse grained implementation of my FIRE Spectrum.

At the moment, we have 200k EUR buffer before degrading into a lower frequency in the FIRE Spectrum.

This metric is more representative of my current state of mind, and it will become useful again if/when I decide to quit my new job.. It requires maybe a review of the thresholds, their growth rate, and maybe a quantization of different shades of freedom. But this is a ladder I want to climb, and enjoy the journey.

A Brave New Job

“So, RIP, how’s the new job going?”

Let’s start by quoting my previous Update:

My guess is that even if in this supposedly “perfect” working scenario I can’t function as a Software Engineer (actually, Principal Research Engineer) anymore, a tombstone will have to be put on my career and I need to live with that and move on.

My pessimistic bet is that it’s really unlikely for me to function as an employee anymore. I consider myself almost unemployable. Which sounds crazy to me, but it’s probably the default mental state of every millennial, even those with less than 10% of my ‘stashed amount 😀

Time will tell.

Time is telling.

It started with the right foot:

But I’m slogging through the days, studying ML, fighting bureaucracy, fighting impostor syndrome, feeling outdated, feeling one of the baddies…

And I’m perceived as the “Master of the Clouds”, who knows everything about the state of the art of technology, hardware and software because: 7.5 years experience at Hooli! But by working at Hooli you’re insulated from the rest of the world, and after so many years of swimming in a pond, the Pacific Ocean can be intimidating.

I’m supposed to drive a cloud infrastructure setup, suited for Deep Learning with a bunch of GPUs, which is a research field on its own. Big Tech companies are solving it by developing their own hardware, like Google TPUs, Nvidia DGX, Intel Cognitive Computers, and all the other AI Accelerators.

Re-Learning AI after 15 years, while learning Cloud Computing and its jargon, frameworks, and libraries while everyone pictures you as the expert in the field is… stressful to say the least.

I’m at an inflection point.

Either I listen to the ego that deep down desperately wants me to keep my “successful” career going – and kind of feels guilty because I’m complaining for a dream job 99% of the world population would kill for having a chance to swap places with me – or I listen to the heart that tells me “listen bro, you have been 5 months out and you loved it. You have enough money to go all-in with your passions and write those 5 books that you want to write, launch a podcast, blog more, and… look, you earned few hundred bucks from donations alone! C’mon, let your old career go 😉”

Paul Graham said:

In high school she already wanted to be a doctor. And she is so ambitious and determined that she overcame every obstacle along the way—including, unfortunately, not liking it.

Now she has a life chosen for her by a high-school kid.

But he also said:

Is there some test you can use to keep yourself honest? One is to try to do a good job at whatever you’re doing, even if you don’t like it. Then at least you’ll know you’re not using dissatisfaction as an excuse for being lazy.

Paul, you’re not helping me 🙁

This would have been the perfect job for myself 5 or even 3 years ago.

Not having quit Hooli earlier, as soon as the signs of my own decline showed up, might have irreversibly damaged my ability to appreciate such a perfect job.

My burnout might have degenerated in allergy toward “working for someone”, or computer science, software engineering, and IT in general.

Or maybe having focused on FIRE for so long played a role here. The larger my nest egg becomes, the marginally less significant a salary becomes.

Or maybe is blogging to be blamed.

We don’t have “passions“. We play with something we’re curious about, we get some positive feedback, we might or might not enjoy the process, we interact with experts or peers, improve, have more fun, and repeat. Until one day we decide we love it, and call it a passion, part of our identity.

That’s how I became a good software engineer – because I was very good. But having played the same game with blogging for 4.5 years might have passioned myself away from my previous creative endeavor, i.e. software engineering.

Something similar happened with theater acting in 2004. I was close to quit my not-even-started-yet software career to follow that two years old passion. Good thing I didn’t! I was able to keep theater acting as a side passion, and working my ass off as a software engineer. Why is this time different? Why shouldn’t I show middle finger to whatever is carrying me away from my perfect career?

But why do we need to blame something? Can’t I just accept that I’m a different person now? Are we sure it was a good thing I didn’t pursue an acting career back in 2004?

Anyway, this is the inner dialogue happening in my brain right now.

And yes, I’m sure it was a good idea not to pursue acting more than 15 years ago. Even though at least 4-5 of my theater companions back then managed to have a successful acting career. But I’m also sure this this time it’s very different. The industry has changed, I am obsolete, I’ve got enough money, and I’ve already put a lot of effort in this endeavor.

But let’s look at the bright side! I had bureaucracy issues related to my contract with my academic institute: the payroll and HR functions are handled by an external company and a part time employee in my institute. I’m kind of the only person working from Switzerland, while the Academic Institute is located abroad (in Europe).

I documented the story and the happy ending in a thread on MustachianPost Forum.

TL;DR: I complained about entries in my payslip associated to insurances and pension fund being unfair and/or plainly wrong. Thanks to raising these concerns I got some entries fixed and a much better Pillar 2 agreement. It sums up to ~1400 CHF/Month more in net take-home pay.

Morale: if you “don’t care” about those things, you sign papers and end up screwed. Financial awareness is a negotiation superpower.

“So, RIP, “the bright side” of your new job is salary negotiation and financial-savviness? Give it a chance to shine for what it is, not for the blogging opportunities it offers to you!”

Doesn’t it tells us something?

A Brave Old Blog

I’m having a lot of fun blogging 🙂

What I like more of blogging is the creative process at different zoom levels. I like to write individual posts, think about new post ideas, new post series, book ideas, up to “personal life philosophy”.

I don’t see writing a post as a single deliverable product, but as a piece of a larger puzzle that I’m not even close to grasp the size of.

I’m frustrated by not being able to write more, write faster, be more concise, improve the quality faster, touch all the topics I want to touch with the required depth. I’m also frustrated by feeling obliged to publish regularly. I might like to take time off to focus on digging deeper on topics I want to write more about, and then publish something higher quality. Like Wait But Why does, or Robert Caro. But I also like the high creative bandwidth of some contemporary young writers like David Perell and Nat Eliason. They really live the productive life I’d like to emulate!

But I also love my blog as it is today. I might want to evolve, change, pivot, launch new projects (I want to podcast), maybe go public with my face and real name, maybe produce educational material aimed to the masses – like a course, or a software product. Maybe ethically monetize my blog. Nat’s post about “how to blog” flipped my perspective. I might also want to evolve myself into a certified something (probably CFP, I’m mentally giving up on CFA). But at the same time I also want to write fiction, novels. I have so many ideas… I want to explore other aspects of creativity, writing, education, entertainment, and financial coaching. The sky is the limit.

Anyway, since late August the blog 2x-ed its traffic baseline:

2020 traffic was slowly growing anyway, but since August 28th the game has changed.

What happened in August 28th? Marcello!

Marcello (570k+ YouTube subscribers) mentioned me in one of his videos, and this happened to my metrics:

The long tail of “Marcello effect” lasted for very long, more than a month (and counting).

Before Marcello, I averaged 800-900 pageviews per day. Today, the baseline is almost double than that. And there was a second spike on September 18th, when Marcello mentioned me again in another video (about Fake Gurus).

We’re planning to produce some content together, so stay tuned 😉

Thanks to the “Marcello Effect” I got contacted by many Italians, and the experience has been much better than I anticipated. This is probably because Marcello’s audience is made of young, curious, and driven people. When I happen to hit some Italian “traditional media” headline, it’s usually not a pleasant experience.

Now, what to do with this “10 minutes of fame” (that arrived right before starting the new job)?

Well, I don’t know. I’m not doing anything special, but the feedback I received in the last month has been… inebriating.

I don’t know how long will it last, but I’m happy it happened.

I enabled donations after 4 or 5 readers asked me to, and I’ve received more than 400 EUR in less than 2 months. Wow! I can’t tell you how much this motivates me to keep doing what I’m doing!

I’ve been extremely productive on my blog since than. I wrote 9 posts in September 2020, a total of 39 (40 including this) so far in 2020. It’s been my most prolific year by far (and it’s not over yet!), with the same number of words written in 2020 so far than 2019 and 2018 combined (the screenshot refers to before this 7k words post).

Given the low activity of 2017, I bet 2020 will end up with more words published than 2017-2019 combined!

Ok, I know, “word count” is not a proxy for quality, but it’s a proxy for commitment. I’m nowhere near to what I want to become as a creator, and the fact I was able to commit so much despite having a job and a family means a lot to me. It means this thing is real, it’s not a fad!

One huge risk is becoming audience-pleasing.

So far, I used to receive visits mostly from Switzerland (this is July 2020):

Now I’m flooded with Italians (September 2020):

This is cool, but I’m of course tempted to produce more Italian-related content. Which might not be what I want to do. I’ve already worked a lot to improve the Ufficio Antisqualo (the Italian Anti-Sharks office), and I’ve another Italian page in draft.

At the end of 2019, while looking at the yearly metrics, I remember telling myself “Uhm, it would be great to reach 250k page views in 2020!”

Goal achieved, with 3 more months to go!

But as I said, I don’t know if I’m able to handle more “success”. I might want to play like Venkatesh Rao here.

And I’m doing my best to piss SEO off with long posts, poorly edited, the opposite of clickbait titles, and close to zero social media presence. I’m the anti-marketing by definition.

Despite that, despite hiding in a cave, people are finding me and finding value in what I do.

This means a lot to me. It’s a strong signal to keep going. To double down. To go all-in.

During this Quarter I’ve published few spare posts (Fake Guru, Nat is Wrong, Fuck Brexit) the 2020 Q2 Update, a series on my experience at Hooli, a series on my Spreadsheets, and an ongoing series on Learning Journal. Quite a lot of posts. Quite a lot of effort. Quite a lot of fun!

Other Random Facts

Missed Investment Opportunity

I don’t invest in individual stocks (well, I tried) so you can imagine that I don’t invest in private companies either. They’re riskier (many startup fail) and the investment is illiquid for a long time. You can only cash your investment at IPO or acquisition date – or via privately trading your shares with another willing investor. Good luck with that.

But when I saw David Perell announcing his investment in Roam, I felt like I missed the best investment opportunity of my life.

Same day, an email from Roam Team said:

I really wanted to invest in Roam. I don’t even know if I would have been able to.

I think Roam research will change how people organize their Personal Knowledge, and become the de facto standard for Note Taking, Journaling, Personal Wiki, and PKM.

I use it, I love it, I would have invested 100k in it no question asked.

Actually, I asked he question:

But Conor didn’t reply to my DM on Twitter, he’s better things to do that reply to a typo-bloated message from a nervous anonymous stranger on the internet I guess. Like handle a $200M Post Money Evaluation company, already profitable, with 9M USD more in the bank.

I wish you good luck, Conor. I know I’d have “10x”ed my investment in 2 years.

Let’s see how the crowdfunding offer will look like, but I know that the ream meat would have been being part of this round of investors. Time will tell.

Vesuvio and Passoscuro

In July, my brother in law organized a surprise party to my in-laws for their 50th wedding anniversary, in Naples. We had to go. It was fun! Seeing both my parents in law crying when they saw Baby RIP popping up into the restaurant was priceless.

We used this opportunity to visit my family in Rome as well, and to relax (sadly for only 2 days) in Passoscuro, a not very famous beach close to Rome, which is our historical family summer vacation location. I spent my first 18 summers of my life there.

The water was extraordinarily transparent (thanks Covid), and the overall experience was great. This is all the sea Baby RIP will experience this cursed 2020. Next year I’ll bring you in Sicily or Sardinia, promised!

Anyway, I missed Pasta con le Telline for sooo long!

Deutsche Donau

BabyRIP’s krippe (child care) closed for two weeks in July-August, and we decided to take a small last minute vacation.

We decided to bike along the Black Forest Deutsche Donau in early August. We had a 6 days very intense and funny vacation. The Deutsche Donau is less famous and popular than the Passau-Vienna leg, but still very well served. And much more nature friendly.

The reference website is full of info, and the path is perfectly tracked with signs everywhere. You can’t get lost. We didn’t start from Donaueschingen (Danube source), we started from Tuttlingen. Actually we started in Schaffhausen, in Switzerland, and biked to Singen, in Germany. We discovered the hard way that you need to book in advance your bicycle tickets on the non-regional trains, and crossing border with the bicycle would have triggered a 20 CHF extra ticket for each bicycle (we had 3, the bike trailer for Baby RIP counted as another bike).

We wanted to reach Ulm, but given the complexity of the way back with public transportation we decided to stop in Riedlingen, bike back to Sigmaringen on our penultimate day, and spend an extra day in Sigmaringen – actually in the swimming pool of Mengen (been there for 3 consecutive days!).

After 6 days of slow travel by bike, 35-40km per day, we were so sad to come back home. Our bodies started to get used to work out for few hours per day, and back home I felt the urge to keep biking for a while, Then it faded out, and sedentary life settled back again.

But I’m much happier when I use my body than when I use my brain.

That’s all for today!

Great news all over.

If I might suggest, I have the feeling going full blogging would not really work for you.

Your blog is not so great.

Writing skills are just not there I guess.

Try to stick to computing cloud and shit.

What if I blog from the cloud? Could that work?

While doing a shit on the loo obvs. That could work 😀

Great post btw!

Haha thanks!

Thanks for the post mr. RIP great content again. Don’t get too obsessed with number of user visits. Your blog deals with topics which are complex for most people so number of visits do not tell the whole story.

Sure. I’m not obsessed with numbers, but seeing numbers growing is a bit addictive 🙂

Will like to offer an alternative view of stock valuation: Equity Risk Premium. Blackrock uses this as well. https://www.blackrock.com/us/individual/literature/investment-commentary/taking-stock-quarterly-outlook-en-us.pdf. Stocks are attractive compared to bonds.

I think the logical fallacy here is “begging the question”, or “Circular reasoning”. Of course today’s “high valuations” make sense because interest rates are low, and bonds suck. But this can and must change, it’s like walking on a thin line. Raising interest rate will be NECESSARY at one point, else the monetary system is doomed.

Even tulip bulbs prices felt reasonable in 17th century according to current economy.

Hi Mr, RIP

Excellent report and great pictures , thanks for sharing all this information.

I am glad you are enjoy blogging and we do enjoy reading … 🙂

Thank you ATM 🙂

Let’s see how events unroll in the next months…

It’s great to see that your net worth is still growing despite the Covid 19 pandemic where most people have suffered a loss in that respect. Your report is inspiring.

Yeah, but the growth is lower than my savings (if measured in EUR), which means I must have screwed up with investments overall.

Hello Team,

kindly assist in removing link or url in post above or delete it altogether.

I am having a spam problem on my site and undertaking some clean up.

Thanks in anticipation.

regards,

Emmanuel

I’m sorry to hear that you’re being spammed, I hope no spammy traffic is coming from my blog.

Anyway, I removed the URL to your website from your original comment, I hope that’s what you meant.

Let me know if that’s enough

Hi Mr. RiP,

Congratulations! I like your blog very much and follow all your posts. I never post any comment because I mostly always agree with your opinions. However, this time I have to disagree.

I read with some disappointed that you are currently out of the stock market. That my friend, is called market timing… It sounds to me like: “Do what I say, and not what I do”. I think you have to live up to your principles, and with this decision your not doing that at the moment.

In my humble opinion, you are suffering from “short-sightedness” , that is, your planning for a short career and taking decisions based on that. I think the contrary will be true, i.e. your career will be long and successful (just based in your past experience). Hence, you should plan for long term investments, because you won’t need that money anymore for a very long time. And that means being in the market, even if the market looks crazy expensive.

That’s my five cents… Otherwise, stay happy and healthy, all the rest will just happen in due course.

I know, I know, and as I said I’m not proud of what I’m doing.

I want “what I say” and “what I do” to converge, and I’ll find a way that works for me.

I’m just a man, and I’m here to also show you my irrationality, my inconsistencies, and my rationalizations.

What I’ve learned this last 12 months, after 2 chicken-out events, is that I can’t stomach market volatility with 1M+ invested and a dying career. That’s a new thing to me.

Maybe I’m suffering from short-sightedness. I’m quite sure that Mr. RIP 10 years in the future would like to slap today Mr. RIP for being too pessimistic, but I’m quite sure my career in tech is almost over.

Maybe I’ll have success in other areas if I devote my full attention to something else, but I need to plan for the worst case.

Thank you for your honest comment 🙂

Hi Mr.RIP, I missed that you started working again… if there a post where you talk about it? how you found job in Switzerland again? what is your new gross salary now comparable to hooli?

thanks!

Hi Guy, I think I announced here, and more info here.

The new gross yearly salary is 200k, but the total comp including pension contributions is in the 220-230k range. At Hooli, total comp of 2019 was 280k. Not that bad to be a non-Swiss Academic Institution 🙂

damn… I can I come to swiss, I am poor fucking italidiots with 30yo and 30k gross… 30-30 shit. will nevar reach FI here

*How can I come to Switerzland?!

Equities as an asset class won’t change their short-term volatile nature – if you cannot stomach it just because of the high invested amount, perhaps you need to look at other asset classes like real estate or even content monetization to fuel your FIRE. There are other sources of passive income which are not as volatile.

Anyway we all appreciate your candid sharing of your inner thoughts on your investments and career and hope you will work things out to your satisfaction in the near future.

Hi Rip,

judging by the length of the post you sure have not lost your passion for blogging! I have to admit I skip-read the last quarter of it.

As i outlined at FIWE when we met, I felt I was in kind of the same position as you in the end of my career at my corporate job, only I had already left at the time for a few years, while you were pondering your future plans. Already then I felt liberated by not working for other people anymore and no longer submitting to bureaucracy, corporate shitshat and especially how forever long it took, before anything good done.

Now a few years on I feel even more satisfied being self-employed and just doing what I like.

If you feel unsatisfied in your new job consider quitting it and doing something else. Life is too short to waste time. And as you said, you don’t need the money.

All the best

Hi Claus, nice to hear from you 🙂

Yep, passion for blogging is still up but I’d like to change direction somehow. Step up, have a plan. At the moment I’m only writing whatever I want whenever I want. To step up I need to have clearer goals, a vision, a plan.

Thank you for your advice, I appreciate and value it a lot. As you said, you’ve walked my way few years ago.

I feel stuck at the moment, and that’s only due to high cost of living in this expensive heaven. But I won’t let this drag me down again.

Ciao Mr RIP,

thanks for your continued transparency, i keep on coming back to your site for the great content!

i’m curious about your comment about value stocks. you say they are inefficient due to dividends being taxes, but the dividend yield of ETFs such as VBR (1.71%) is not that different to, say, VTI (1.44%). what am i missing?

i am interested in tilting my portfolio towards value as suggested by Ben Felix and others and im trying to decide which ETFs to use. Ben in their recently published model portfolios recommends AVUV and AVDV but i’m hesitant to use such new products from a comparatively small provider.

You’re comparing apples with oranges. VBR is small cap (value). In general, small cap have way smaller dividends. It’s unfair to compare them with VTI.

Anyway, I’m planning to get back into value stocks, so I’m with you.

Btw, which Ben Felix video are you talking about? This RR one?

I haven’t watched it yet.

Yea that’s the video. Go watch it, it’s good!

Maybe i wasn’t clear enough. What i’m talking about is essentially implementing 5 factor investing as recommended here by Ben in the new Model Portfolios (https://rationalreminder.ca/s/Rational-Reminder-Model-Portfolios_12-2020.pdf). Which is essentially having a global market portfolio with added SCV (small cap value).

My question was regarding how to best implement that as as Swiss Investor since these portfolios are geared towards Canadians. I was trying to compare VTI and VBR (or VIOV or IJS) merely from the angle of your comment about inefficiency due to dividends and taxes (now i can actually not find that comment anymore). I was curious about which specific inefficiency you were talking about.

Inefficiency of dividends being taxed in Switzerland vs Capital gain not being taxed.

In Switzerland, growth is more efficient than value (even though value is not necessary “high dividends”, because value is “price to book ratio”… but it’s usually correlated with good dividend yield) assuming same total return.